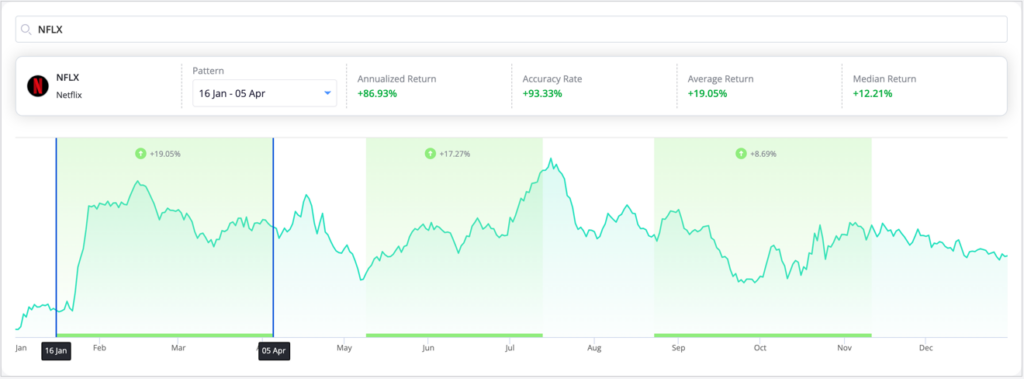

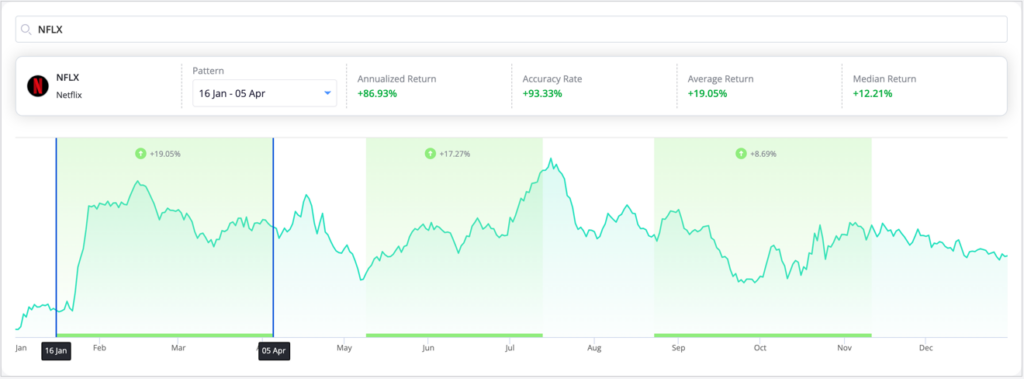

| More Articles | Free Reports | Premium Services By Keith Kaplan, CEO TradeSmith Ignorance is no defense. But it sure does induce a lot of anxiety. And unknowns are one of the most anxiety-inducing things for the market. We saw it in the third quarter of 2024, right before the election… The VIX was soaring, investor sentiment was tentative at best, and we weren’t sure if the Fed would surprise us (again). But as soon as those unknowns disappeared, the market charged forward. That’s the power of knowledge. It soothes that fear of the unknown. Of course, there are many things about 2025 we won’t know until we face them. But there’s no need to forge forward blindly and in fear. We’ve made the biggest breakthrough in our history… We’ve uncovered a way to solve one of the biggest unknowns in trading: the absolute best times of year to buy and sell any asset… … all based on measurable, tangible patterns. Let me show you how. A Time to Plant To the naked eye, stocks seem to trade erratically. They whip upward one day. They plummet the next… sometimes even after good news. But there are stocks that trade so consistently... rising (or falling) sharply during specific windows of time, year after year... that you can map out an entire year of great trades – right now. It’s not unlike how farmers make their plans for the year. They don’t know if it’ll rain or snow next Wednesday. They can’t assume that every field they plant will produce a healthy crop. But farmers do know when to plant for the best results. Here in the Northern Hemisphere, that’s in spring. This is a dependable seasonal pattern in nature. Humans have used it to our advantage for thousands of years. With only a glance at their calendars, farmers prep and plant their fields from March to May. They tend the crops from June to August. Then they harvest in September to November (depending on the crop). In fact, farmers behave this way so reliably that it creates a specific cycle in agricultural prices. Every year when it’s time to harvest, there will be downward pressure on the price of those crops, since supply will temporarily be greater than demand. Just as dependably, stocks go through seasonal cycles, too. And like farmers, you can know down to the very day when the best time is to buy or sell any given stock. We’re hosting a webinar on the strategy tomorrow, January 8 at 10 a.m. ET, and we’ve set up a website where registrants can run their own stock tickers through our breakthrough TradeSmith Seasonality tool. To try it for yourself, register here to attend the webinar and get free access to seasonality patterns on your stocks. This unique tool will display consistent historical patterns coming up that can help you make informed decisions about stocks on your watchlist, stocks you already own, or ones you’re just now exploring. And with the new year underway, a whole new slew of cycles are about to begin… The “Why” Doesn’t Matter Take Netflix (NFLX), for example. The popular streaming stock tends to climb dramatically starting in January. That’s the first seasonal window highlighted here in green on our TradeSmith Seasonality chart:

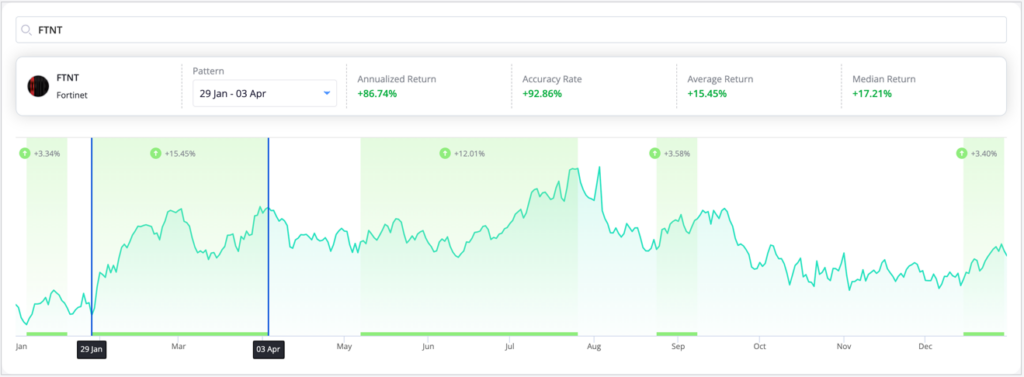

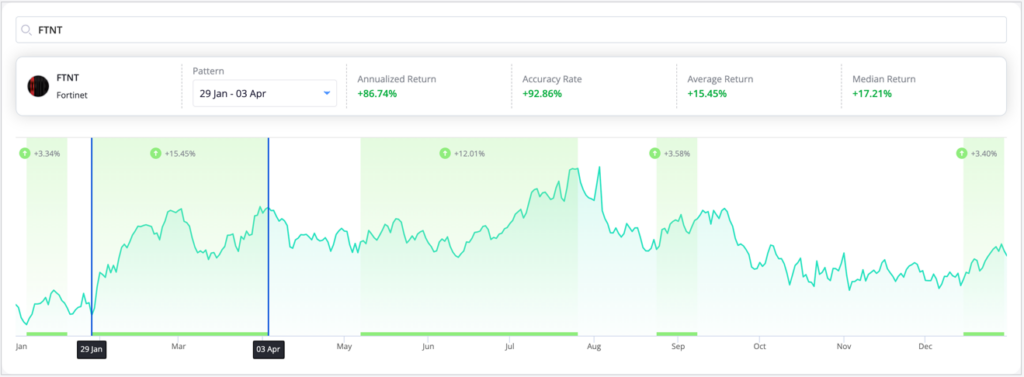

But why is January to April such a great time for Netflix? Maybe it’s the earnings report... although those have been a mixed bag the past few years. Perhaps the company has been releasing hot new shows early in the year. We can’t always say why. And the why doesn’t necessarily matter. Instead, we can simply recognize that the stock price has risen 19%, on average, between January 16 and April 5 during the past 15 years. Will it play out the same way this year? There are never any guarantees, but this bullish seasonal pattern has a 93.3% track record of success. The odds are in our favor. Let’s look at another example: cybersecurity giant Fortinet (FTNT). FTNT is also a good buy in January. It tends to climb 3.3%, on average, from January 5 to January 20, then another 15.4% from January 29 to April 3. It has an 80%+ track record of gains during both these periods. In fact, the stock seems to be highly seasonal in how it trades, with several high-probability patterns playing out throughout the year:

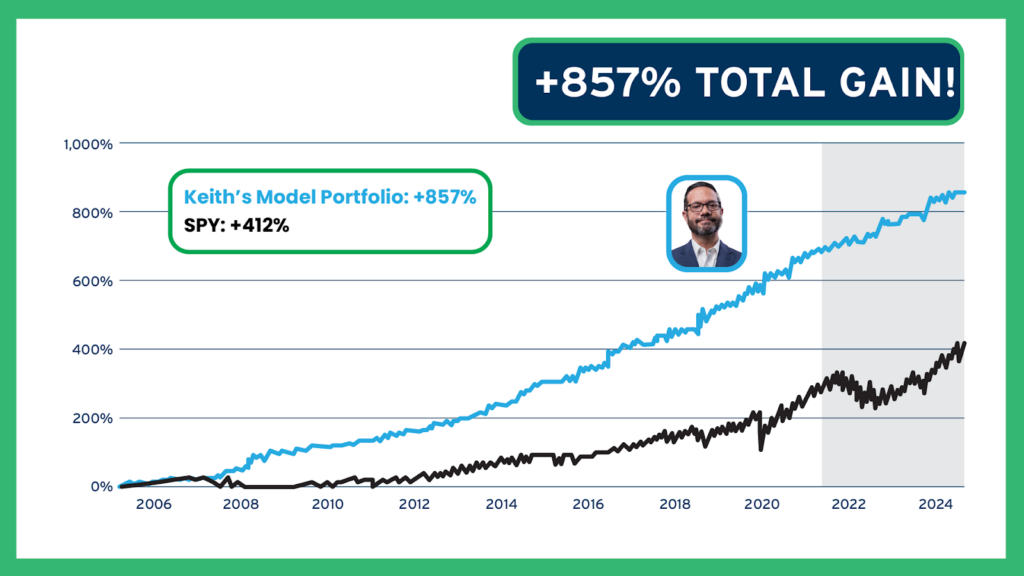

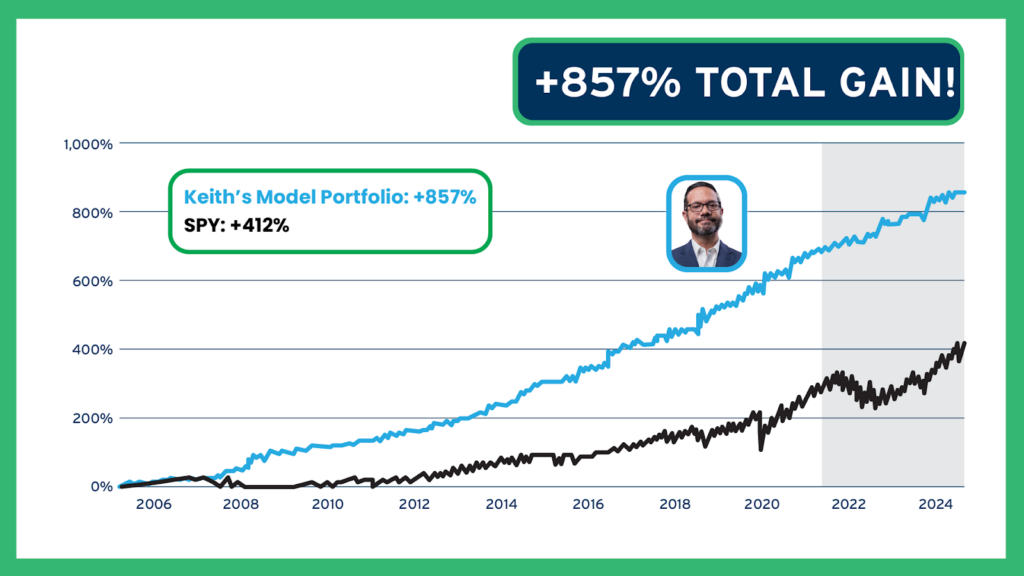

I could go on all day showing you different seasonal patterns in various stocks. With a quick TradeSmith screener for seasonality, I was able to find 22 of them with a high-probability bullish pattern starting this month, averaging 10% to 20% gains in the first quarter. All of this is to show you how you can plan your trades on any stock... down to the day. See, most people who recognize the power of seasonality can’t get that specific about it. They can show you which sectors tend to perform best in the summer or the winter, sure. They can even try to explain why so you’ll feel confident in their conclusion. But typically stock pickers don’t have the data or the firepower to crunch all the different numbers and say: For any particular stock, which is the best day of the year to buy... then sell? Even when you can plot out a whole year’s worth of seasonality, as we do at TradeSmith, some days are still far better than others. We highlight those days for you as the green zones you saw on my charts here today. The Simplest Strategy Is the Most Effective I don’t mind telling you that this could be the biggest breakthrough we’ve ever had at TradeSmith. This can allow us to recommend trades more confidently than ever before in 2025 – because we know which stocks will offer us high-probability trades months ahead of time. But I am only interested in bringing you a trading strategy that could win at least 80% of the time. And when we backtested our seasonality system with all sorts of different criteria, we actually discovered that the simplest strategy was the most effective... We narrowed it down to a two-step process for selecting these trades. In our 18-year backtest, we had a positive average return every year: 5.96% overall, with an average hold time of 19 days. Keep racking up such wins frequently throughout the year, and you could see a 118% annualized return. Even the worst year in our backtest – 2007 – saw an average trade of 2.5% and an annualized return of 37.9%. That’s far better than the S&P 500 will earn you in any year (but especially in 2007). Overall, testing this strategy over 18 years showed 857% growth – more than twice what the S&P delivered over the same period.

Tomorrow at 10 a.m. Eastern, I’ll show you everything I can about this strategy and how we will use it to find you the most reliable stocks to trade in 2025... on their very best days of the year. Click here to register to attend to learn more about these new seasonality signals – our major breakthrough for 2025 – and try the tool for yourself, 100% free. All the best, |

No comments:

Post a Comment