| I'm Chris Anstey, an economics editor in Boston, and today we're looking at how markets are causing headaches for UK policymakers. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Bank of Japan officials may discuss raising their inflation outlook, people familiar with the matter said, as higher prices cause consumers to cut spending.

- Several Federal Reserve officials confirmed the US central bank will likely hold interest rates at current levels for an extended period.

- Coming up: US employers likely added a healthy number of jobs in December and the unemployment rate was unchanged.

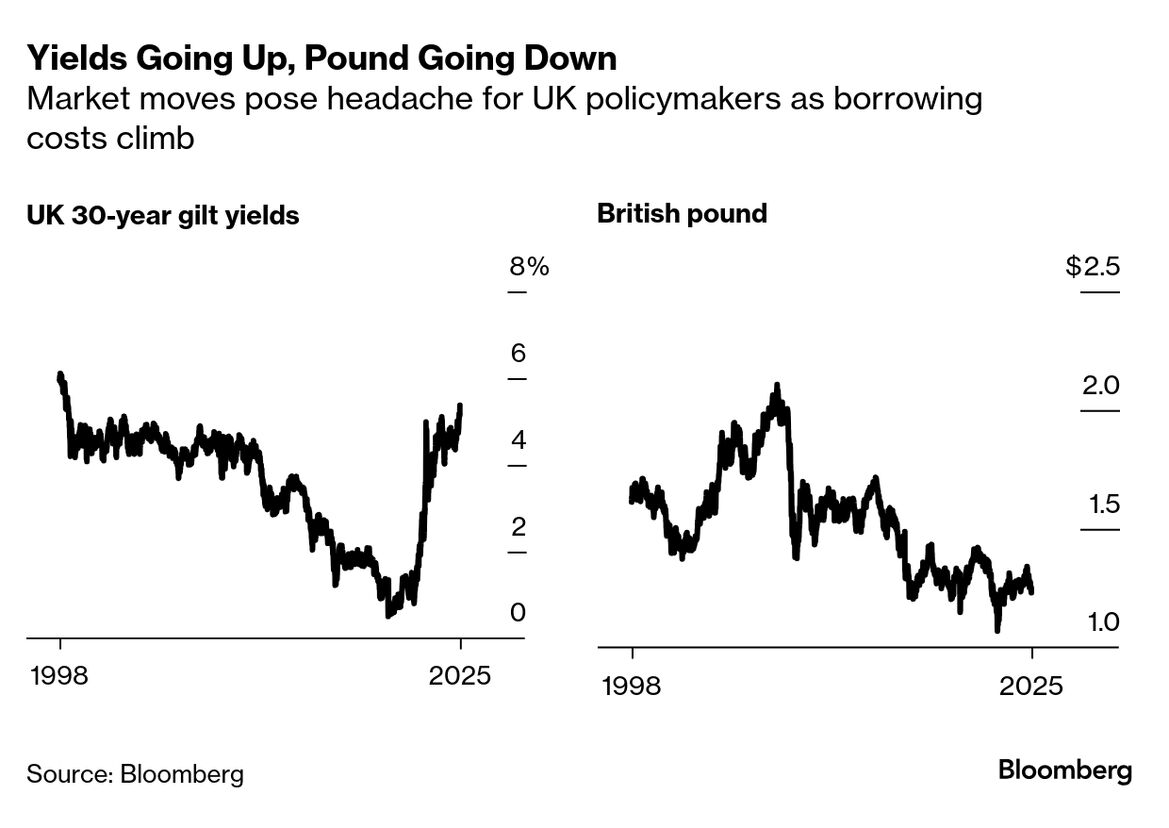

Outgoing US Treasury Secretary Janet Yellen, in one of her final press appearances, on Wednesday highlighted the need to avoid fiscal tightening as a forced response to some sort of financial-market disruption. "I would hate to see it come to the bond vigilantes," she said in a CNBC interview — referring to investors who demand more to buy government debt thanks to their perceived budgetary indiscipline. "Investors around the globe count on the US to be responsible in managing its fiscal policy, and not to rely on market responses to produce deficit reduction." She expressed hope the Trump administration will take the large US fiscal deficit "seriously" and take steps to address it. Across the Atlantic, the newly installed UK government of Prime Minister Keir Starmer thought it was taking things seriously last year with a new budget imposing a fiscal rule to pay for day-to-day spending out of taxes. But lately, UK policymakers have come under pressure thanks to a sharp selloff in gilts, which morphed into a slump in the pound as traders exited British assets. Yields on 30-year government bonds soared Thursday to the highest since 1998. The pound slumped to the weakest in more than a year. Ironically, the origin of the bond selloff was in the US, about a month ago, as traders responded to evidence of economic resilience by paring back expectations for Fed rate cuts in 2025. That lifted yields across the globe, including the UK. Higher yields in turn boost the interest bill for governments, especially ones carrying much higher debt loads nowadays. HSBC calculates the climb in UK yields might already have wiped out the £9.9 billion ($12.2 billion) buffer Chancellor Rachel Reeves set aside for her budget rules — and endangered her whole vision for the economy and the public finances. Reeves will favor fresh cuts to public spending over tax hikes if soaring UK borrowing costs wipe out her fiscal headroom, people familiar with her plans told Bloomberg. She plans to reaffirm her fiscal rules in a speech in coming weeks aimed at reassuring investors and businesses, they said. Meantime, one former UK central banker, Martin Weale, is warning of a parallel with the 1970s, when the once global economic superpower sank to having to ask the IMF for financial assistance. It all underscores an unsettled time for both bond investors and fiscal policymakers. Some big investors aren't flinching — but the vigilantes seem restive. The Best of Bloomberg Economics | - China said it has fiscal firepower to respond to external challenges, and the central bank suspended buying bonds. Meanwhile its pension system faces a new threat.

- German company insolvencies jumped in 2024 as the country's businesses buckled under the strain of a shrinking economy.

- Turkish central bank officials will step up meetings with business leaders to improve communication at the start of what's expected to be a lengthy rate-cutting cycle.

- Argentines are turning more optimistic on the economy, while Brazilians show mounting disapproval of how President Luiz Inacio Lula da Silva is running theirs.

- India, Indonesia and Vietnam are set for a tourism "bonanza" as middle classes expand and grow wealthier, according to an Accor group executive.

- Peru restarted monetary easing after one of the lowest inflation rates in emerging markets fell even further.

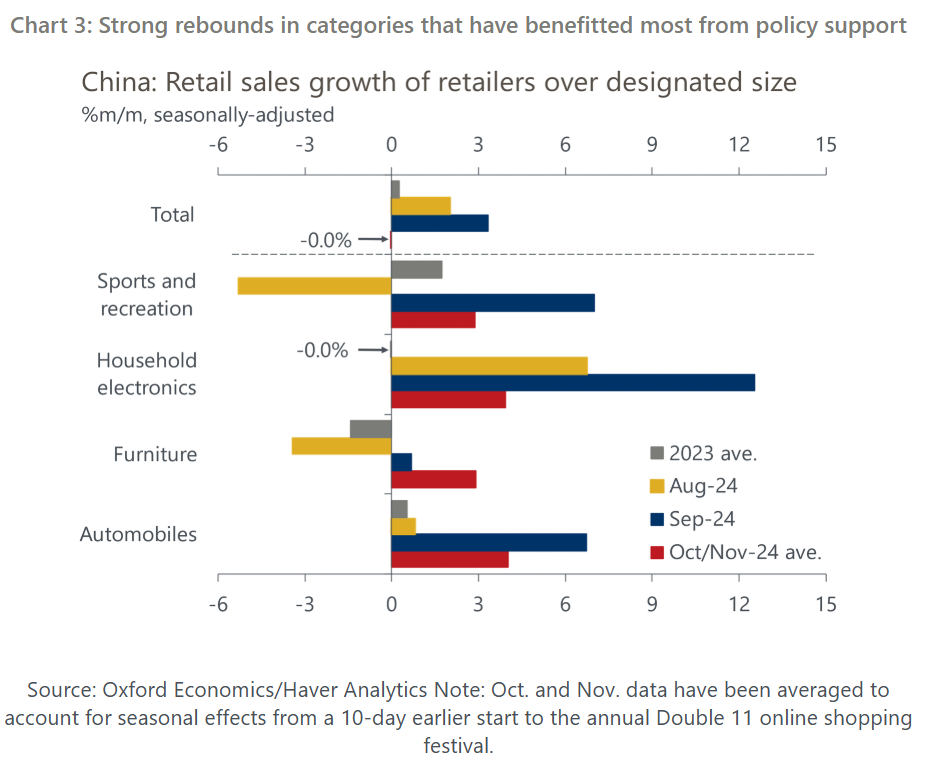

China's policymakers have doubled down on a program aimed at boosting consumer spending that incentivizes households and companies to turn in obsolescent equipment and buy new durable goods. Retail sales for covered items — from appliances and cars to smartphones and tablets — have accelerated as a result. "Policy intervention has lifted retail sales," Oxford Economics economist Sheana Yue observed in a note this week. "An expanded trade-in program will be a welcome tailwind for retail sales," she wrote, while noting the full scale of funding for the next stage isn't yet clear. But the upside to spending is limited because of the finite number of things that can be replaced, she said. Plus, there's a downside because the program effectively borrows from future consumption, she wrote. "Boosting broader consumption will require measures aimed at dealing with structural problems that have weighed heavily on consumer confidence. This includes fixes to the labor and property markets." |

No comments:

Post a Comment