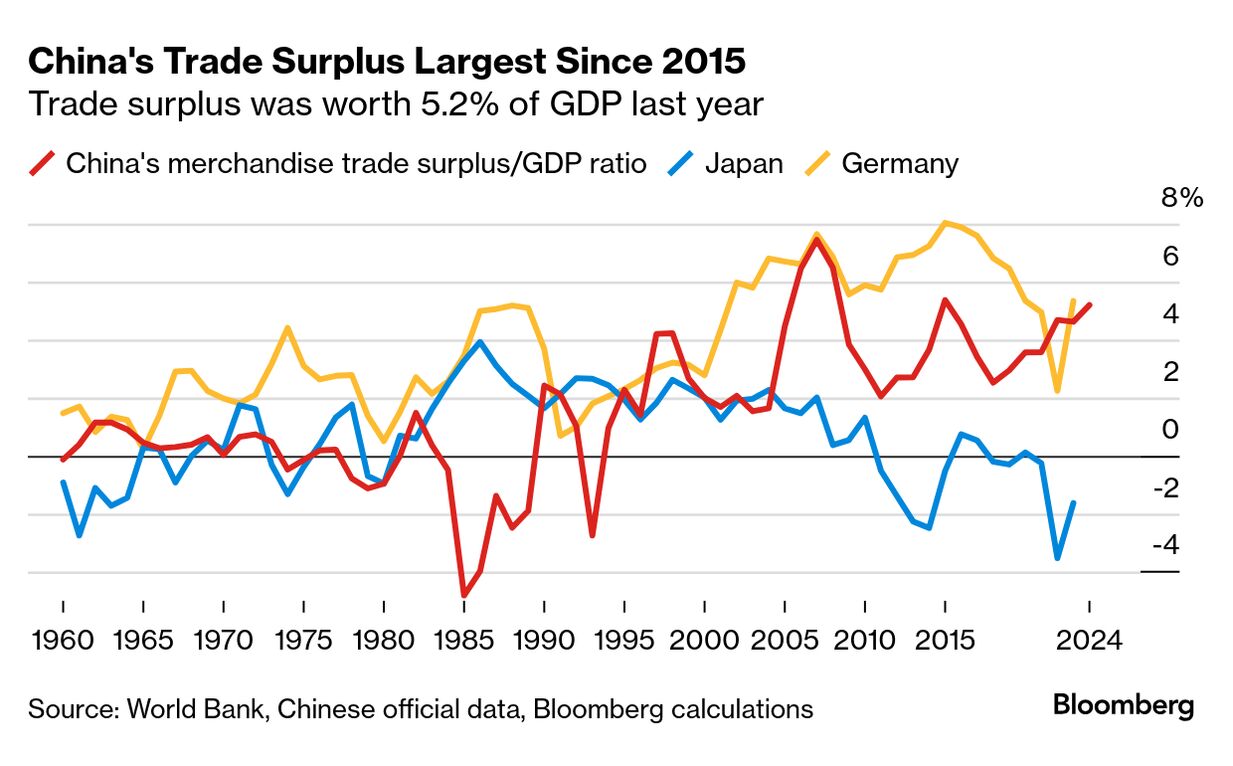

| Donald Trump's first presidency upended the rules governing the global economy as he shifted when and how America invokes national security by embracing a broad concept of economic security that put a wide range of things from Canadian aluminum to European cars in the sights of his tariffs. This time he appears ready to redefine America's concept of a national emergency as he reboots his trade wars. If, as many expect, Trump in the coming days invokes the International Emergency Economic Powers Act to impose tariffs on US imports, he will have to declare an emergency. But what will that emergency be? Presidents have used IEEPA to impose sanctions on countries, companies and individuals dozens of times since it went into effect in 1977. President Joe Biden cited IEEPA to impose restrictions that took effect just this month on outbound investment in strategic technologies in "countries of concern." QuickTake: What Trump's New Tariff Push Means for the Economy The law's predecessor was used by Richard Nixon to impose a 10% tariff on imports as part of his attempts to force a realignment of global currencies in August 1971, though the levies were only in place for a few months. Reading through lists of past emergencies, the common thread is how targeted they are. Nuclear proliferation, terrorist financing, Russia's invasion of Ukraine, and the coup in Myanmar all resulted in sanctions. Border Crackdown Even when Trump in May 2019 cited IEEPA to threaten tariffs on Mexico, it was for the specific purpose of provoking Mexican authorities to curb the number of migrants crossing the border, which they did. In recent weeks Trump has threatened tariffs against Canada and Mexico if they don't limit migration into the US and the trade of fentanyl. He's done the same with China over shipments of the opioid. Read More: TikTok Restores Service After Trump Vows to Extend Deadline If Trump invokes IEEPA and delivers on those threats, the use of tariffs would be novel but the sorts of emergencies identified wouldn't. But what if Trump uses IEEPA to justify something broader like universal tariffs? What would the emergency be then? A persistent trade deficit that has plagued the US since the 1970s? Decades of lost US manufacturing jobs and industrial capacity, much of it due to American corporations' own decisions to offshore production? A dollar that has surged against other currencies of late mainly due to anticipation of his policies? Read More: Chinese Vice President Meets Musk Before Trump Takes Office Whether tariffs will do anything to close the trade deficit or bring back manufacturing or end any crisis is debatable. Many economists are skeptical. Tariffs in the short term are more certain to lead to a further appreciation of the dollar, raise the cost of imports, and add to government revenues, at least initially. In the longer term, though, if Trump invokes broad emergencies to impose new tariffs it may set yet another precedent. Until Trump in his first term began citing national security as a justification for tariffs, governments largely saw an exception meant for times of war as an extreme loophole in global trade rules. Blocked Steel Deal That changed when Trump ended America's restraint. The legacy of his first term in part is a world in which governments have a wider view of national security as an economic defense. Biden demonstrated that when he invoked it to block Nippon Steel's acquisition of US Steel. The same applies to national emergencies. If anything can be described as an emergency then everything is tariffable. And the rules governing trade take another step towards extinction. It's worth remembering Trump's threats don't always come true. But Trump is pledging a wider campaign against what he portrays as national calamities from immigration to imports. "I will act with historic speed and strength and fix every single crisis facing our country," he told supporters on Sunday. He sees crises everywhere. How he fixes them and justifies his actions when it comes to tariffs will establish what his legacy is. Not just for the US but also for a world that has long relied on America to lead the way. —Shawn Donnan in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment