| US 30-year bond yields rose to the highest since 2023. The uptick in yields adds further pressure to US debt, which has come under scrutiny |

| |

| Markets Snapshot | | | | Market data as of 06:30 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- US 30-year bond yields rose to the highest since 2023. The uptick in yields adds further pressure to US debt, which has come under scrutiny over concerns the Trump administration will reignite inflation.

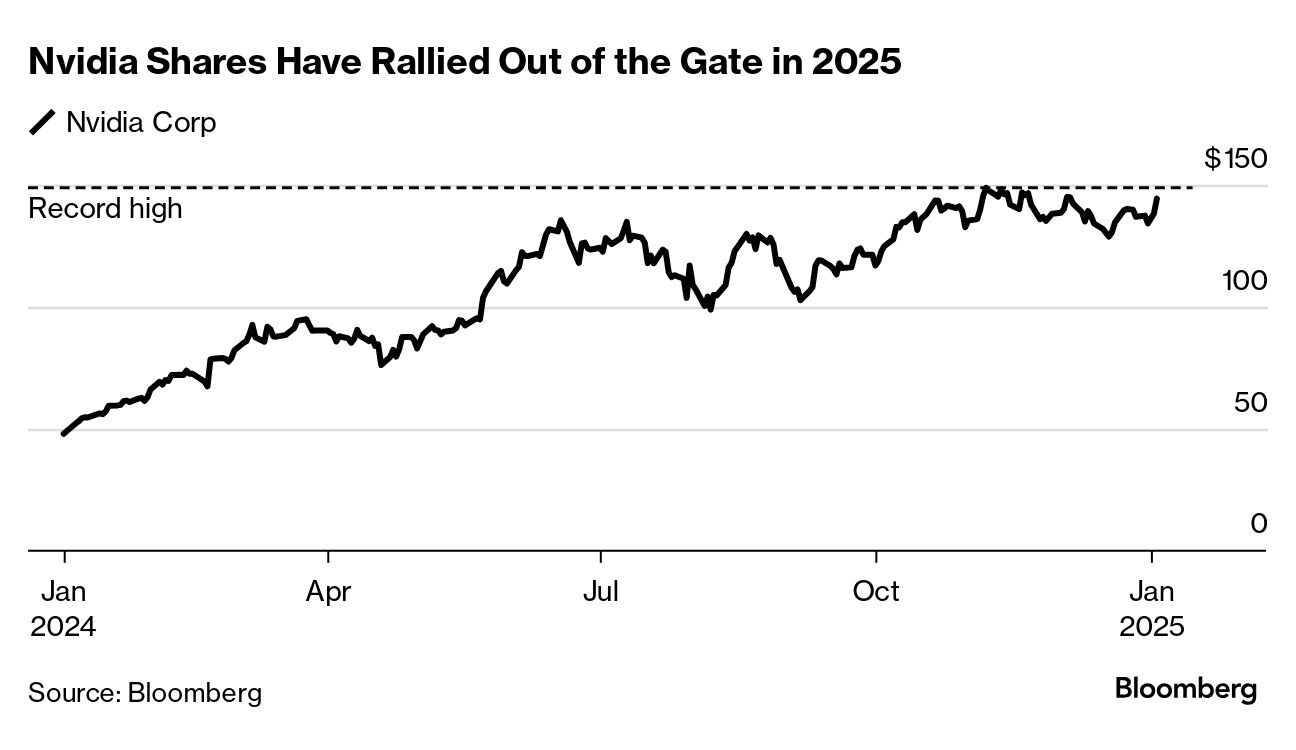

- Tech stocks rallied in early trading after Microsoft announced plans to spend $80 billion on data centers and iPhone assembler Foxconn reported faster-than-expected revenue growth. Nvidia and Advanced Micro Devices gained more than 2%.

- Justin Trudeau is expected to announce his resignation this week as head of Canada's Liberal Party, the Globe and Mail reported, triggering a contest to replace him as prime minister. The currency strengthened and Canadian stock futures were slightly lower.

- Goldman Sachs no longer sees gold reaching $3,000 an ounce by the end of 2025, pushing the forecast to mid-2026 on expectations the Fed will make fewer interest-rate cuts. Even so, investors see plenty of reasons to remain bullish after a 27% rally last year.

- US stocks and the dollar will be the biggest beneficiaries of American economic growth set to be boosted by Trump's policies, according to the latest Bloomberg Markets Live Pulse survey.

| |

| |

| Bond traders are entering the new year with fresh worries about inflation and the presidency of Donald Trump.

Longer-dated bonds have been hit by a sharp selloff, with the yield on benchmark 10-year Treasuries rising to more than 4.6%, roughly a full percentage point above where it was when the Fed started easing monetary policy in September. The 30-year bond yield topped 4.85% today.

There's $119 billion of government debt issuance coming this week, and growing concern that Republicans will drive up spending and widen the budget deficit. Trump has urged Congress to move rapidly on a bill to extend the 2017 tax cuts. House Speaker Mike Johnson is pushing for legislation that includes money for mass deportations and either raising or eliminating the debt ceiling. Sticking with shorter-maturity notes "is not a bad approach right now," said Jack McIntyre at Brandywine Global Investment Management. "Until you see the pain in the economy, even though yields have come up quite a lot, it's just better to keep the powder dry."

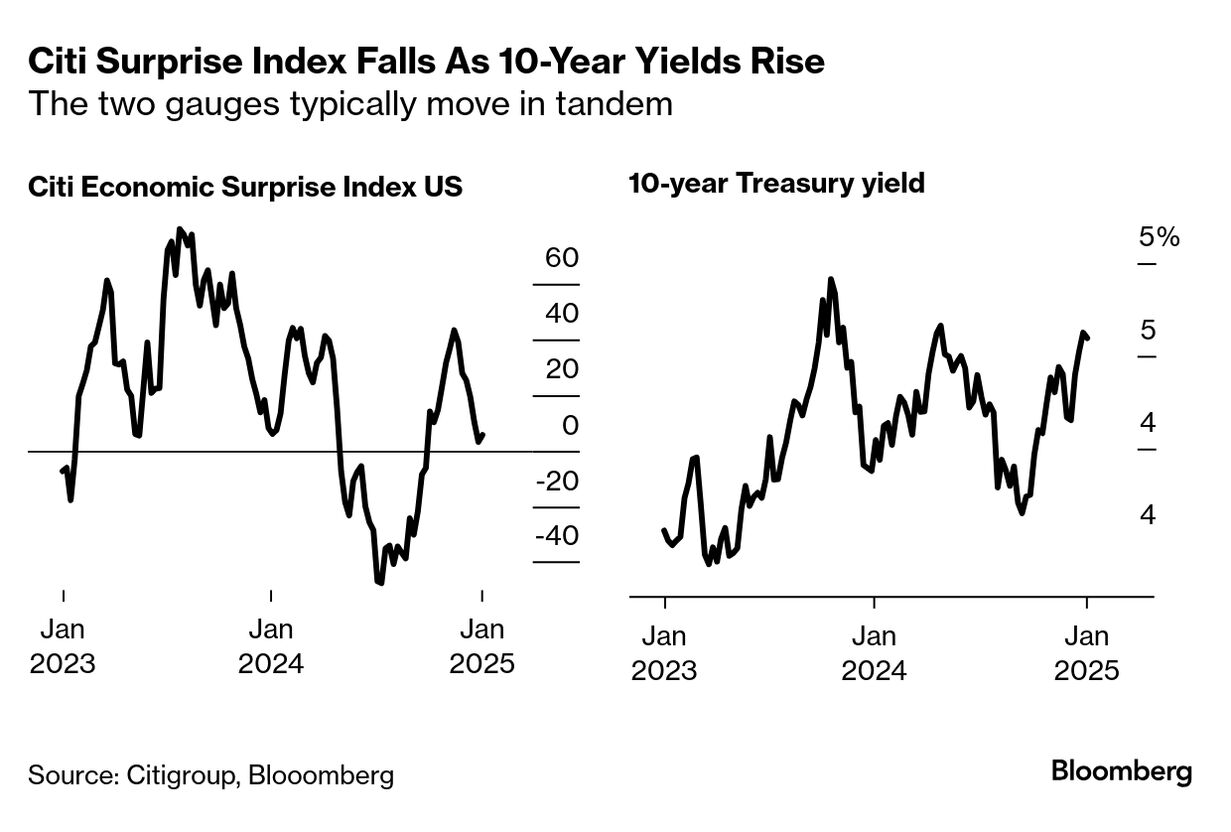

There's a hint of that economic pain in Citigroup's Economic Surprise Index — a measure of how data is faring versus expectations. It's fallen in six of the past seven weeks, meaning economic indicators are turning out weaker than anticipated. Bond yields and the Surprise Index usually move in unison. But lately, they've been going in opposite directions. The divergence is "pretty unusual," says Emily Roland of John Hancock Investment Management. Roland says she expects the Treasury market eventually to bend to disappointing data. That makes Friday's job report all the more important for anyone trying to guess the timing of the Fed's next move. Right now, futures traders anticipate the central bank could hold rates steady until as late as June and only cut by half percentage point in all of 2025. "A weak number will bring talk about a March Fed rate cut back on the table," said Priya Misra at JPMorgan Asset Management. —Michael Mackenzie, Ye Xie and Isabelle Lee | |

| |

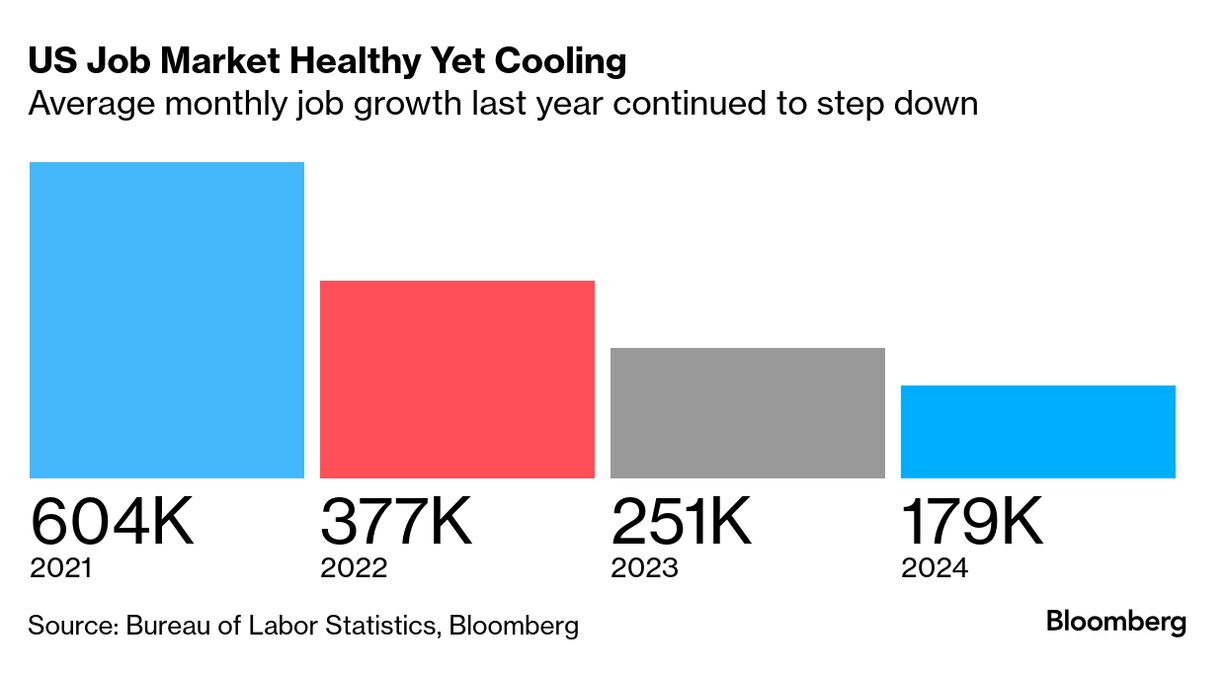

| The main event is the US jobs report on Friday. It's predicted to show companies tempered their hiring last month with payrolls increasing 160,000. That would put average monthly job growth near 180,000 for 2024 — lower than the prior three years but consistent with a firm labor market. On Wednesday, the Fed publishes the minutes of its December meeting. In Canada, jobs data for December will be also be released on Friday. A trade report on Tuesday will show whether Canada's economy remains in a deficit with the world, despite a surplus with the US that's a source of ire for President-elect Donald Trump. Elsewhere, several major economies will release inflation data, with China likely to be close to deflation and the euro zone seeing an uptick. Peru's central bank meets Thursday and the early consensus call is for a quarter-point cut, to 4.75%. The US stock market will be closed Thursday for President Jimmy Carter's funeral, and bond trading finishes early that day.

The global earnings calendar is light this week. Highlights include Samsung reporting on Wednesday and Delta Air Lines on Friday. Here's the full week ahead calendar. —Simon Kennedy | |

| |

| Nvidia investors are hoping that a speech tonight from CEO Jensen Huang will keep a rally in the shares going. Nvidia typically uses the CES trade show in Las Vegas to showcase consumer devices using its chips. However, investors will focus on any commentary the company gives on its Blackwell chip, considered its next major growth driver. Blackwell has faced supply constraints but robust demand, while manufacturing challenges slowed the rollout. —Jeran Wittenstein and Ryan Vlastelica | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment