| I'm Katia Dmitrieva, Asia economics correspondent in Hong Kong. Today we're looking at China's year ahead. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Leaders from a US dockworkers' union and the group that represents their employers are set to resume contract talks on Jan. 7 as the threat of a strike looms.

- Asia's factory activity crawled ahead in 2024 as risks loom with potential tariffs and weaker domestic demand.

- Here's (almost) everything Wall Street Expects in 2025 — read our Big Take.

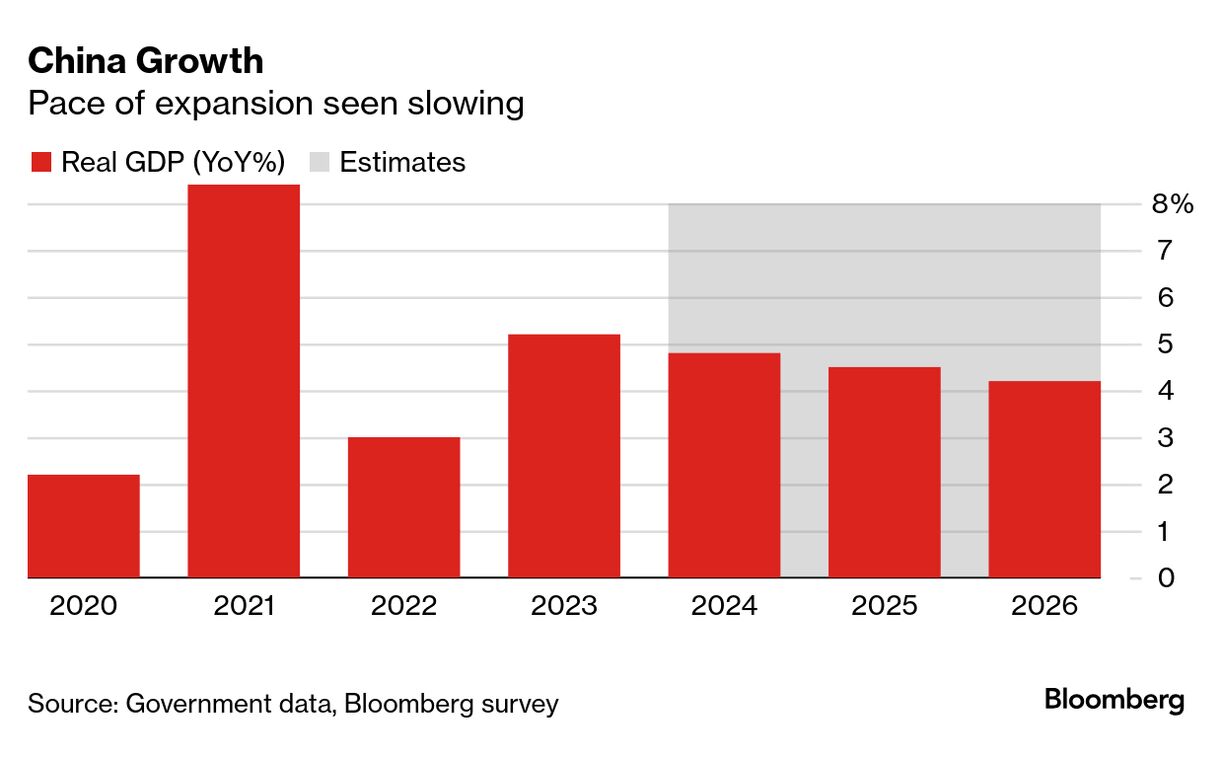

On the final day of 2024, Chinese President Xi Jinping issued a warning about the path ahead, telling a gathering of top politicians that "the journey of Chinese modernization" wouldn't be just sunny skies, but also "choppy waters, and even dangerous storms." Those storms erupt pretty early in 2025 with the inauguration of Donald Trump as US president, set to usher in long-promised tariffs that threaten China's main source of economic growth in 2024. Higher levies would not only weigh on the country's trade, but also risks commerce with other nations as they turn more protectionist. A stronger US dollar also poses a conundrum for China's central bank, with less scope to lower rates without weakening the currency. And Trump is just one of the headwinds for the world's second-largest economy, with tepid consumer spending, the housing market in negative territory and deflation threatening to spiral further. Growth this year likely came in at the government's "around 5%" target, Xi said Tuesday, but economists see that slipping each year to 4.5% in 2025 and 4.2% in 2026. Trade tensions explain part of it — exports growth is seen easing to 1.2% this year from more than 5% in 2024. But the other part is domestic demand, which the government has failed to reignite after the housing market slump. The labor market has also flatlined, with reports in 2024 of cut wages and nixed bonuses. Young citizens went from "laying flat" to being "lifeless," as one economist put it. China's already signaled an increased appetite for spending and lowering borrowing costs, across a flurry of conferences and announcements in the final months of the year. The approach so far has been targeted and reactive rather than a blanket boost. (Take for example the latest move, a treat for some government workers of a salary increase ahead of the January holidays.) Xi's final words of the year show that the government is generally OK with that approach so far, even if the top leader and country's economist-in-chief is showing signs of gently shifting gear to release more stimulus and ensure the economy doesn't slow too much. Recently, state media even lambasted the drive for "speed" that's so common across governments. Perhaps the big question for China in 2025 isn't about the speed or whether it'll be able to meet its growth target, but just how bad the storm damage will be. The Best of Bloomberg Economics | - UK housing prices climbed close to a record high in December, a rare spot of strength in the overall economy.

- Bank Indonesia intervened to stabilize the rupiah after President Prabowo Subianto scaled back a tax hike.

- South Korea cut its economic growth outlook for this year, reflecting the ongoing fallout from political upheaval and Trump's tariff plans, as the central bank vowed to stay flexible. Meanwhile, exports maintained growth momentum in December.

- Turkey's annual inflation in December likely eased less than the central bank projected as policymakers begin to set the stage for more easing.

- Thailand's government expects a selection panel to quickly conclude the process to pick a new chairman for the nation's central bank after its previous nominee was deemed unsuitable for the job due to his ties with the ruling party.

- Swedish central bankers are likely to resist a longer wait before a final reduction in borrowing costs even as they are adopting a more patient approach to changes in monetary policy.

The US is often lauded as one of the top countries in the world for starting a business and entrepreneurial activity. And foreign-born students may be a big part of that, according to a new paper published by the National Bureau of Economic Research.

Researchers wanted to find just how much foreign-born students contribute to startups in the US. They found that for each ten percentage-point increase in foreign students graduating with a Master's degree, there are 0.4 additional startups in that cohort. Foreign-born graduates even have an effect on domestic peers, with up to 45% of startup creation effect attributable to "positive spillovers" of foreign students on US-born creators. |

No comments:

Post a Comment