| Donald Trump is the talk of Davos this week, and he'll join the conversation when he speaks to attendees by video at 11 a.m. New York time. |

| |

| Markets Snapshot | | | | Market data as of 04:18 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Donald Trump is the talk of Davos this week, and he'll join the conversation when he speaks to attendees by video at 11 a.m. New York time. The CEOs of Blackstone and Bank of America are among those who will pose questions to Trump.

- The rally in the stock market stalled after gains since Trump's inauguration took European and US benchmarks close to record highs.

- Electronic Arts slumps 13% in premarket trading after the videogame publisher's bookings for last quarter missed forecasts in part because of the weak performance of its latest soccer game.

- Traders are placing big options bets on the European Central Bank delivering at least one half-point cut to interest rates by midyear. Policymakers at Davos this week said they intend to reduce rates further as inflation remains primed to slow to 2%.

- A massive rally in emerging-market junk bonds has lured investors for two of the most far-fetched trades: debt from Venezuela and Lebanon, two economic basket cases that are wallowing in default. For investors looking for the next lottery ticket payoff, they're too cheap to ignore.

| |

Wall Street is skeptical of this rally | |

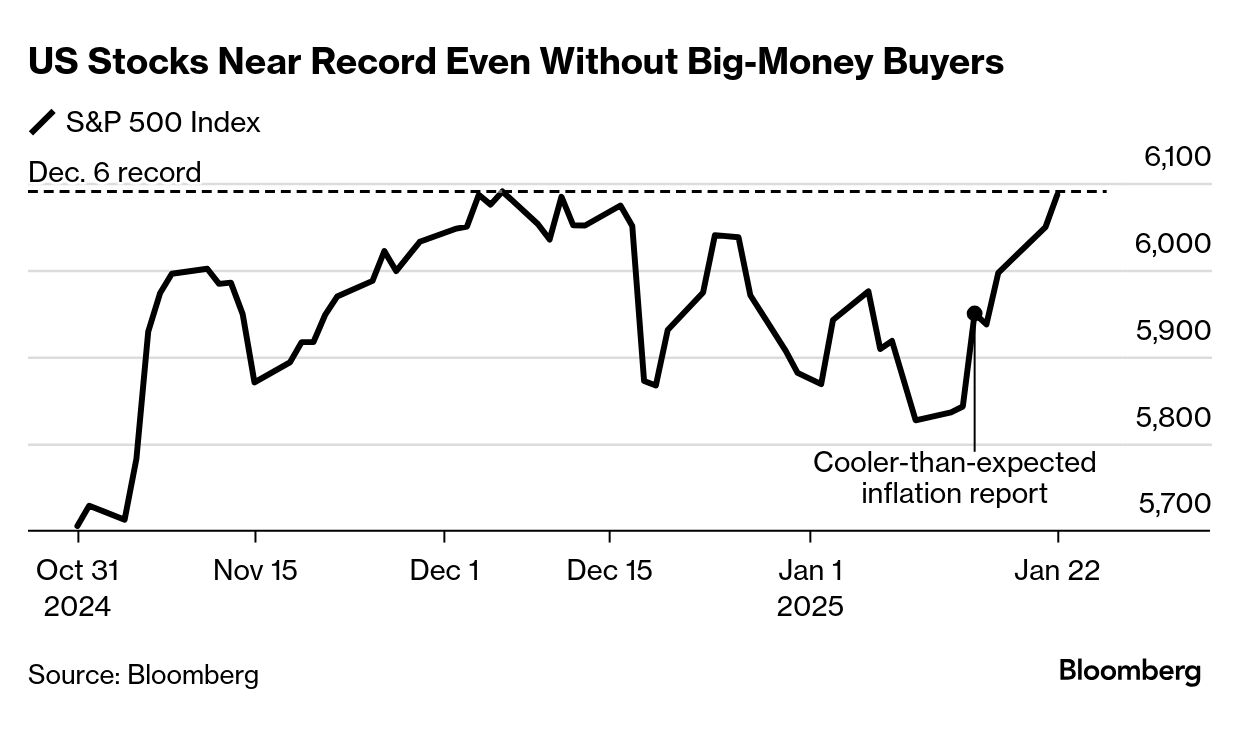

| The gains that lifted the S&P 500 to the cusp of a fresh record have been missing one ingredient: inflows from big-money investors. Paradoxically that's a welcome development for bulls. Skepticism from the pros can bode well because it means more cash to buy equities down the road. With inflation cooling, the economy chugging along and fourth-quarter earnings off to a strong start, the bulls see catalysts that will lure in that money. "Positioning is not reflective of the current rally in risk assets," wrote Scott Rubner, managing director for global markets and tactical specialist at Goldman Sachs. In his eyes, asset managers face the risk of FOMU — or the fear of materially underperforming.

A measure of the bullish positioning among quantitative funds and other big investors has fallen to a two-month low, according to data from Deutsche Bank. And the trend-following crowd known as commodity trading advisors cut their long stock exposure to the level last seen in the aftermath of a market rout in August, data from Goldman's trading desk show. If stocks keep moving higher or even stay flat, commodity-trading advisors may put $15 billion to $30 billion into the market over the next month, Rubner wrote. Hedge funds are starting to do just that, piling into US stocks last week at the fastest pace in 10 weeks following a cooler-than-expected CPI report, Goldman's data show. —Natalia Kniazevich | |

| |

| Puma shares sink 18% in Frankfurt, heading for their biggest drop on record. The German sportswear company reported disappointing fourth-quarter earnings and pushed back profitability targets, a day after rival Adidas beat estimates. Alaska Air rises 5.2% in premarket trading after the carrier forecast a smaller-than-expected loss in the first quarter. The results extend a run of better-than-expected profits and bullish forecasts to begin the year from larger rivals United and Delta.

American Airlines reports before the market opens today. GE is also due before the bell and Texas Instruments after the close. —Subrat Patnaik | |

China's message: Please buy stocks | |

| Chinese authorities are taking the direct approach in their latest effort to revive the nation's sputtering stock market: They asked big investors to buy more equities.

The nation's top securities watchdog today told mutual funds to raise their holdings of onshore equities by at least 10% annually for the next three years. Large state-owned insurers will need to strive to invest 30% of their new policy premiums from 2025. The news initially had its desired effect, lifting the CSI 300 Index as much as 1.8%. But skepticism crept in soon enough, with the gauge ending just 0.2% higher for the day. All the jawboning can only do so much to encourage investors disillusioned by the moribund economy. —Lin Zhu | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment