| I'm Chris Anstey, an economics editor in Boston. Today we're looking at a new Bloomberg Economics outlook for the world's benchmark interest rate. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President-elect Donald Trump could slowly ramp up tariffs — but outgoing Treasury Secretary Janet Yellen warns the US shouldn't be too "unilateral" to the world.

- Chancellor Rachel Reeves will speak in Parliament for the first time since market turbulence rocked the UK, on the eve of key inflation data.

- China's increasing determination to defend its currency against a strong dollar has worsened a liquidity squeeze in the country.

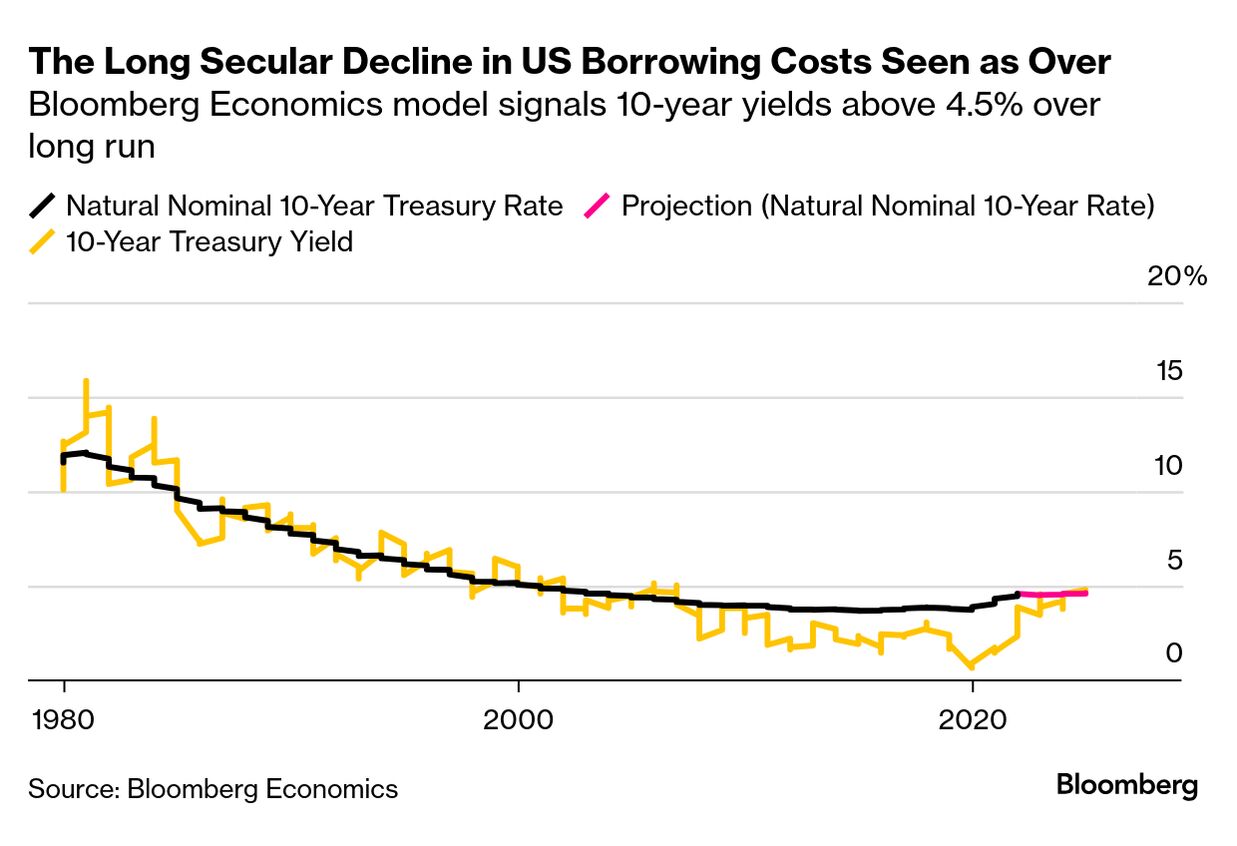

Don't hold your breath waiting for mortgage rates to return to pre-Covid levels. That's just one takeaway from a new long-run estimate for what is effectively the world's benchmark interest rate: the 10-year US Treasury yield. While the Federal Reserve targets an overnight rate, it's the long-term cost of borrowing that has most relevance for things like home loans and the government's debt servicing costs — given average borrowing maturities of several years. That rate saw a decades-long slide from the 1980s into the 2010s. But the dynamics that drove that have reversed, making it more likely the recent run-up in yields is here for the long haul, a new Bloomberg Economics model shows. It calculates the "natural rate" for 10-year yields — the one that balances the supply of saving with the demand for investment, after any shocks have worked their way through the system. "Uncertainty is high, of course, but we aim to reduce it by tying our estimate of the natural rate to structural drivers that are supported by economic theory," Jamie Rush, Tom Orlik and Martin Ademmer of Bloomberg Economics wrote in their note on the analysis. "If the theory is good and our projections of the drivers are right, then borrowing costs have likely shifted onto a permanently higher path." Looking backward, the natural 10-year rate sank from 12% in 1980 to less than 4% by 2015 thanks to a combination of factors, including a slowdown in economic growth (which undercut investment demand) and the progression of the big baby-boom generation into its high saving years. Some excess saving in China also found its way into the US Treasuries market, depressing rates. But now that growth slowdown seems to have run its course, and the boomers have retired and are no longer squirreling more savings away. Meantime, governments are borrowing a whole lot more nowadays. And the old dynamic of China plowing cash into Treasuries seems over. For those and other reasons, the natural rate by 2024 had probably moved up to 4.5%, Bloomberg Economics estimates. And "we expect the natural rate to keep edging up, with nominal 10-year Treasury yields moving closer to 5% in the early 2030s," Rush and his colleagues wrote. Even more alarming is that the risks may be stacked toward even higher rates, considering scenarios like a productivity boom and bigger spending on a transition away from fossil fuels. "It's plausible to imagine" a combination of effects that puts 10-year nominal yields "in excess of 6%," the team wrote. - Read the full Bloomberg Economics note on the Bloomberg terminal here, and see the authors' academic paper published here, free to view.

The Best of Bloomberg Economics | - India's new central bank governor has shown willingness to allow the rupee to move more freely in tandem with peers in the region.

- France's premier will make a key policy speech, just as the Socialists near a deal to back him in return for the suspension of a pension reform.

- Mexico's President Claudia Sheinbaum announced a plan to reduce imports from China in a bid to support local industry and align herself with the US and Canada.

- Bank of Japan Deputy Governor Ryozo Himino signaled the possibility of a rate hike next week by saying that the board will be discussing it.

- European Central Bank policymaker Olli Rehn expects euro-zone borrowing costs to reach a level that no longer restricts the economy by mid-2025.

- Colombia's government is committed to keeping public debt sustainable and retaining investor confidence, the nation's new finance minister said.

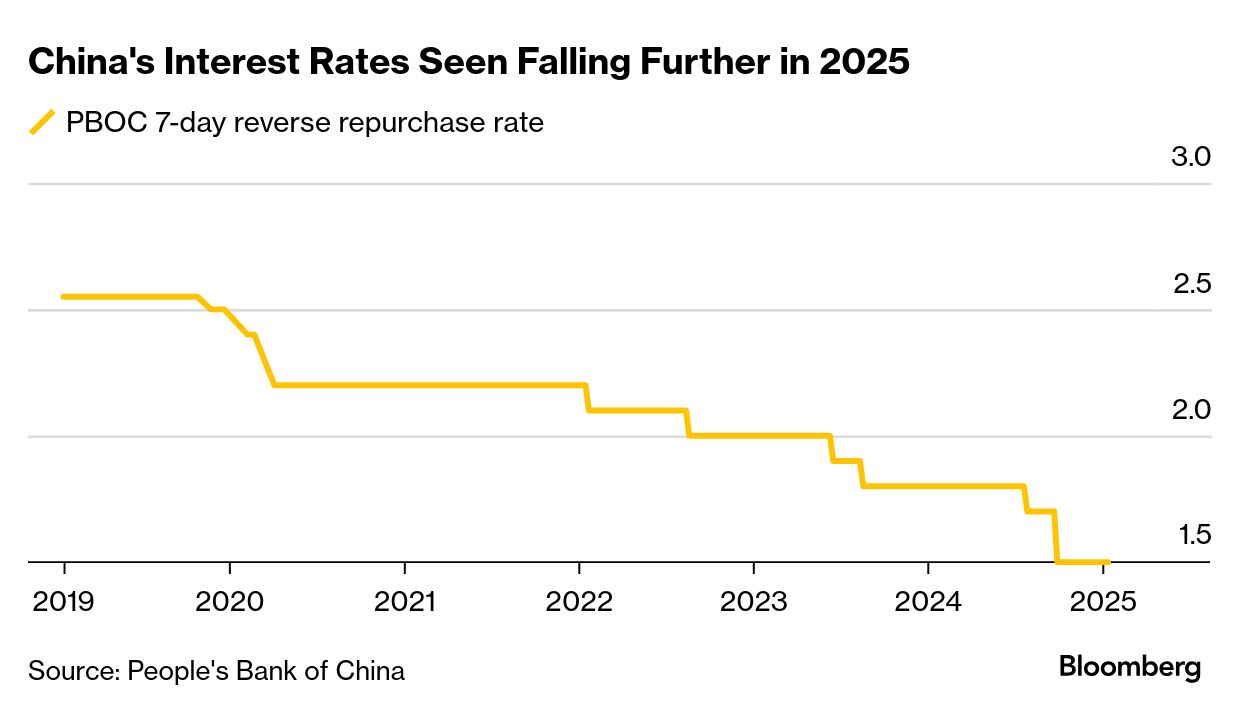

China's central bank chief, Pan Gongsheng, made a surprise appearance at a forum in Hong Kong Monday. Indeed, he's made a number of unexpected announcements since taking over in mid-2023. That means investors should be on watch for more powerful action in 2025. That's the analysis of Wei He, China economist at Gavekal Dragonomics. He wrote in a note Monday that each of the People's Bank of China's rate cuts in 2024 exceeded expectations, suggesting that Pan "seems to understand that simply meeting market expectations will not be enough to engineer a rebound in market confidence." Pan's record so far, including with regard to measures tied to the bond market and credit volumes, "demonstrate that he is an aggressive PBOC governor, willing to adopt unconventional tactics to achieve the central bank's policy goals." He concluded "there is a growing chance that in 2025 he might take extraordinary steps to boost market sentiment, such as a major one-off interest-rate cut of perhaps 50 basis points or so." |

No comments:

Post a Comment