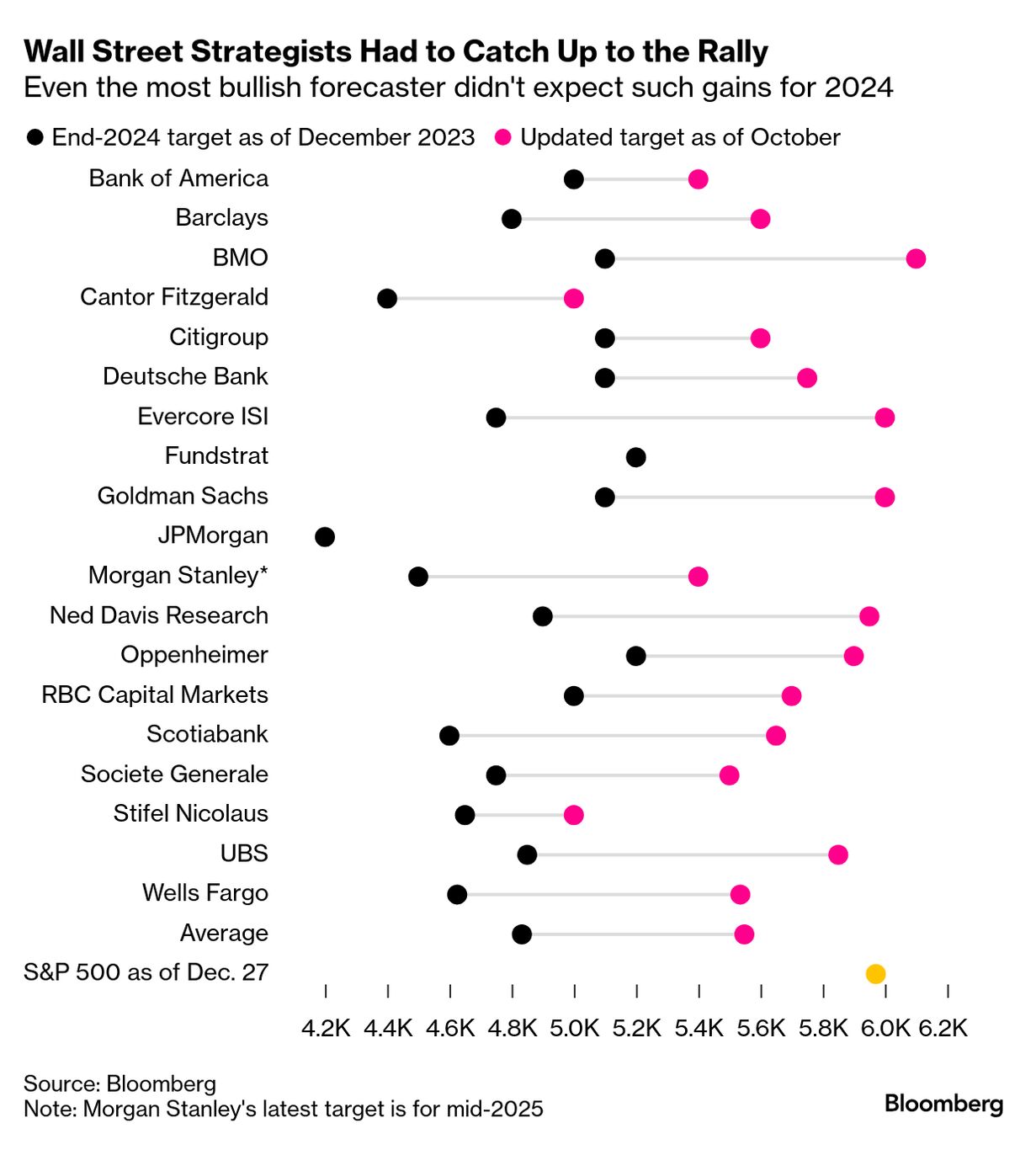

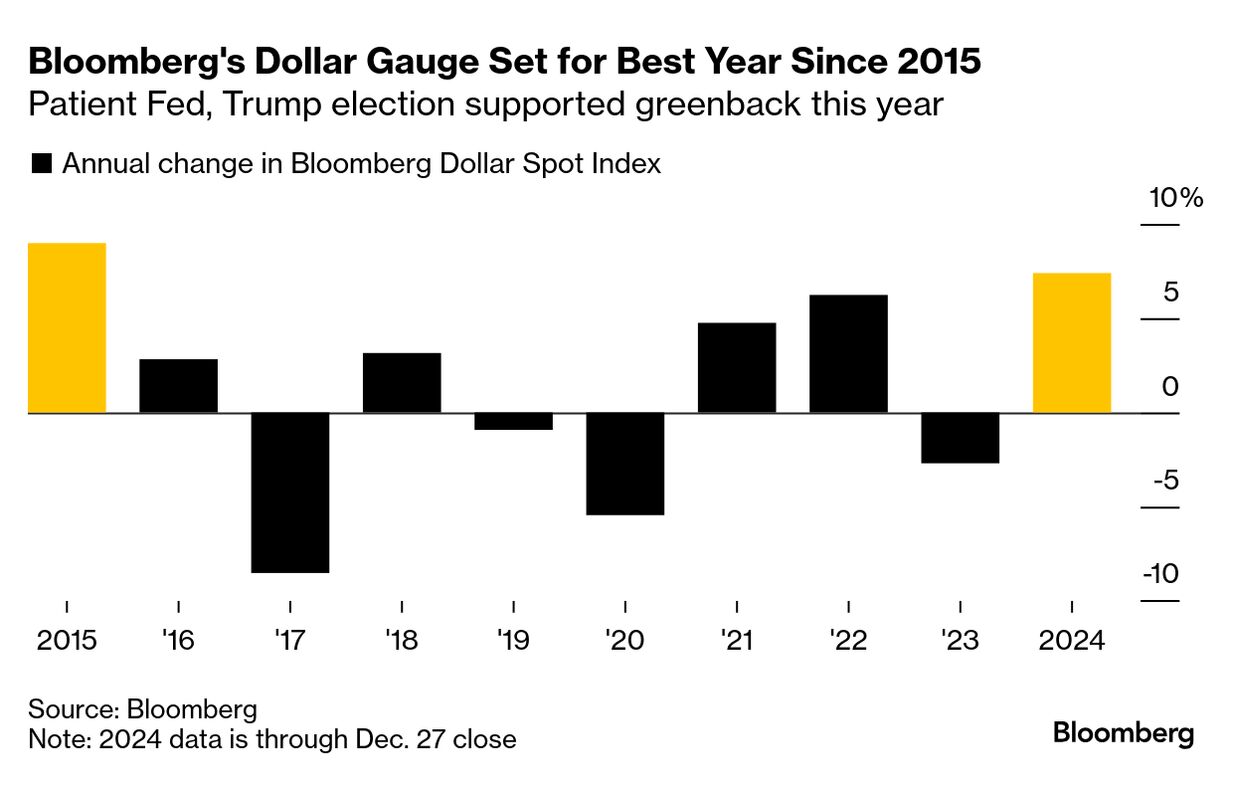

| This time last year, the stock market's rally had blown past even the most optimistic targets and Wall Street forecasters were convinced it couldn't keep up the dizzying pace. So as strategists at Bank of America, Deutsche Bank, Goldman Sachs and other big firms sent out their calls for 2024, a consensus took shape: After surging more than 20% as artificial intelligence breakthroughs unleashed a tech-stock boom and the economy kept defying the doomsayers, the S&P 500 Index would likely scratch out only a modest gain. As the Federal Reserve shifted to cutting interest rates, Treasuries were seen as ripe to give equities a run for their money. What followed, instead, delivered another humbling to Wall Street prognosticators who have been caught off guard by the market's twists and turns ever since the end of the pandemic. Rather than lose steam, equity prices continued to soar higher. By late January, the S&P 500 had already surpassed the average year-end target from strategists. It went on to hit one record high after another and is heading to a 25% gain in 2024, capping the strongest back-to-back annual runs since the dot-com bubble of the late 1990s. "There is an element of miraculousness to it," said Julian Emanuel, chief equity and quantitative strategist at Evercore ISI, who by mid-year abandoned his call for a slight dip in the S&P 500 and was the first among major strategists to introduce a year-end target of 6,000. "Trends can go on longer and go farther than one could ever imagine."

Still, a normally sleepy year-end session on Friday in the US saw the S&P 500 fall as much as 1.7% on no obvious news — underscoring risks to the one equity strategy that has worked reliably in 2024. So-called momentum investing, or riding the market's winners, has rewarded its faithful handsomely — while also raising risk that blowups like Friday's will become more common. "Momentum is great until it's not, until something changes," said Melissa Brown, head of applied research at SimCorp. — Alexandra Semenova, Sagarika Jaisinghani and Justina Lee |

No comments:

Post a Comment