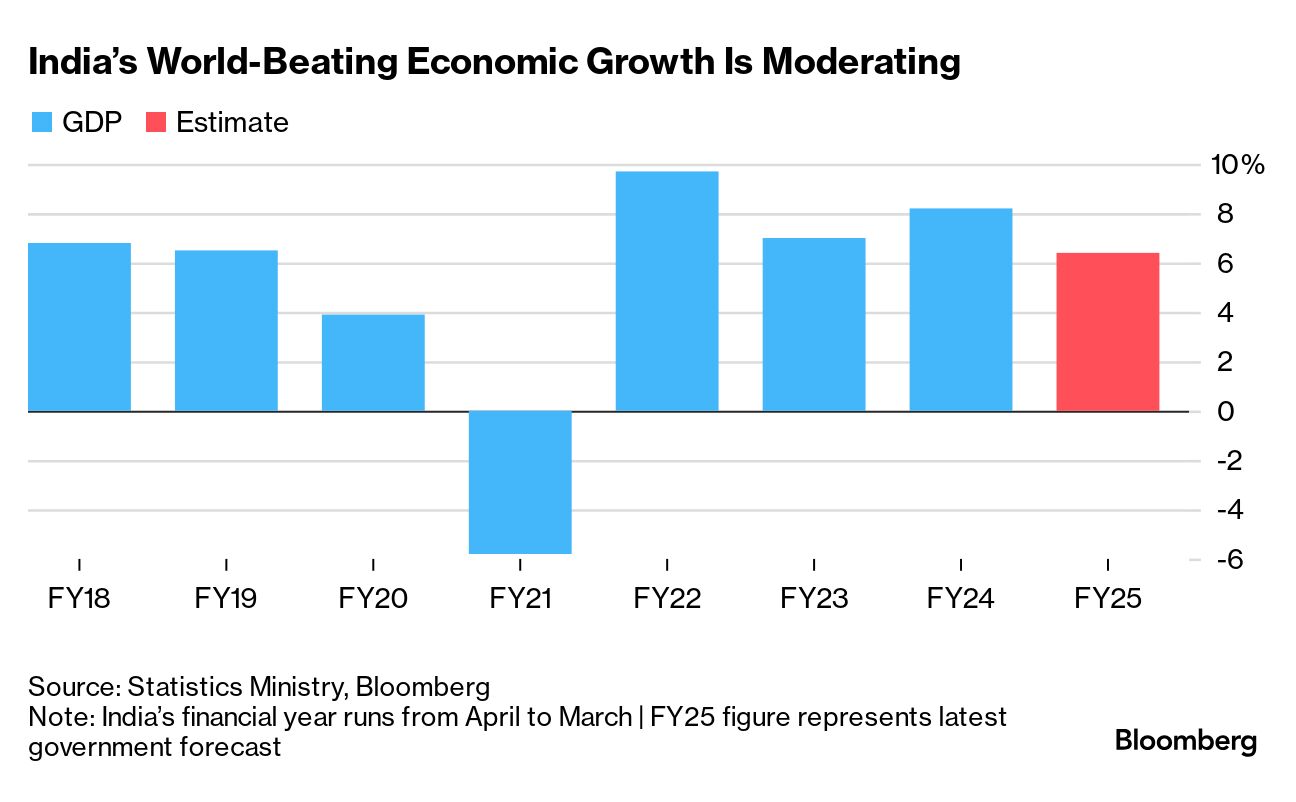

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today, we're looking at India's growth stumble. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. India has been the world's fastest-growing major economy for much of the past 10 years as its youthful population lures investment and fuels a consumption boom. Now, the global growth champion is stumbling. The government has lowered its economic growth projection for the fiscal year to the weakest since the pandemic and economists say even that forecast may be too optimistic. Consumers have cut back spending after wages slid and inflation spiked. Meantime, the government has undershot its budgeted expenditure this year, partly because of last year's elections that ran over several weeks, further crimping growth. Goldman Sachs economists see scope for improvement. One reason is they believe the economy's deceleration has come about in part due to policy tightening — the fiscal deficit was lower for much of 2024 and credit growth slowed after regulatory measures from the Reserve Bank of India, analysts led by Andrew Tilton wrote in a note looking at 10 key questions for Asia in 2025. Pressure is now building on new central bank governor, Sanjay Malhotra, to begin cutting interest rates and reverse the restrictive stance of his predecessor, Shaktikanta Das. Under Das, the RBI kept rates unchanged for almost two years despite growing calls — including from within the government — to ease. "The slump in India's GDP growth signals the fragile state of the economy and the need for all-out policy support to get it back on track," Bloomberg Economics's India economist Abhishek Gupta wrote. "This should spur calls for the central bank to undo its restrictive policy by initiating an easing cycle at its next review in February." He predicts a rebound, supported by RBI policy easing and liquidity support through bond purchases as well as stalling of FX sales. Gupta expects the government to ramp up capital spending and encourage consumption through tax cuts for low-income earners and boost incentives for domestic manufacturing. Longer term, a key question for India's growth prospects is whether it can sell itself as a manufacturing alternative to China as Donald Trump returns to the White House. The Best of Bloomberg Economics | - China stepped up its support for the yuan as the managed currency weakened toward a policy no-go area — the edge of its allowed trading range against the dollar.

- German factory orders dropped the most in three months, highlighting industry's woes just weeks before Chancellor Olaf Scholz faces elections.

- Brazil's government is weighing more spending cuts after failing to soothe worries about President Luiz Inacio Lula da Silva's commitment to fiscal responsibility.

- A measure of Australian inflation slipped closer to the central bank's target band, while Sweden's core consumer-price growth slowed more than anticipated.

- Russia's invasion of Ukraine triggered an economic boom built on the back of government stimulus. Now there are signs the bill is about to come due.

- Sri Lanka faces temporary deflation that could offer "respite" to its consumers, central bank Governor Nandalal Weerasinghe said.

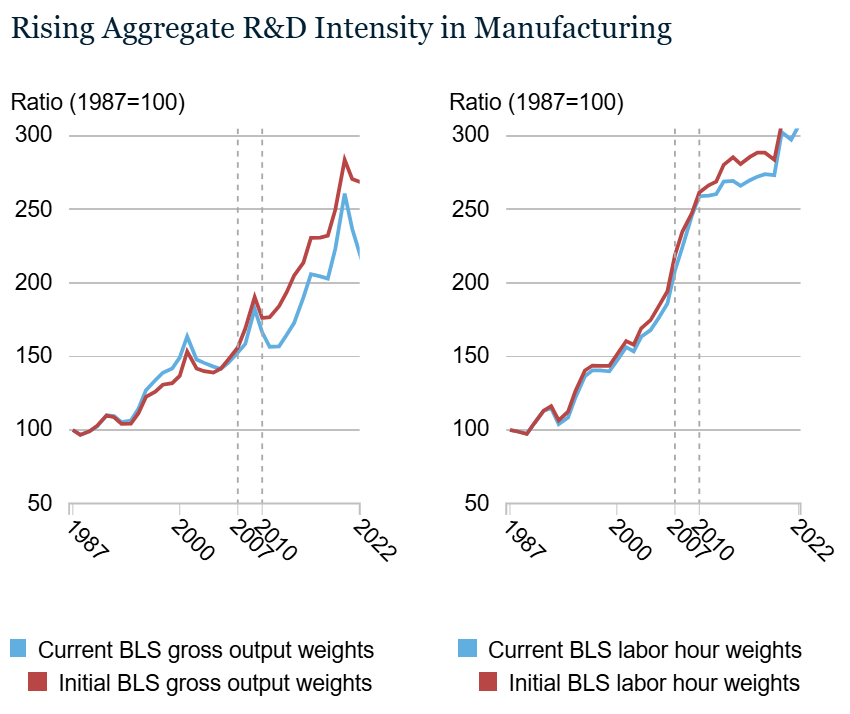

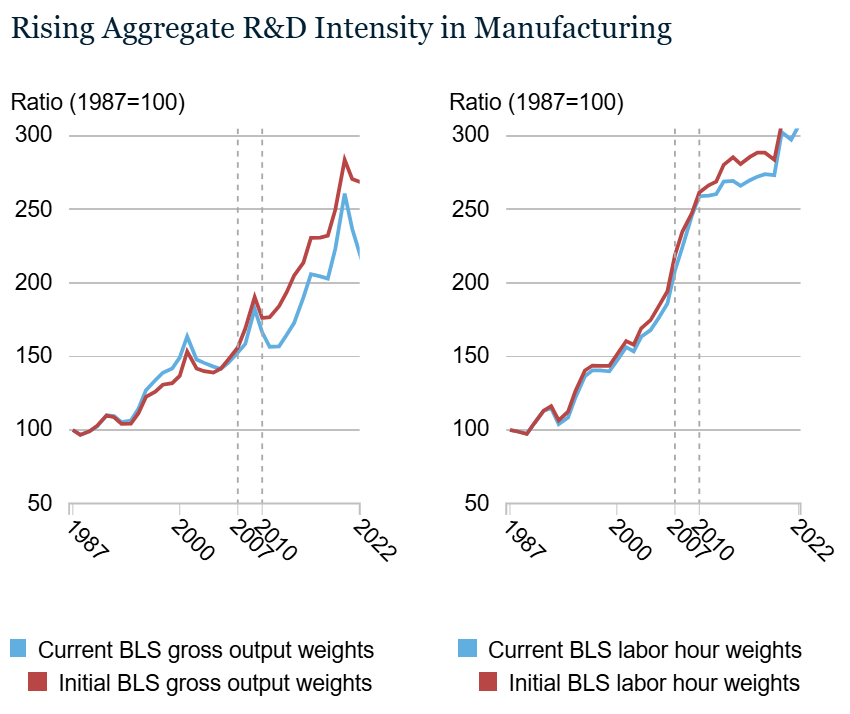

US manufacturing productivity has been lackluster over the past decade or so, but that's not for want of investment in research and development. Analysis by New York Fed economists shows that R&D spending has picked up relative to the pre-financial crisis period. The intensity of R&D relative to both output and working hours climbed over the 12 years through 2022, Danial Lashkari and Jeremy Pearce wrote in a note published Monday. That this increase in intensity came alongside a stagnation in productivity suggests that R&D doesn't have the same potency it used to, they said.  Source: Danial Lashkari and Jeremy Pearce, Federal Reserve Bank of New York What's more, "this decline in the efficiency of R&D appears broadly across firms and sectors," they wrote. Whether that's because manufacturing has eked out all its possible gains, R&D is being misdirected somehow, workers are less able to deploy the fruits of R&D, or some other reason is for another study. The duo said that "further work" is required. |

No comments:

Post a Comment