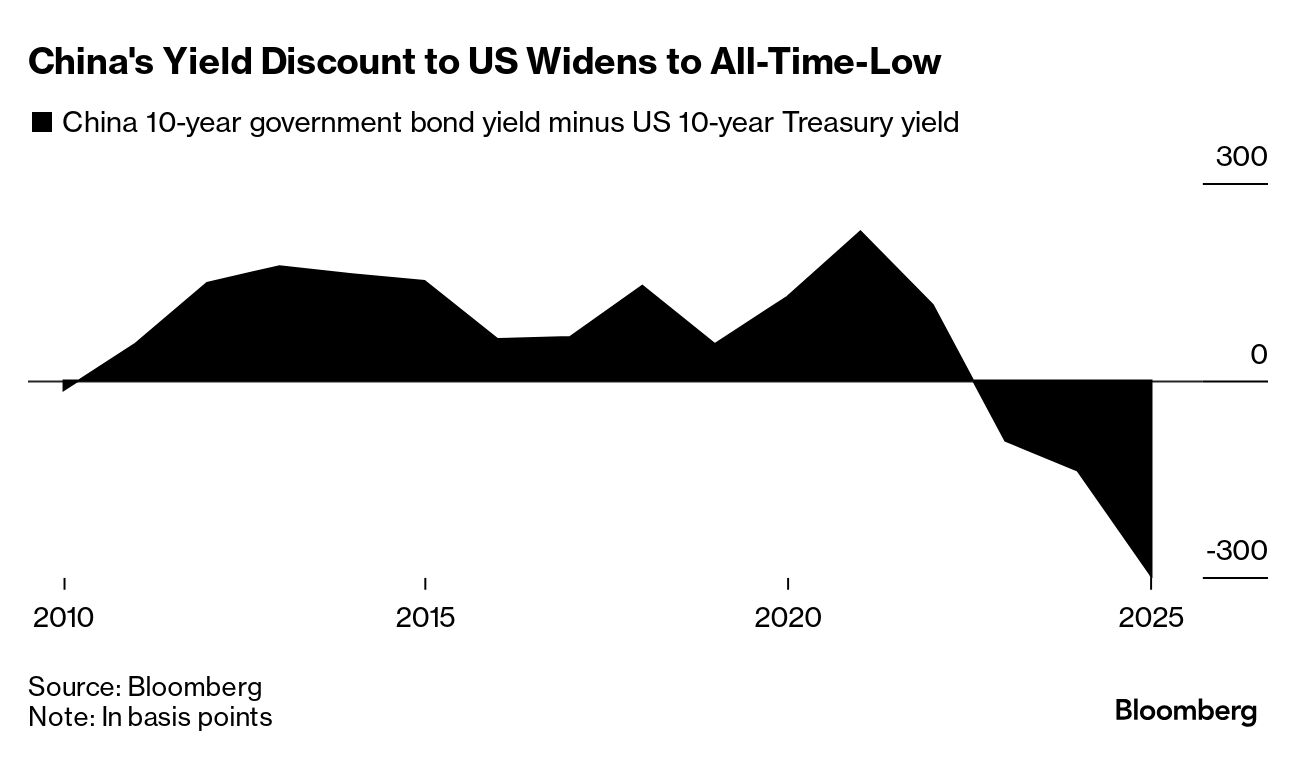

| The contrast in signals from the bond markets of the world's two largest economies couldn't be clearer. On one hand, US Treasury yields are climbing higher by the day, powered by seemingly unstoppable economic growth. On the other, traders have rarely been so pessimistic about China, forcing yields to fresh record lows on fears the No. 2 economy is heading for a deflationary spiral, as Joanne Wong and Finbarr Flynn report in today's Big Take. The divergence is playing out in all corners of the two debt markets. Tuesday's 10-year Treasury auction drew the highest yield since 2007, investors are now targeting 5% yields for the benchmark and swap traders have pushed bets on the first quarter-point interest rate cut this year out to July from June.

(For an explainer on why short- and long-term rates in the US are going in different directions, check out our QuickTake.) China's dour outlook, meanwhile, has triggered a stampede into bonds. The 10-year securities now yield an unprecedented 3 percentage points less than comparable US debt. The yields are far below levels reached during the Covid pandemic and 2008 global financial crisis, underscoring that Japanification is now a real risk. BlackRock's Navin Saigal is among those who see bond yields reflecting a "desynchronization" of the US and Chinese economies. Juicy US yields are also presenting an "incredible" opportunity, he says. Citigroup's wealth division also says US debt would be worth buying at a 5% yield. The move higher in US yields, though, is threatening to undermine the long-running rally in stocks. The move echoes the ones seen in 2022 and 2023, which were accompanied by sharp drops in global equities. Yet this time, the rally has only taken a gentle breather, leaving scope for losses should yields keep surging. "The yield backup is of course a little painful," Saigal, BlackRock's head of fundamental fixed income, Asia Pacific, said on Bloomberg Television. "But in some ways it could also be viewed as a gift — there's still a lot of cash sitting on the sidelines and now this cash can now be put to work." —Ruth Carson |

No comments:

Post a Comment