| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union.Less than two weeks befo |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Less than two weeks before Donald Trump takes office, the EU's new industry chief said it's "the end of European complacency" when it comes to defending its companies. Stephane Sejourne, in his first TV interview as an executive vice president, told us the bloc is ready to consider both defensive and offensive measures if Trump follows through on his tariff threats, including retaliatory penalties on US imports and financial support for European businesses. Sejourne said he still hopes to convince Trump that a trade war would harm all parties, noting that the EU has a market of 450 million consumers. The former French foreign minister also called for a more meaningful single European market for the telecom and finance industries. —Andrea Palasciano | |

| |

| Spend More | Trump suggested NATO nations should spend the equivalent of 5% of their economic output on defense, ramping up his demands on European allies to more than double the current target of 2%. No member of the military alliance is currently spending 5% of GDP on defense, not even the US. Coveting Greenland | In a news conference that may be a preview of the disruption ahead, Trump also declined to rule out using military force to seize Greenland and also suggested he might use "high-level" tariffs to persuade Denmark to give up Greenland, which is a self-ruling territory of the country. Hours earlier, Danish Prime Minister Mette Frederiksen had tried to put a positive spin on the claim by praising US interest and investments while reiterating Greenland isn't for sale. Trump's relentless Greenland fixation has put Denmark and Frederiksen in the spotlight. Target Europe | Elon Musk has his sights on Europe: In recent weeks, Trump's billionaire backer has personally insulted German and UK leaders, backing the far-right and embracing conspiracy theories. While causing outrage and bewilderment, these interventions have left his targets weighing how to respond to a man who has the ear of the incoming US president. Hard Line | Friedrich Merz, the German conservatives in pole position to become the next chancellor, is toughening his position on migration as he tries to fend off the threat of the far-right Alternative for Germany. At a meeting with his Bavarian partners today, he will promise to toughen rules on obtaining passports while making it easier to strip citizenship from foreign-born Germans who commit serious crimes. | |

| |

| Budget Crisis | France's Socialist Party is willing to compromise on the budget, which would give Prime Minister Francois Bayrou's new government a narrow path to avoid collapse in its efforts to repair creaking public finances. Ministers are negotiating with different political groups this week to urgently piece together a 2025 budget. Sovereignty Spat | Tensions flared between African countries and former colonial power France, which is reconfiguring its military presence on the continent. African officials bristled at Emmanuel Macron saying they owed their sovereignty to French troop interventions. "France has neither the capacity nor the legitimacy to ensure Africa's sovereignty," Senegalese Prime Minister Ousmane Sonko quipped back. Austrian Provocateur | He's both the most admired and the most loathed politician in recent Austrian history, and he's about to take the reign of the country. Conservative-nationalist Herbert Kickl has been tasked with forming Austria's next government. He claims that only an outsider like him can fix Austria's flailing economy. Second Chance | Once called the "ugliest building in the country," the Dutch central bank's headquarters got a major makeover, and a chance at winning over the hearts of Amsterdam's residents. It has reopened its doors after a major renovation designed with sustainability in mind. | |

| |

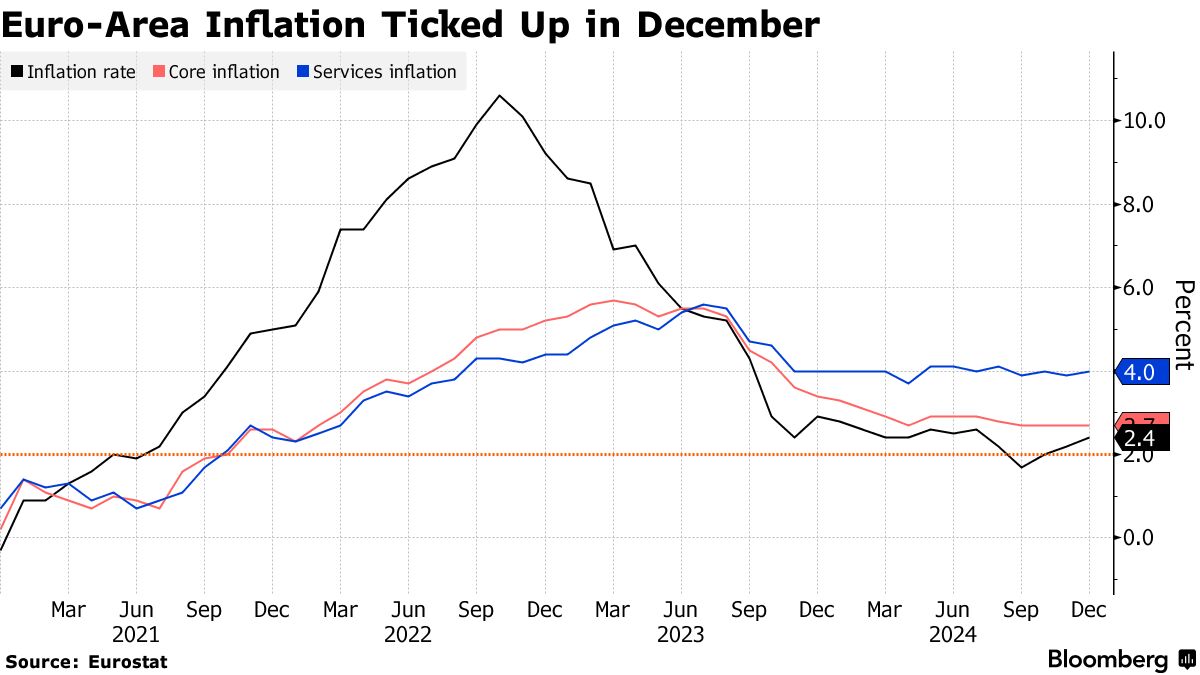

| Euro-area inflation accelerated last month, supporting the European Central Bank's gradual approach to reducing interest rates, without derailing them altogether. Consumer prices rose 2.4% from a year ago in December, up from 2.2% in November. The increase was largely driven by energy costs. The ECB repeatedly warned that the path back to its 2% target will be bumpy. | |

| |

- EU foreign affairs chief Kaja Kallas meets Jordanian Foreign Minister Azman Safadi

- European Parliament President Roberta Metsola meets the speaker of Egypt's House of Representatives and the president of its Senate in Cairo

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment