| The US reports inflation data today, which is expected to show a fifth month of firm increases. An elevated reading will bolster the case fo |

| |

| Markets Snapshot | | | | Market data as of 06:42 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- The US reports inflation data today, which is expected to show a fifth month of firm increases. An elevated reading will bolster the case for an extended pause in Federal Reserve interest-rate cuts. Ten-year Treasury yields tick lower and equity futures rise.

- US banks are about kick off earnings season, with Citigroup, JPMorgan and Goldman Sachs and Wells Fargo all expected to release results. Financial shares edged higher in premarket trading.

- The Biden administration is planning more regulations to stop advanced chips made by Taiwan Semiconductor Manufacturing and others from flowing to China. And in separate measures, dozens of Chinese mining, solar and textile companies were added to a list of those banned from exporting to the US due to alleged forced labor practices.

- Global oil markets face a smaller surplus this year than previously expected amid stronger demand and new risks to supply, the International Energy Agency said.

- The SEC is bringing a lawsuit against Elon Musk, accusing him of cheating Twitter shareholders out of more than $150 million by waiting too long to disclose his stake as he prepared a takeover bid.

| |

| |

| Nvidia's scorching 800% rally in the past two years has hit a stumbling block. Facing pressure from slowing revenue growth, tougher competition and stricter regulation — Nvidia shares have dropped for the past five days, shedding 12% since a record on Jan. 6. And since October, the stock has largely been stuck in the trading range. While the bulls are still largely unfazed, it's a sign that the AI frenzy isn't what it used to be, especially compared with a year ago when the trading desk at Goldman Sachs dubbed Nvidia "the most important stock on planet Earth." "The AI revolution is going to be a long road with a lot of potholes," says Kevin Mahn, chief investment officer at Hennion & Walsh Asset Management. "I'm not concerned we've seen a peak in Nvidia." Here's a look at what investors are watching: - Wall Street is still very bullish. Nvidia shares are projected to rise 32% over the coming year, according to the average of analyst price targets compiled by Bloomberg.

- But it all depends on AI spending. Nearly half of revenue comes from a handful of tech giants who are rushing to add computing capacity. Capital expenditures by Microsoft, Amazon.com, Alphabet and Meta Platforms are projected to hit a combined $257 billion in the current fiscal year, up from $209 billion in 2024.

- Nvidia has a virtual monopoly on AI accelerators. Advanced Micro Devices is probably its closest competitor. But its projected AI accelerator sales of more than $5 billion is a sliver of Nvidia's expected $114 billion in data center revenue.

- Some investors argue the valuation is reasonable. The shares are priced at 30 times projected profits. "There's still plenty of growth left," says Scott Yuschak, managing director of equity strategy at Truist Advisory Services. "Still, that number depends on bigger and bigger spending. If there are any signs of a slowdown in AI spending, the price investors are willing to pay for Nvidia shares will fall." —Jeran Wittenstein

| |

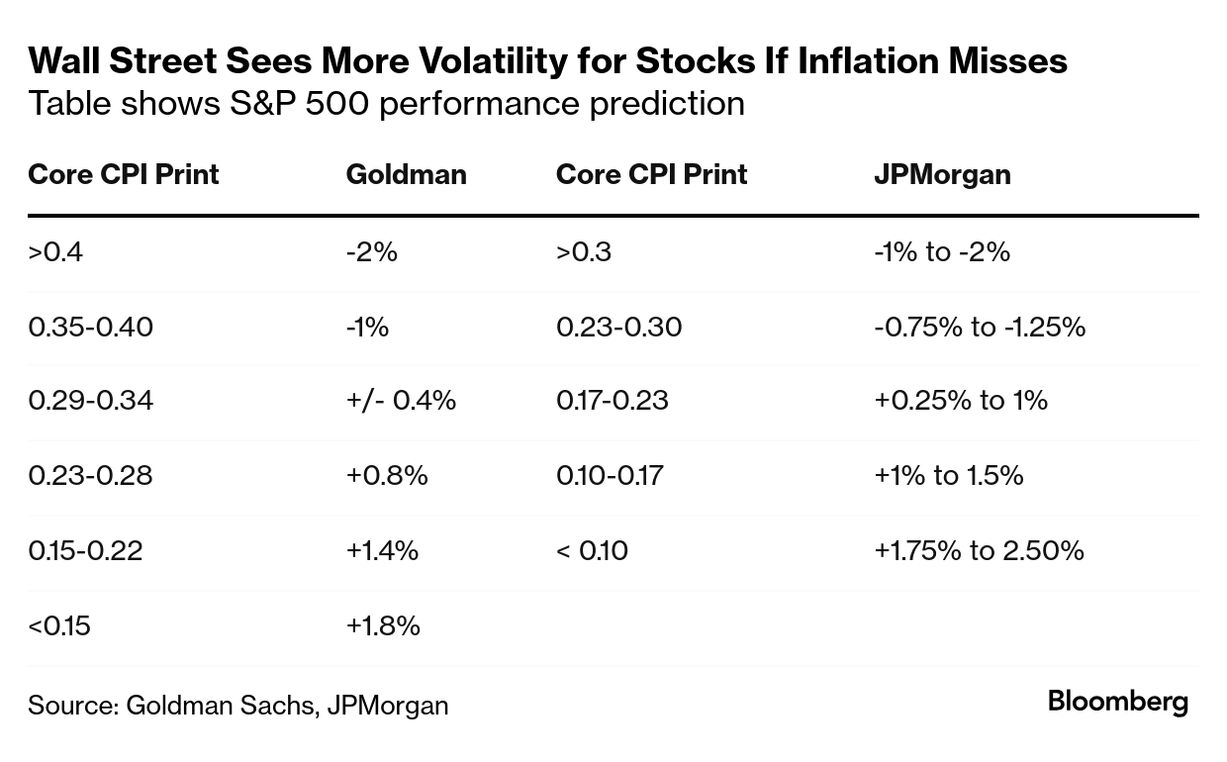

A guide for the CPI report | |

| With just hours to go before the inflation data, we take a look at what JPMorgan and Goldman Sachs expect for stocks depending on the outcome of the report. "US equities may now need clear relief from hawkish policy to make a sustained move higher," Goldman Sachs strategist Dom Wilson wrote on Tuesday. "We think equities may remain more fragile until we reverse the perception that the Fed put is now struck lower." —Jan-Patrick Barnert | |

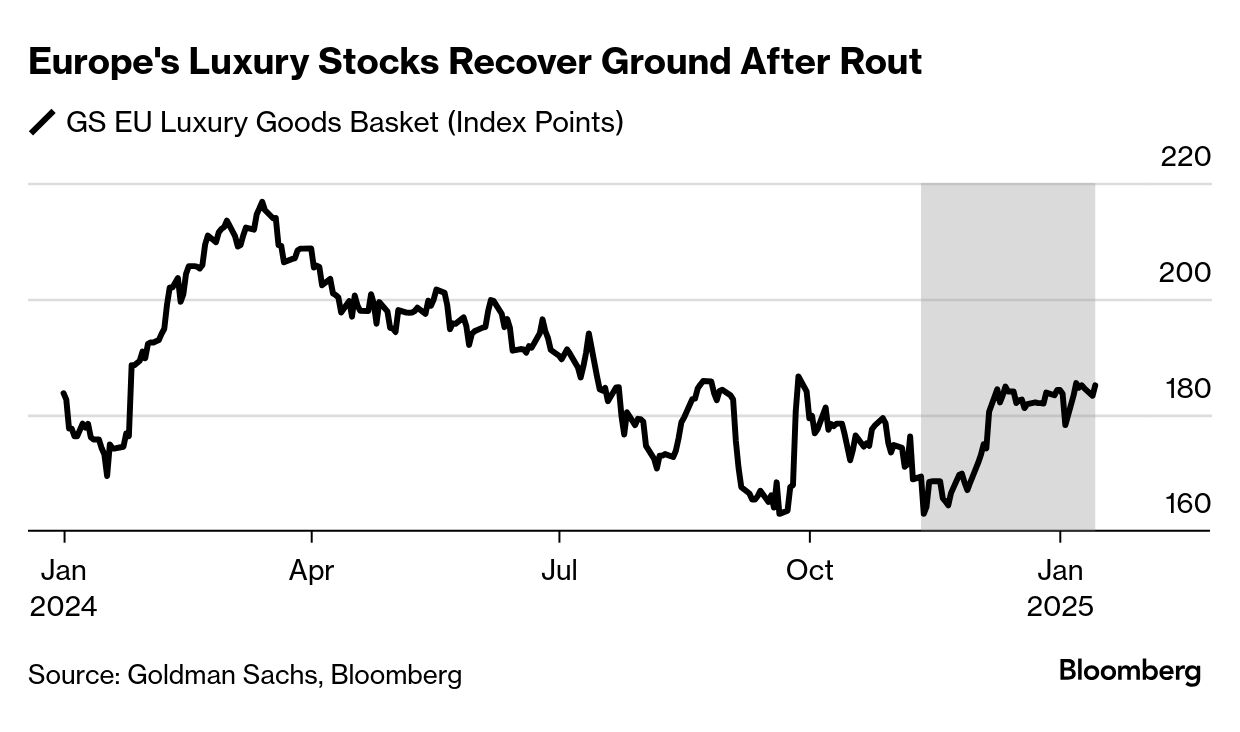

Can the luxury rebound last? | |

| Luxury companies are gearing up to report earnings soon, and the results will likely decide whether the rally keeps going or fizzles out.

A Goldman Sachs basket tracking the sector is up 13% since mid-November, outpacing the broader market. The first big test will come Thursday, when Cartier owner Richemont reports sales. LVMH announces on Jan. 28, Gucci owner Kering is scheduled for Feb. 11 and Hermes on Feb. 14. "What we really want to see is a sense of increased confidence," said Nick Clay, a fund manager at London investment firm Redwheel. Investors want signs "that suffering has bottomed in the fourth quarter of last year." —Kit Rees | |

Word from Wall Street | | "Even if tariffs are hiked gradually, markets may not be as optimistic as Trump's team that inflation can be controlled. A hot CPI today could easily get investors jittery on the inflation topic before tariffs are even considered." | | Francesco Pesole Currency strategist at ING Bank NV | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment