| Bloomberg Morning Briefing Americas |

| |

| Good morning. It's Inauguration Day and Donald Trump's kicking off with a flurry of executive action. TikTok's out of the dark, but not the woods. And Bitcoin rallies as crypto execs rebuff Trump's memecoins. Listen to the day's top stories. | |

| Markets Snapshot | | | | Market data as of 07:38 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Donald Trump at the Capital One Arena in Washington, DC. Photographer: Anna Moneymaker/Getty Images Donald Trump took a final victory lap at a rare pre-inauguration rally, touting the "end of American decline" and reiterating he'll sign close to 100 executive orders after being inaugurated as the 47th president at noon ET. The imminent, sweeping action includes a plan to invoke emergency powers to unleash domestic energy production while seeking to reverse President Joe Biden's actions to combat climate change, people familiar said. Here's what to watch in Washington today, where the desire among CEOs to get in Trump's good graces will be on prominent display.

Joe Biden granted pardons to retired General Mark Milley, Anthony Fauci and members of Congress who served on the select committee investigating the Jan. 6 attack. The outgoing president yesterday also granted a posthumous pardon to the late civil rights leader Marcus Garvey. As of the last full day of his presidency, Biden had issued a total of 70 pardons and 4,163 commutations. Here's a Q&A on one of the most absolute and misunderstood provisions of the Constitution. TikTok is back. Even before the inauguration, Trump vowed to extend the deadline for the video platform's Chinese parent ByteDance to find a US backer, prompting it to restore services after a brief outage. He also proposed a joint venture under which American owners would purchase 50%, but it's unclear if this would be accepted by ByteDance and Chinese officials. Meantime, Instagram and and X pounced on the opportunity to tout new video tools. | |

| |

| $TRUMP and $MELANIA crypto tokens joined the memecoin melange, sparking criticism from industry executives who called the first family's new offerings a "blight" and "zero-sum lottery" that'll ultimately lose value. After reaching $15 billion, Trump's coin briefly slid below $8 billion as Melania's coin took some of the spotlight. Meantime, OG token Bitcoin hit a fresh all-time high above $109,000. What next for the industry? Austin Campbell, CEO of stablecoin company WSPN USA, speaks on the latest Odd Lots podcast about the possibilities that lie ahead.  One of the Israeli hostages is handed over to the Red Cross in Gaza on January 19. Photographer: AFP A long-delayed ceasefire in the Gaza war took hold with Hamas releasing three Israeli hostages—reunited with their mothers near the border—in exchange for 90 Palestinians held in Israeli prisons. The six-week truce aims for the gradual release of 33 hostages and around 1,000 Palestinians in prison in Israel. "Today the guns in Gaza have gone silent," Biden said, adding that maintaining the truce will "require persistence" by the Trump administration. Watch the video of hostage-prisoner swap and read more about what's next for Gaza. | |

| A Couple More |  | |  | | | |

Deep Dive: Fed's Next Move | |

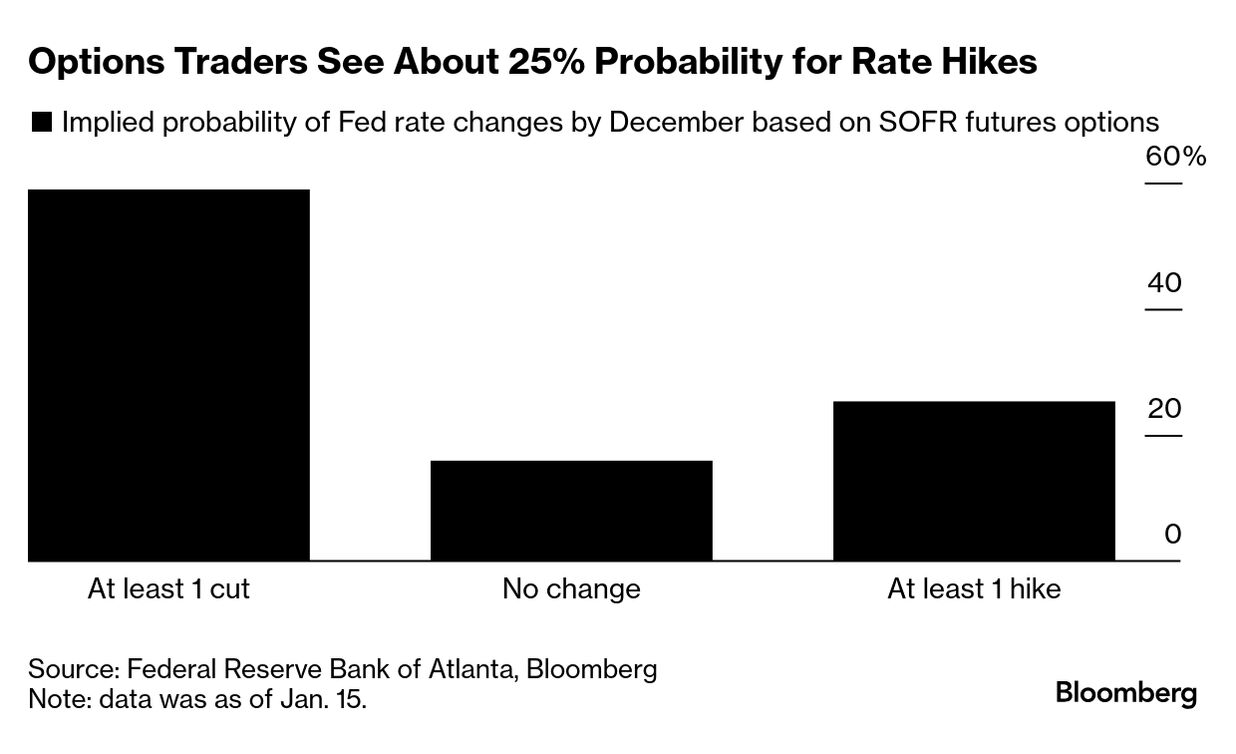

| A contrarian bet has emerged among die-hard bond traders that the Federal Reserve's next interest-rate move will be up and not down, hinging on the idea that Trump's policies will bolster inflation. - Traders see about a 25% chance that the central bank will lift rates by year end. Up until over a week ago, a hike wasn't even entertained: 60% of options traders were betting on more Fed cuts and 40% for a pause.

- The bar for a hike is high, but the Fed has reversed course before. In 1998, officials cut rates three times in rapid-fire succession to short-circuit a financial crisis before starting to increase rates in June 1999 to contain inflationary pressures.

| |

| Related Stories |  | |  | | | |

| |

Illustration: Deena So'Oteh One big idea is in vogue at this year's gathering of the business elite at the World Economic Forum: Embrace Trump—fast, with head-snapping zeal. For some CEOs, that means abandoning key ideas previously celebrated at the summit in order to curry favor with the new US leadership. Or as one exec put it, "It's sort of like, 'OK, which time were you lying?'" | |

| Big Take Podcast |  | | | |

| |

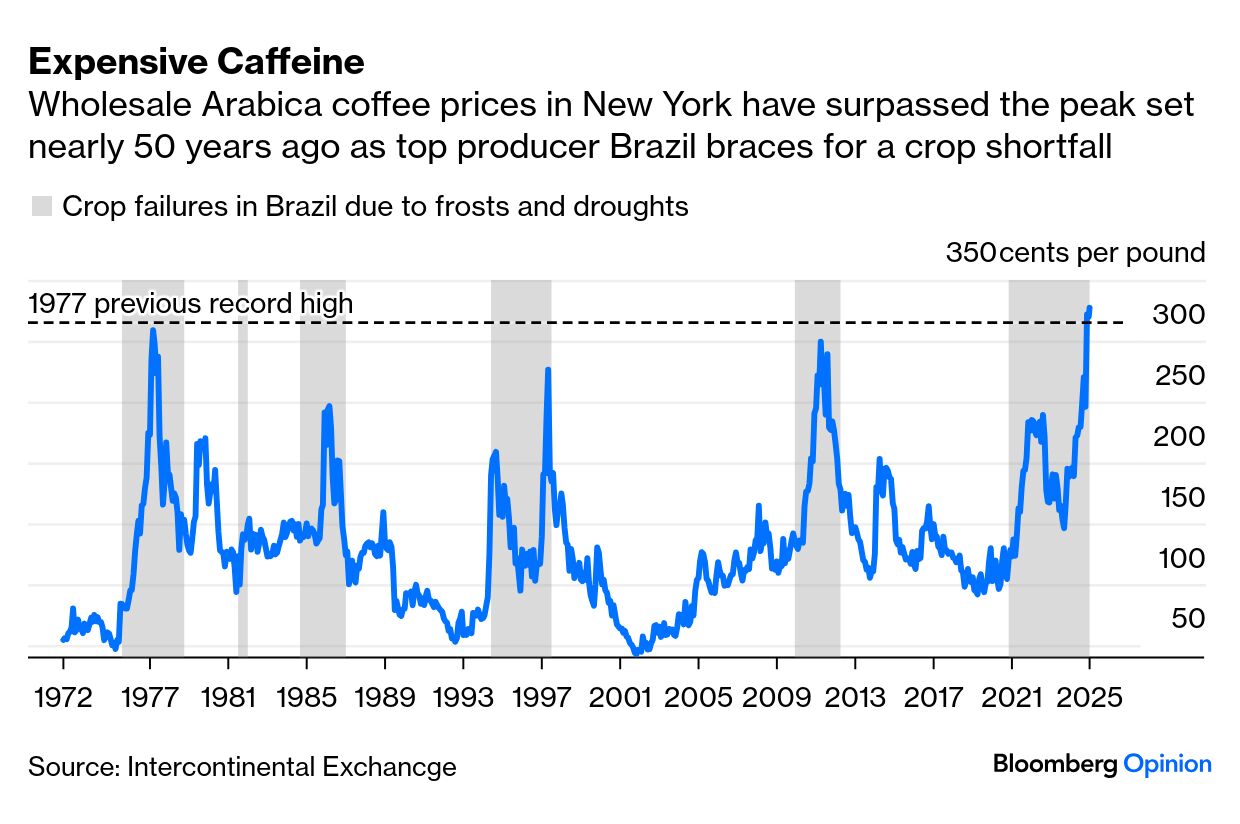

Photographer: Anthony Kwan/Bloomberg Your morning latte will soon come with a double-digit inflationary kick, Javier Blas writes. Arabica coffee prices in New York have topped the peak set nearly 50 years ago as bad weather in Brazil and Vietnam leads to a supply deficit. If anything, it's a surprise retail prices aren't higher already. | |

| More opinions |  | |  | | | |

| |

A home from Turkel Design. Source: Turkel Design LA fire victims are turning to prefab companies to overcome labor shortages and speed up the process of rebuilding. Firms are seeing a jump in enquiries, with some hoping to cater to the ultra-rich with fire-resistant materials and pricier custom designs. | |

| One More Thing |  | | | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment