| Bloomberg Morning Briefing Americas |

| |

| Good morning. The SEC is suing Elon Musk, at least for now. The Biden administration plans yet more chip curbs. And crypto offerings did well last year, but Bitcoin is still the one to beat. Listen to the day's top stories. | |

| Markets Snapshot | | | | Market data as of 06:46 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

| Elon Musk cheated Twitter shareholders out of over $150 million by waiting too long to disclose his growing stake in the platform ahead of a takeover bid back in 2022, the SEC said in a lawsuit. (It's been probing him since 2022.) The complaint was immediately disputed by Musk's lawyers, but he's also facing investor litigation accusing him of hiding his acquisition of Twitter shares. The US is said to be planning to introduce more regulations to prevent advanced chips from being sold to China, targeting producers such as TSMC, Samsung and Intel. It'd be the latest in a flurry of tech-trade measures from the Biden administration during its final days in office and follows an incident in which TSMC-made chips were secretly diverted to blacklisted company Huawei. | |

| |

| Confirmation hearings for Donald Trump's Cabinet continue today, with Senator Marco Rubio—the president-elect's pick for secretary of state—to say China has lied and cheated its way to superpower status at the expense of the US, according to prepared remarks. Pam Bondi, the nominee for attorney general; Chris Wright, to be the energy secretary; and would-be Transportation Secretary Sean Duffy, who's vowed to cut red tape, will also be on the Hill. Los Angeles latest: Southern California is contending with a combination of high winds and minimal humanity, which threatens to fan wildfire flames. Insurance loss estimates are now seen as high as $40 billion. And surprising absolutely no one, real estate vultures are circling the middle-class community of Altadena, which was devastated by the Eaton Fire.

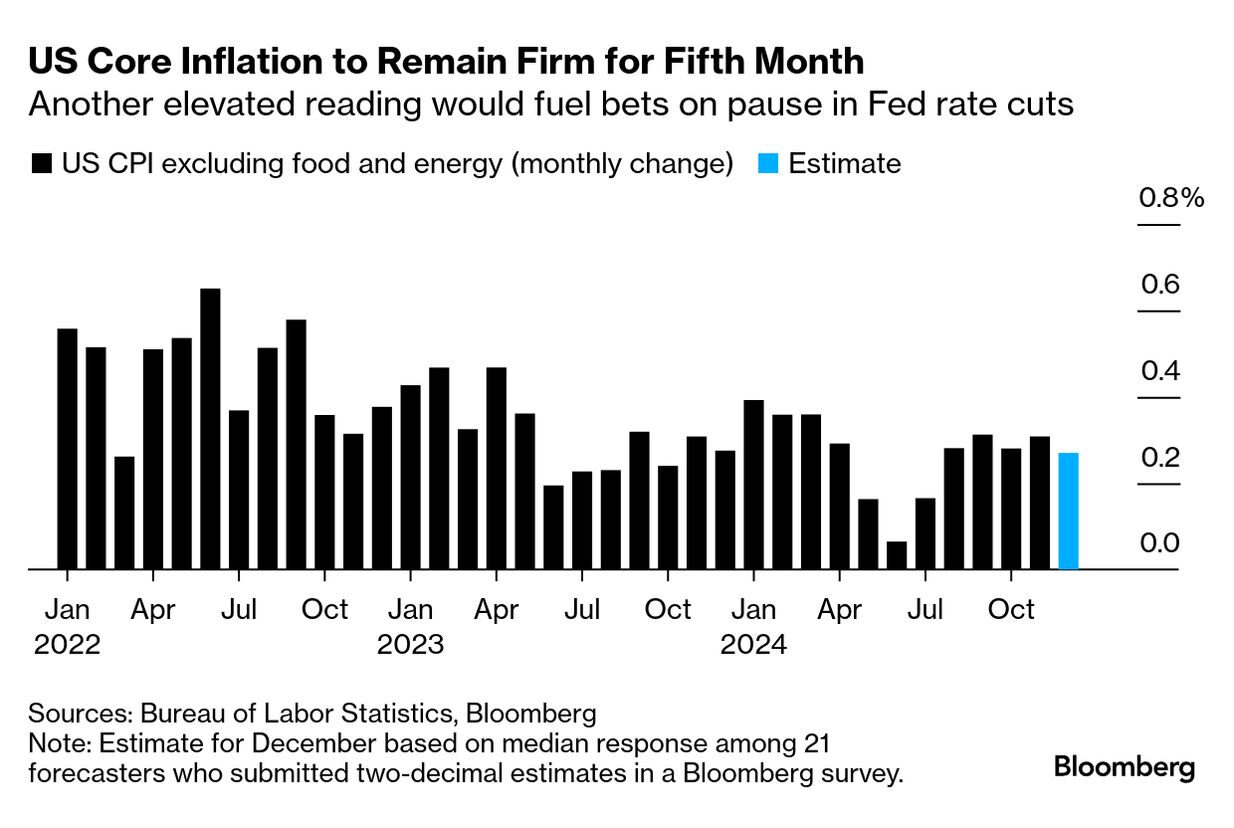

US inflation probably accelerated in December, according to data due later today. That'd mean a fifth straight month of firm increases, bolstering the case for an extended pause in Federal Reserve interest-rate cuts. | |

| |

| During a great year for crypto, hedge funds focused on digital assets unsurprisingly did very well, too. Just not as well as the OG: Bitcoin. - In 2024, a number of crypto hedge funds logged double-digit returns, with the VisionTrack Composite Index, which tracks the performance of 130 crypto-dedicated hedge funds, jumping a whopping 40%, according to data provided by Galaxy's VisionTrack.

- But those gains are paltry when compared with the advance notched by Bitcoin, which surged 120% to above $100,000 for the first time.

- Beating Bitcoin's performance is challenging for crypto hedge funds because "it's really hard to time these things," said David Jeong, CEO of Tread.fi.

| |

| |

Photographer: Shiho Fukada for Bloomberg Businessweek Toyota's recent success is getting in the way of its EV future. The world's No. 1 automaker has kept its focus on hybrids and gas-guzzlers, for better and worse. How long can that last? | |

| Big Take Podcast |  | | | |

| |

| Greenland's mineral supplies are actually relatively small and prohibitively expensive to extract, Javier Blas writes. The US has better places to flex its diplomatic muscle, such as the Democratic Republic of Congo, which is home to huge reserves of copper and cobalt.

| |

| More Opinions |  | |  | | | |

| |

Ons for sale in New York. Photographer: Nina Westervelt/Bloomberg via Getty Images Forget about the funny name—Ons, with their weird soles and unfamiliar logo, are dominating the running shoe and comfy sneaker boom. The Swiss brand (Roger Federer is an investor) has seen 30% year-over-year growth and increased its market share almost eightfold from 2019 to 2024. Now the challenge is to maintain momentum. | |

| A Couple More |  | |  | | | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment