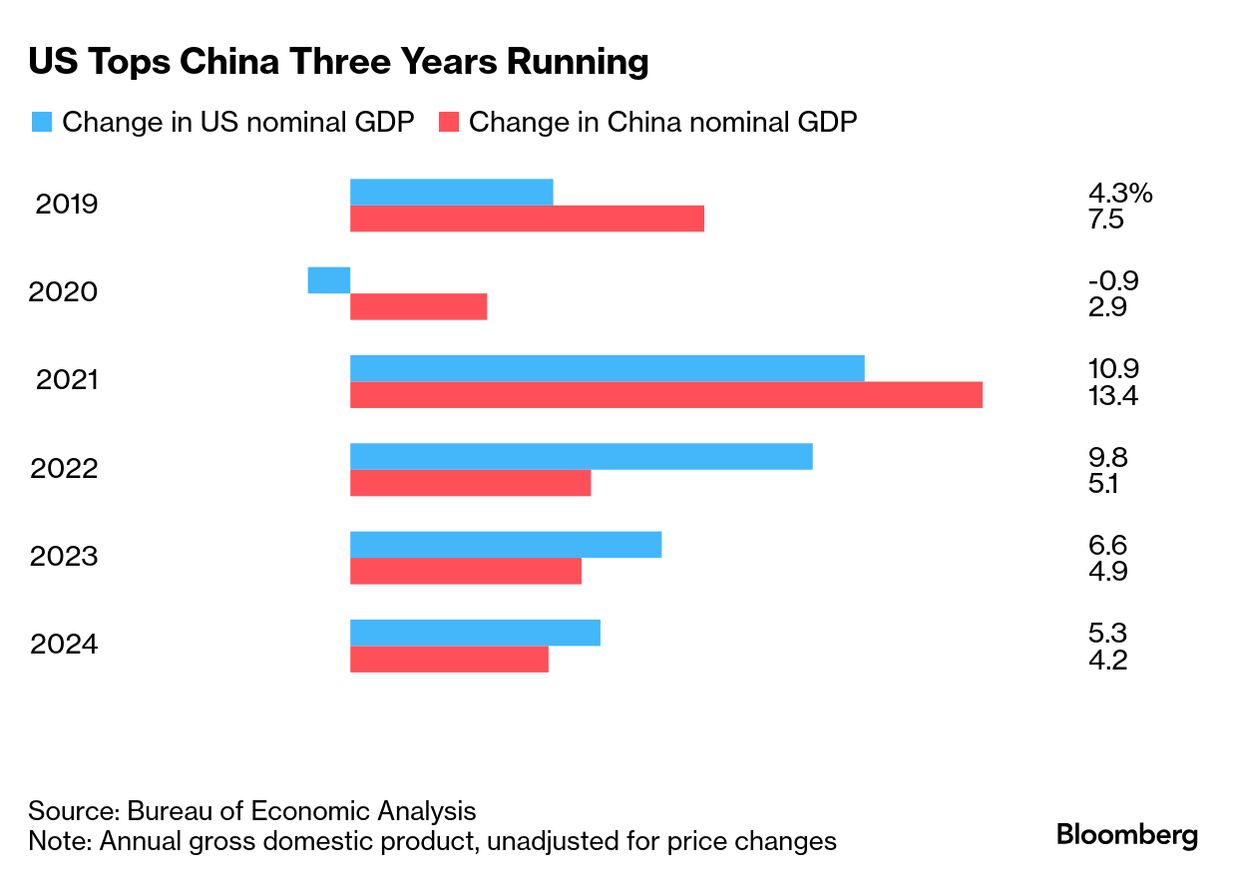

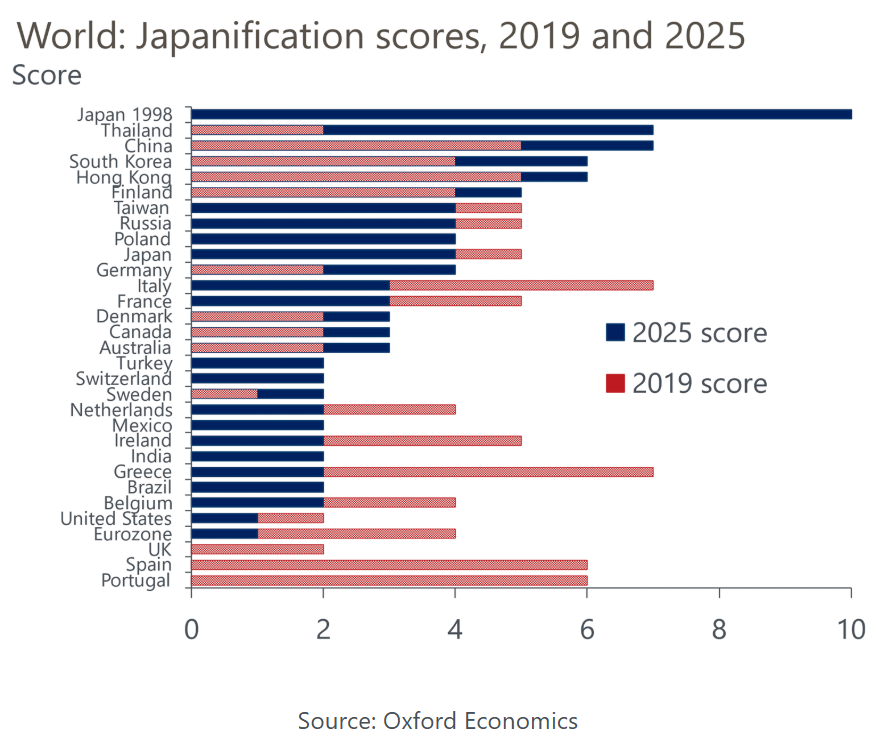

| I'm Chris Anstey, an economics editor in Boston, and today we're looking at the latest US vs. China GDP figures. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. In the global economic rankings contest, the US has just tightened its hold on the championship belt, with its 2024 growth rate surpassing that of China, thanks in large part to the irrepressible American consumer. Data Thursday showed US nominal GDP — that is, before counting inflation — rose 5.3% last year. That's more than a percentage point faster than China's 4.2%, released two weeks ago, and marks a third straight year of American outperformance. (It also showcased how Trump inherited a strong US economy.) Typically, lesser-developed nations like China sustain faster expansion rates as they catch up with their advanced rivals. China's GDP per capita was $12,614 in 2023, the latest year for which the World Bank has comparative data. In the US, it was $82,769 — showcasing the enormous catch-up potential for the world's No. 2. But China has suffered the impact of a deep downturn in the property market that's in turn hurt consumer confidence. President Xi Jinping's campaign in recent years to tighten oversight of the nation's private-sector enterprises has also had an impact — including in the stock market, with the benchmark CSI 300 Index down 31% the past four years (39% in dollar terms). With limited domestic demand, excess capacity has caused deflation in China, making its nominal GDP look weaker than the "real" figure, where Beijing achieved its 5% growth target for last year. Prices have been falling in the GDP series since mid-2023. By contrast, US nominal GDP growth exceeded the real rate of expansion thanks to inflation. The GDP price index, a broad gauge of costs across the economy, was up 2.4% for 2024, compared with the 1.9% average over the two decades through 2019. US nominal GDP also outstripped China in 2023 and 2022, when inflation was even higher, at 3.6% and 7.1%. The inflation surge in recent years was painful for American households, but it also fed through to higher corporate revenues and profits, and helped end the pre-Covid narrative of secular stagnation. Today, interest-rates are at levels akin to pre-great financial crisis years, whereas China is seeing bond yields plumb record lows. Now, it's fair to say that the US isn't the undisputed champion in the standings of economic heavyweights. Measured by purchasing power parity, which tries to take account of differences in prices between countries for the same good or service, China's GDP is estimated by Bloomberg Economics and others to have exceeded the US years ago. But when it comes to buying goods on global markets or making loans to trade and investment partners, those are done in nominal dollars. And by that measure, the US has extended its lead. The Best of Bloomberg Economics | Oxford Economics has re-run an exercise from 2019, when it assessed the risk of Japanification — "a lengthy period of low growth and low inflation or deflation" — in various economies around the world. The result: chances are now higher in China and a number of other Asian countries, while divergent trends are seen in Europe. Germany's large savings surplus and a decline in house prices contribute to the former euro-region growth engine having a relatively high Japanification score, Adam Slater at Oxford Economics wrote this week. By contrast, other European nations have benefited from asset-price gains and a continuing trace impact of Covid stimulus. "China's current combination of worsening demographics, low inflation, and elements of a balance-sheet downturn is worryingly reminiscent of Japan in the late 1990s," Slater wrote. Both its stock-market and property prices are weak, while it continues to have a large savings surplus, he said. |

No comments:

Post a Comment