- Goldman Sachs is still betting on US exceptionalism, and it's still probably right.

- Friday's non-farm payrolls leave the US looking even more of an exception — and hint that the next rates move will be up, not down.

- The UK gilts market could now be a good buy after the selloff, but it's best to ignore UK stocks.

- There's a mystery; elite education and robust human capital help the US, but not the UK.

- AND a final catalogue of noise pollution.

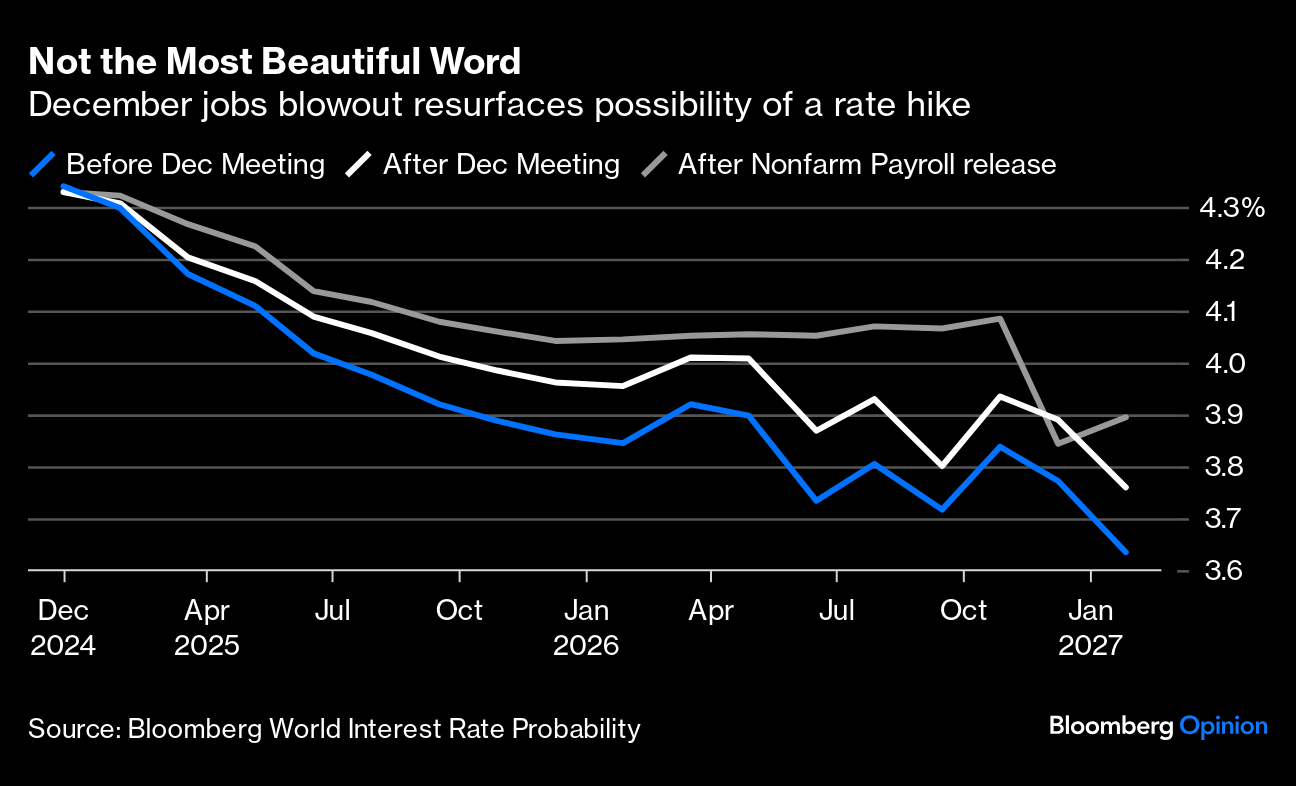

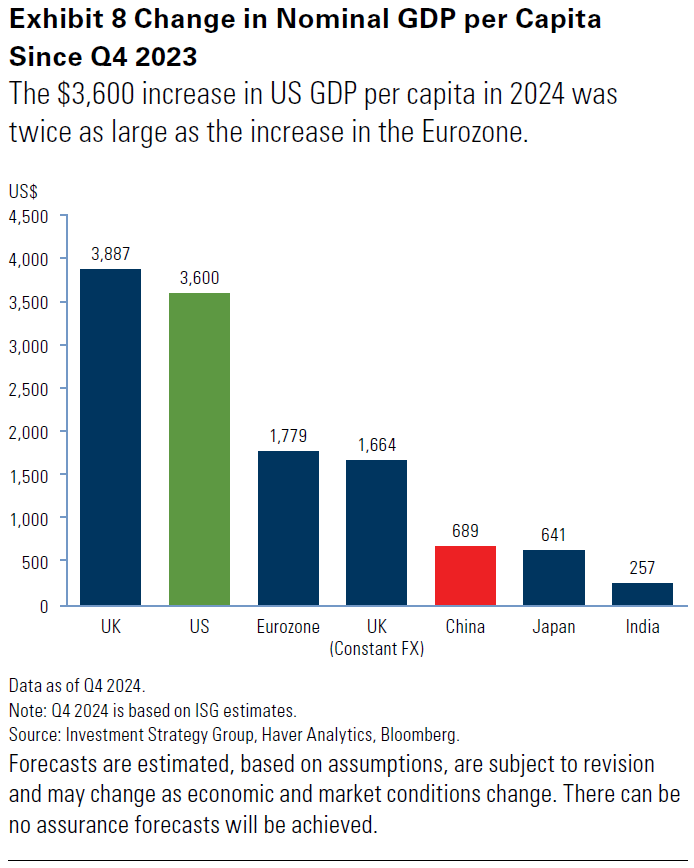

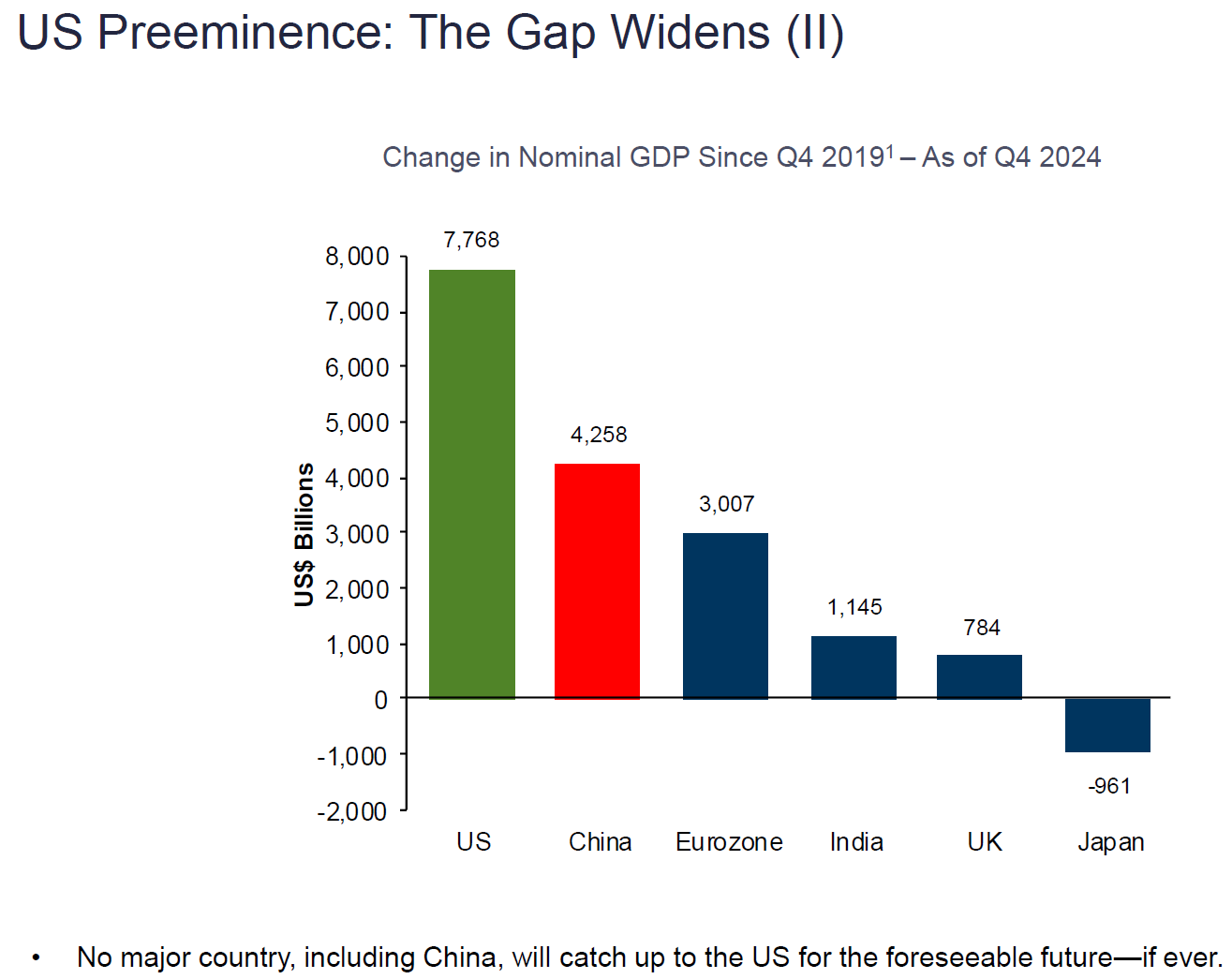

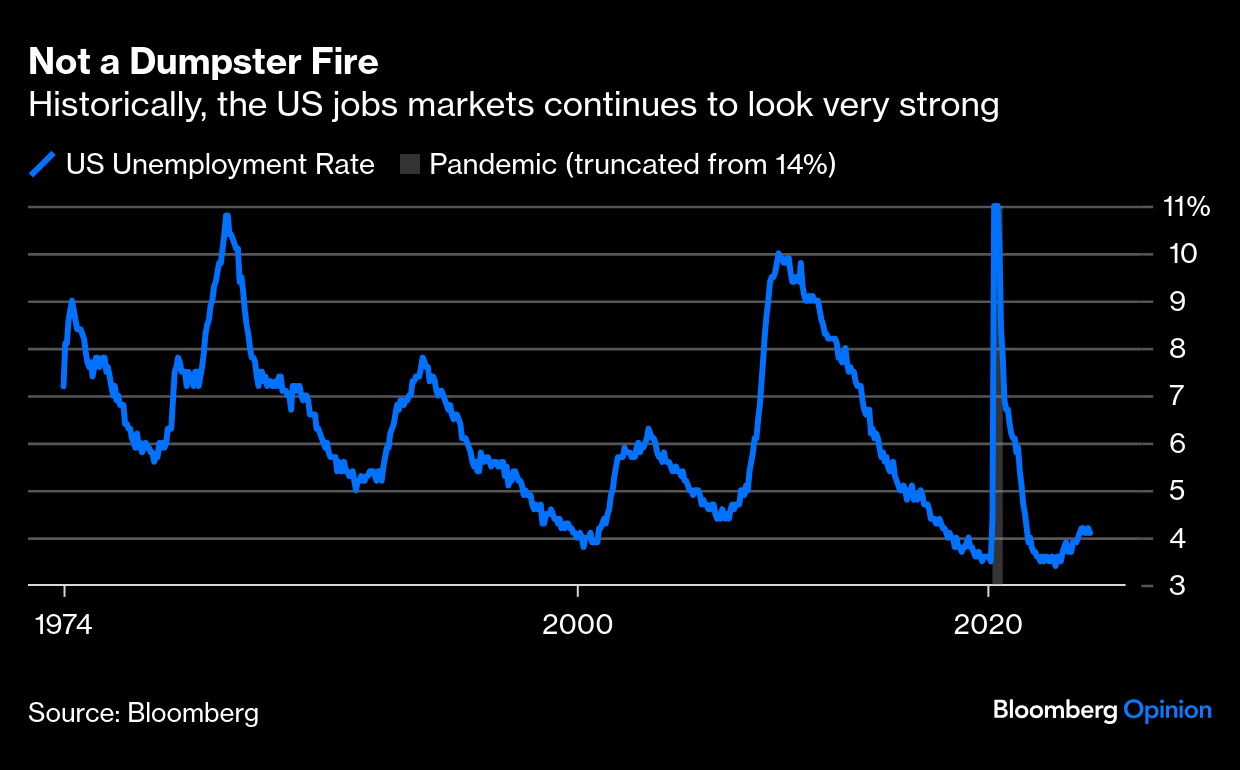

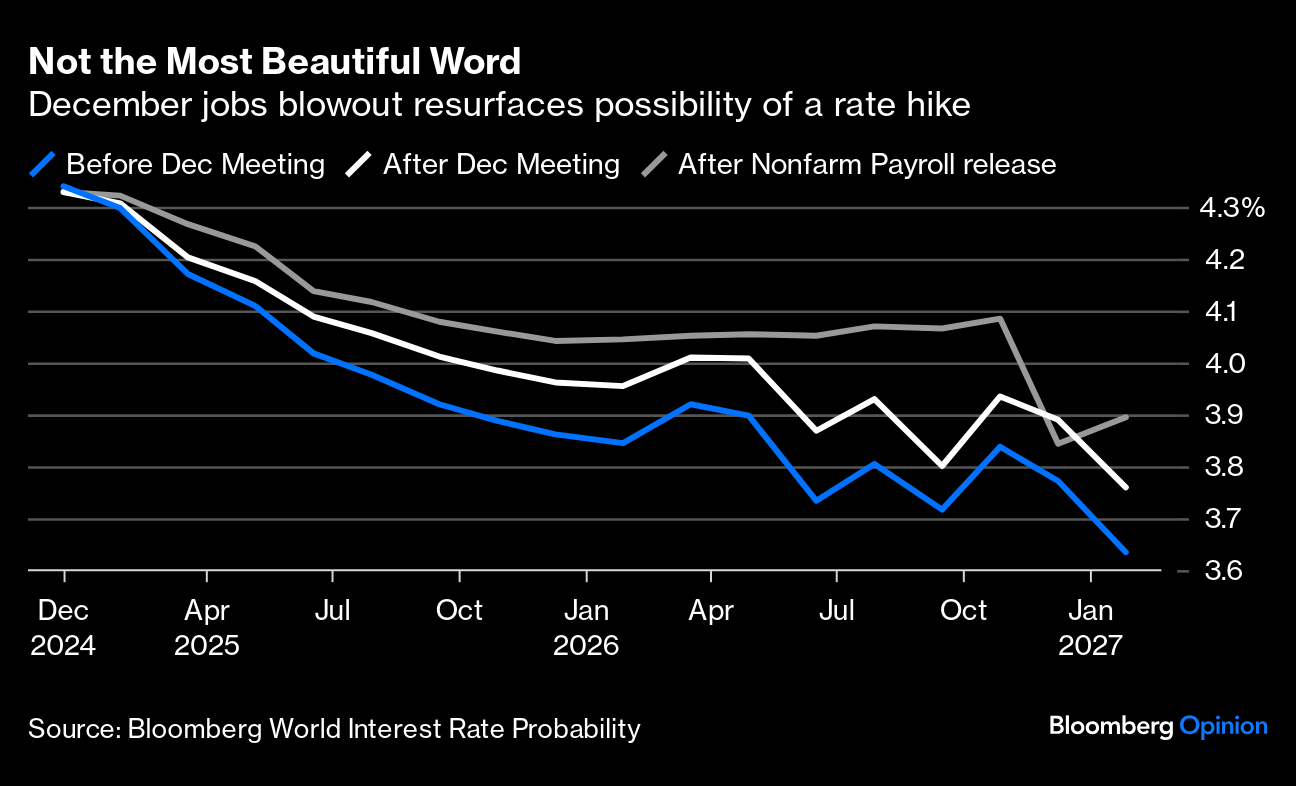

Five years ago, this newsletter was headed Doubting America Can Cost You a Lot of Money. It turned out to be the last Points of Return before the market peaked and made its terrifying Covid-driven dive. And yet virtually every word still rings true. Ever since the Global Financial Crisis broke out in 2007, it has been folly not to invest in the US. Rather than bet on US outperformance to revert to the mean, as I have counseled on any number of occasions, it's been better to heed the advice of Sharmin Mossavar-Rahmani and the team at Goldman's Sachs' investment strategy group. They keep recommending going overweight America, and keep getting proved right. Their latest global forecast, to be released Monday, continues the pattern. The bottom line for Mossavar-Rahmani is that the US economy grows faster than anyone else. This is since the onset of the pandemic: We've written a lot about American exceptionalism of late, and the Goldman team does expect the advantage for US stocks to narrow somewhat from here. But as long as it's growing faster, valuations aren't a good reason to get out. The valuation gap with the rest of the world is much narrower once the weight of giant American tech stocks is accounted for — and in any case, valuation doesn't help at all with timing the market. And while the US remains preeminent, it retains greater freedom of action. That's particularly important in the light of the latest jobs data. At December's Federal Reserve press conference, Chair Jay Powell was asked whether he would rule out a 2025 rate hike. His response was you don't rule out things completely in this world. He subsequently added that a hike didn't "appear to be a likely outcome," and at 4.3%, interest rates were "meaningfully restrictive." After Friday's non-farm payrolls, he will have to talk about the possibility of a hike some more. The unemployment rate fell, to 4.1%. While the incoming administration is complaining of a "dumpster fire," it's a much healthier inheritance than most presidents get: That confirmed the story from initial claims for jobless insurance, the best real-time indicator we have to the rate of layoffs. They rose early last year. Now, they're the lowest since May. There is little sign of anything that need concern policymakers who are worried about unemployment:  This opens new questions for the Fed — and in the process presents new problems for central banks in the rest of the world, who would prefer lower US rates. Last month, the Fed revised its "dot plot" survey of Fed governors' expectations to project only two cuts this year, down from the three previously estimated. Its concerns about inflation — with the numbers for December due on Wednesday — are unmissable. And the market's response to Friday's exceptional non-farm payrolls shows upside risks, not downside, to the Fed's employment mandate. Robust jobs growth adds to inflationary pressures that haven't been extinguished, and brings into question whether current interest rates are truly restrictive. The Bloomberg World Interest Rate Probabilities function, which derives implicit policy rates from futures and swaps prices, shows a visible change in rate expectations since the last Fed meeting, and a further shift after the jobs data. The timing of the first cut — if any — has shifted to September from June:  Bank of America's analysts argue that the "gangbusters" jobs report combined with robust prices effectively ends the Fed's cutting cycle, only three months after it started. If these conditions persist, easing makes little sense. The bank's base case has the Fed on an extended hold: But we think the risks for the next move are skewed toward a hike. Markets are still pricing 30-35 basis points of cuts this year. We see this mostly as risk premium, in case the economy weakens substantially. In our view, the salient issue going forward will be the threshold for hikes. The bar is high since the Fed still thinks rates are restrictive. But hikes will likely be in play if y/y core PCE inflation exceeds 3% and/or long-term inflation expectations become unanchored.

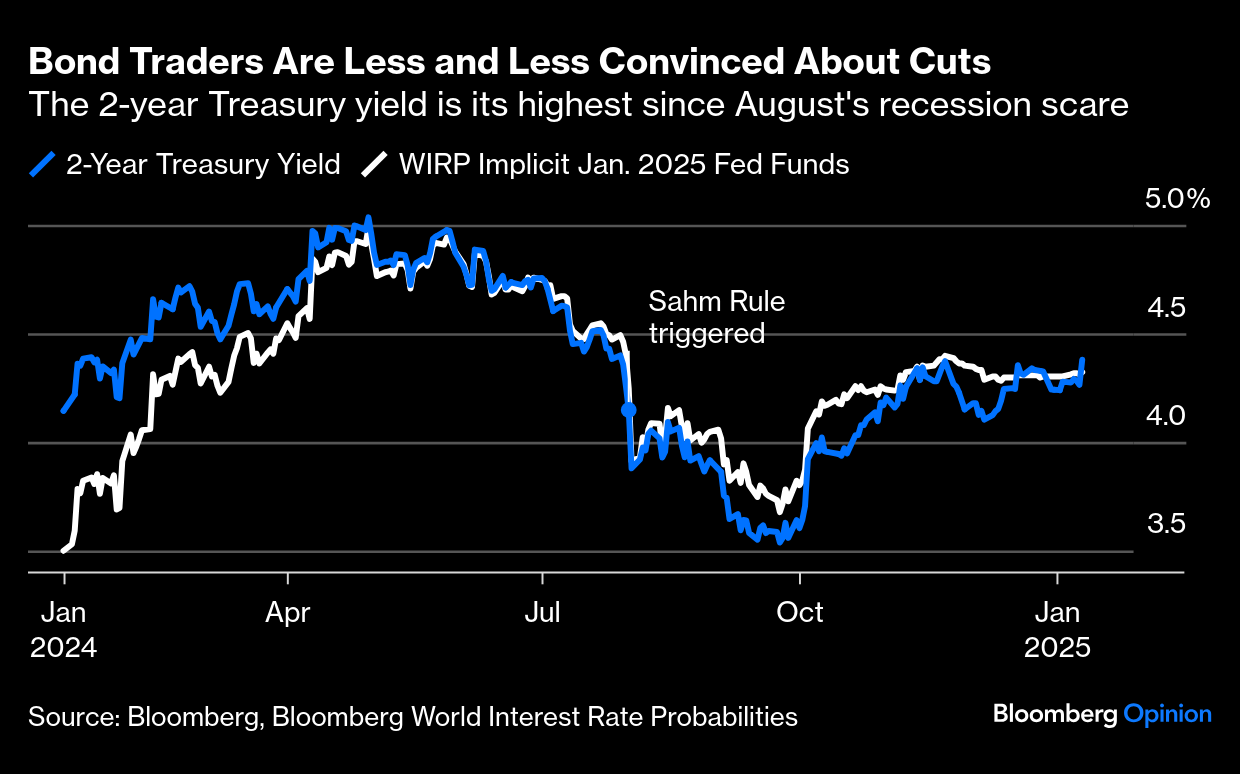

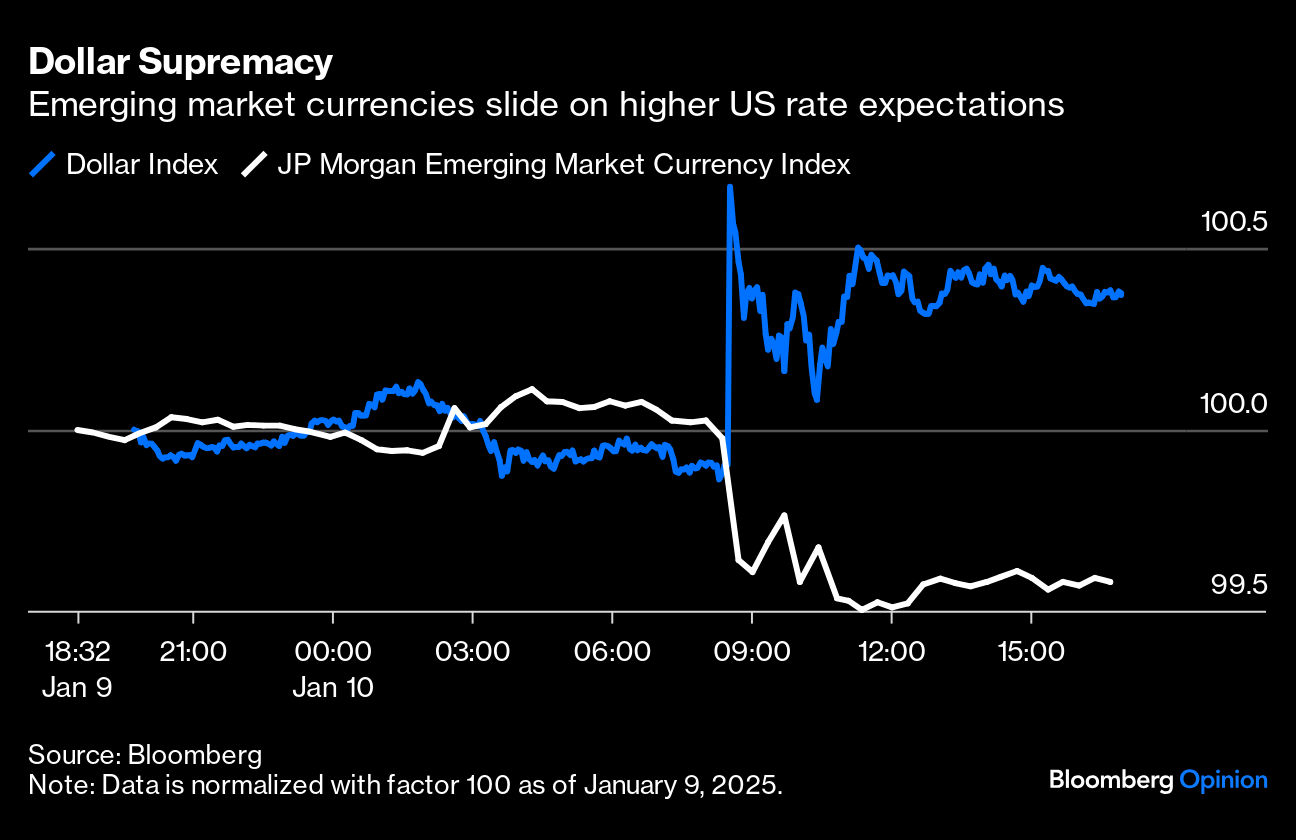

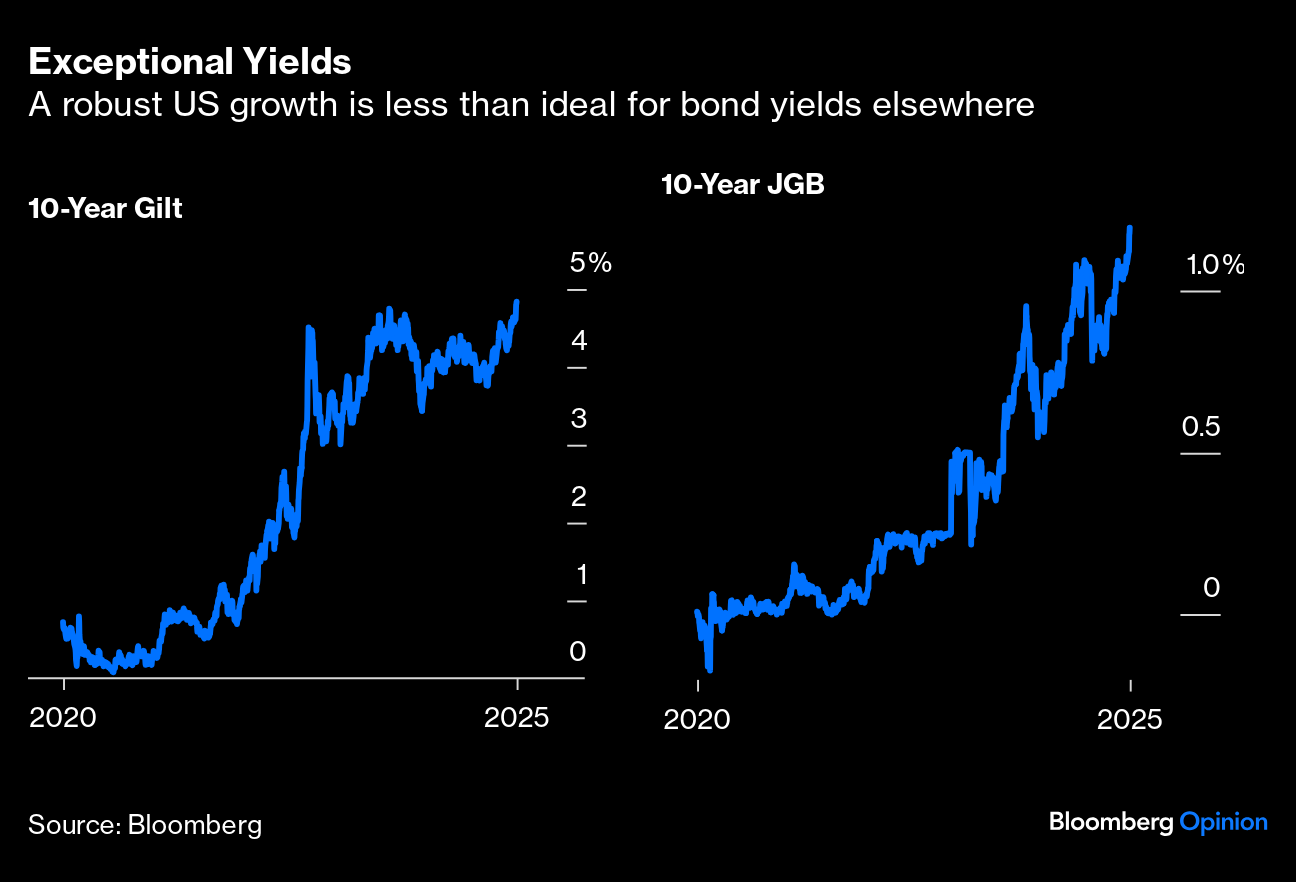

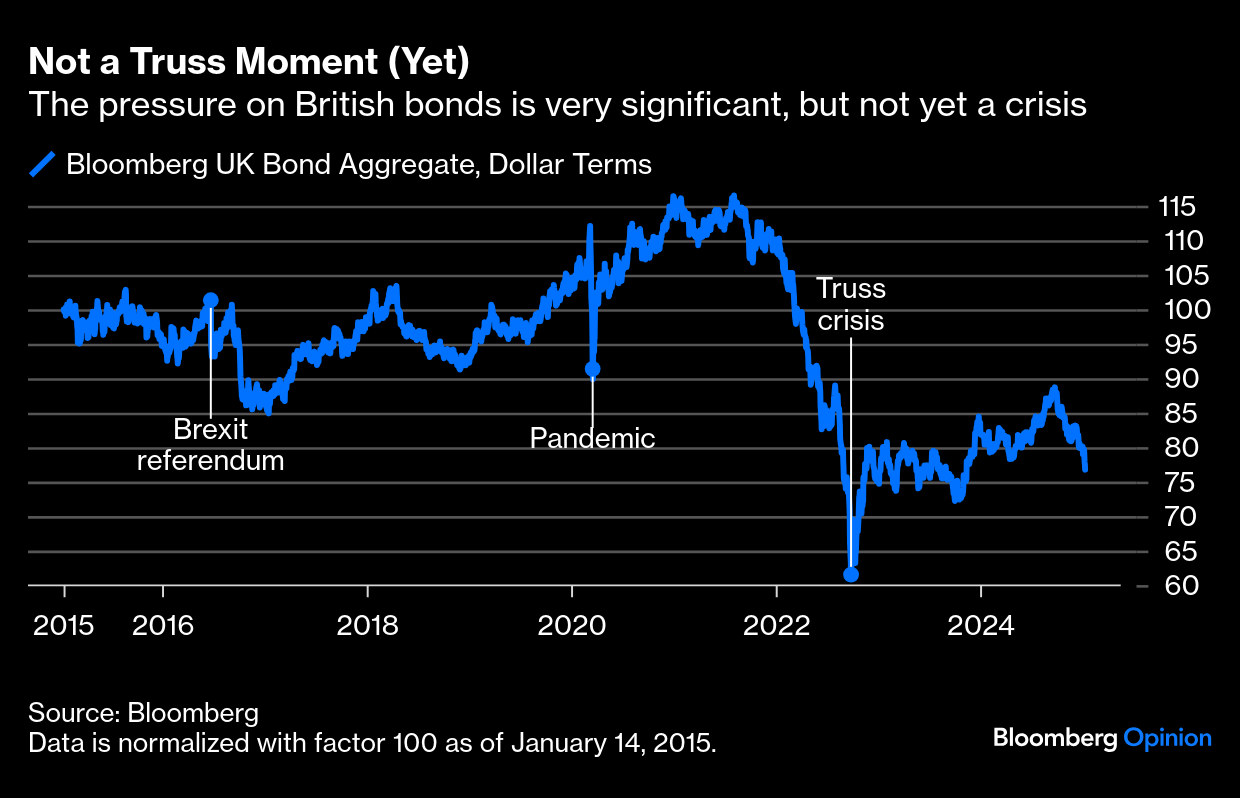

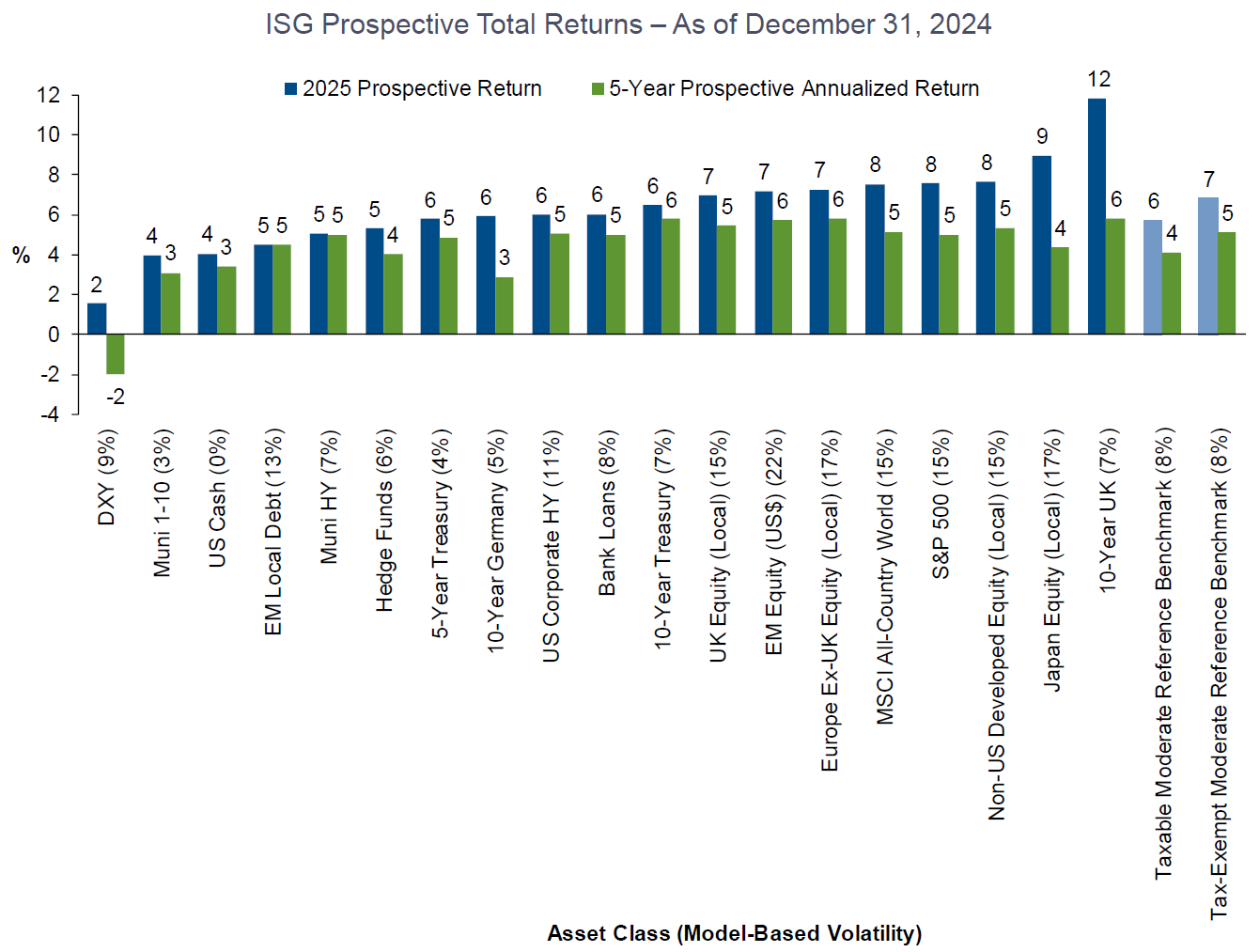

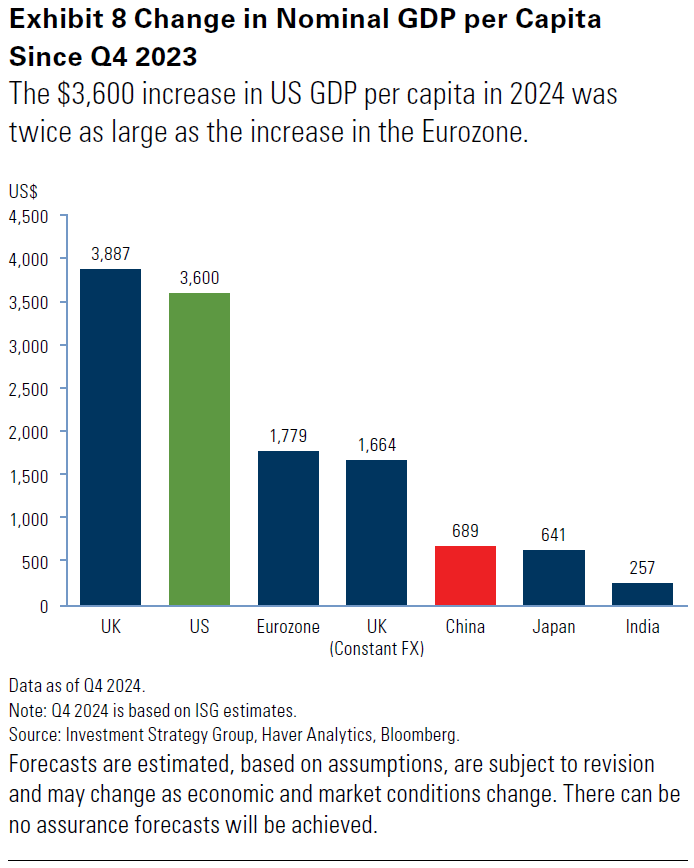

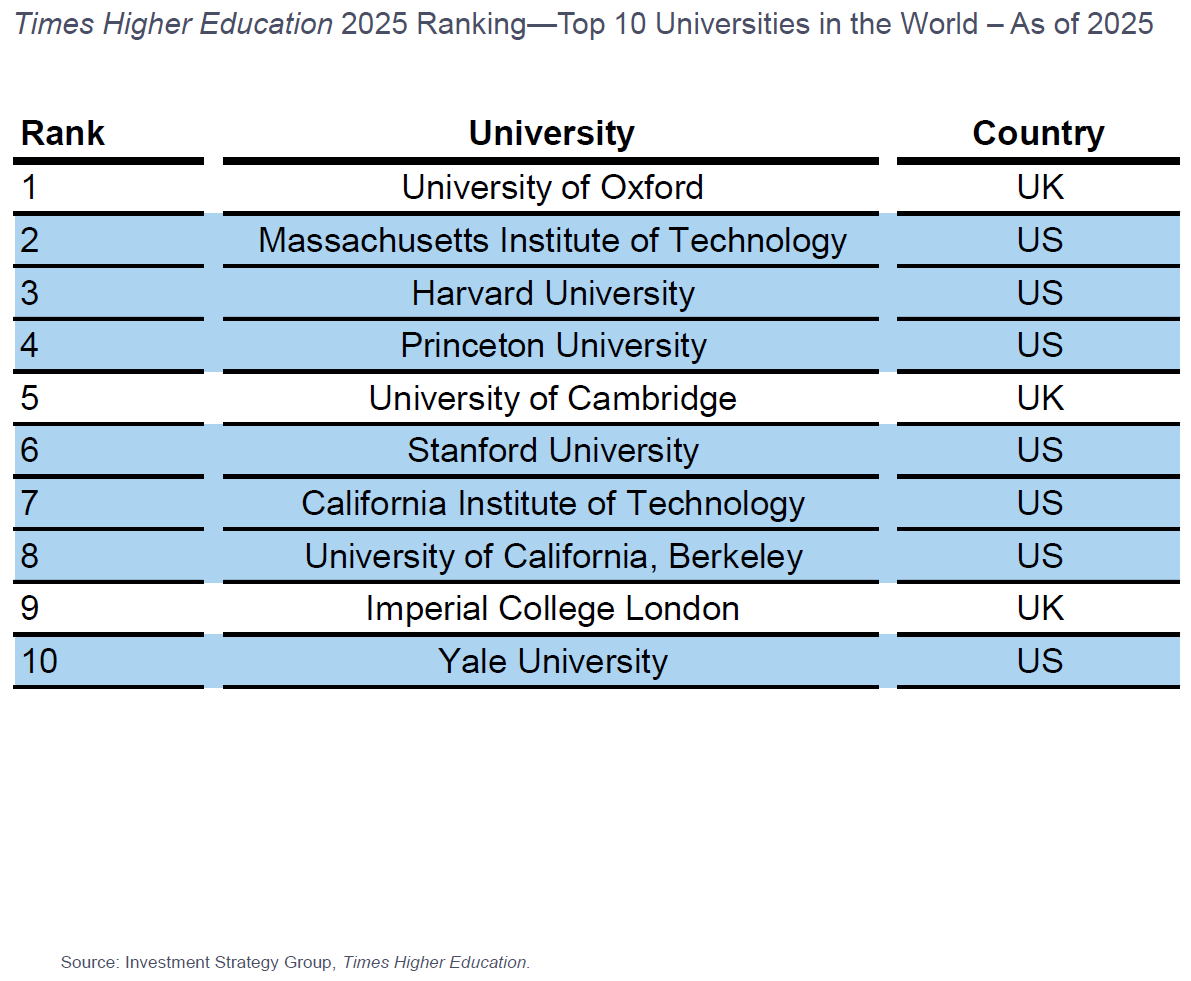

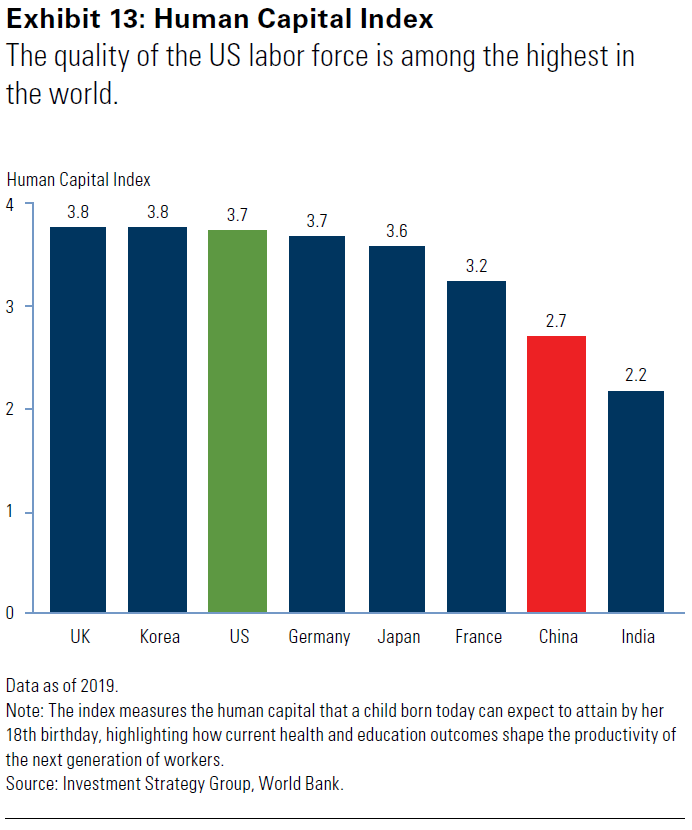

Is the sudden change in rate expectations an overreaction? Treasuries' response suggests otherwise. Friday's release was a classic example of when good news sounds like bad news, with the two-year yield now its highest since last July, immediately before a disappointing jobs report triggered the Sahm Rule, named for Bloomberg Opinion colleague Claudia Sahm, which predicts a recession once the unemployment rate has risen 0.5% from its low. Expectations for fed funds have always been closely aligned with the two-year: Such strong job numbers pile on the evidence for quintessential US exceptionalism, which invariably causes pain elsewhere. This is the dollar's response to the jobs data (an upward move in the dollar index means that the US currency has strengthened, as does a falling line for the emerging market currency index): Bond yields elsewhere have also spiked, showing a positive correlation with strong US growth: Wednesday's release of December's CPI will now be even more closely monitored both at home and abroad. Last week's global bond selloff, led by UK gilts, showed that other governments cannot afford hotter US inflation. The minutes from the Fed's last meeting reflected grave concerns about inflationary pressures. An extended pause in monetary policy, as figured by the futures market, looks close to inevitable. Now that rates markets have shifted to expecting a protracted pause, what are the chances of that next rate move to be upward? Apollo Global Management's Torsten Slok points out that other recent data releases, including the Institute of Supply Management's index showing prices paid for services, show strong economic momentum, implying that monetary policy isn't in fact restrictive. Combined with higher animal spirits and the latest Atlanta Fed GDP estimate at 2.7%, he sees a 40% probability that the Fed will hike rates in 2025. As for cuts, Jack McIntyre of Brandywine Global suggests that the December jobs report further proves that the Fed made a policy mistake by cutting rates 100 basis points last year. The longer the Fed is on pause, the more likely that the next move will be a hike, MacIntyre adds. "As important as the labor situation is, the critical variable for the Fed and markets is all things inflation. This week's inflation data will be more important." —Richard Abbey The UK is also beginning to look exceptional, for all the wrong reasons. Sterling is falling while bond yields are rising, increasing the government's borrowing costs and potentially forcing budget cuts. It's still only 27 months since the gilt selloff doomed the premiership of Liz Truss, so comparisons with that incident are inevitable. Bloomberg's index of UK bonds in dollar terms, to capture the phenomenon in full, shows that the latest selloff is significant, but far less severe than the Truss implosion — or indeed those that followed the 2016 Brexit referendum and the onset of the pandemic. This isn't to say that everything is good, because it isn't. But it could be a lot worse: What if the gilt selloff is a buying opportunity? Buying during the Truss crisis would have worked out well for foreign investors, largely because of the revival in sterling. And according to Goldman Sachs' investment strategy group, gilts have the best prospective returns of any global asset this year, with a projected return of 12%. After the selloff to start the week, that should mean an even nicer return for those who buy now: The selloff at present also looks as bad as it does in part because sterling had a great 2024. Goldman published this chart of the rise in gross domestic product per capita last year, in dollar terms. Britain's GDP actually rose by more than that of the US — but only because the currency appreciated:  Unfortunately, Goldman is bullish about gilts because it's bearish about the UK economy. Thanks to the Truss precedent, and the sharply negative market reaction to Chancellor Rachel Reeves' decision to ease fiscal rules in last year's budget, the UK will not resort to fiscal largesse. The odds favor spending cuts, which will be bad for the economy and the stock market, but great for British bonds. As Goldman also sees a need for the European Central Bank to cut more than is currently priced in by the market, that is a recipe for further monetary easing, also good for gilt prices. No crisis, but a miserable year of poor performance. It's a horrible prospect for a new government that was hoping to change things and has instead come under vicious attack from abroad, but it should be great for gilt investors. What is galling, if you're British, follows in Goldman's exploration of the causes of US exceptionalism. A major element is higher education, which provides the US with the skills and know-how to excel. It's hard to disagree, but Goldman publishes this ranking of the world's top universities. Three of the top nine, including the number one, are from the UK, which has roughly a fifth the population of the US: Elite education has helped US preeminence, but done nothing to avert decades of British underperformance. That is amplified by Goldman's look at the World Bank's human capital index, which estimates the human capital a child born today can expect to accumulate by 18. The US ranks high, meaning it has a really capable workforce. The UK (along with South Korea) ranks higher. There's always a risk of measurement errors, but it's fair to assume that the UK really does have good elite education and a well-trained workforce, compared to others. So how can it possibly have drifted so far into trouble? One last dose of cathartic noise to be turned up loud, starting with I Wanna Be Sedated by the Ramones (how did I not mention that one straight away?). Also: Celebrity Skin by Courtney Love and Hole, S***list by Courtney Love and L7, Shake Dog Shake by The Cure, Switchblade by Link Wray, You Need Loving by the Small Faces, Fistfight in the Parking Lot by Crisis of Conformity, Baby Please Don't Go by Them, Dance… by Violent Femmes, Coolio's Fantastic Voyage, Rammstein's Mein Herz Brennt, 800db Cloud by 100 gecs, Time Has Come Today by the Chambers Brothers, I Fought the Law by the Dead Kennedys, War Ensemble by Slayer (as thrash as it gets), Down, Down by Status Quo (altogether gentler although also very noisy). Also, from classical music, you could try Stravinsky's Rite of Spring, probably the single most shocking work of music ever composed. Have a great week everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment