| |

| |

| Markets Snapshot | | | | Market data as of 04:56 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Taiwan Semiconductor shares jump 7.5% in premarket trading after the company delivered a strong outlook, fueling hopes that AI hardware spending will stay resilient. The results are giving a boost to tech stocks and Nasdaq 100 futures.

- Scott Bessent, Donald Trump's nominee for Treasury secretary, will be quizzed on his policies and priorities when he appears before the Senate Finance Committee today for a confirmation hearing.

- Nate Anderson, the short seller who founded Hindenburg Research, is disbanding his firm. The researcher gained renown for targeting billionaires including Gautam Adani and Jack Dorsey.

- Bank of Japan officials see a good chance of an interest rate hike next week as long as Trump's arrival at the White House doesn't trigger too many negative surprises.

- UnitedHealth, Bank of America and Morgan Stanley posting earnings results after yesterday's blowout profits from big banks.

| |

| |

| Does the Trump administration want a strong or weak dollar?

That's a question being thrust back into the spotlight as Bessent prepares to face Washington lawmakers today.

The former hedge fund manager will tell senators that "critically, we must ensure that the US dollar remains the world's reserve currency," according to remarks released before the testimony. It's a statement that stops short of the "strong dollar" language of Treasury secretaries past, even if that seemed more a bumper sticker than a fully formed policy. And it leaves some wiggle room there for Bessent to realign US currency policy, if he chooses. But don't expect that to happen today. Bessent will probably stop short of a full-throated call for a weaker exchange rate, especially as Donald Trump has voiced support for the dollar's global status. Lawmakers could also probe him about whether he agrees with Trump's plans for a 100% tariff on countries that abandon the dollar. It's worth remembering that the President-elect's stance on the currency hasn't been clear cut. In the past, he's railed against an overvalued dollar for making American industry less competitive on the world stage and blowing out the trade deficit. "We doubt Bessent will want to go anywhere near the subject of a weaker dollar, although there is a chance he could discuss the need for trading partners to strengthen their currencies – that's the outside risk today," writes Chris Turner, head of foreign-exchange strategy at ING. "But that is a hard message to balance against the need for the dollar to remain the world's pre-eminent reserve currency." For a complete preview of Bessent's hearing, check out this list that covers US borrowing, international policy and the IRS. —Simon Kennedy | |

| |

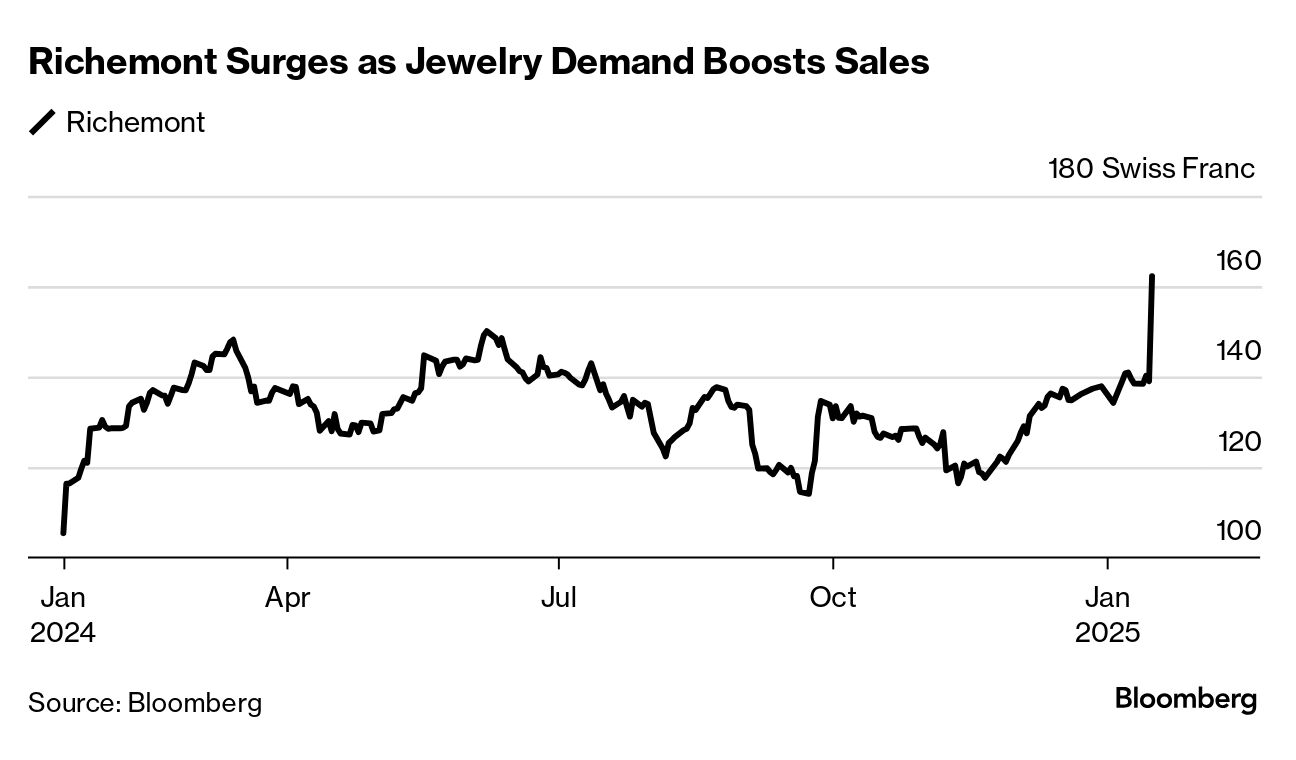

| Richemont shares soar 17% in Swiss trading today. The Cartier owner said sales unexpectedly jumped by double digits as consumers splurged on jewelry over the holidays. LVMH gains 8.6% in Paris and Hermes is up 6%. —Subrat Patnaik | |

| |

| Prominent short sellers have retreated from the limelight in recent years, fearing lawsuits, short squeezes and government probes. Now, Nate Anderson is joining their ranks. "There is not one specific thing — no particular threat, no health issue and no big personal issue," Anderson wrote in a letter on Wednesday. "The intensity and focus has come at the cost of missing a lot of the rest of the world and the people I care about." Anderson, 40, made international waves in January 2023, publishing a report accusing Adani of "pulling the largest con in corporate history." The Indian tycoon ranked as the world's fourth-richest person at the time, according to the Bloomberg Billionaires Index.  WATCH: Carmen Reinicke discusses Nate Anderson deciding to disband Hindenburg Research. Anderson said he's winding up his firm as of Wednesday after working through the last of its ideas and handing off tips on suspected Ponzi schemes to regulators. Over the next six months, he plans to work on a series of videos and materials on Hindenburg's model, so others can learn how the firm conducted investigations. —Katherine Burton | |

| |

| Is the UK's Rachel Reeves facing a "Liz Truss" moment? Where will US and UK yields settle? Let us know in the Markets Live Pulse survey. | |

Word from Wall Street | | "It's going to be a rocky reporting season, although not necessarily as much on the earnings number itself. My nervousness is more on how much beats get rewarded versus how much misses get hit, particularly in the US where the valuation multiple is very high." | | Helen Jewell Chief investment officer of fundamental equities EMEA at BlackRock Inc. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment