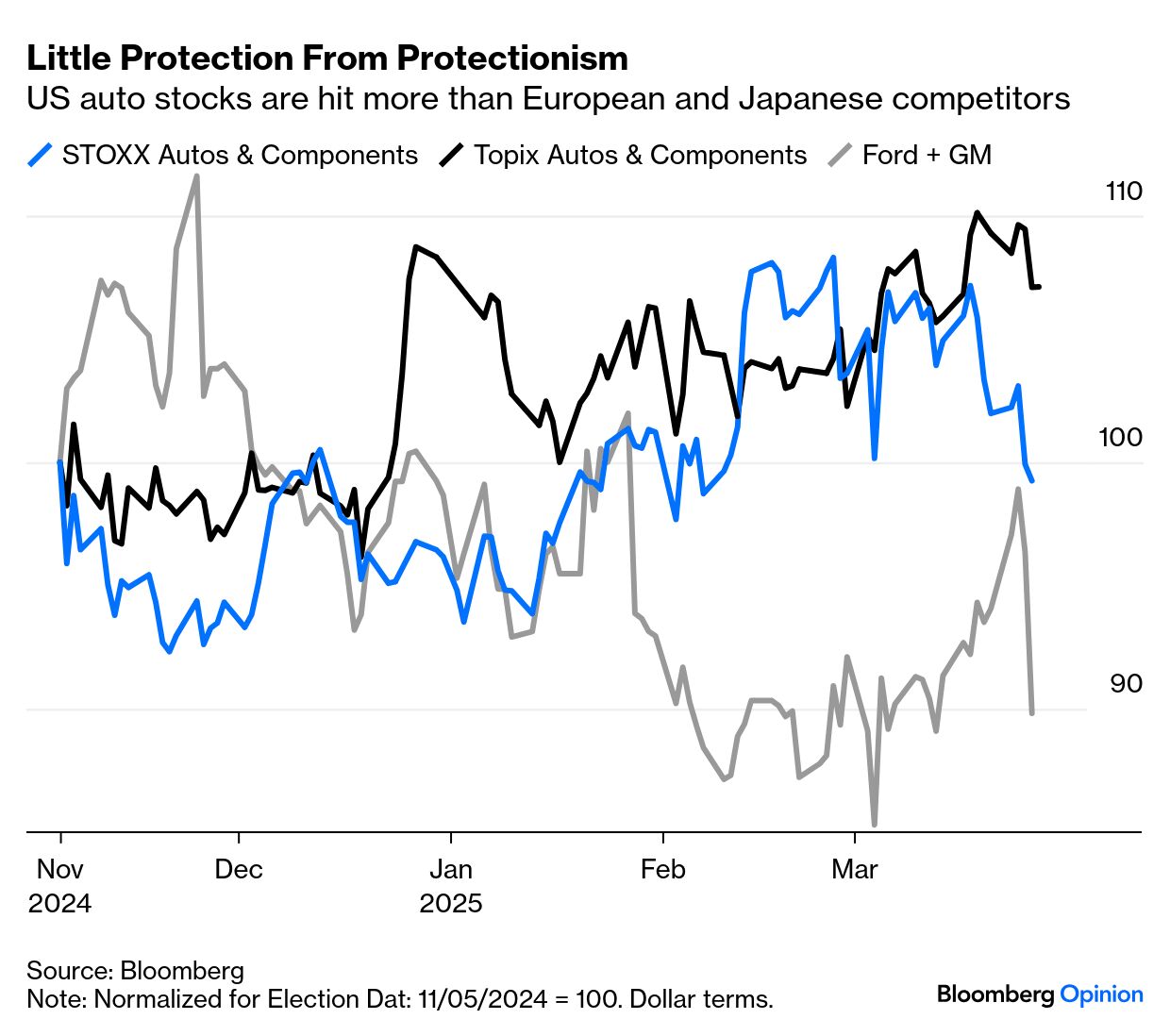

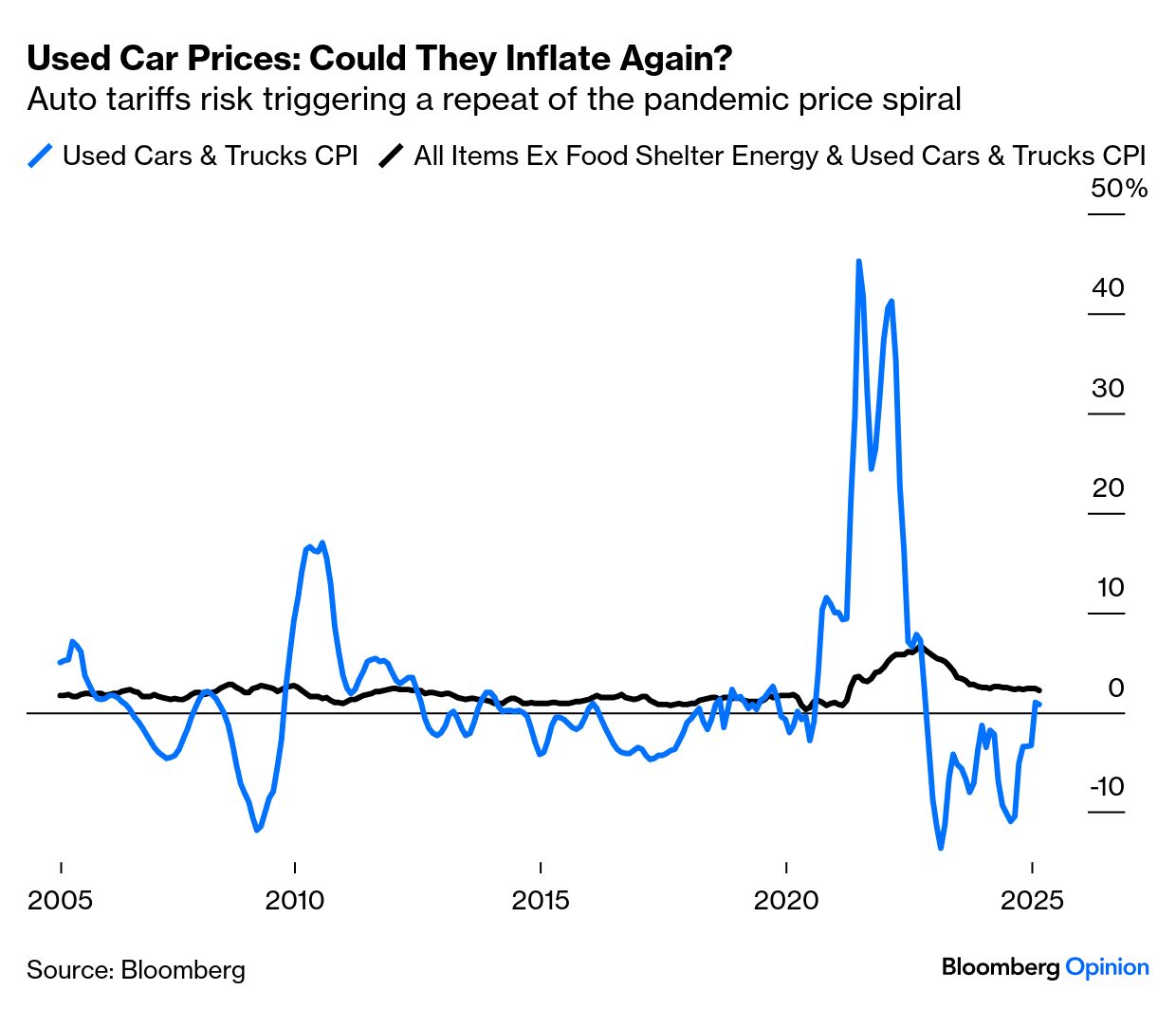

| It seems we can assume that the US will be levying tariffs on motor imports next week. What happens next? Several responses await. We need to know whether other governments retaliate, or attempt to come to a deal; how tight supply chains are and whether the highly integrated US-Mexico and US-Canada production lines can even keep working; how much of the tariff the carmakers try to put on the consumer; and how consumers will respond. This last gets the least attention, which is reasonable because other effects need to play out before consumers get confronted with having to pay for a new car. But one interesting line of thought is that it could bring the US right back to the scene of the crime that did in Joe Biden's administration — and reignite used car inflation. As a reminder, it was a sudden spike in used car prices in 2021 that first set off the inflation scare. The debate over whether inflation was "transitory" revolved in large part around the exceptional move in this one category. It even became fashionable to publish a new version of core inflation to exclude used cars and trucks, in an attempt to show that the problem didn't extend beyond them. Here's a reminder of what happened: Given the political disaster that price spike eventually inflicted on the Democrats, it behooves the new administration to take great care not to stage a repeat. But tariffs on imported new cars might do just that. Mark Malek, chief investment officer at Siebert Financial, puts the problem as follows: Most discussions around inflation and tariffs have been around how companies might pass along tariffs to consumers... Those price increases will occur over time and only once inventory is cleared off of lots. But there is something else that will occur more immediately, and that is likely to be sharp increases in used cars. If a consumer wants a foreign car and is unlucky enough to want one of the models that is imported, that consumer will have two choices: 1) buy a different model/brand made in the USA, or 2) buy a used car. The popularity of used cars has gone up significantly in the last five years due to the high price points of new vehicles.

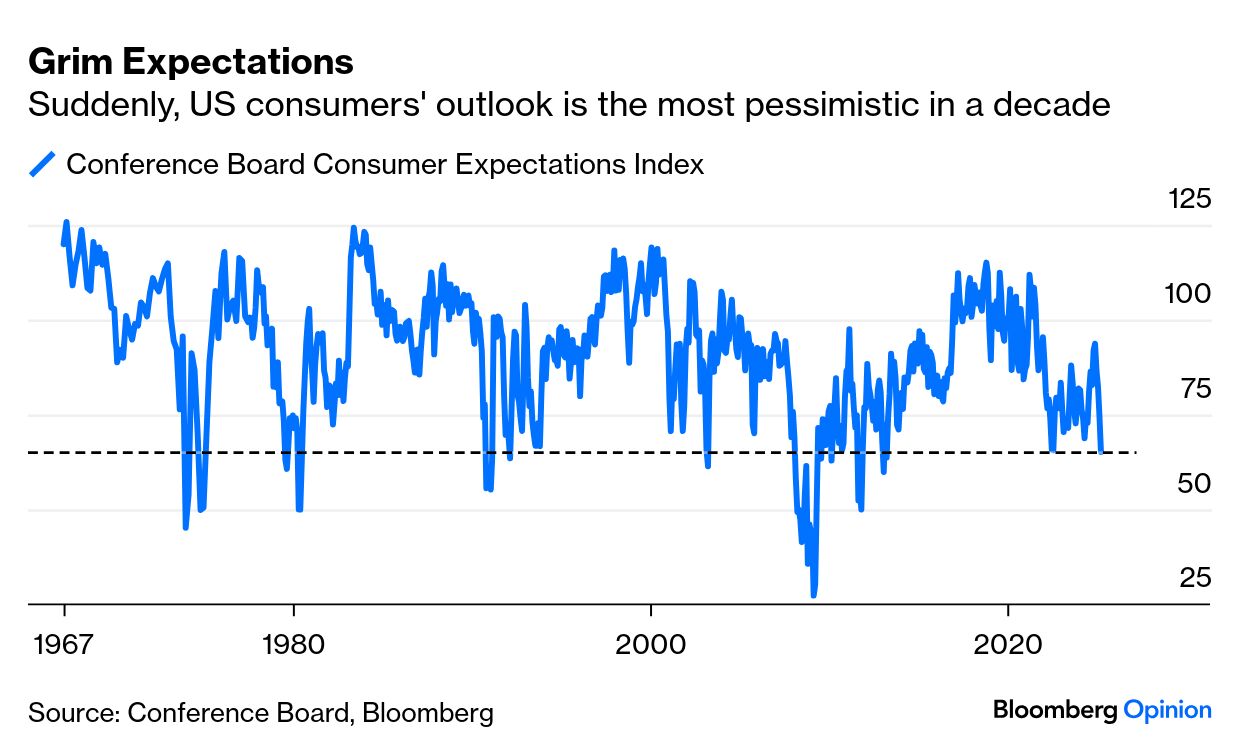

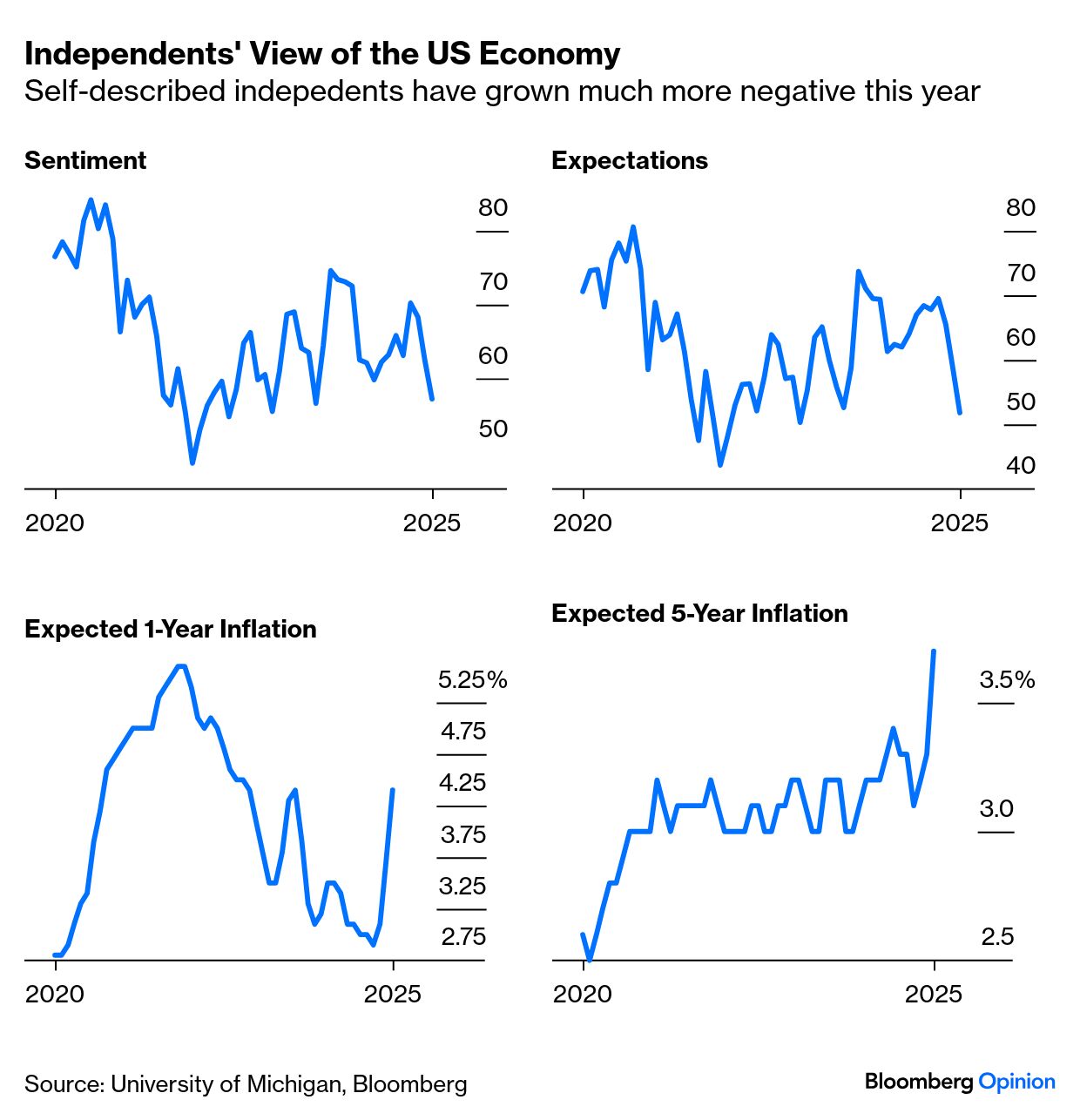

When it comes to new cars, he points out that prices will rise just because of the complexities introduced by tariffed components. Malek argues that even Tesla, which does most of its manufacturing for the American market in the US, will pay more for parts because of competition among all manufacturers competing for the existing supply of non-tariffed parts, materials and components.  Runin' on empty in 1979. Photographer: Janet Fries/Hulton Archive/Getty There is much talk of market guardrails. A major fall for the stock market might well prompt a rethink by the administration. But in a democracy, it's what hurts voters the most that could matter, which means inflation. The latest survey of consumer sentiment by the Conference Board found expectations dropping to their lowest level in a decade (a period that includes both the pandemic and the inflation spike): It's true that such numbers can be driven by political messaging, rather than by real-life fundamentals. It's possible that consumers are merely latching on to scaremongering by the Democrats. However, amid all the invective since Donald Trump's return to power, I've never heard anyone accuse the Democrats of being good at getting their message out. Rather, this loss of confidence looks organic. As tariffs dominate conversation, it's a reasonable inference that US consumers are drawing their own common-sense conclusion that they'll have to pay higher prices. For one partial way to check that this isn't being driven by Democrats' negativity, the University of Michigan divides its sentiment survey into Republicans and Democrats (whose views have diverged in extreme fashion) and independents, who might provide a check on how the economy appears to those who aren't wearing partisan glasses. The independents are getting much more negative. Perhaps most alarmingly, their expectations for longer-term inflation are now higher than they were at any time during the inflationary implosion under Biden: Sequencing is all-important. In the long-term, this policy is explicitly intended to bring back manufacturing jobs, a goal that has very great support. But any spike in inflation would come well before any noticeable increase in jobs; prices can be jacked up quickly, while building and opening new factories takes time. If there is an economic guardrail to force a rollback of tariffs, which is plainly what many investors want, inflation is it. Over the weeks ahead, expect to look very, very carefully for any signs that used car prices are rising fast again. |

No comments:

Post a Comment