| Katherine Tai has been the face of US trade policy for the past four years, traversing the world to negotiate agreements to bolster domestic |

| |

| | Supply Lines is now exclusively for Bloomberg.com subscribers. As a loyal reader, we'll keep sending it to you for a limited time. If you'd like to continue receiving Supply Lines, and gain unlimited digital access to all of Bloomberg.com, we invite you to subscribe now at the special rate of $129 for your first year (usually $299). | | | | | | |

| Katherine Tai has been the face of US trade policy for the past four years, traversing the world to negotiate agreements to bolster domestic supply-chain resiliency and the broader economy. Also, perhaps more than any of her predecessors since the office of US Trade Representative was created, Tai and USTR officials have traveled domestically, visiting all 50 states in pursuit of building a "worker-centered" trade policy. In a wide-ranging interview in the second-floor conference room of USTR's headquarters across the street from the White House complex, President Joe Biden's trade representative talked about the administration's successes, frustrations, and called for a broader US conversation about trade and tariffs. Here are a few excerpts from our conversation on Tuesday: - "I feel tremendously proud of the contributions we have already made to the project of re-imagining globalization and reforming our institutions and changing the way people talk about trade."

- On tariffs: "In terms of the role of tariffs in trade and the economy, we have to have a more nuanced conversation about this. Tariffs are a tool. It's how you wield that tool and what you're trying to accomplish with that tool that matters. If we can get people to climb off of their reactive stances where they say 'Tariffs are always good' because they feel good when you talk about tariffs or 'Tariffs are always bad' because of too simplistic logic that tariffs increase costs, then that's a good evolution."

- Tai connected her tenure to those of her Republican predecessor Robert Lighthizer and Trump's choice to follow her, Jamieson Greer, saying all three share a recognition of distortions in global trade, and that she hopes the Trump administration will work with allies to address them.

- On disputes with the European Union over large civil aircraft, steel and aluminum: "I wish that we had been able to do more and that we had been able to move faster. That said, we'll take the progress that we made. Looking forward, whether or not we get the rest of the way is really going to be up to not just my successor, but really up to Europe."

- On issues in the upcoming US-Mexico-Canada Agreement review, since it took effect in mid-2020, the automotive industry "is under acute pressure from competition from China that's been based on a kind of monopolistic industrial policy. That is top of mind for many people, but I would just caution that that's not the only one. For our three economies, the more comprehensive and holistic this conversation around our industrial supply chains can be in these next years, the better off we'll find ourselves."

Read the full story here. —Eric Martin in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. | |

| |

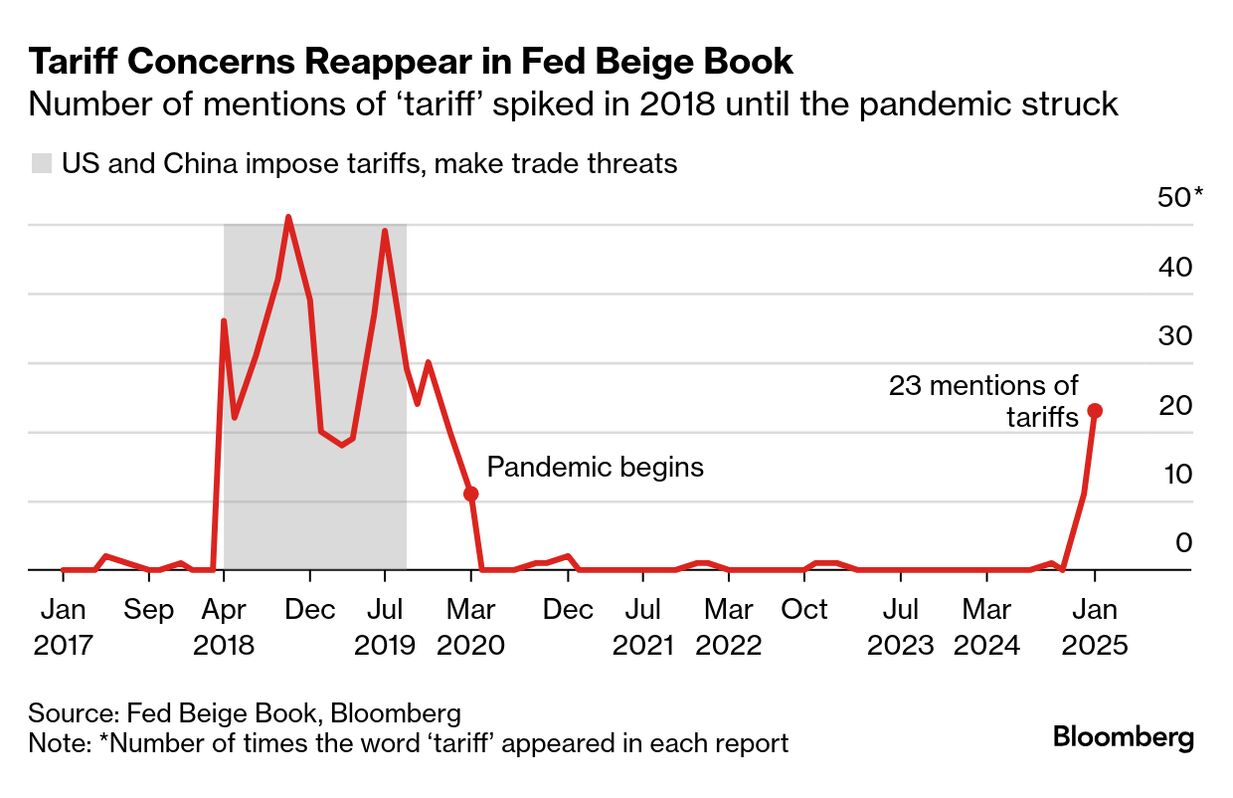

| Tariff talk | The number of mentions of tariffs in the Federal Reserve's beige book increased again as President-elect Donald Trump prepares to take office on Monday. Economic activity increased "slightly to moderately" across the US in late November and December, supported by strong holiday sales, the Fed said in its latest survey of regional business contacts. | |

| |

- Israeli Prime Minister Benjamin Netanyahu accused Hamas of reneging on parts of a ceasefire agreement that looked set to pause more than 15 months of fighting in Gaza, risking completion of the long-awaited deal.

- China will start an investigation into whether the US dumps lower-end chips and unfairly subsidizes its own chipmakers, one of Beijing's strongest retaliatory moves so far against American technology sanctions.

- Canada has drawn up an initial list of C$150 billion of US-manufactured items that it would hit with tariffs if Trump decides to levy tariffs against Canadian goods. Separately, Canada wants its allies to explore a pricing floor for critical minerals to address what it views as market interference from China.

- Trump confirmed his interest in acquiring Greenland for the US, Denmark's Prime Minister Mette Frederiksen said following a 45-minute phone call with the incoming US president.

- South Korea is considering buying more oil and gas from the US to diversify its energy sources and also potentially head off the threat of Trump's proposed tariffs.

- New Zealand, Australian and US dairy companies are accusing Canada of dumping low-priced milk products on world markets and are asking their governments to intervene.

- The Vietnamese dong is likely to test new lows as the country's growing trade surplus with the US puts it at risk of targeted tariffs from the incoming Donald Trump administration.

- The Netherlands tightened export control rules to make ASML apply for licenses with the Dutch government instead of Washington for some of its tools.

- In this Talking Transports podcast, Ken Beyer, CEO of Transportation Insights and Nolan Transportation Group, shares insights about where freight markets are heading.

| |

On the Bloomberg Terminal | |

- Airbus CEO Guillaume Faury said the engine issues afflicting many of its narrowbody aircraft will continue into the first half of the year and possibly beyond, complicating the European planemaker's outlook as it grapples with persisted supply-chain constraints.

- Prime Minister Pham Minh Chinh has approved investment policy for Can Gio international container transshipment port project, according to an emailed statement from Vietnam Maritime Corp., known as VIMC.

- Run SPLC after an equity ticker on Bloomberg to show critical data about a company's suppliers, customers and peers.

- Use the AHOY function to track global commodities trade flows.

- See DSET CHOKE for a dataset to monitor shipping chokepoints.

- For freight dashboards, see BI RAIL, BI TRCK and BI SHIP and BI 3PLS

- Click HERE for automated stories about supply chains.

- On the Bloomberg Terminal, type NH FWV for FreightWaves content.

- See BNEF for BloombergNEF's analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

| |

| Don't keep it to yourself. Colleagues and friends can sign up here. We also publish Economics Daily, a briefing on the latest in global economics. For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Supply Lines newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment