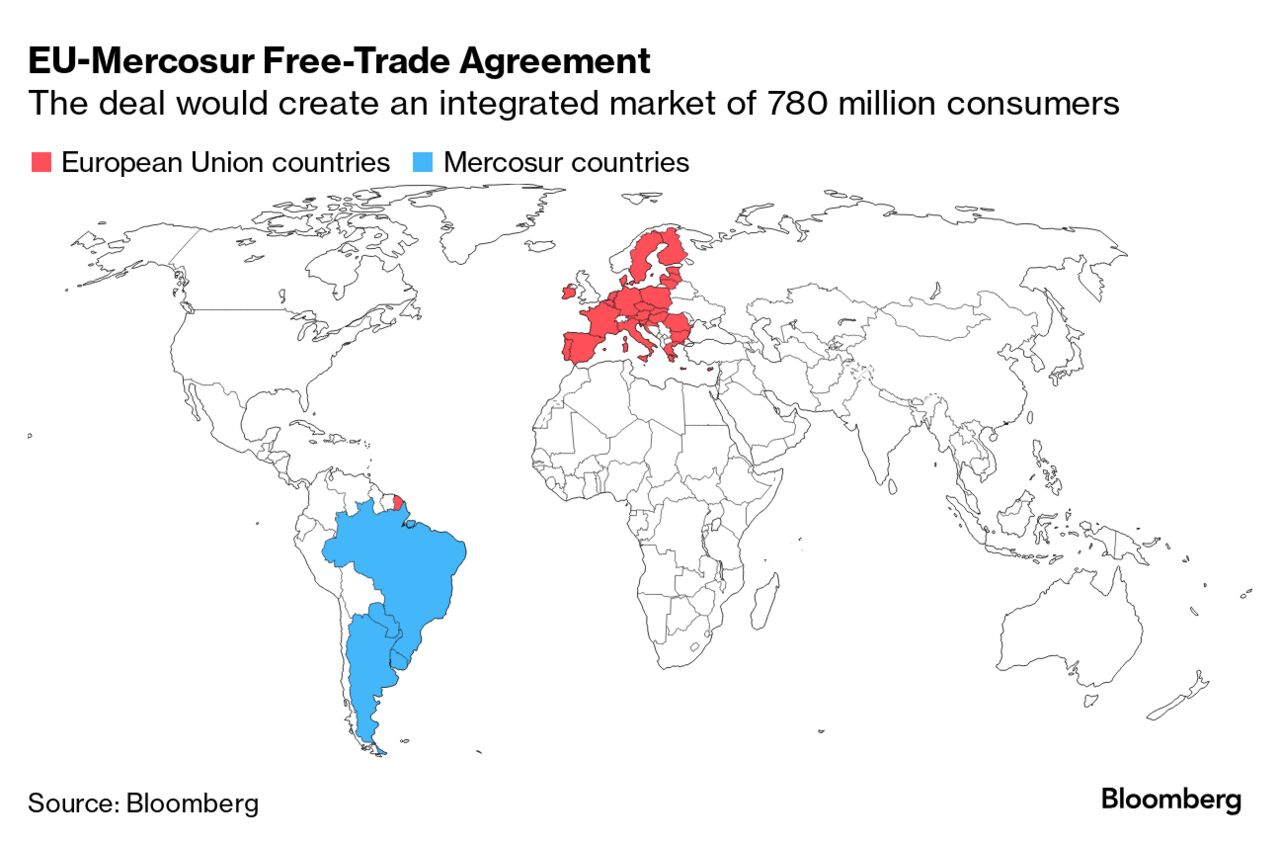

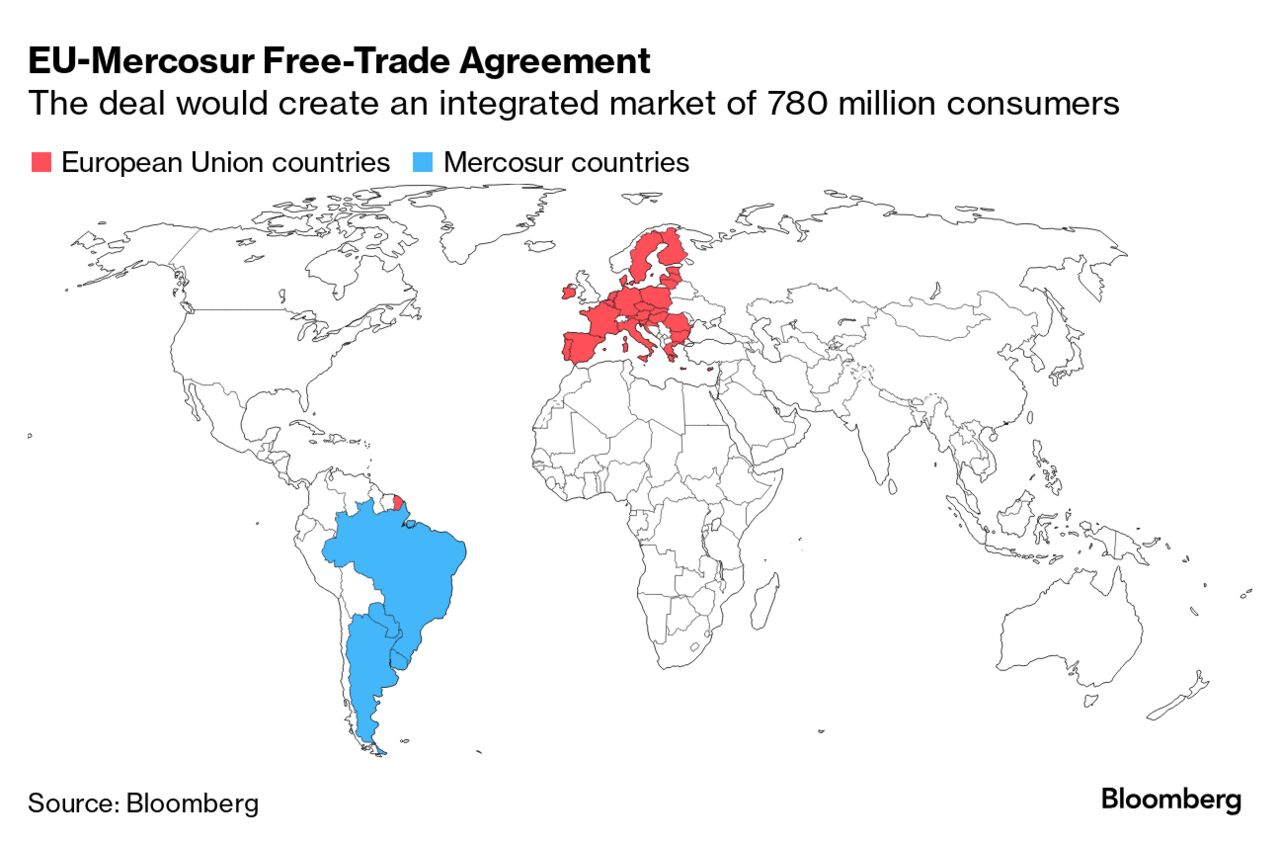

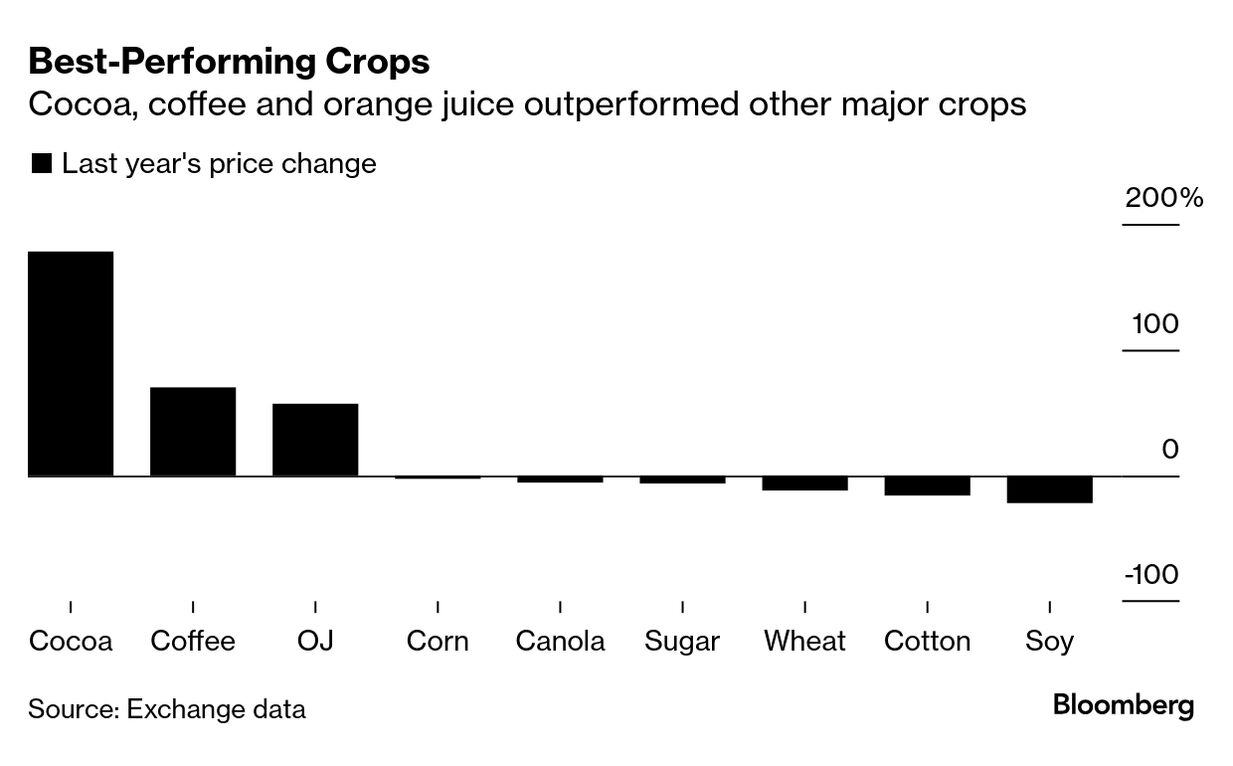

| Welcome to another year of global food editions of the Supply Lines newsletter. The past 12 months saw a new level of farmer angst and indulgences getting more expensive as cocoa and coffee prices spiked. Climate change continued to strain crops and Europe's global green ambitions took a knock. There's every chance 2025 will be even more eventful. Here are some key themes to watch for in the agri-food universe: Change in Washington Donald Trump's return to the White House has many markets on tenterhooks, not least food. The industry is bracing for trade wars — especially with China — that could again upend global flows, as well as the impact that the incoming president's immigration policy will have on farm workers. Some of his Cabinet picks will also be important to watch. Besides Robert F. Kennedy Jr.'s vaccine skepticism, Trump's nominee for health secretary has vowed to take on Big Food, corn syrup, seed oils, artificial food dyes and pesticides. So expect attention on ultra-processed foods to continue. Agriculture secretary pick is Brooke Rollins, the head of the America First Policy Institute, who's set to oversee farm subsidies and federal nutrition programs. Other Trade Ripples It's not just trade wars that could reshape shipments and affect supply chains, and two recent developments are of particular importance in Europe. One is a trade deal between the European Union and South American Mercosur bloc, which after 25 years in the making is finally in sight. Farming was a contentious aspect of the accord, which still needs to be ratified. European growers are concerned that inflows of cheaper goods from Latin America produced at lower standards to their own will put them at a disadvantage.  Source: Bloomberg The second is the EU's deforestation rules, which will now come into effect at the end of December after a one-year delay at the 11th hour. Businesses such as chocolate makers had said they needed more time and money to prepare, as did nations that supply them. Despite the postponement, the regulations will still test the level of preparedness among industries. NGOs have warned that the delay will also worsen the treatment of indigenous people and is bad news for deforestation. Climate in Brazil COP30 climate talks will take place later this year in agricultural powerhouse Brazil, home to the Amazon, the world's largest land carbon sink. The summit is widely expected to address key aspects of food systems and the bioeconomy — from methane in livestock to nitrogen from fertilizers to protecting forests. The dearth of available climate finance for farmers will continue to be a sore point as increasingly erratic weather ravages crops around the world. Soaring Prices Weather rattled some key markets last year. Cocoa prices almost tripled on African harvest problems, while premium arabica-coffee beans jumped 70% amid worries about Brazil's crop, with both hitting records. Orange juice also climbed to an all-time high, and a broader measure of global food prices rose for the first time in three years. At the retail level, worse may be yet to come. For example, higher cocoa costs for chocolatiers haven't fully filtered down to supermarket shelves. New Frontiers Farmers need money — and new technology — to adapt to climate threats and become more efficient as the population grows. Watch out for new advances in gene-editing and artificial-intelligence tools that may help them. Mouth-Watering Trends In the restaurant world, the formerly humble seasoning pepper has become a not-so-secret weapon for chefs, in a range of colors, shapes and provenances, as Bloomberg News' Kate Krader writes. Plus, prepare for more temaki, inventive pizza toppings and... duckweed. —Agnieszka de Sousa in London |

No comments:

Post a Comment