| This is Cécile Daurat and Nazmul Ahasan from Bloomberg News' US economy team. Today we're looking at tariff evasion. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's economy entered 2025 on a weak note, while its central bank injected record cash into the financial system this month.

- President Donald Trump threatened and then quickly pulled US tariffs on Colombia after the two countries reached a deal on deported migrants.

- German companies unexpectedly became gloomier at the start of the year, adding to growth doubts before next month's snap election.

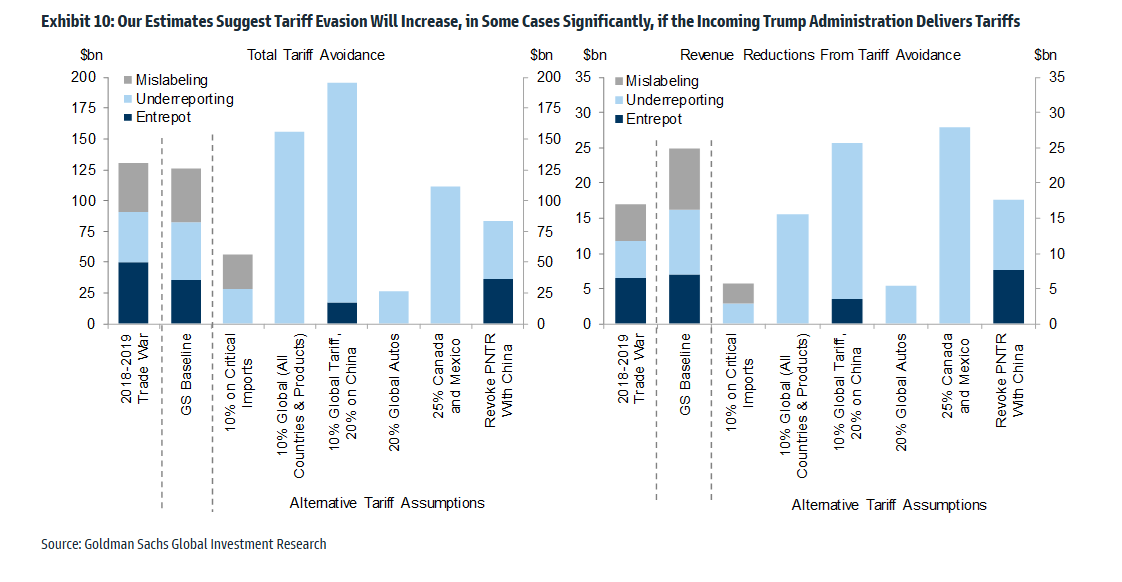

Since the first iteration of Trump's trade war in 2018-19, China's share of US imports has dropped significantly. Although other factors were at play in global trade, on the face of it, tariffs did exactly what they set out to do. But the drop fails to capture a practice that's as old as trade itself: duty dodging. As Goldman Sachs economists reminded us in a note, tariffs can be avoided in three ways: shipping goods through another country (known as entrepôt trade), underreporting the value of products or mislabeling them as similar goods that have lower duty rates. The economists analyzed granular product-level data and found tariff evasion can explain as much as $90 billion of the estimated $240 billion pullback in US imports from China compared with pre-trade war levels. It remains to be seen what Trump will do this time around. Since his inauguration, the president has threatened to impose tariffs on economies including China, the European Union, Canada, and Mexico — but the only concrete action so far is a call for a review of trade practices that's due by April 1. Untangling the reasons behind trade shifts is a complex challenge. Research from the Federal Reserve last year found that as the US has reduced its reliance on China for goods since 2017, other suppliers of imported goods — such as Vietnam and Mexico — have increased their sourcing from China. But it doesn't necessarily mean that third-party countries are used as China's backdoor to the US, the researchers concluded. Other factors can explain the changes. There's a lot of uncertainty around what trade policies Trump will eventually implement. Regardless of the scenarios, tariff evasion will increase in the coming years, Goldman Sachs economists say, and US trade indicators will likely overstate the actual impact of tariffs. The Best of Bloomberg Economics | - Rising hunger in the US highlights the sharp-edged choice Fed officials face over rates. Pimco's Marc Seidner expects more aggressive easing than other investors.

- The euro zone's lackluster growth is set to keep the European Central Bank on a rate-cutting path this week.

- China is set for a great reshuffling of local government ranks this year, offering a glimpse at the officials set to become the nation's top leaders.

- African countries representing about three-quarters of the continent's GDP are set to take diverging approaches to monetary policy in the next month.

- Thailand handed out $890 million to elderly (about $300 each) to spur the economy as the cost of living rises.

- UK firms saw the biggest hit to profit and output since the pandemic.

The US economy remained at a comfortable cruising speed in the final stretch of 2024, powered by healthy consumer spending and creating even more separation from global peers. Economists surveyed by Bloomberg project the government's initial estimate of fourth quarter gross domestic product — the sum of goods and services produced — to show an annualized 2.7% increase. That would follow back-to-back quarters of about 3% growth. Thursday's report surfaces a day after the conclusion of the first Fed policy meeting of 2025. Central bank decisions in the euro region, Sweden and Brazil are among other highlights — see here for the rest of the week's economic events. Staying with the topic of tariffs, Maeva Cousin and Eleonora Mavroeidi at Bloomberg Economics modeled the hit from tariffs that Trump has so far threatened to impose on America's four largest trade partners. Mexico — with exports to the US worth more than 26% of its GDP — faces the biggest risk by far. Canada's activity would also take a hit, while China and the EU are significantly less exposed. Trade between the US and these countries would plummet. The US will see a more modest blow to growth, they found, but also a bigger threat of inflation. To read the full research on the Bloomberg Terminal, click here. |

No comments:

Post a Comment