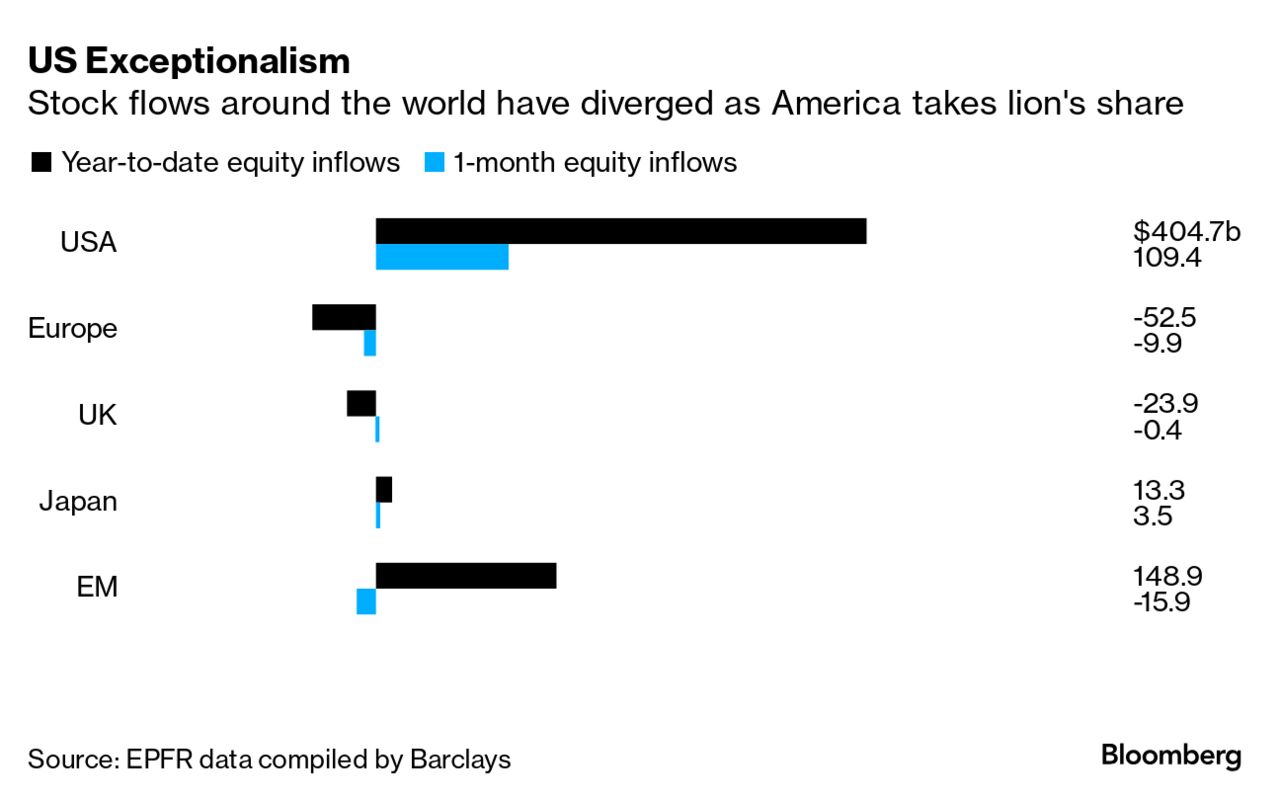

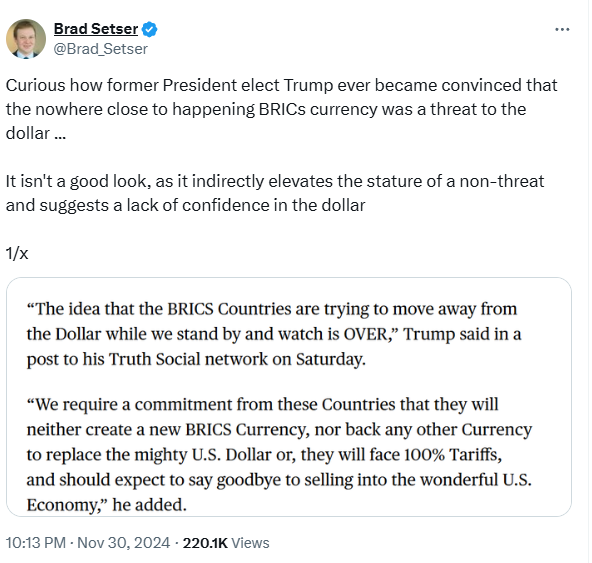

| It's almost a month since Donald Trump secured another term in the White House and the trades that greeted his victory are largely intact. Stock investors have celebrated the most, with the S&P 500 up 4.3% since the election as investors cheer the president-elect's plans to cut taxes and deregulate. Other indicators back up the "American Exceptionalism" vibe. Inflows into US equities have risen over the past month, while Europe and emerging markets went the other way, according to EPFR data compiled by Barclays. Such gains are all the more remarkable given US equities are already set to beat the rest of the world by the most since 1997, according to MSCI indexes — just as it has in all but two of the last 15 years. That has pushed up their relative valuations, while their weightings in global indexes have reached a record high. Wall Street pundits from JPMorgan to UBS see the outperformance continuing. To a lesser degree, other assets also reflect Trump's return. While the dollar has reversed some of its recent climb, Robin Brooks of the Brookings Institution notes it also rose following Trump's 2016 win and then gave back some of its gains, only to rise again "as markets realized what was coming." Brooks predicts the same will happen now. Bond yields have climbed, although the 10-year Treasury has failed to convincingly break above 4.5%.

So what next?

The case for US exceptionalism may well rest on American growth remaining fairly resilient to any blowback from Trump's own policies, such as higher tariffs.

Adam Slater of Oxford Economics suggests the higher yields are somewhat due to "a considerable rise in uncertainty about growth and inflation outcomes connected to areas like US trade and fiscal policy." Meantime, he reckons Trump's protectionism will hurt export-heavy economies like Germany and China, meaning slower growth abroad. Continued strength in the dollar could pinch US companies with overseas exposure. As a signal of concern, Slater points to the fact that industrial metals and bond yields in nations such as Germany have fallen since the election. "The picture looks more uniformly deflationary than in 2016," Slater said in a note last week. "The optimism of stock markets could prove premature." —Justina Lee |

No comments:

Post a Comment