| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. Mideast Money has dominated dealmaking in 2024, and Gulf hubs have become even more prominent centers of finance. It's been six months since this newsletter started popping up in your inboxes and in this final edition of the year, we showcase our best work while casting an eye into 2025. Thanks for your support, and Happy New Year! The Middle East is now one of few regions in the world with three trillion-dollar wealth funds that are tasked with diversifying oil-rich economies and accounted for close to $100 billion worth of transactions this year.

The year threw up a few key themes, including how Gulf funds are now forcing money managers to reshape longstanding practices. Global firms are increasingly being asked what they'll do in return for an investment. Many are doing away with typical management and performance fee arrangements to secure commitments.

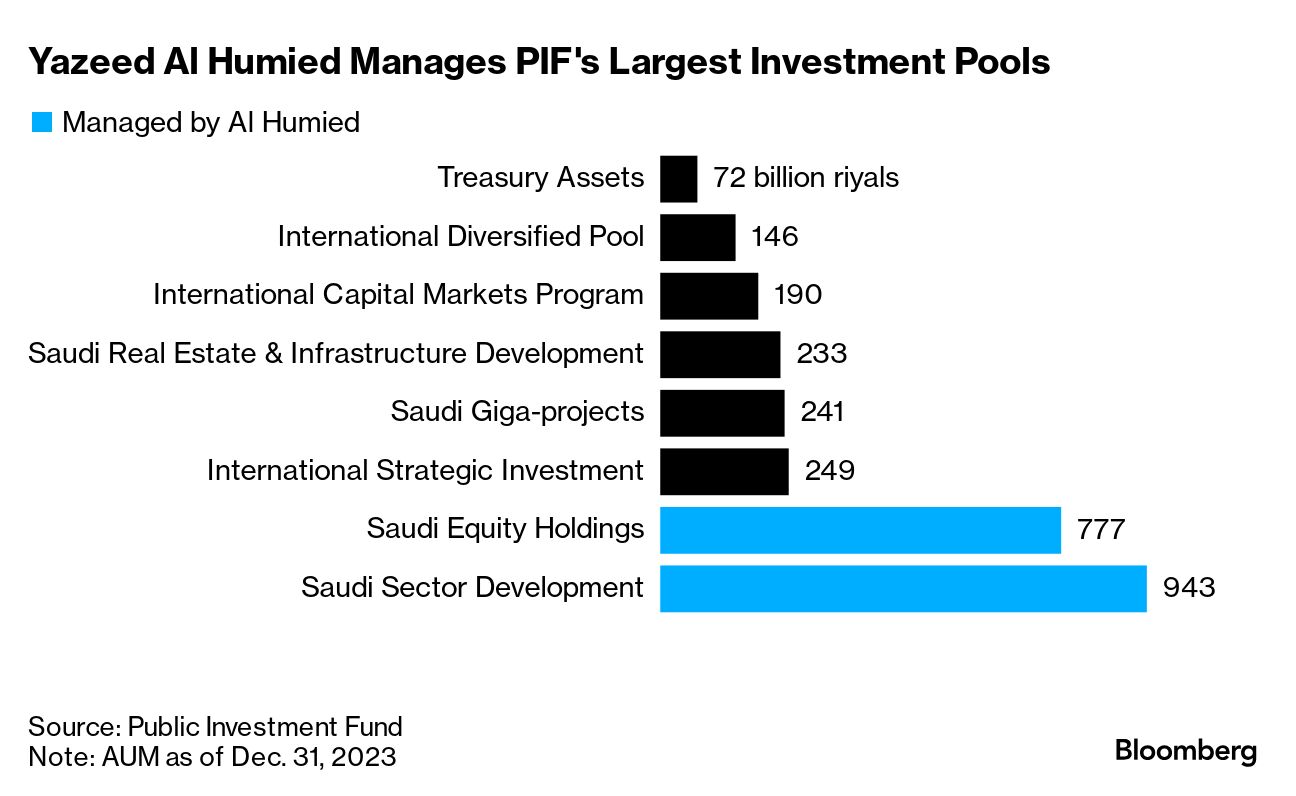

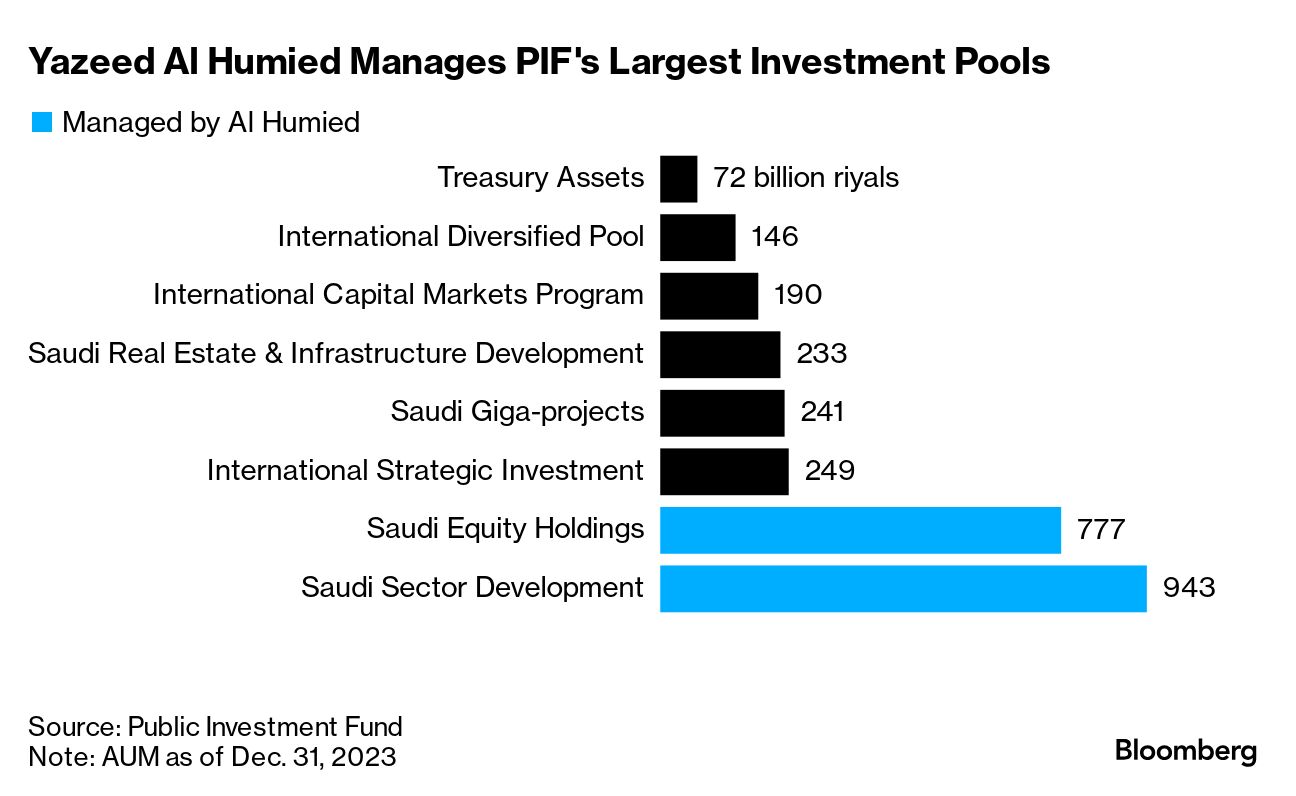

We also covered the personalities that drive dealmaking. For instance, Saudi Arabia's local pivot is boosting the profile of a low-key executive at the Public Investment Fund, who's being courted by global firms looking to do deals in the kingdom.  The PIF has emerged as the main vehicle driving Crown Prince Mohammed bin Salman's trillion-dollar Vision 2030 agenda, and is ramping up debt sales and share issuances in portfolio companies to raise cash for some of these projects — moves my colleague Matthew Martin flagged up at the start of the year. There will likely be more in 2025.

Also Read: Mideast IPO Momentum Faces Valuation Test After $13 Billion Year

While Saudi Arabia will have to shell out cash for a range of local priorities, including a FIFA World Cup in 2034, things are looking a bit different for Qatar as the country emerges from a period significant domestic spending — including a footballing spectacle of its own. Qatar recently named a new head for its $510 billion wealth fund, which is expected to reap a windfall from an expansion of Doha's gas output, while its new CEO has significant experience in the US. A key question will be if the fund goes back to its roots of doing large deals.  QIA's new CEO Mohammed Al Sowaidi. Photographer: Jeenah Moon/Bloomberg Over in Abu Dhabi, which is home to three wealth funds, we detailed strategy shifts at the biggest one — the $1 trillion ADIA, which is embracing an increasingly scientific approach to investing, leaning more on its own quant team to speed up decision-making as it seeks to bolster returns. We also profiled Khaldoon Al Mubarak, who oversees Mubadala — the wealth fund that's done deals across a range of sectors including AI and data centers to finance, entertainment and health care. Mubadala Capital recently snapped up Canada's CI Financial in one of the largest-ever privatizations by an Abu Dhabi entity in the financial sector.  Mubadala Investment's CEO Khaldoon Al Mubarak. Photographer: Chris Ratcliffe/Bloomberg Also Read: Select Power Players Hold Keys to the UAE's $1.5 Trillion Man

This was also a year of change at another investing giant — the managing director of Kuwait's nearly $1 trillion wealth fund departed after three years, capping a turbulent tenure at the investor that's been overshadowed by regional peers. The re-jig is unlikely to result in significant strategy shifts at the KIA, which has largely focused on artificial intelligence, digital infrastructure, data centers and semiconductors this year. Also Read: Global Law Firms Rush to Cash In on $150 Billion Gulf Deals Boom If there was one headline that crystalized Abu Dhabi's position in the world of hedge funds, it would perhaps be news of the scale of Brevan Howard's operations in the city — $10 billion, more than New York or London. The year was neatly bookended by London-based peer Marshall Wace's decision to set up in the city. Some of the world's largest financial firms were drawn to the twin hubs in the United Arab Emirates by large pools of capital — Abu Dhabi's $1.7 trillion in sovereign wealth and Dubai's $1.2 trillion private wealth, which has also led to a private banking boom in the city. The influx of firms is also helping the cities dodge the commercial real estate crisis rippling around the world.  Attendees listen to panellists during the Abu Dhabi Finance Week conference. Photographer: Christopher Pike/Bloomberg Also Read: Hedge Funds From East Join Western Peers in Booming Mideast Hubs

Neighboring Saudi Arabia, too, saw firms lining up to set up regional headquarters there. In May, Goldman Sachs became the first Wall Street bank to take a step toward complying with an ultimatum for foreign firms to set up their Middle Eastern base there or risk losing business.

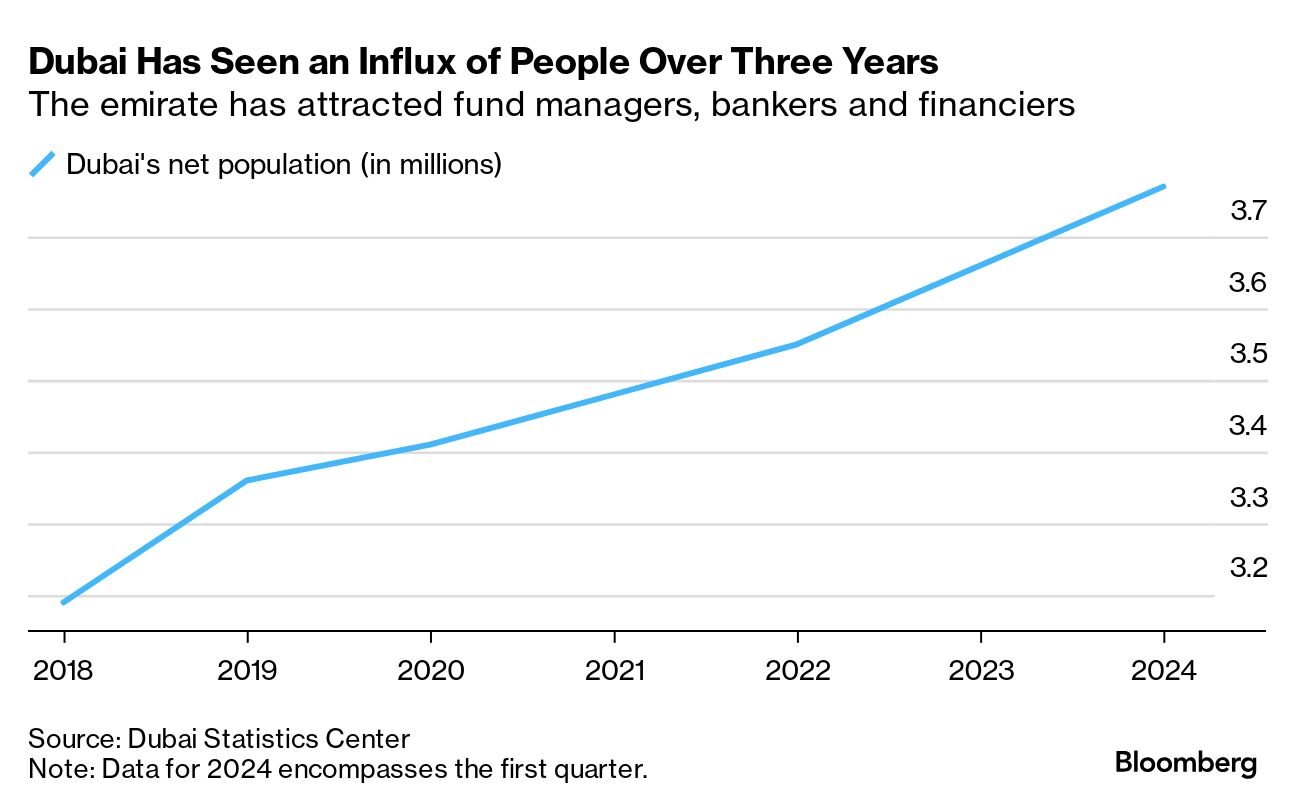

And as the countries vie for the spot of the main Gulf finance hub, competition is creeping in — many firms looking to raise cash or plug into dealmaking driven by ambitious diversification programs are trying to keep a foot in both camps. The rally in Dubai's residential prices continued in 2024, defying predictions of a slowdown and prompting some to say that the Middle Eastern business hub might be breaking free from its boom-and-bust cycles. All told, prices climbed by about a fifth this year, according to Knight Frank and the real estate consultancy expects average values to rise 8% next year.

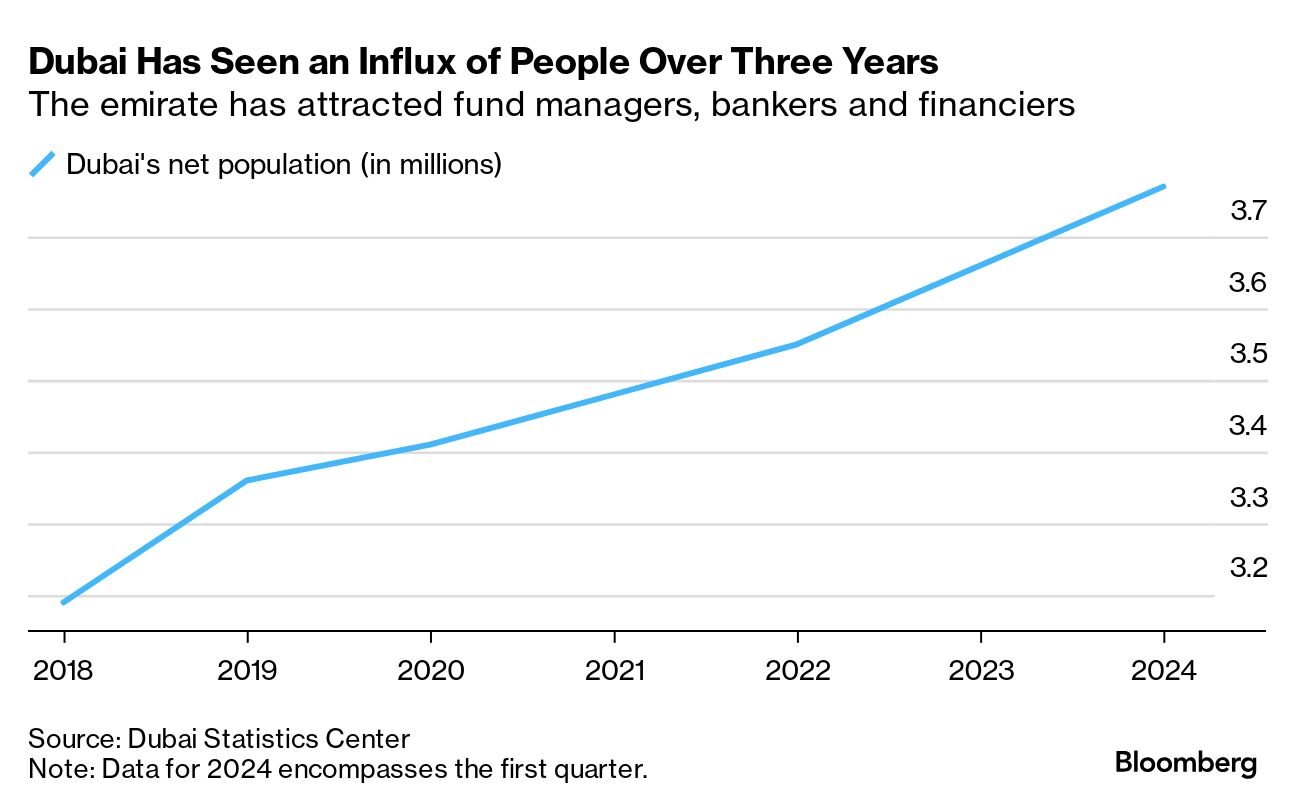

The turnaround started during the pandemic, when Dubai — emboldened by high vaccination rates — welcomed visitors before most countries lifted lockdowns. That, combined with easing visa regulations, spurred a rush of crypto millionaires, bankers from Asia and digital nomads. Moscow's invasion of Ukraine in 2022 prompted another wave of newcomers as wealthy Russians moved to shield their assets. Since 2020, about 400,000 people have arrived, drawn by low taxes, safety and proximity to major markets — the city is home to 3.8 million now, and that's expected to surge to 5.8 million by 2040.  Home values in the emirate have now risen for 17 straight quarters and rents for single family homes — villas — have soared 86% since the start of the pandemic, according to real estate consultancy JLL. That's also resulted in some buyers being priced out of the market, and even looking to move to the neighboring emirate of Sharjah.  The Sharjah Skyline at sunset. Photographer: Rustam Azmi/Getty Images Europe That said, luxury homes in Dubai — ranging from beach-front villas to branded developments — are still competitively priced compared to global peers. Related Coverage The ramifications of Donald Trump's second term, with its prospects of tariffs and trade wars, will be felt in the Middle East in the new year. While Gulf rulers have welcomed the expectations that the new US administration will renew pressure on Iran over its nuclear program and push for an end to regional conflicts, in other areas, Trump's goals may be at odds with the region's priorities.  Donald Trump and PIF Governor Yasir Al Rumayyan play golf in Bedminster, New Jersey, in 2022. Photographer: Rich Graessle/Icon Sportswire/Getty Images For instance, plans for American 'energy dominance' could weigh on oil prices, and Trump's hardline stance on China might cast a shadow over Gulf countries' growing ties with Beijing. The latter issue has already been something Gulf firms have had to deal with. Back in April, Abu Dhabi's main investment vehicle for artificial intelligence, G42, lined up a $1.5 billion investment from Microsoft after the two worked out a deal with the US government where the Gulf firm agreed to end any cooperation with China. Still, for those at the top echelons of Middle East finance, Elon Musk's presence in Trump's inner circle presents a significant opportunity. Gulf funds are increasingly optimistic that the addition of Musk to the mix will help them win even more deals in the US — particularly in sensitive areas like technology and artificial intelligence, where the Biden administration placed heavy restrictions, Bloomberg News has reported.  Elon Musk shakes hands with Donald Trump during a campaign rally in Butler, Pennsylvania, on Oct. 5. Photographer: Anna Moneymaker/Getty Images The PIF was among backers of Musk's xAI in a previous funding round, an investment that hasn't been publicly disclosed, a person familiar with the matter had told Bloomberg News. Saudi Arabia's Kingdom Holding and Qatar's wealth fund were among those who backed xAI's latest funding round. Also Read: Trump's Gulf Dealmaker Helps Family Cash In on Property Boom In his first term, Trump oversaw a strengthening of US ties to the oil-rich region where he already had strong business connections. His family has since deepened its ties with the region. The Trump Organization has inked deals to build villas in Oman and new towers in Saudi Arabia and Dubai, while Jared Kushner's firm raised an additional $1.5 billion from entities in Qatar and Abu Dhabi. However, his son Eric Trump and his son-in-law Kushner, have both said that business partners should not expect any favors from them. That's a pledge that ethics watchdogs and critics will closely scrutinize. Also Read: Jared Kushner Sends a Message to Investors After $1.5 Billion Haul The very first edition of this newsletter highlighted how the UAE and Saudi Arabia are increasing their investments in the semiconductor industry, as they look to tap the AI boom. Since then, the AI push has turned into an all-out race for regional supremacy. Riyadh is planning a new project backed by up to $100 billion that'll invest in data centers, startups and other infrastructure to develop AI, Bloomberg News reported in November. "Project Transcendence" will complement Saudi wealth fund-backed firm Alat, that plans to plow $100 billion into everything from technology to semiconductors and capital goods. All of this puts Riyadh in direct competition with Abu Dhabi. G42 set up a technology investment firm targeting deals in AI and semiconductors that could surpass $100 billion in assets under management in a few years, Bloomberg News has reported.

That new company, called MGX, is teaming up with BlackRock and Microsoft on one of the largest efforts to date to bankroll the build-out of data warehouses and energy infrastructure behind the boom in AI. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment