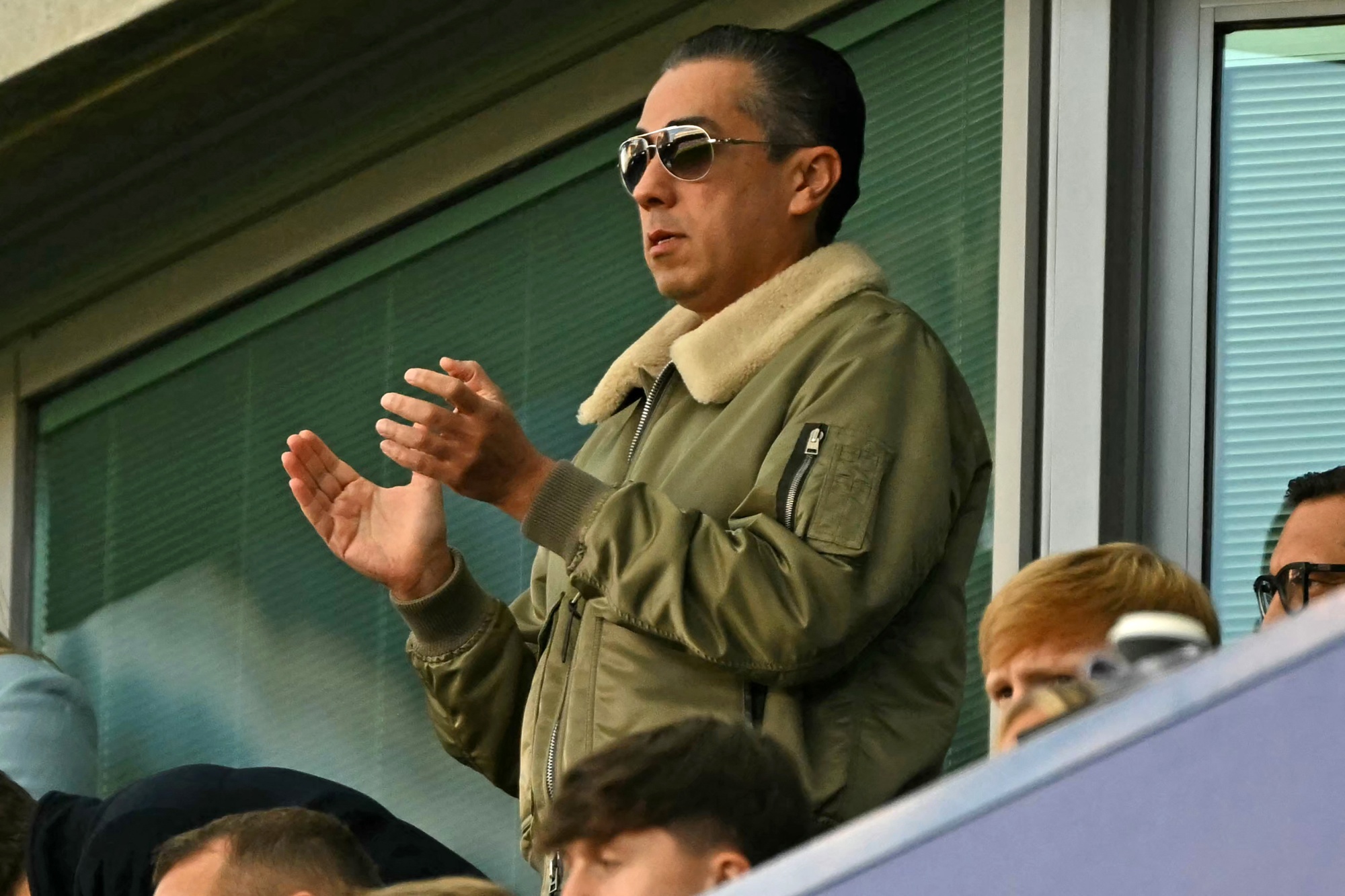

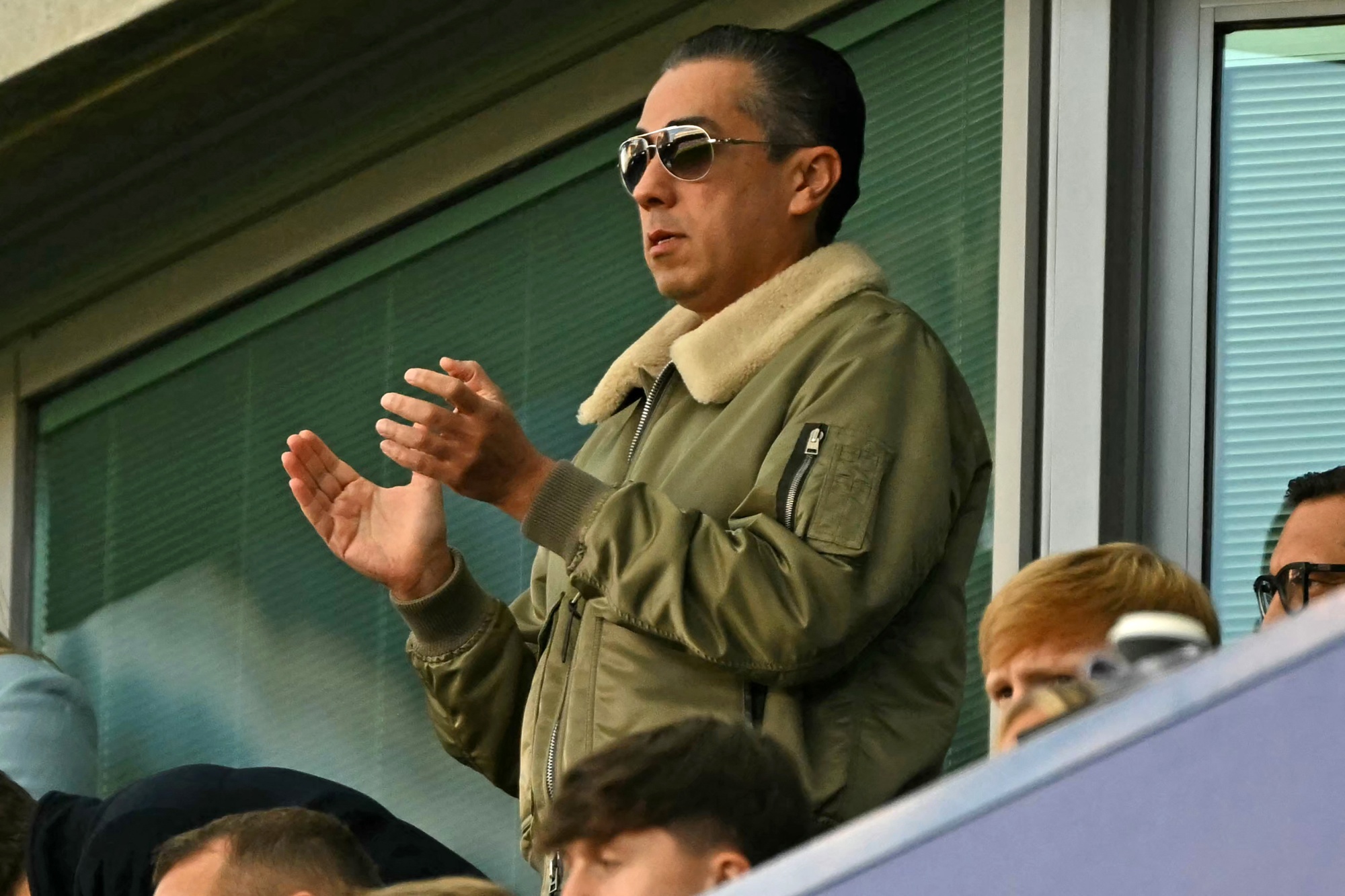

| It sounds so saintly. After Yuletide boozing, give up alcohol for just 31 days and see the benefits pour in. Television ads, social media posts, even promotional texts from food and drink brands now push the perks of so-called Dry January. You'll save money, they say. You'll drink less the rest of the year. You'll just love their brand new non-alcoholic mocktails (which are, somehow, close in price to standard cocktails). Most important: Your health will improve. That latter point has been thrown into sharp relief following a warning last week from US Surgeon General Vivek Murthy. The nation's top doctor published an advisory arguing alcoholic drinks like beer and wine should carry warnings of their links to cancer. That spooked everyone from inveterate barflies to casual drinkers, sent spirit stocks slumping and seemed to bolster the case for making this month — and maybe all the ones after it — dry. But hang on a minute. This is your personal finance newsletter, and I am not going to argue with evidence of alcohol's health risks. What I am going to urge you to do is consider two tendencies Dry January reveals about human behavior. Taking control of them could make your life, financial or otherwise, a lot less knee-jerk and a whole lot better. The first has to do with how bad we are at changing our habits. We aim to save more, spend less, bulk up, slim down or of course, cut out alcohol. But instead of methodically conceptualizing how we're going to do these things, we just dive in. We cut behaviors wholesale for the blunt period of a month and hope that'll do the trick. "A common mistake people make is thinking that all they have to do is set a goal," says Katherine Milkman, a professor at the University of Pennsylvania's Wharton School and author of the book How to Change. "They don't think about what their plan will be or use science to actually achieve their goals and overcome the obstacles that might be the reasons they haven't yet succeeded." Milkman explains that periods of abstinence can be helpful to break habits because they make them less ingrained in our lives. (This is a point many experts make about Dry January, if we're talking about moderate drinkers without alcohol dependency.) But Milkman says periods of good behavior can later trigger bad behavior through a process known as "licensing" — the feeling of entitlement you might get after behaving so well in January that February turns into a bender. This happens with money, too. Take me, for instance: To get to a train station this week, I took the bus instead of a cab. That made me feel I could afford an expensive steak at the supermarket, even though the savings did not add up at all. This connects to another human quirk: We tend toward myopia when evaluating costs and benefits. I hear this a lot from Bloomberg readers who have good jobs and high incomes, who are rich on paper, but don't feel that way. Often this is because they focus almost exclusively on the costs of not having big dollar amounts in the bank without also considering the benefits that come from spending more to save time or to accumulate experiences. Edward Slingerland, a professor at the University of British Columbia, fellow of the Royal Society of Canada and author of the book Drunk: How We Sipped, Danced, and Stumbled Our Way to Civilization, makes a similar point about booze. "Our public discourse around alcohol is stunted because it all occurs through a medicalized, risk-reduction-only lens," he says. "And that's just the wrong way to think about any kind of human behavior." Slingerland studies human history from an evolutionary perspective, and whenever he sees people engaged in dangerous or costly behavior over long periods of time and place, he tries to inquire into the benefits that offset the obvious costs. Increasingly, research shows a physiological cost to alcohol. That may make it more uncomfortable to think about its benefits, but for the sake of truth — or at least argument — they are worth considering. One of those benefits is social. I will note here that the same surgeon general who warned about alcohol has also written about an American "epidemic of loneliness and isolation." Slingerland sees a moderate role for alcohol here. "A huge physiological negative for people is loneliness, a lack of social connection," he says. "One of the major functions of moderate alcohol consumption is to enhance social connection, social bonding and the airing of feelings between people. That's been one of its main functions throughout our history as a species." Of course, drinking will not automatically make you friends. Excessive consumption will likely cost you them, and more. But his point — and one that I promise relates to your finances — is that our behaviors come with both good and bad consequences. Even if society changes how it views those consequences, they are worth addressing to figure out the degree to which we want them in our own lives. I'm not participating in Dry January this year. I agree with Slingerland, who sees the exercise as something of a neo-Puritanical virtue signal, the sort of thing tech bros might do to make you think they are deserving of everything they have because they are piously ascetic. At the same time, I have done Dry January in the past, liked that it helped me stop drinking for a while and will probably do it again. If you're abstaining this month, I salute you. I also offer anyone who may have slipped up here or there this month a parting thought from Erika Manczak, an associate professor in the department of psychology at the University of Denver who studies social relationships. "When we try to be super rigid with ourselves or really critical of ourselves when trying something new that doesn't go our way, it pretty universally backfires," she says. "I'm very supportive of people being a lot gentler with themselves." — Charlie Wells A global bond selloff left US Treasury yields flirting with 5%. Concerns across the world's bond markets are pushing yields toward key thresholds amid escalating worries about elevated inflation, tempestuous politics and swelling government debts. In the US, the 10-year Treasury yield rose as high as 4.73% Wednesday, pushing it toward the 5% peak hit in October 2023, before pulling back down. In the UK, that yield hit as much as 4.82%, the highest since 2008. Meanwhile in the UK, the pound sank to a more than one-year low. Sterling retreated as much as 1% to $1.2239. The nation's assets are at the forefront of a global rout fueled this week by Donald Trump's latest threats to impose tariffs and worries that inflation will remain elevated for longer than expected. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Ken Fisher was the biggest gainer in percentage terms, with a 95% gain that brought his net worth to $11.5 billion. The founder and chairman of Fisher Investments was up thanks to a minority stake sale in the company, an investment adviser that had over $299 billion of assets under management as of Dec. 31. Qi Shi was the biggest loser percentage-wise, facing a 13% loss that took his net worth to $13.1 billion. The majority of Qi's wealth is derived from his stake in East Money Information, an online broker and financial information provider. Shares are down some 13% this year. Chelsea FC Owner Eghbali Bought a £56 Million London Penthouse Behdad Eghbali, co-owner of Chelsea FC and co-founder of Clearlake Capital, bought a luxury penthouse in London's high-end Mayfair district for more than £56 million ($70 million), making it the UK's most expensive apartment deal in 2024.  Behdad Eghbali Photographer: Glyn Kirk/AFP/Getty Images The tycoon purchased the flat at the start of the summer in a building featuring a cinema, swimming pool and spa, according to a UK filing. Back in 2023, Eghbali bought an apartment in the same neighborhood for about £34 million, Bloomberg News reported previously. Spiral Tower in Hudson Yards Raises $2.7 Billion in Bond Sale The partnership of Tishman Speyer and Henry Crown raised $2.65 billion in the commercial mortgage-backed securities market for The Spiral office tower in New York. A bond sale backed by the mortgage on the trophy property wrapped up on Tuesday, with the top tranche paying out a coupon of 5.47%, according to a person with knowledge of the matter. The building's owners will use the proceeds to refinance existing debt, pay for tenant reserves and return equity to sponsors. This week, we're looking for people who have bought Bitcoin or other cryptocurrency for their children. If this is you or someone you know, we want to hear your story. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. When it comes to your world and your money, you want answers from leaders who know how to build empires, protect portfolios and create the next big thing. Held in the heart of New York's Financial District, Bloomberg Invest is an essential gathering that convenes allocators, dealmakers and investors from across the globe. Powered by one of the world's largest newsrooms and led by Global Finance Correspondent Sonali Basak, join us on March 4-5 as we help you track, dissect and navigate the markets with the industry's most influential voices. Learn more here. |

No comments:

Post a Comment