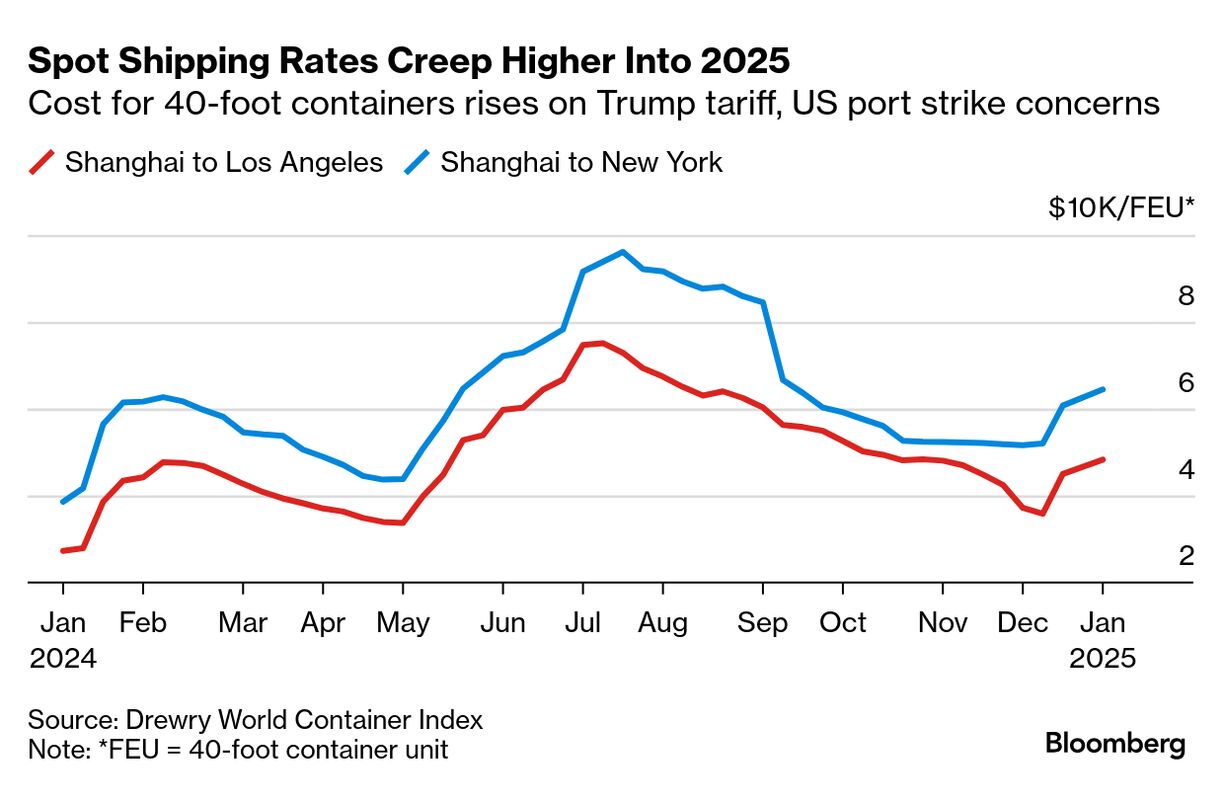

| US port operators along the East and Gulf coasts and the longshoremen they employ to keep cargo flowing look set to return to the negotiating table after a seven-week-long stalemate. As Bloomberg's Laura Curtis reports today from Los Angeles, talks between the International Longshoremen's Association and US Maritime Alliance are set to resume next Tuesday — a small but important breakthrough in an impasse dating back to mid-November. That leaves just over a week for the two sides to either resolve their remaining grievances and sign a new contract, or extend the talks again. Otherwise, the dockworkers union is threatening another strike after the Jan. 15 deadline. QuickTake: Why US Port Workers Are Threatening to Strike — Again The ILA is framing its fight against automation as an existential one, and it's received the backing of President-elect Donald Trump, who takes office on Jan. 20. The USMX is making a broader economic case that the ports need to modernize to serve the needs of American businesses, saying the automation will help improve the efficiency of domestic ports, protect jobs and ensure terminals can handle higher volumes in the future. Meanwhile, the dual threat of a US port strike and Trump's tariffs are boosting spot shipping rates. The Drewry World Container Index released Thursday showed the rate for a 40-foot shipping container from Shanghai to New York rose 6.1% over the past week — that route's third straight weekly advance — while the rate to Los Angeles gained 7.3%. —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment