| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the Fed's policy meeting. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The ECB is set to lower interest rates for a fifth straight meeting after data showed a flatlining economy — follow our TopLive blog here.

- The White House is considering challenging the constitutionality of a 50-year-old law limiting the president's control over federal spending.

- Trump administration officials are exploring additional curbs on the sale of Nvidia chips to China.

When the Federal Reserve released its policy decision Wednesday, neither stocks nor bonds liked the statement's removal of language referring to inflation having "made progress" toward getting down toward the official 2% target. Instead, the Fed simply reiterated that "inflation remains somewhat elevated." It looked like, after three rate cuts in the final four months of 2024, the central bank had shifted to a hawkish crouch. When asked about the alteration in his press conference, however, Chair Jerome Powell rejected the idea that it was no longer the case that progress had been made on disinflation. "We did a little language clean-up there" is all, he indicated — "we just chose to shorten that sentence." Big Take: Trump's Tariffs Hindered US Growth Before, and Threaten to Again Powell has a history of offering dovish interpretations of Federal Open Market Committee meetings, and in the case of the September 50 basis-point rate cut, was seen as having been successful in marshalling almost all his colleagues behind his bid to start the easing cycle with a big move. So his benign read on the FOMC statement may suggest he's more dovish than the median voter. It did help moderate some of the market reaction, with the S&P 500 closing off of the day's lows.  Television stations broadcast Powell on the floor of the New York Stock Exchange. Photographer: Michael Nagle/Bloomberg For now, the Fed is in wait-and-see mode. Asked whether a rate cut is on the table for March, Powell said "the broad sense of the Committee is we don't need to be in a hurry to adjust the policy stance." At the same time, he said that policymakers do "expect further progress on inflation," and that "we think the pathway to that could happen." It may not happen immediately. Friday brings the next release of the Fed's preferred inflation gauge, the PCE price index, and Powell noted the expectation there is for a 2.8% year-on-year core reading for December, the same as the previous two months. But thanks to relatively high inflation readings in early 2024, the 12-month prints — which Powell emphasized are the relevant ones to watch — on the core PCE may indeed suggest progress in coming months. And how did President Donald Trump take the Fed refraining from rate cuts now after having executed three straight reductions under his predecessor? He posted on Truth Social that, because the Fed had "failed to stop the problem they created with inflation," he would do it through policies including stepped up energy output. Trump included criticism of the Fed over bank regulation, but not specifically on rates — continuing a pattern of dissonance from his 2019 approach, as this newsletter highlighted Wednesday. The Best of Bloomberg Economics | - The Bank of Japan made a significant step toward shrinking its massive balance sheet last week as Governor Kazuo Ueda proceeds with the normalization of policy. Higher rates will drive up debt-servicing costs for the heavily-indebted government.

- UK Chancellor Rachel Reeves said she wants construction work to begin on a third runway at Heathrow Airport before the next election is due in 2029.

- Brazil's central bank lifted its rate by a full percentage point for the second meeting. Meanwhile, the South African Reserve Bank is set to lower borrowing costs by another frugal 25 basis points on Thursday.

- The Hungarian economy climbed out of recession at the end of last year though it was far from gaining momentum.

- The Philippine economy grew slower than expected in the fourth quarter, dragging expansion in 2024 below target as setbacks in investment, consumption and farm output held back momentum.

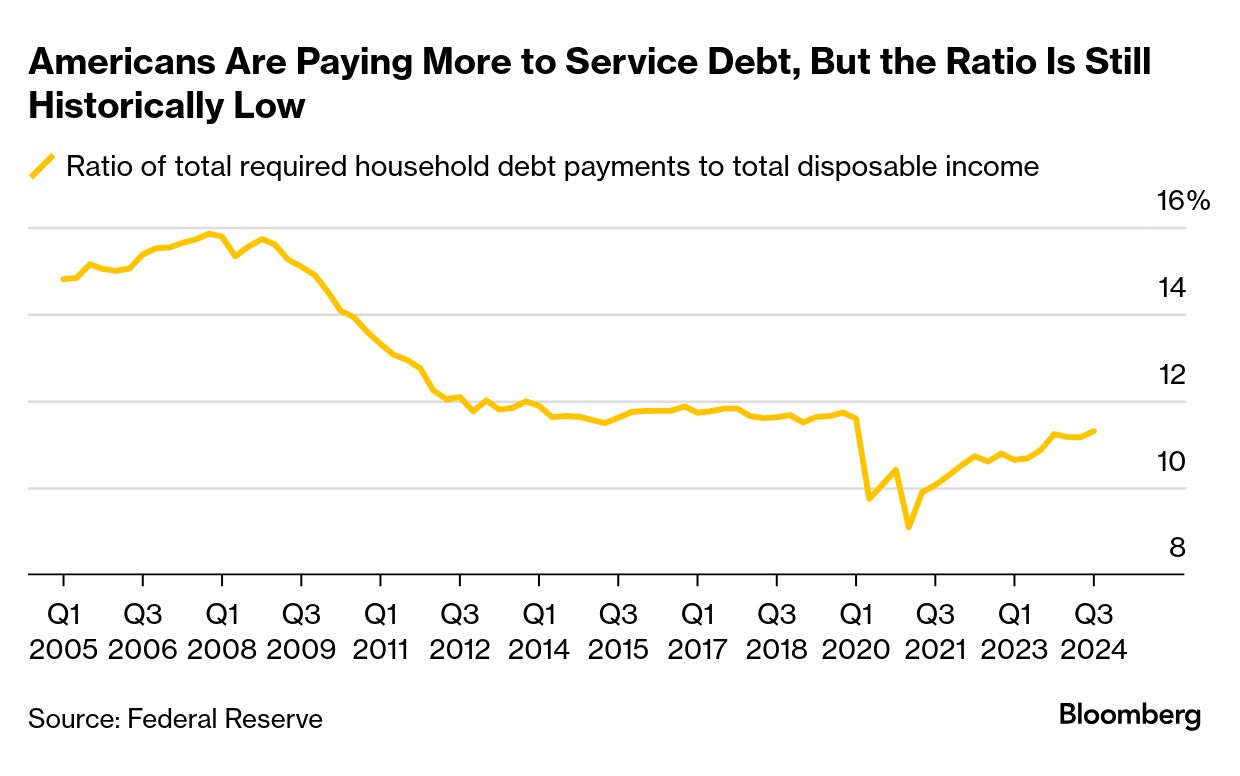

US household debt has been on the rise, and an increase in delinquency rates — especially for lower-income folks — has shown the impact of higher borrowing costs lately. But the broader picture is still one of resilience, according to Stephen Stanley at Santander US Capital Markets. What's most remarkable is that the ratio of debt-service payments to disposable (that is, after-tax) income remains around 2019 levels — a time when rates were much lower than they are today, Stanley wrote in a note this week. Part of that is because many households locked in low mortgage rates during the pandemic period, he said. But another reason is the strength of the job market and wage growth in recent years, which are "making it easier for households to carry a larger nominal debt load without excessive strain," Stanley says. Over time, as more people move and lose their low Covid mortgage rates, things will evolve, however. If current trends continue, "we may be a year or so away from seeing debt service burdens that modestly exceed the prevailing levels in the late 2010s." |

No comments:

Post a Comment