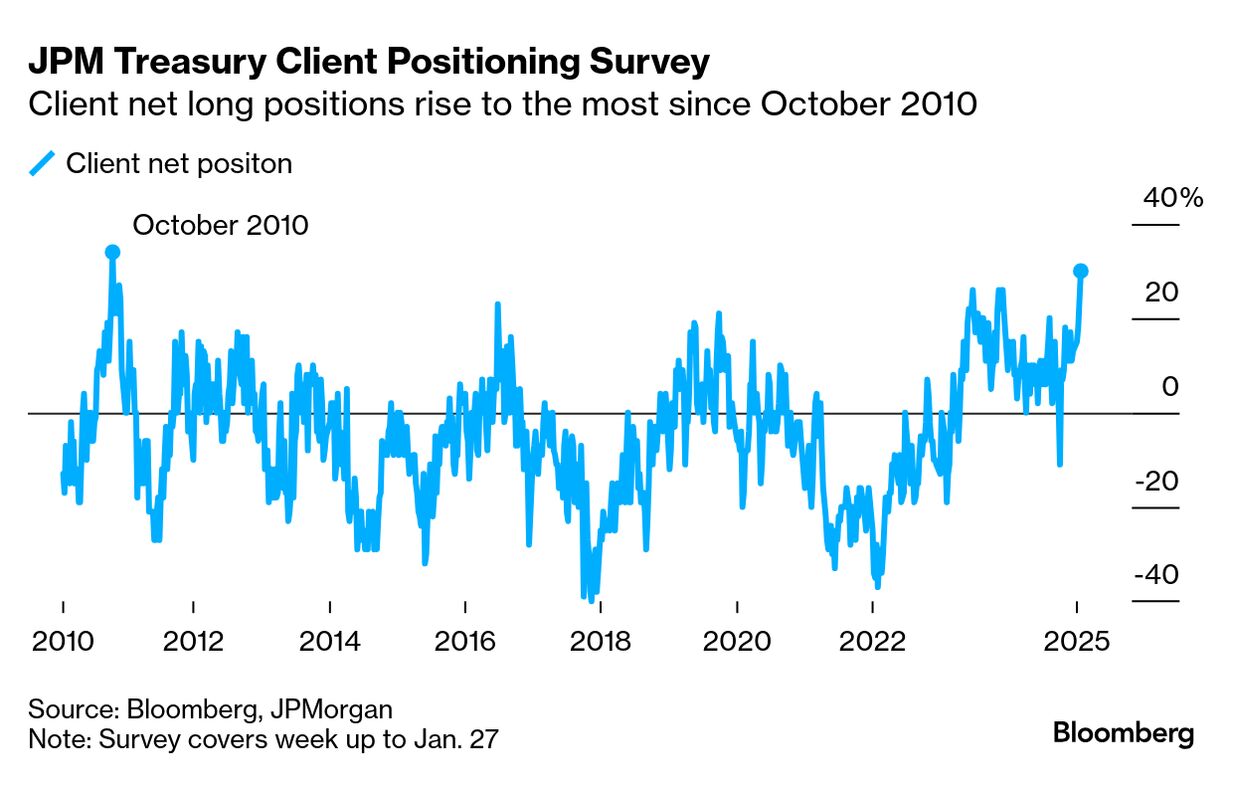

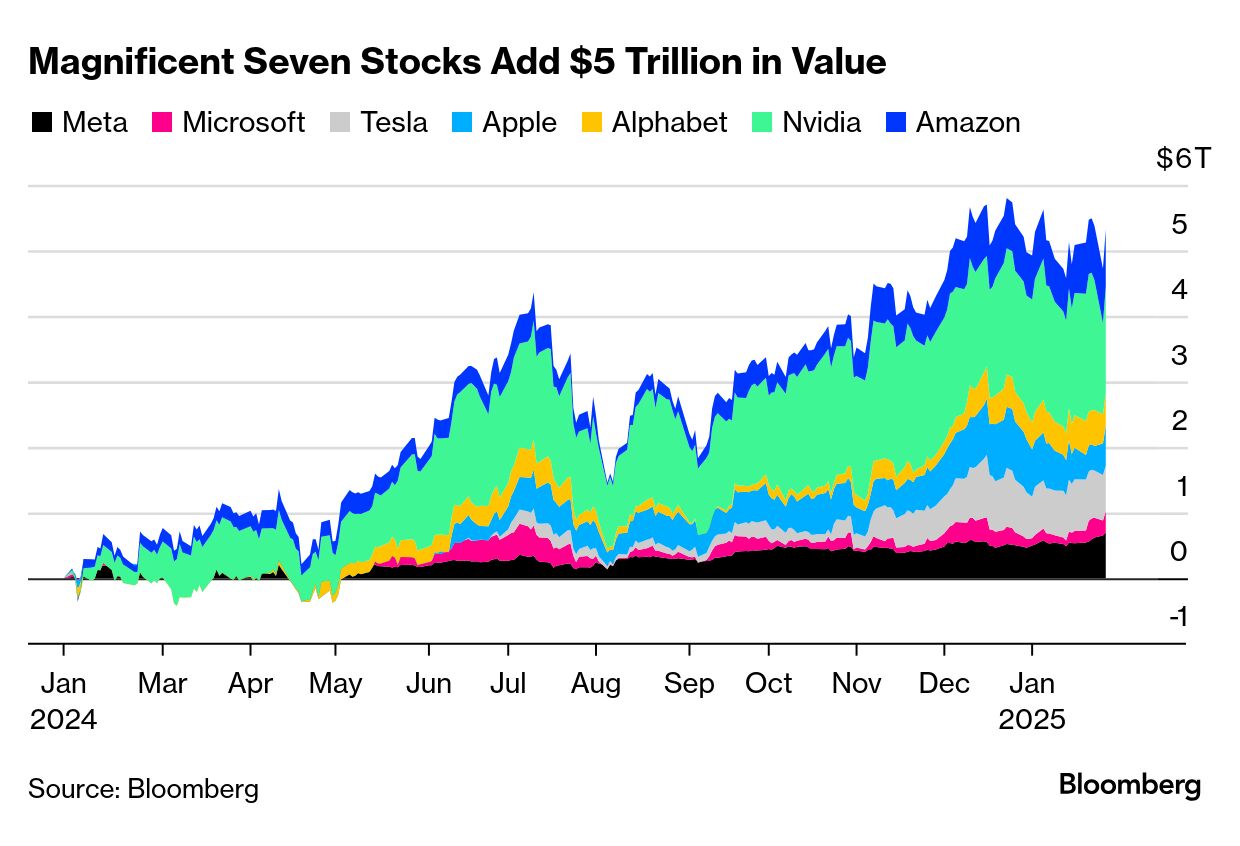

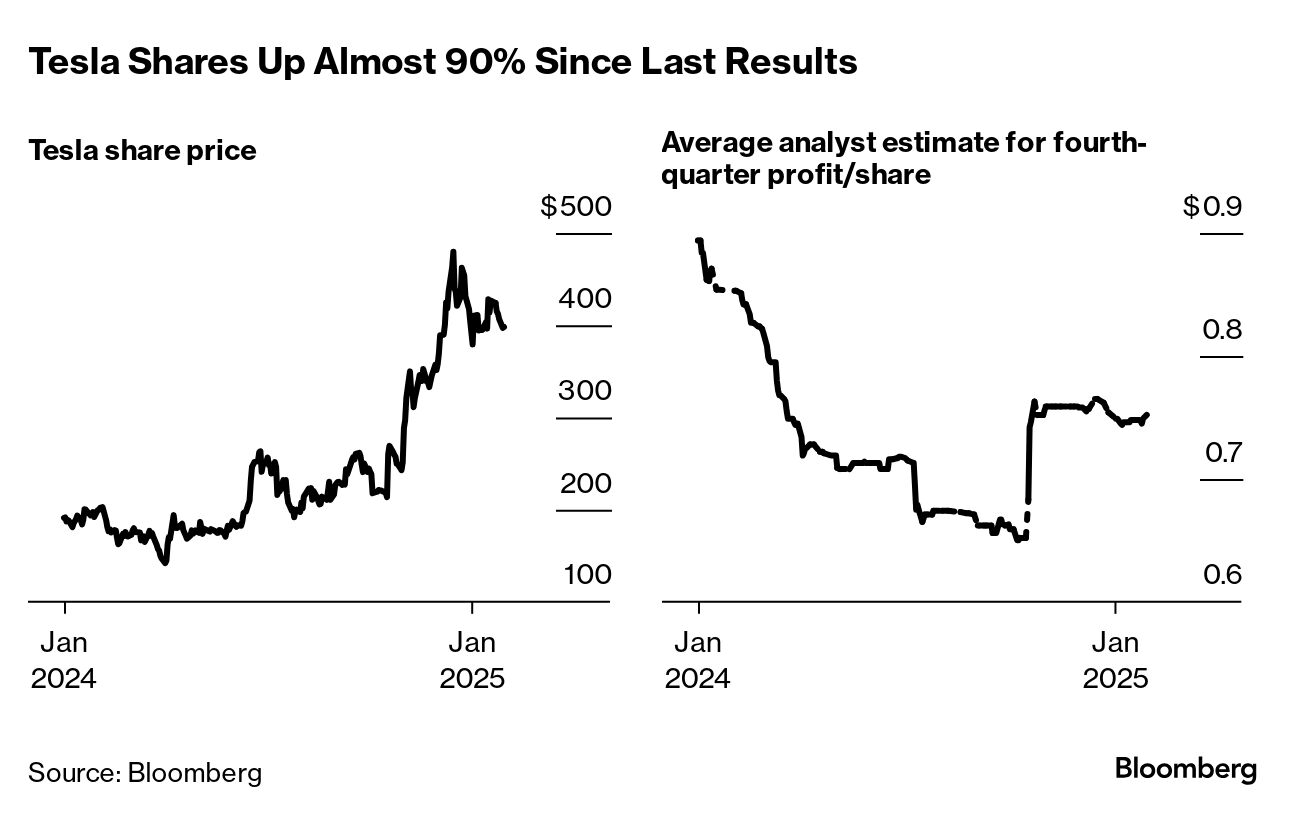

| After the brief tech-stock freakout, it's back to regular programming for investors: The Fed and earnings are taking center stage. In the bond market, traders are ratcheting up bullish Treasury bets in hopes that Fed Chair Jerome Powell will signal a cut in March is firmly on the table. Traders have a lot riding on Powell's press conference remarks. Expectations for further easing climbed during Monday's tech-driven rout in stocks, and two-year Treasury yields recently fell to the lowest in more than a month. JPMorgan's latest client survey shows the biggest net long position in US government debt in almost 15 years. In another sign that long positions are building, open interest in futures — or the amount of new risk held by traders — is increasing in 10-year Treasury contracts. Policy makers are likely to keep rates steady, given the sturdy US economy and worries over sticky inflation. DoubleLine Capital's Jeffrey Gundlach described today's decision as the most predictable "no change" in recent years. The Fed has cut at three straight meetings since September, lowering the benchmark rate by a full percentage point. Their target range is now 4.25% to 4.5%. The big question mark for the direction of rates, of course, remains President Donald Trump's tariff plans and their impact on the economy. Meanwhile, the stakes are even higher now for the earnings from Microsoft, Meta and Tesla, thanks to DeepSeek. They face more scrutiny for spending hundreds of billions of dollars on AI research, given that profits are still largely elusive. The ramifications are also immense for a stock market that has rallied almost solely on the promise of AI. In the past year alone, the Magnificent Seven stocks have added more than $5 trillion in combined value as they rallied 66%. The rest of the US stock market gained $8 trillion, by comparison. "Between Microsoft, Meta and Tesla you'll get some real perspective about the AI outlook and how much of a revelation DeepSeek has created that you can do these cheaper," said Michael O'Rourke, chief market strategist at JonesTrading. "What type of threat is that to the massive investment that has gone into the AI space?"—Phil Serafino, Edward Bolingbroke and Jeran Wittenstein |

No comments:

Post a Comment