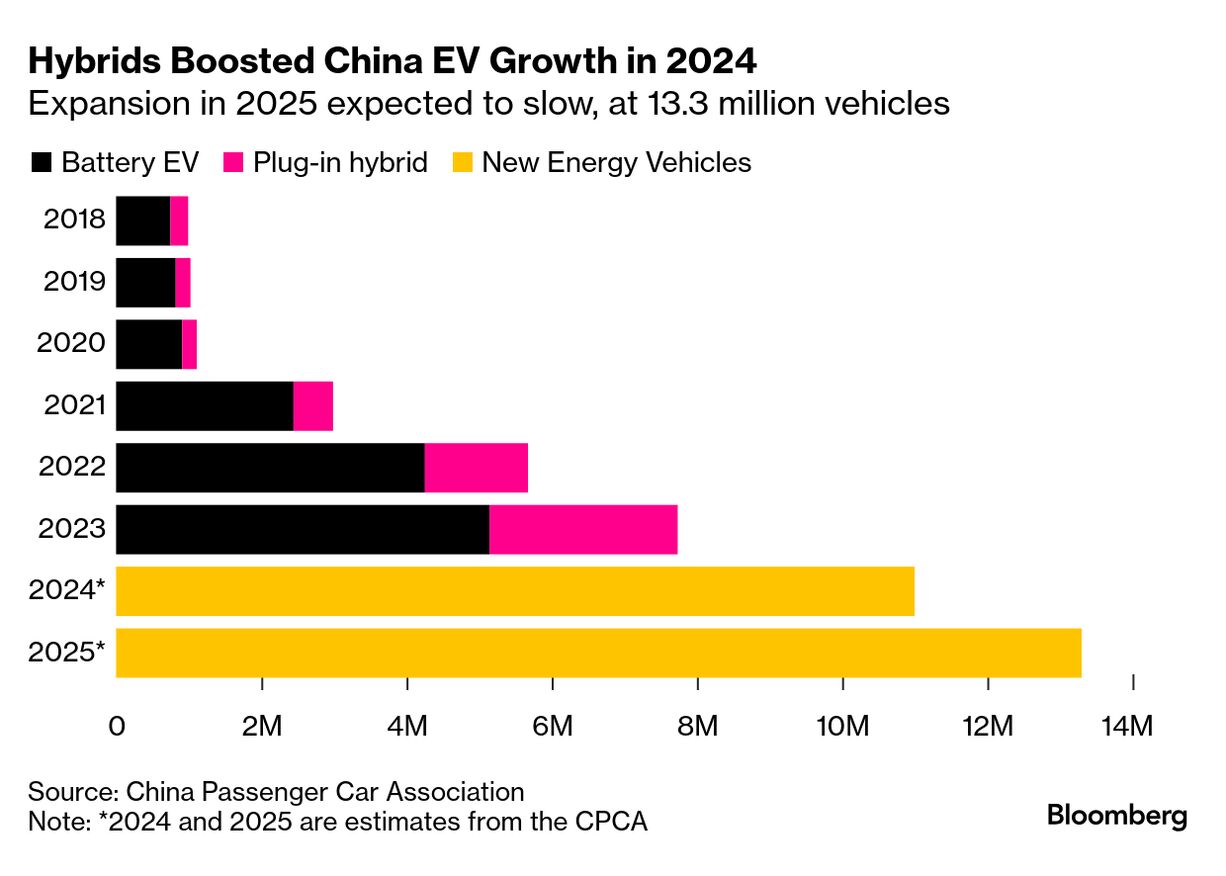

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Strap In for Another Tough Year in China | China's leading electric vehicle makers have high hopes for 2025 despite some falling short on last year's goals and intense competition in the world's biggest autos market showing no sign of letting up. Sales of electric and plug-in hybrids may touch 13.3 million units this year, the China Passenger Car Association said in its new year message. That's a lot, no doubt, but only up from 11 million such vehicles in 2024, or projected growth of around 21%, slower than in prior years. Interestingly, the PCA said that goal is premised upon the government continuing its trade-in program, which, fortunately for automakers, does seem to be the case. Local media reported in November that Beijing plans to assess the effectiveness of its trade-in policy, which provides a 20,000 yuan ($2,730) payment for people willing to swap their older EVs or combustion engine cars for new electric ones. PCA Secretary General Cui Dongshu suggests that some carmakers posted weaker-than-forecast 2024 numbers because they were holding back deliveries into this month to avoid the optics of falling sales in January. Lunar New Year comes early this year, meaning showrooms will be very quiet for a spell later this month. Meanwhile hardly anyone is expecting the price war that's been a feature of China's car market since 2023 will fade. Paul Gong, the head of China autos research at UBS, says it could even get worse over the coming two to three months. "We're already seeing more discounting since December, with companies extending incentives in the first weeks of January," Gong said. "We're seeing the price war heating up again." Right on cue, Li Auto has started a cash rebate of 15,000 yuan for customers who purchase vehicles this month to make up for the lack of trade-in subsidy, which ended in December. (The government hasn't made an announcement yet on any next round.) Nio meanwhile has offered to match the subsidy for people placing orders in January and February in the form of battery charging or swapping credits. Both EV makers are also promoting three-year, interest-free loans.  A BYD Seal electric vehicle at a showroom in Mexico City. Photographer: Jeoffrey Guillemard/Bloomberg Like last year, however, BYD remains the brand to beat. It's set a quite conservative target of selling at least 5 million battery-powered cars in 2025, according to Citibank, versus 4.25 million passenger vehicles in 2024. Around one million could come from overseas, where in many countries BYD is only gaining a foot hold. Having those growth opportunities outside of China would be a counterbalance to fierce domestic rivalry. Geely Automobile, another large domestic player, is forecasting 2.71 million shipments in 2025 after finishing 2024 comfortably ahead of its goals. That would still translate into annual growth of about 24%, higher than the industry average. Rounding off the big carmakers is Chongqing Changan Automobile, which reckons it can do 3 million in sales, up 17.5% on 2024. But Changan has a big portfolio of combustion engine vehicles that it's trying to wean itself off.  A Xiaomi SU7 electric vehicle. Photographer: Qilai Shen/Bloomberg Xiaomi will be another one to watch in 2025 after its splashy debut last year. Afforded rockstar status, CEO Lei Jun is mobbed by crowds at auto shows. His car efforts are being bankrolled personally and he's set his sights on selling around 300,000 EVs over the coming 12 months. That's after smashing expectations by finishing 2024 at north of 135,000 sales. Not bad for a one-car brand with a relatively unproven track record in electric vehicles. And doubtless, 2025 will bring disappointments too. One EV maker that may struggle is Nio, which in 2024 fell short of its delivery goals despite the introduction of a new sub-brand at a lower price point. Its financial challenges, including its failure to turn a profit after 10 years, give rise to doubts about just how many inroads it can make against more established brands.  A Kia EV6 electric vehicle recharges at an Avis rental location near New York's LaGuardia Airport. Photographer: Bing Guan/Bloomberg Why not consider kicking off the new year with a resolution to do more to go green? Bloomberg has a whole list of options for ways to start living in a more climate-friendly way for people with all budgets and levels of commitment. One of them — rent or lease an EV. In the US, now's an especially good time to take advantage of particularly cheap leases while renting lets you pick from a variety of models and experience the daily reality of driving an electric car that you won't get from a perfunctory test drive at an auto dealer. |

No comments:

Post a Comment