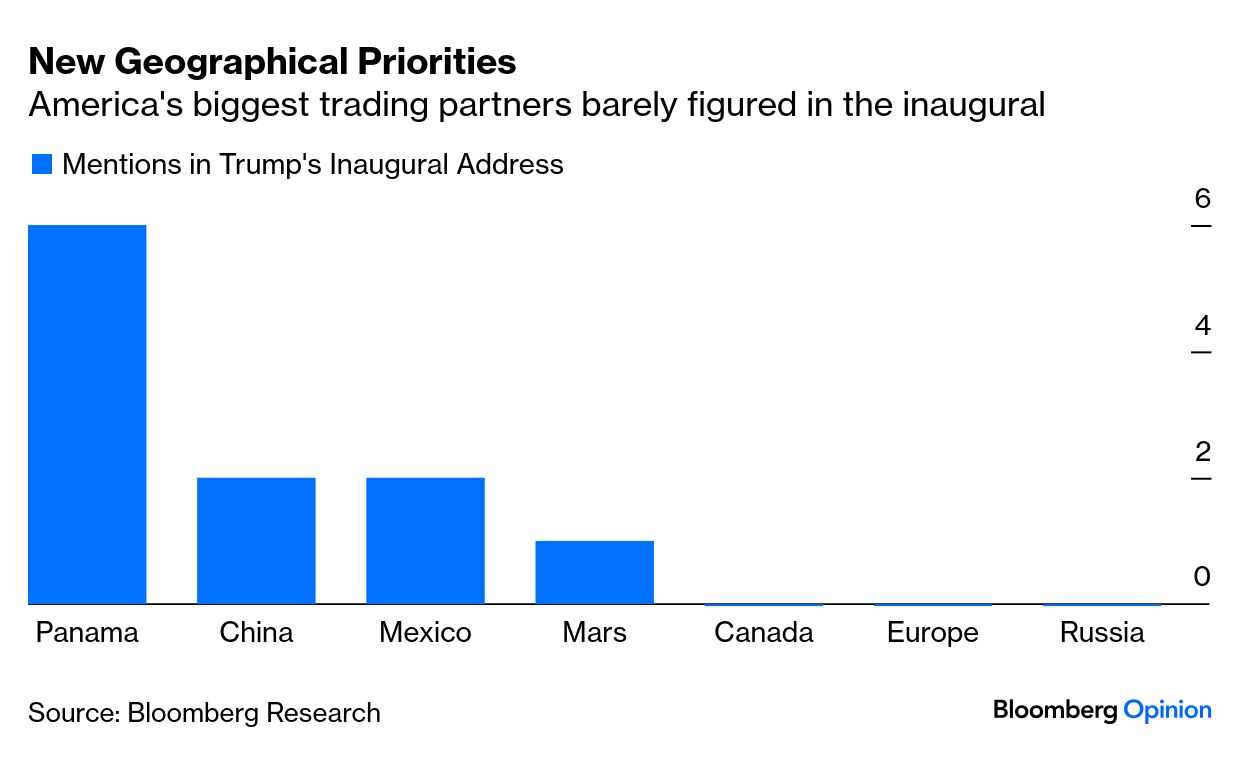

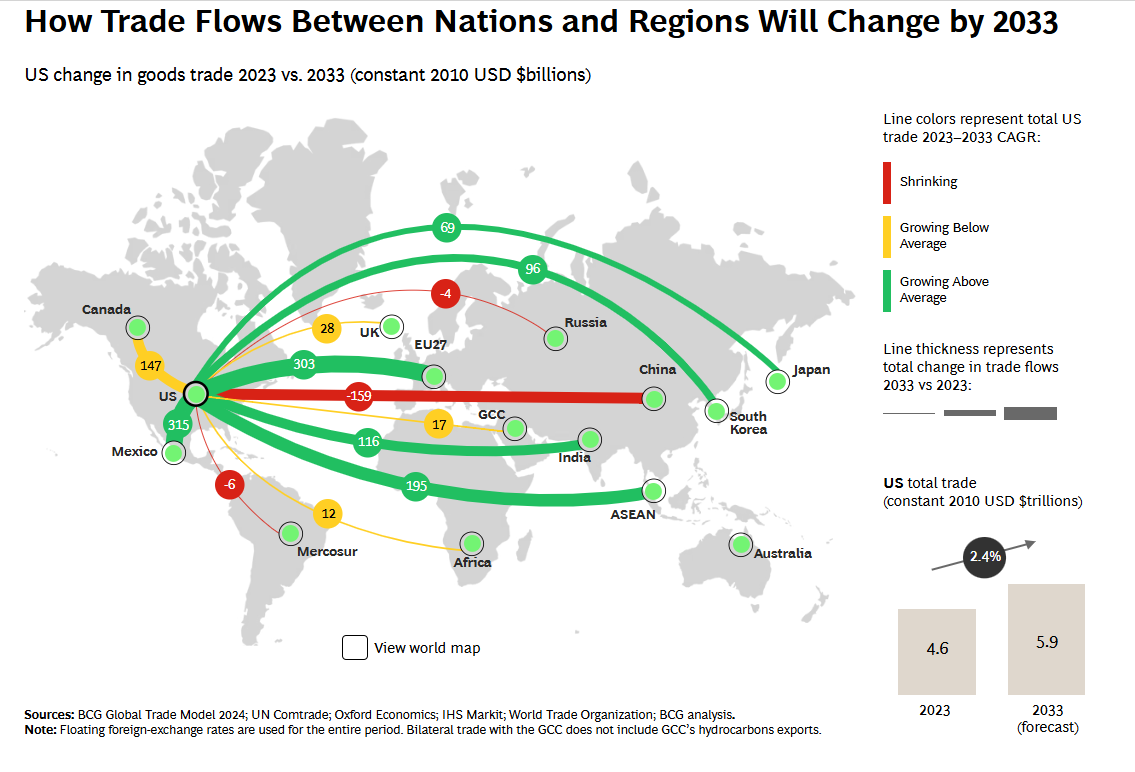

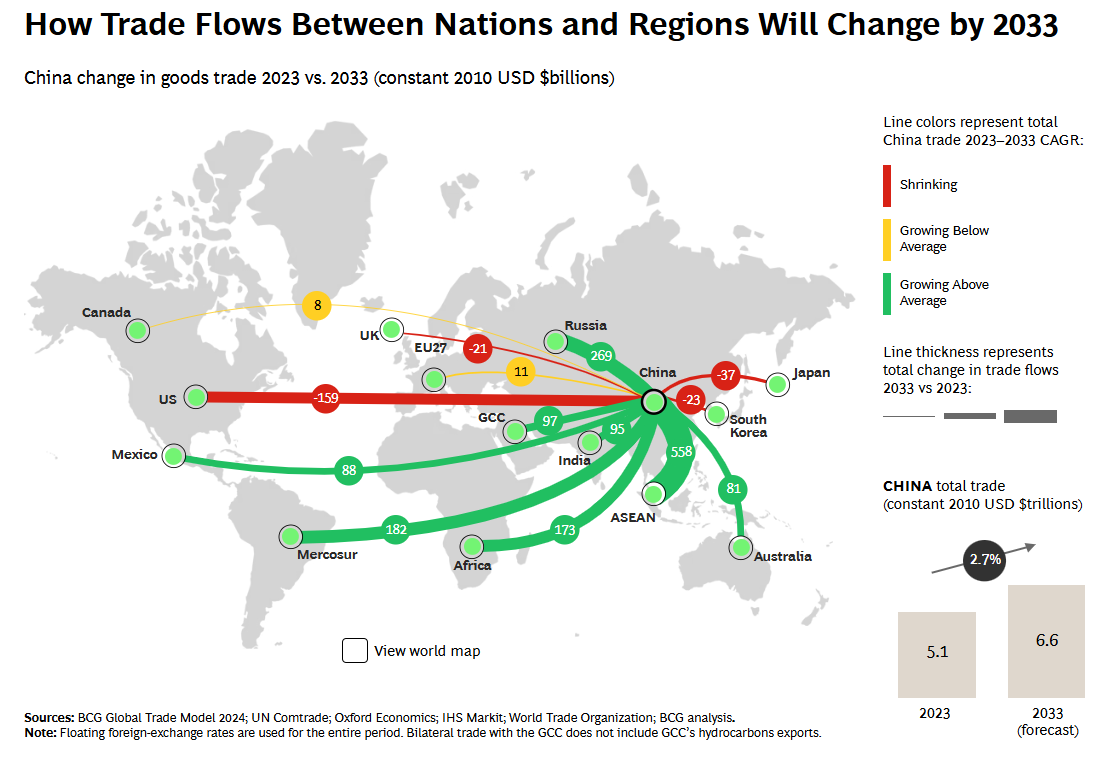

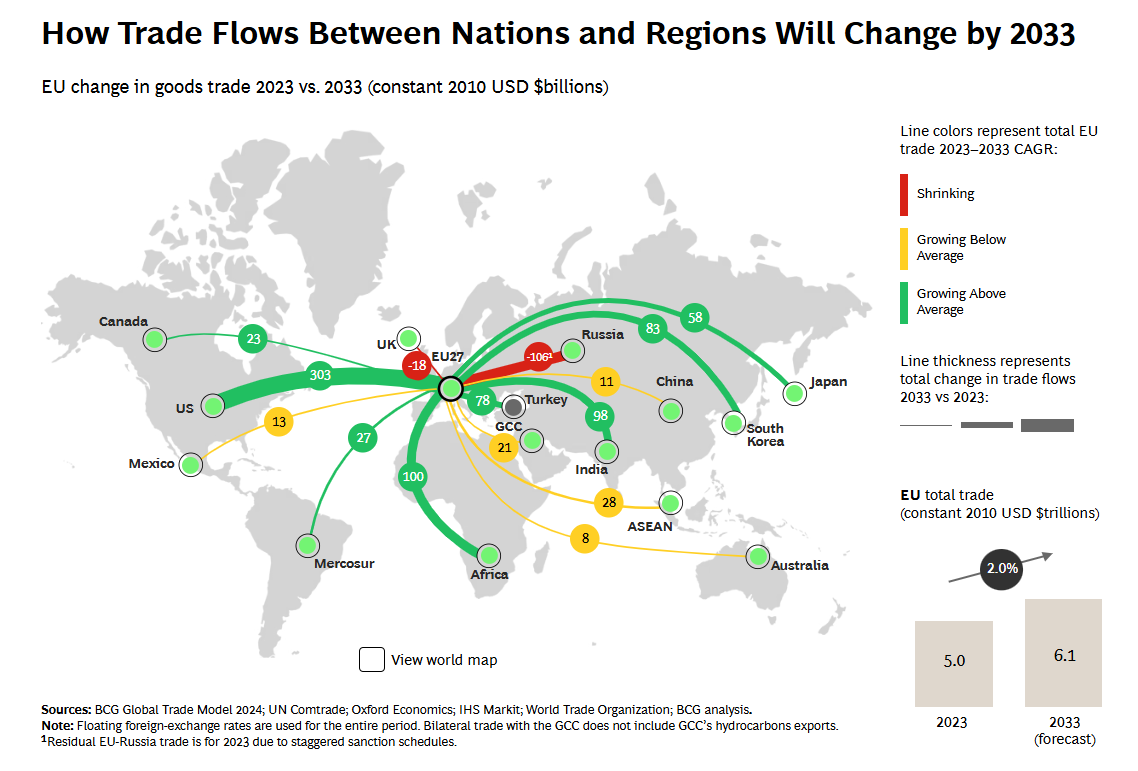

| To get John Authers' newsletter delivered directly to your inbox, sign up here. One Day Down. 1, 460 to Go | He's ba-a-a-ck. Donald Trump's second term has started without — despite one of his more infamous soundbites — proving to be a day of temporary dictatorship. It was still, however, a day of chaotically erratic messages that sent global markets on a roller coaster. The main news (for the moment) appears in the summary above; for some reason, Trump said nothing about his plans for Mexico and Canada until the end of the day. Things already probable and now confirmed include an initial focus on an immigration crackdown, and on culture war issues. The US has left the Paris climate accord again, much more quickly than in Trump 1.0, and restrictions on oil drilling are being lifted. What did markets make of it? The wait before committing to new tariffs counted as a big positive, and prompted a dramatic rally for the currencies of the biggest US trading partners — Mexico, Canada, China and the euro zone — against the dollar. They leapt when the news first broke at 8:30 a.m. that he was asking for further study on tariffs without taking immediate action, and again once the inaugural address started. But they took a dive when Trump later made statements deemed more concrete:  Canada and Mexico had avoided abuse during a series of Trump speeches during the day, as he concentrated his fire on domestic enemies. Instead, a story was leaked to the press in the American morning that he'd ask his team to study possible tariffs on a range of criteria. His comments on 25% tariffs on the two US neighbors came in answer to a reporter's question in the Oval Office. The reasons for doing this are imports of fentanyl, and the influx of illegal immigrants, neither of which would appear to involve Canada. And it was an infuriatingly offhand policy announcement: Trump's team is "thinking in terms" of 25% tariffs, and "I think we'll do it on Feb. 1." Close allies might have wanted a little more precision and formality than that. Parsing the inaugural address, Trump's geographic priorities did look bizarre. China only came up twice (in complaints over the Panama Canal). Canada wasn't mentioned at all, nor was Europe. Mexico came up only in connection with renaming the Gulf of Mexico. Those are the four biggest US trading partners. Mars, however, got a mention. And Panama beat them all: What conclusions can we draw? Markets matter to this administration, and could function as a guardrail. Stocks are not going to change hands based on the back of pardons for people who attacked police officers on Jan. 6, 2021, or a formal government policy that there are only two genders. The presence of a few hugely powerful CEOs on the inaugural dais is largely symbolic, but it's a powerful signal that Trump doesn't want to upset the stock market. The silence on China, so far, signals that Trump wants a deal, maybe even a Plaza Accord II, that encompasses Xi Jinping, and he's using tariffs as a tool to bring others to the negotiating table. His bid to be the savior of TikTok sets him apart from China hawks. This is much better than many had feared. And as Chinese tariffs could upset the markets badly, deferring them makes sense until Trump can offer some certainty that his far more market-friendly tax cuts have survived what will inevitably be a drawn-out horse-trade with Congress. Day One might then be a well-camouflaged attempt to leave room for negotiations wide open, both with the legislative branch and with trading partners. That, at least, was what I was planning to write before Trump was asked about Mexico and Canada. It's harder to sustain that argument now. Whatever one thinks of Trump's trade policies — he has a mandate for tariffs, but it seems crazy to start with friendly neighbors rather than China — this undisciplined approach to releasing information makes planning impossible and more or less guarantees volatility. Markets, executives, and foreign governments alike will all feel a similar frustration that this is to be their lot for another four years. Many things have changed since Trump 1.0. The lack of message discipline isn't one of them. Tariffs and What's at Stake | Even if America's closest trading partners have a stay of execution, the questions over tariffs persist. Trump's decision to hail William McKinley, America's most dedicated 19th century protectionist, and restore his name to the Alaskan peak Denali, shows that protectionism remains important to the new president. It's also true that whatever the Trump tariffs eventually look like, global trade is taking a new shape. Boston Consulting Group, which has been tracking shifts in global trade since 2018, reveals in a new report just how sharply geopolitical rivalries and alliances are rewiring the global economy. It projects that total world goods trade will grow at 2.9% annually for the next decade, and that the routes will change markedly. The authors' projections predate the inaugural and exclude potential retaliation. The biggest conclusion is that the most significant decisions lie ahead. Apart from when and how supply chains are disrupted by material tariffs and need to adapt, the emergence of a secondary currency is a risk. North America The research identifies five drivers that could accelerate in the coming decade. Firstly, without any disruptive tariffs, the tight trade between the US, Mexico and Canada relationship — as they try to ease reliance on Chinese imports — should still support growth: Any change to existing treaties would matter a lot. For long-term investors considering Mexico or Canada, the forthcoming renegotiation of the current trade agreement due in 2026 will likely hold them in check: BCG says one issue to watch is whether the US will pressure Mexico to screen Chinese foreign investment aimed at circumventing import barriers on low-cost Chinese EVs and other goods. China BCG estimates that Beijing's annual trade with the west will contract by $221 billion by 2033 — on average 1.2% a year. The $159 billion decline in yearly US-China trade could be sharper if Washington goes through with higher tariffs. Under the extreme scenario of a 60% levy, the authors estimate that would further reduce bilateral trade in 2033 by 27%. However, the reshaping of the map is reflected in the volume of trade and the type of goods involved. China's growing ties with the rest of the world won't necessarily be underpinned by rerouting goods destined for the west to the Global South. The two regions have distinct needs. Here's how China's trade routes will transform: Still, the report expects China's trade with the Global South to surge by $1.25 trillion by 2033, with annual growth of 5.9%. That would deepen China's ties with major emerging markets in which it has already invested through infrastructure programs such as the Belt and Road Initiative. Where do these growth opportunities in the Global South come from? China's trade with the 10 members of the Association of Southeast Asian Nations [1] is expected to account for roughly half, while BRICS+, which includes Brazil, Russia, India, and South Africa plus four new members from the Global South, is projected to account for 44% of its total forecast trade growth over the next decade. There would also be an uptick in bilateral trade with Russia. But it won't be painless: We project that China's total trade growth will be limited to 2.7% annually over the next decade, well below the current average real annual GDP growth estimate of 3.8% over the same period. That is also slower than the 4% annual growth in trade that China enjoyed from 2017 through 2022.

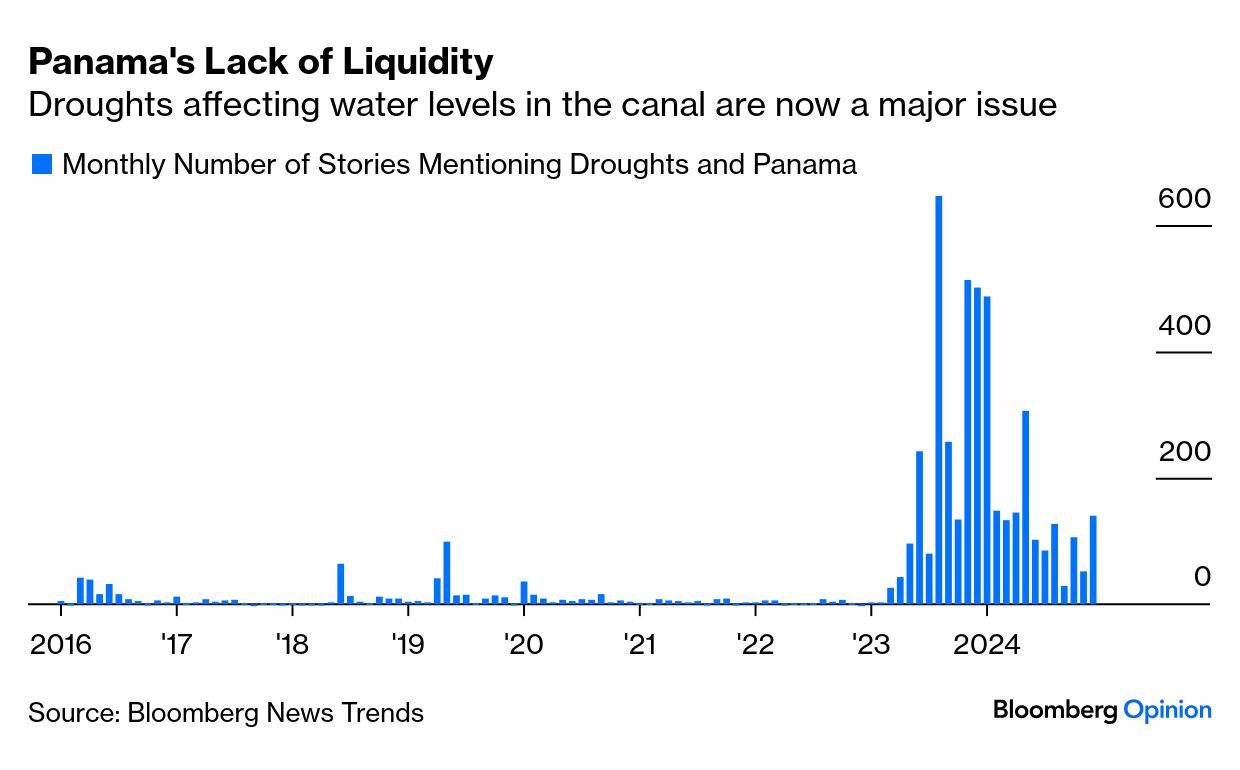

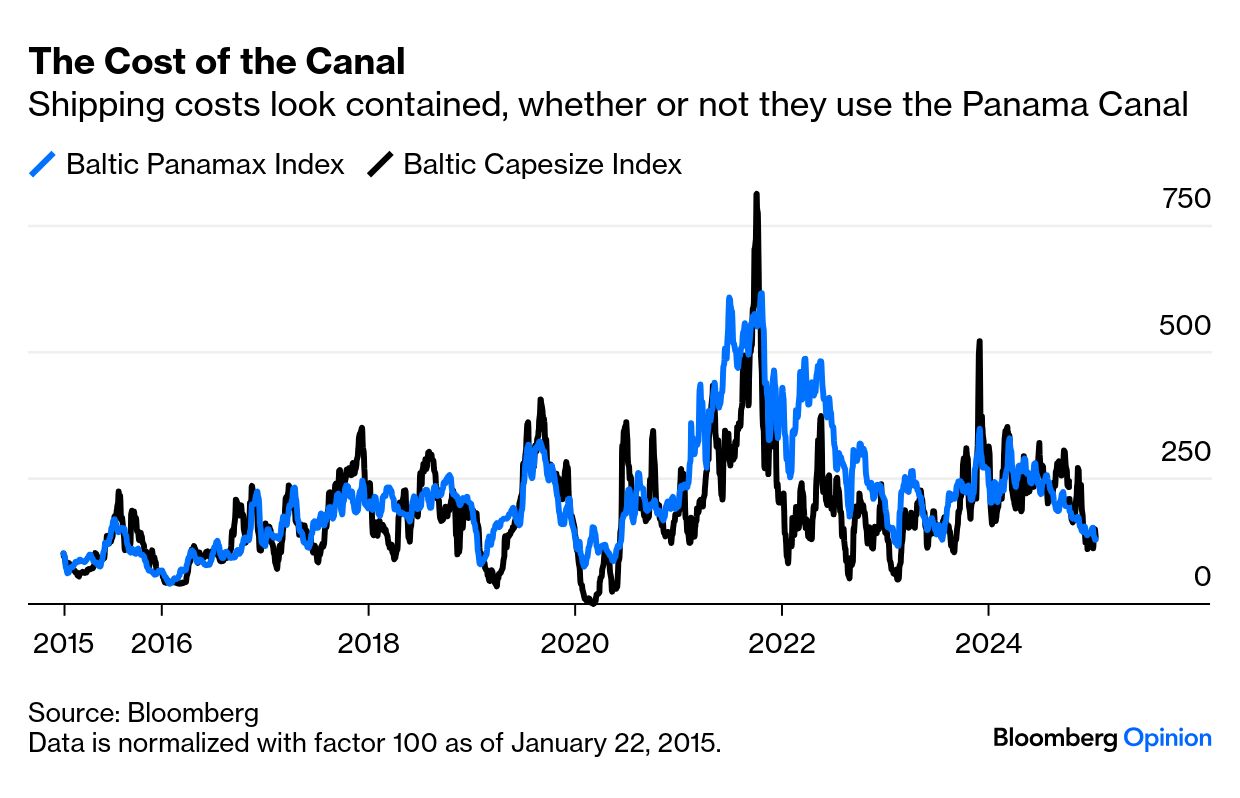

The EU As it scales back trade with China, the European Union will need massive investment to enhance competitiveness, as Mario Draghi, former European Central Bank president, asserted in his The Future of European Competitiveness report. While the bloc's trade with other nations grows by 2% for the next decade, its dealings with the US are dominated by liquefied natural gas imports. Draghi urges the EU to invest more to close its innovation gap with the US. BCG argues that this would be difficult but not impossible. Political crises in both Germany and France don't help. Meanwhile, the EU is in the crosshairs of the US-China relationship, so it will need deeper ties with emerging economies and a stronger EU internal market: India India is on course to be a big winner from a global attempt to "de-risk" China. Its favorable relations with most of the world's major economies should lead to 6.4% growth in total trade through 2033, to $1.8 trillion annually, roughly in line with gross domestic product, aided by incentives for manufacturers, a huge low-cost workforce, and rapidly improving infrastructure. Its annual trade with the US is expected to double to about $116 billion by 2033. Trade with China, however, could be complicated by India's concerns about its trade deficit and their ongoing border dispute. While the current focus is predominantly on the US, BCG shows that companies face the potential of rising tariffs in many markets. The next several years could see a raft of new policies, each setting off complex responses. We ain't seen nothin' yet. —Richard Abbey Lost in Trump's fury at America's surrender of the canal it built is the fact that Panama expanded the waterway a decade ago, in a massive feat of civil engineering funded by its government with loans from multilateral institutions. That allowed modern container ships to pass, and involved building a new canal next to the original one opened over a century ago. This video, featuring old colleague Jude Webber, demonstrates that it was quite an undertaking. The canal's problem in recent years has been global warming. A drought has reduced water levels, making it harder for ships to pass. Just look at the sudden prevalence on the terminal of stories mentioning Panama and droughts: As for the cost of using the canal, shipping rates gives us a good idea. The Baltic Exchange has indexes for Panamax ships, the largest that can go through the canal, and Capesize, which are so big that they have to go around the capes. Over the last 10 years, they have generally moved in line with each other, and neither at present looks unreasonably high: It's much easier to pick a fight with Panama and its 4.5 million people than to take on China. It's not at all clear that there's any point in doing so. Some Panamanian cultural tips. Try watching The Tailor of Panama, a fine Le Carre adaptation set in the sleaze of Panama City, or Canoe Man, a dramatization of the true story of a British man who faked his death in a canoe accident and tried to escape to Panama. It's extraordinary. Have a good week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment