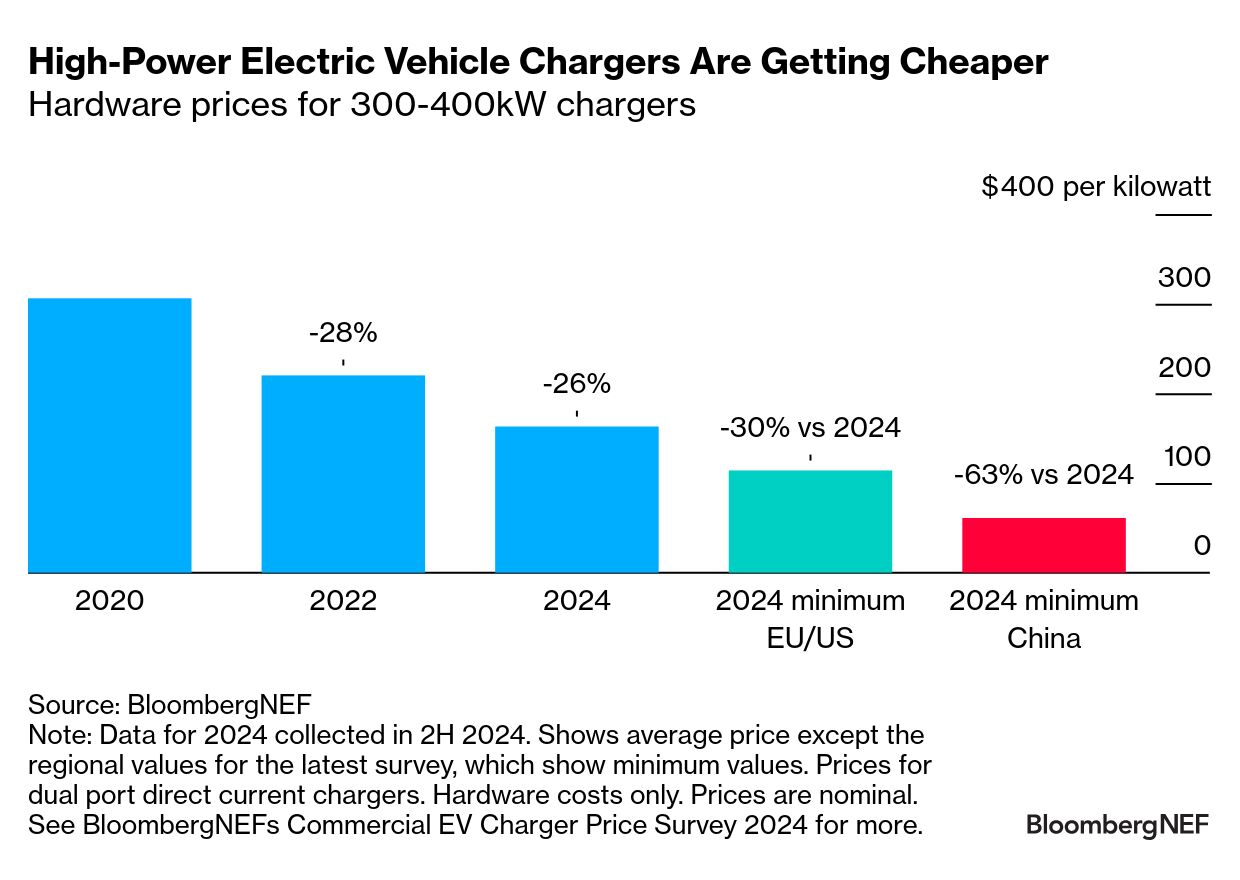

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Cheaper Charging Hardware | The price of high-power electric vehicle chargers popularized by Tesla and its Supercharger network has fallen sharply, driven by economies of scale and increasing competition. The price of a 300 to 400 kilowatt chargers averaged $58,100 in 2024, according to BloombergNEF's latest survey. That's $163 per kilowatt of power, a 26% drop from when the survey was last completed two years ago. That's the good news. The even better: We expect prices to decline further. The minimum cost of chargers in Europe and the US was 30% below the average price, and in China, chargers were as much as 63% cheaper. Manufacturers can expect a sustained period of competition and a race to solve reliability issues that have dogged EV charging networks and left consumers confused as to how long a charge will really take. Tesla is one of the biggest fast-charger manufacturers and has installed over 65,000 Supercharger stalls in its network. Power-electronics giants ABB and Siemens also are in the market, but have been outshone by smaller firms such as Finland's Kempower and Italy's Alpitronic. Alpitronic are estimated to have shipped around 25,000 chargers in 2024, and CEO Philip Senoner told BNEF that revenue exceeded €1 billion for the year. That would make them one of the biggest charging manufacturers in the world — impressive for the Bolzano-based firm that started in 2009. EV drivers are used to seeing Alpitronic chargers across Europe at major networks like EnBW, Fastned and E.On. The company has also made inroads in the US, with Ionna and Mercedes charging. This will be an increasingly important market, and manufacturers will be keenly watching any attempts by the Trump administration to change the $7.5 billion federal charger grant.  A Mercedes EV charger during a March 2024 event at the DC Armory in Washington. Photographer: Kent Nishimura/Bloomberg Kempower was a poster child for success in 2023, as its sales and share price rocketed. It's hit a rough patch, however, as competition has done a number on its sales and pressured prices across the industry. Kempower's revenues probably slumped around 30% last year to roughly €200 million. The company's share price has plunged 80% from its peak. The company wasn't the only company to have found 2024 challenging. ABB highlighted weak performance and losses at its eMobility business during its last investor call. An initial public offering of the division mooted back in 2022 looks unlikely anytime soon. Siemens, however, announced it would carve out its eMobility division in September last year. Asian suppliers are a threat. BNEF's survey found Chinese companies are selling chargers at dramatic discounts to the average global price, and many are looking to expand in the US and Europe. This includes Phihong subsidiary Zerova, Autel and Starcharge, all of which have set up manufacturing facilities in the US. Many manufacturers are also incorporating power modules, which are one of the most expensive components of the EV charger, from Chinese suppliers. Price is not the only factor for prospective buyers, of course. Reliability, efficiency, and the ability to deliver consistent charging powers all matter. A Kempower whitepaper suggested 25% of sessions fail on average, and that this number may be around 15% even for the best operators. EV charging software provider Monta's CEO Casper Rasmussen highlighted error rates between 9% and 14% for the top AC and DC charger manufacturers it works with. A myriad of issues can cause these errors, from failing hardware and charger cables, to communications between the vehicle and charger, and payment systems which can rely on flaky authentication systems and internet access. Ensuring support for legacy hardware is one of the biggest challenges for charging manufacturers who would prefer to focus on shipping new product. The industry is evolving fast, and its many stakeholders are coming together to solve issues. Charging operator EVgo said its "one and done" charger success rate had risen to 95% in its presentation of third quarter results. In addition to improving reliability, efficiency is important for the next generation of chargers. Electricity costs can far exceed hardware costs in the lifetime of a fast-charging hub. Ensuring the charge rate is clearly advertised to consumers is also important. Many EV drivers pull into a charger only to discover they're getting much lower power than anticipated, and therefore have to wait much longer to charge. This can be due to vehicle and battery limitations, but power sharing across chargers is also common. This is a problem all of the industry will need to solve together. Dropping charger prices can play a factor in making EV driving more attractive, but it's only part of the puzzle for the manufacturers and operators in the market. See BNEF's report for more on charger technologies and the outlook for sales.  Hyundai vehicles bound for shipment from the company's Ulsan plant in South Korea. Photographer: SeongJoon Cho/Bloomberg Hyundai warned of slowing growth as US President Donald Trump's tariff threats and a turbulent domestic political landscape hurt the South Korean automaker's sales outlook. The company aims to sell 4.17 million cars this year, just 0.1% more than in 2024, as a raft of global uncertainties weigh on demand. Jaguar Land Rover's owner Tata Motors separately flagged a drag on profit from economic challenges in China, a market where weak demand and consumer preference for electric vehicles are hurting sales of traditional top-end cars. |

No comments:

Post a Comment