| Plus, China's outlook and Canadian prediction markets. |

| |

| Welcome back to The Forecast, where we help you think about the future — from next week to next decade. This week we're looking at China's economic outlook for 2025, what Wall Street banks expect this year and the staggering cost of the fires around Los Angeles. We've received some great emails already about the themes you're watching or the questions you have for 2025. Keep them coming! | |

China's Economic Outlook in 2025 | |

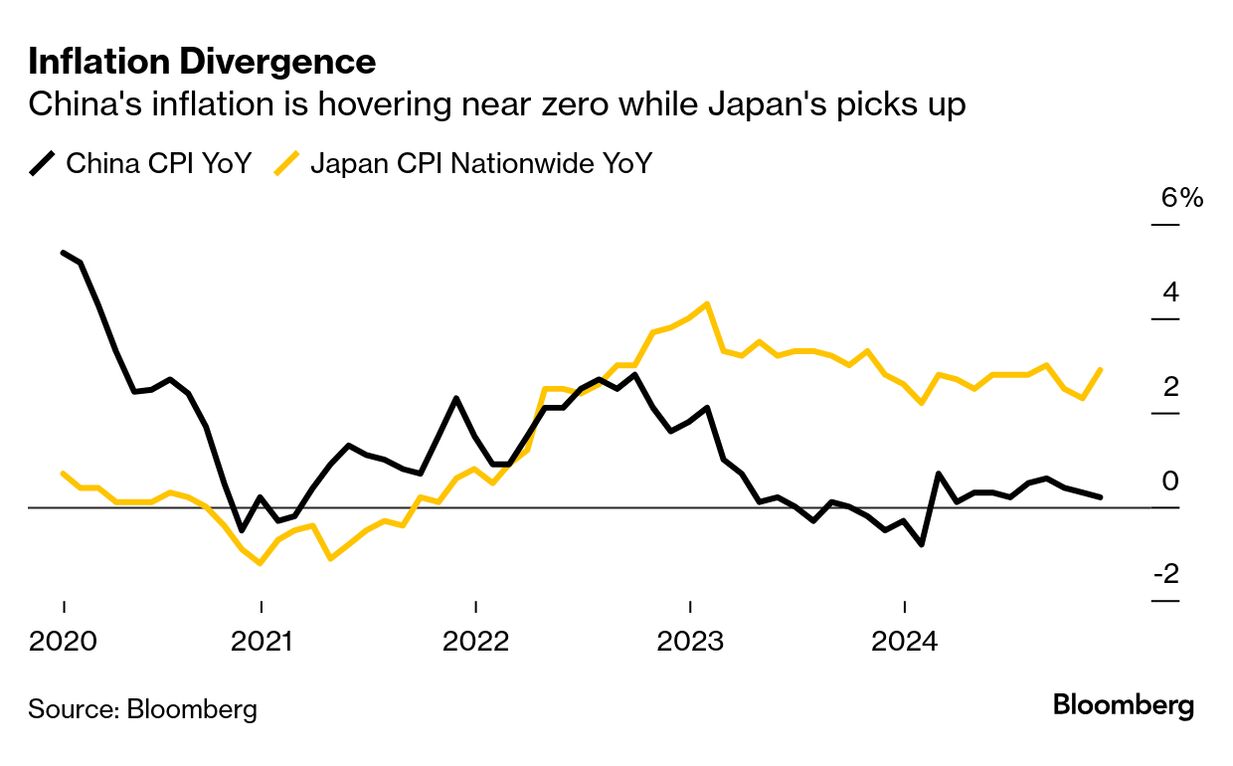

| After declaring that China had "smoothly" achieved its targets for 2024, President Xi Jinping said in late December that the nation faces a "very arduous" year of reform in 2025. He's not wrong, at least about the second point. Many economists and market watchers think that escaping deflation needs to become China's top priority this year. Prices are falling as households pare back spending during a property crash, prompting comparisons to Japan's lost decades. The People's Bank of China can't fix deflation on its own. The country's economy needs reforms that reduce overcapacity and allow inefficient zombie firms to fail — but that would mean layoffs, making things worse in the short term. Keep an eye on China's solar industry, one of its least profitable sectors, as a potential test case for reform. Then there's the Chinese consumer. Xi has made getting the nation's 1.4 billion people spending a top priority for 2025. Historically, that's been a struggle for the Communist Party, but a recent slew of consumption vouchers and pledges to secure the social safety net suggest the mindset among officials could be shifting. Finally, there's the return of Trump and the trade war he is promising. China is already facing a rash of tariff threats, and showing that it has new ways to retaliate. In focus are Beijing's stockpile of critical minerals, access to its huge market and America Inc's investments in the world's No. 2 economy. Who will Xi trust to lead the talks, and how will the fallout affect the wider Asia region? Of course, that's just the tip of the iceberg. 2025 will also be critical for the further fracture of technology supply chains, China's relationship with Russia, China's diminishing role in global investment portfolios and much, much more. It remains to be seen how Xi will navigate these issues. But on the last day of 2024, he warned a group of politicians that "the journey of Chinese modernization" would include "choppy waters, and even dangerous storms." — Jenni Marsh, Bloomberg News, and Walter Frick, Weekend Edition

Read More: Markets Sound Alarm Over Deflationary Spiral in China | |

| |

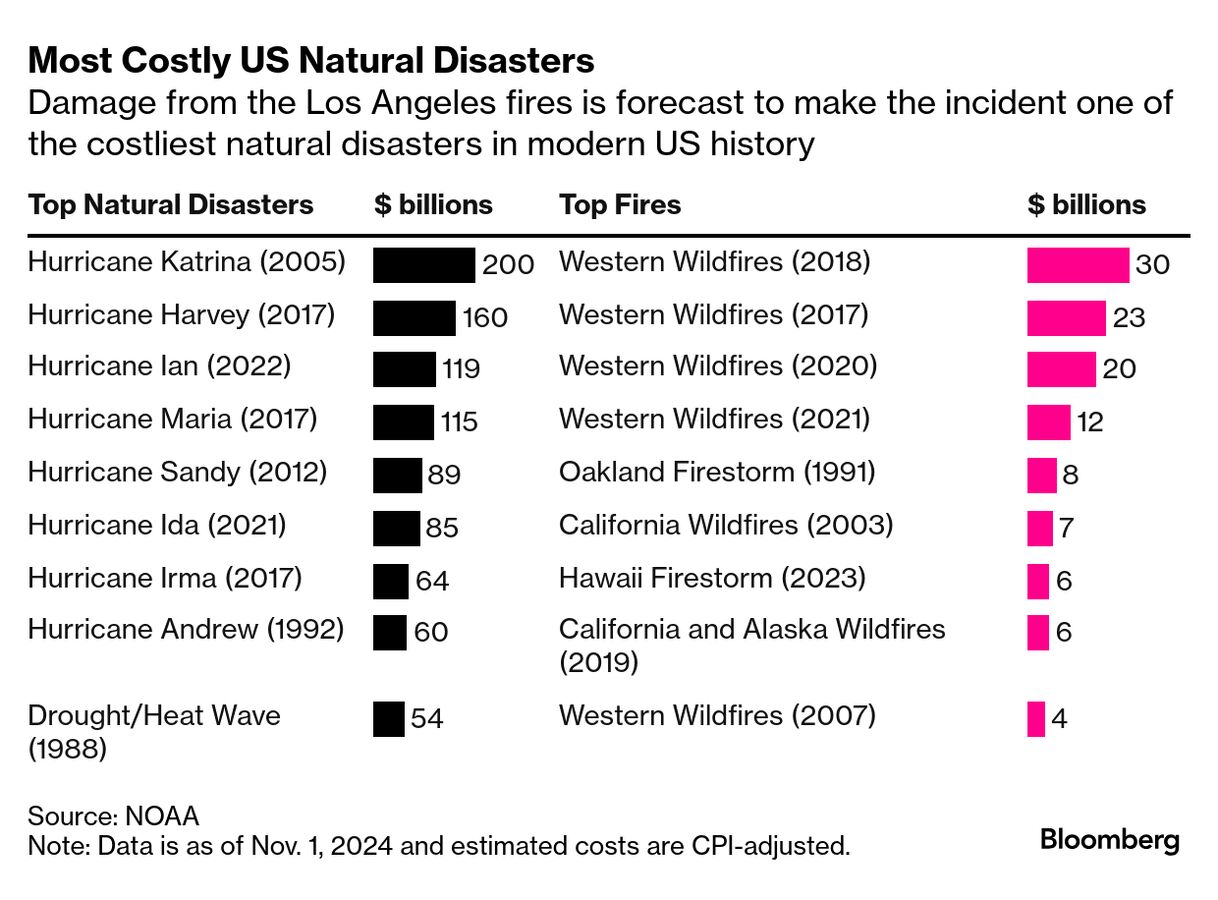

| AI will surpass you this year: "By the end of 2025, it will be evident to most educated observers that the best AI models can beat most experts on intellectual tests. It will beat me on an economics test, I have no doubt." — Tyler Cowen, Bloomberg Opinion "Fusion's gonna work." That's what OpenAI CEO Sam Altman said in a wide-ranging interview with Bloomberg Businessweek that's worth reading in full. — Josh Tyrangiel, Bloomberg Businessweek Alzheimer's treatments could be the next Ozempic: "Novo Nordisk is currently testing whether [semaglutide, the medication in drugs like Ozempic] can benefit patients with early Alzheimer's disease. Late-stage trial results are expected in the second half." — Lisa Pham, Bloomberg News Sequels will continue to dominate Hollywood: "The top three movies will likely be sequels to Avatar, Jurassic Park and Zootopia. The top 10 should include sequels or reboots of Wicked, Superman and Captain America, and possible new installments of Mission: Impossible, Fantastic Four and Snow White." — Lucas Shaw, Bloomberg News The Palisades fire could be the costliest ever: And "losses from the fires 'could push insurance markets over the brink in California,' said Michael Wara, a senior researcher for climate and energy at Stanford University and a wildfire expert." — Leslie Kaufman, Bloomberg Green | |

| |

| What the Big Banks Expect in 2025 The first earnings season of the year kicks off this week with a slew of results from Wall Street's biggest banks. They'll be closely watched by investors, both for signals about the health of financial markets and the US consumer, as well as for any comments from chief executives about what may lie in the year ahead. This slate of reports — which reflect the final quarter of 2024 — come after a solid year for bank stocks. A gauge of 24 of the top lenders rose 33%, outperforming the broader S&P 500 Index and regaining all the ground lost during the 2023 regional banking crisis. But with Trump's inauguration just days away, the banks' outlook for 2025 is especially important. Here are four things to look out for: Hopes that the Federal Reserve would keep up a swift pace of interest-rate cuts have dwindled. That means stocks and US consumers could face mounting pressure, and borrowing costs could remain higher for longer. What do the big bank CEOs have to say about the pace of cuts? Tariff threats have boosted volatility in equity markets and sparked concern that expectations of a blowout year for initial public offerings — which would benefit bank earnings — may be tempered. On the positive side, hopes for deregulation are higher due to Federal Reserve Vice Chair for Supervision Michael Barr's plans to step down from the role. His departure raises questions about the future of a landmark proposal requiring the biggest lenders to hold more capital to protect against losses and future financial crises. Lastly, there's the broader tone of Wall Street's titans of finance. Despite a solid third-quarter showing for JPMorgan Chase & Co., CEO Jamie Dimon gave a more gloomy macro outlook in October, pointing to "several critical issues" including fiscal deficits, infrastructure and a geopolitical situation that was "treacherous and getting worse." Next week, we'll learn whether the gloom has carried into the new year. — Carmen Reinicke and Eleanor Harmsworth, Bloomberg News | |

What Are the Chances... | | 90% | | The chances that Pierre Poilievre, leader of the Conservative Party of Canada, will be the prime minister of Canada after its federal election, according to Polymarket. Forecast as of 5 p.m. on Friday. | | |

| |

| |

| |

| Monday: SpaceX is expected to test its Starship rocket with a launch from South Texas; India publishes CPI; China publishes its trade balance. Tuesday: South Korea's Constitutional Court begins an impeachment trial of President Yoon Suk Yeol; French Prime Minister Francois Bayrou will present his policy agenda to parliament; Argentina reports CPI. Wednesday: Citigroup, JPMorgan, Goldman Sachs, Bank of New York Mellon, Wells Fargo and BlackRock report earnings; the US publishes CPI on the heels of Friday's stronger than expected jobs report. Thursday: Bank of America, Morgan Stanley, TSMC and UnitedHealth report earnings; Bank of Korea might cut rates, says Bloomberg Economics, or might put off a cut until February. Friday: China releases fourth-quarter and full-year GDP, as well as property prices, retail sales and industrial production. Also: Hearings begin this week for Donald Trump's cabinet nominees. Defense nominee Pete Hegseth's is scheduled to begin Tuesday; Treasury nominee Scott Bessent's is scheduled to begin Thursday; Trump will be inaugurated next Monday, Jan. 20. | |

| Have a nice Sunday and a productive week. — Walter Frick and Katherine Bell, Weekend Edition; Jenni Marsh, Carmen Reinicke and Eleanor Harmsworth, Bloomberg News | |

| Enjoying The Forecast? Check out these newsletters: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's The Forecast newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment