| Donald Trump is poised to invoke emergency powers after his inauguration today, seeking to bolster domestic energy production and roll back |

| |

| Markets Snapshot | | | | Market data as of 06:09 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Donald Trump is poised to invoke emergency powers after his inauguration today, seeking to bolster domestic energy production and roll back Biden-era climate regulations.

- Bitcoin soars to an all-time high of $109,241. Trump and his wife, Melania, launched memecoins over the weekend that soared in value, sparking criticism from crypto executives who say they undermine the industry's credibility.

- The World Economic Forum in Davos starts today. Expect to hear less about equality, diversity and climate change as executives try to curry favor with a new US administration.

- MSCI's Asia index rallied about 1% after Trump and Xi Jinping held a call on Friday that raised hopes for easing US-China tensions. The dollar index weakened. US markets are closed for the Martin Luther King Jr. holiday.

- TikTok is available again to US users after Trump pledged to delay enforcement of a law to ban the social-media app. It's not clear whether the app's Chinese parent is able or willing to secure a US backer in time to avoid a permanent shutdown.

| |

| |

| Memecoins by a US president-elect and first lady became a reality this weekend with all the bombastic trappings that are bound to characterize Donald Trump's next term in office. "$Trump is currently the hottest digital meme on earth," Eric Trump wrote on X. "We are just getting started!"

Even though the small print on the website states his token isn't intended to be an "investment opportunity, investment contract, or security of any type," crypto-minded Trump fans immediately started buying.  The Trump memecoin's market value hit $15 billion at one point but then briefly slid below $8 billion as Melania's token took some of the spotlight, figures from aggregator CoinMarketCap show. Major exchanges like Coinbase and Binance have said they intend to list the token.

It's more evidence that Trump's election is ushering in a new era of crypto enthusiasm.

"The reign of terror against crypto is over," David Sacks, the venture capital executive appointed as Trump's crypto czar, said at an inauguration ball. "The beginning of innovation in America for crypto has just begun." —stacy-marie ishmael and Annie Massa

For more, check out our coverage here and subscribe to our crypto newsletter: | |

| |

| The betting is that perhaps just minutes after Trump is sworn into office, he and his staff will be hammering out executive orders and statements of intent on social media. So brace for market-moving news on tariffs, regulations, crypto, energy, immigration, fiscal policy, the dollar and the Fed. On tariffs, the base case for Morgan Stanley strategists is "fast announcements and slow implementation." But they acknowledge investors are prepared for speed on both fronts. If so, they see the dollar appreciating — especially against the Chinese yuan, Canadian dollar and Mexican peso — and short-term US Treasury yields rising faster than their long-term counterparts. It doesn't have to be negative news. "An absence of significant tariffs from the roster, for example, may trigger a global rally," writes Paul Dobson for Bloomberg Markets Live. With US markets closed, Asia may get the first chance to react. The earnings season will also heat up. Here are some of the highlights: - Tuesday: Charles Schwab, 3M and Netflix

- Wednesday: Procter & Gamble, J&J and Abbott Labs

- Thursday: American Airlines and Texas Instruments

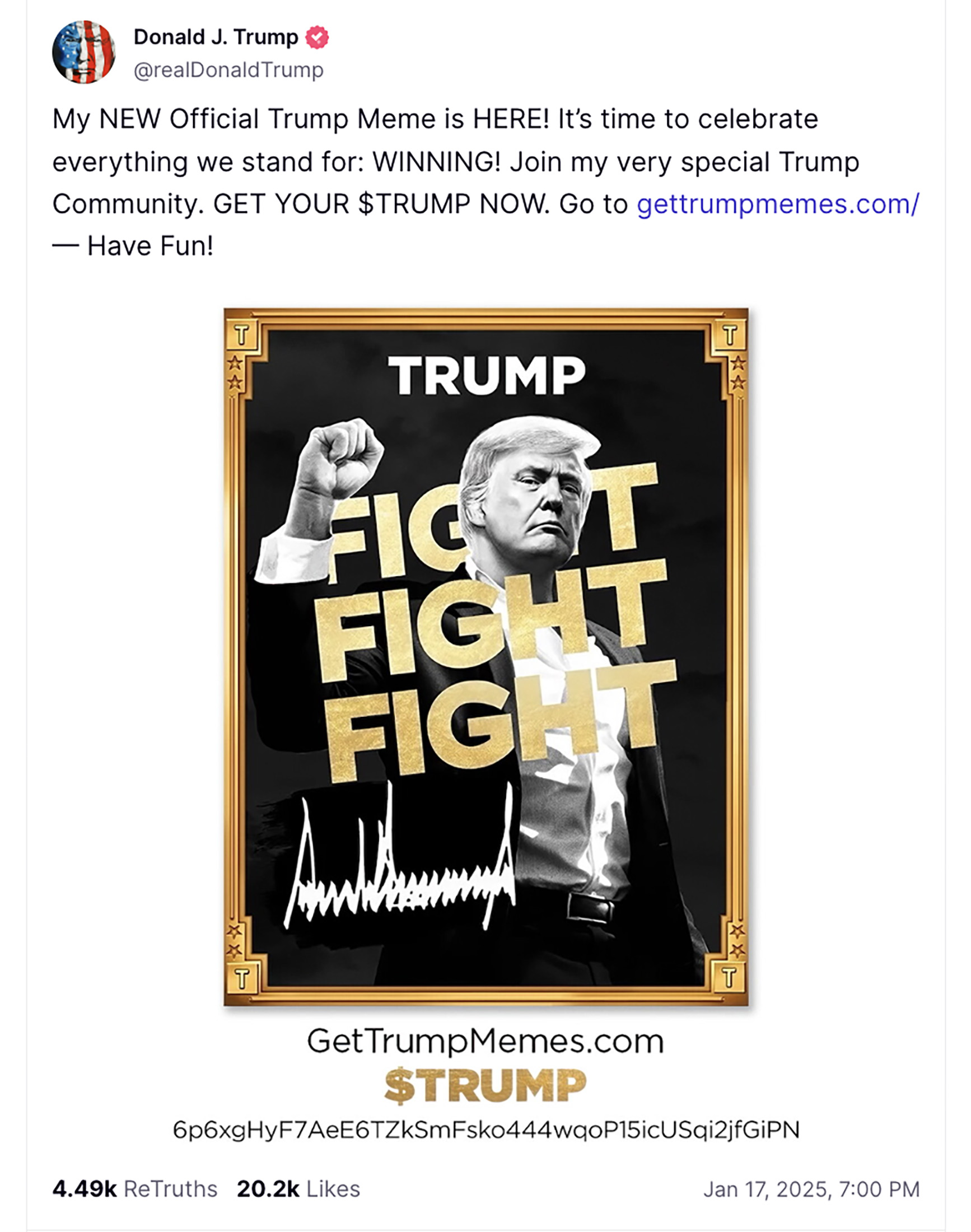

The Bank of Japan is expected to raise interest rates on Friday, and Trump is scheduled to speak virtually at the World Economic Forum in Davos on Thursday. Purchasing manager indexes around the global for January will also draw attention. See the full economic calendar here. —Simon Kennedy | |

| |

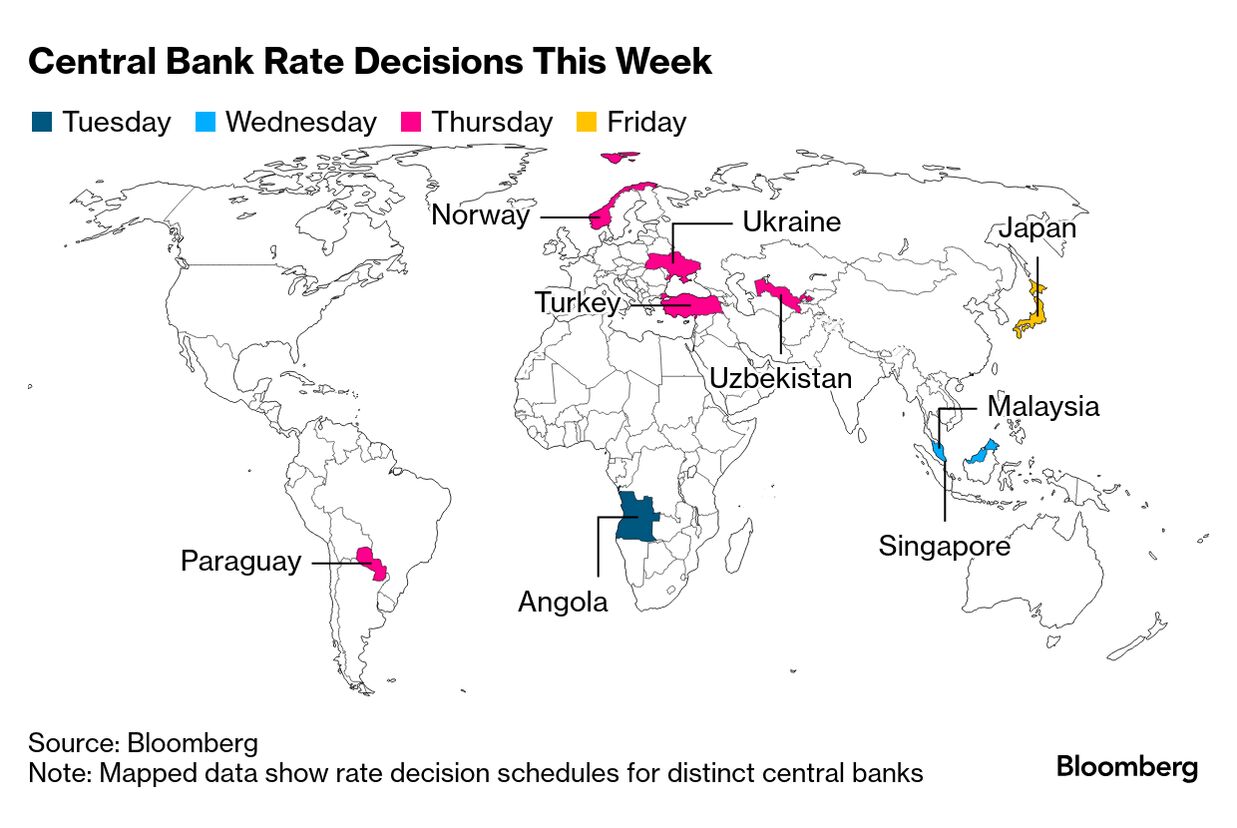

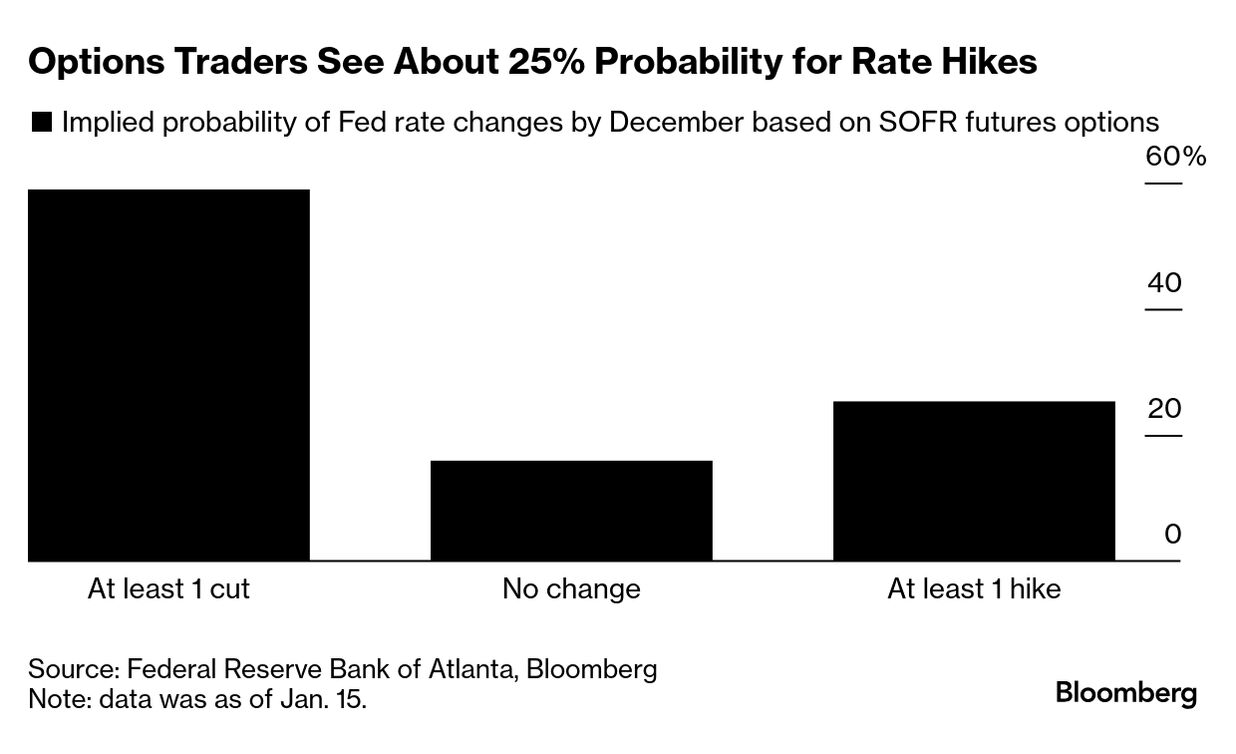

| A group of die-hard bond traders are making a longshot bet — that the Federal Reserve's next move on interest rates will be up, not down.

The wager, which arose after a blowout jobs report on Jan. 10, stands in stark contrast to the consensus on Wall Street for at least one rate cut this year. The contrarian bet has remained in place even after a benign inflation report on Wednesday caused US Treasury yields to retreat from multiyear highs. As with so many things in financial markets these days, it's effectively a bet on Trump's policies. And it hinges on the idea that tariffs and other policies imposed by the new administration will trigger a bounce back in inflation that forces the Fed into an embarrassing about-face. —Liz Capo McCormick and Ye Xie | |

Word from Wall Street | | "Given equities have gone up so much, they are pretty fully valued and that means we are likely to see less valuation expansion as a driver for index returns this year. And therefore we're likely to see a better payoff for being diversified." | | Peter Oppenheimer Chief global equity strategist, Goldman Sachs | | Click here to watch the full interview on Bloomberg TV | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment