| I'm Cécile Daurat, an economics editor in the US. Today we're looking at last week's onslaught of data in the US. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - A roadmap through the drama and realities of Donald Trump's trade war, just as the outgoing administration unveils new restrictions on China.

- China's manufacturing activity expanded for a second straight month, according to a private survey, in a further sign of stabilization.

- France's far-right National Rally indicated that it could topple the government as soon as this week in a standoff over the budget.

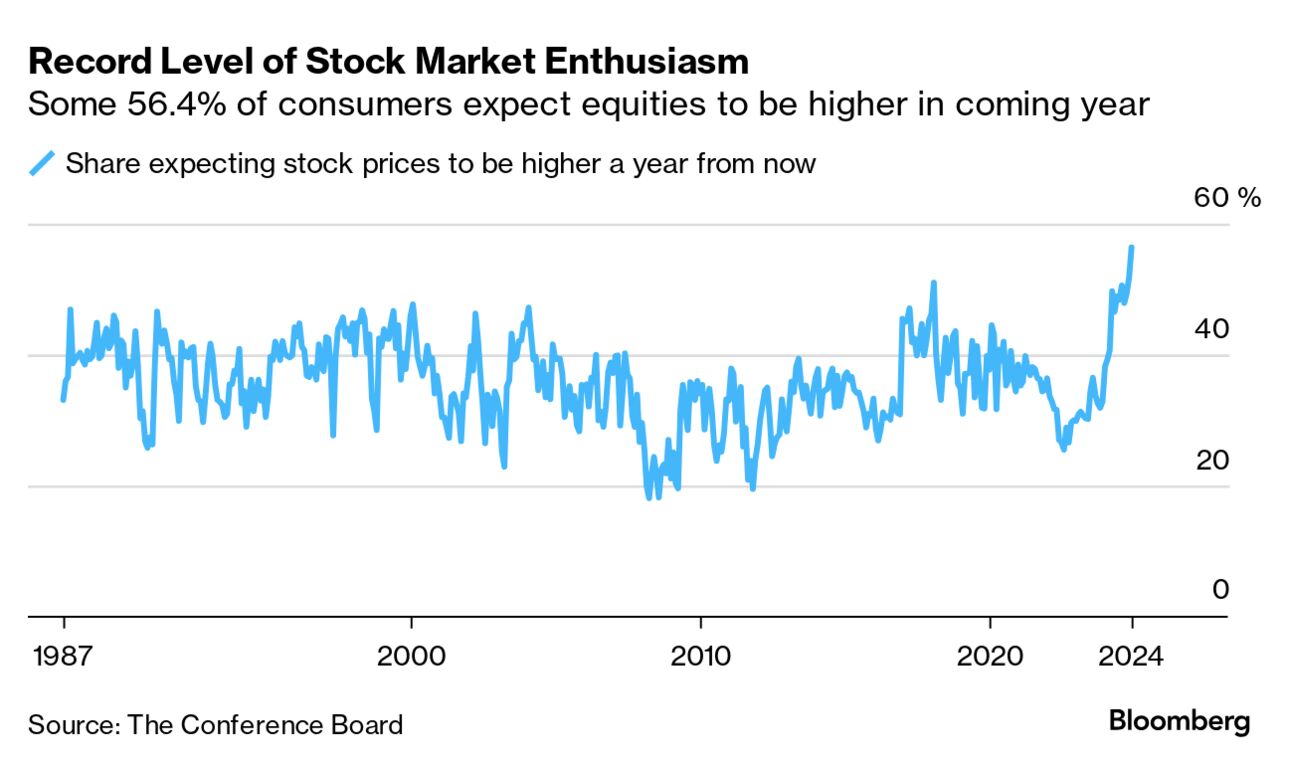

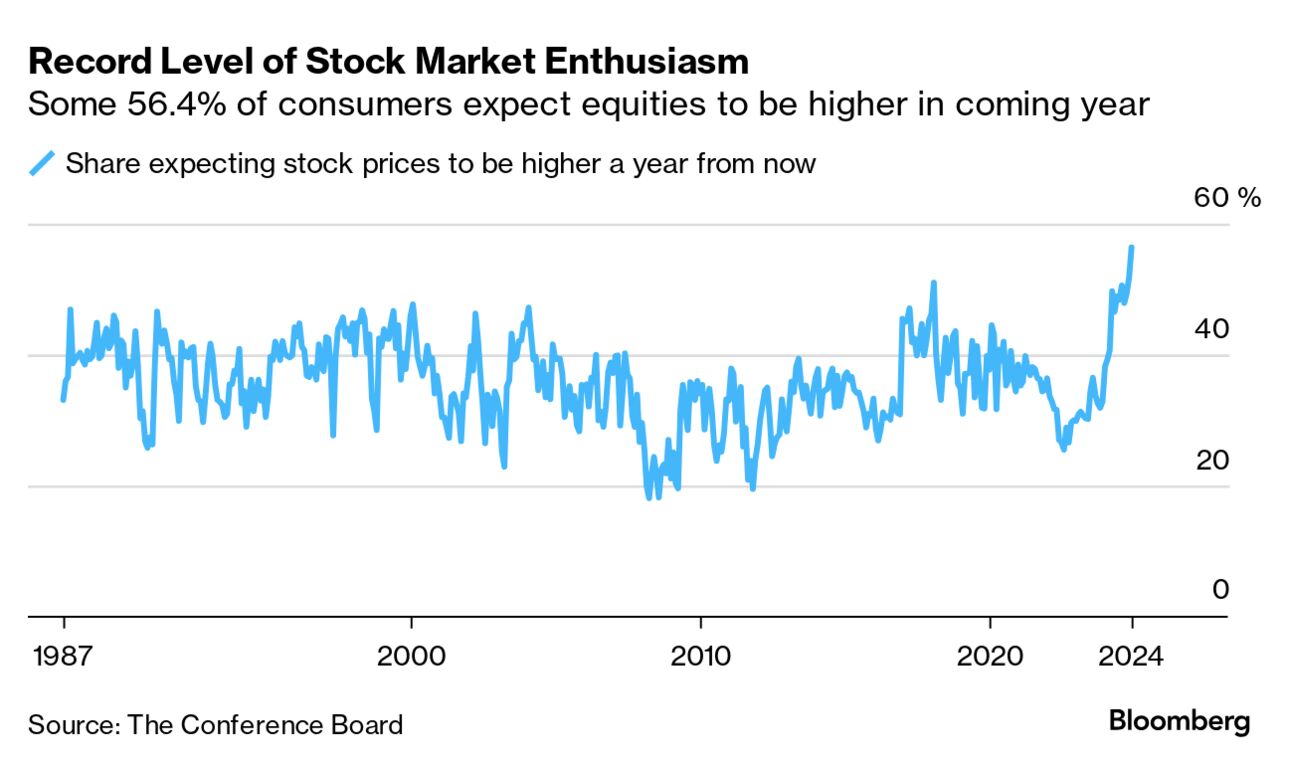

"Animal spirits" have engulfed the markets since the election of Trump and the Republican sweep in US Congress, fueled by the prospect of business-friendly deregulation and low taxes. But an onslaught of data last week ahead of the Thanksgiving holiday in the US provided a clear-eyed look at where the economy actually stands right now. Here are some takeaways: - Consumer spending remains solid but recent trends in real disposable income point to a slowdown after what Stephen Stanley at Santander US Capital Markets called "the extraordinary run in 2023 and so far in 2024."

- The outlook does look good for high-income households, however: the surge in equities and the likelihood that temporary tax cuts enacted under Trump will be extended means high earners will probably continue to splurge — and keep driving economic growth.

- The equities rally in the run-up to the presidential election (aka Trump trade) added 0.24 percentage points to the year-over-year growth of the Federal Reserve's preferred gauge of inflation last month. The culprit is a financial services category in the core personal consumption expenditures price index that mirrors markets moves and contributed in large part to the October acceleration in the index.

- A spike in homes sales at the end of the summer and early in the fall was probably short-lived. A leading indicator of pending purchases rose in October to the highest since March, boding well for November. But with borrowing costs trending higher again and weak mortgage applications, "we think that home sales will drop back to rock-bottom levels around the turn of the year," Pantheon Macro economists wrote in a note.

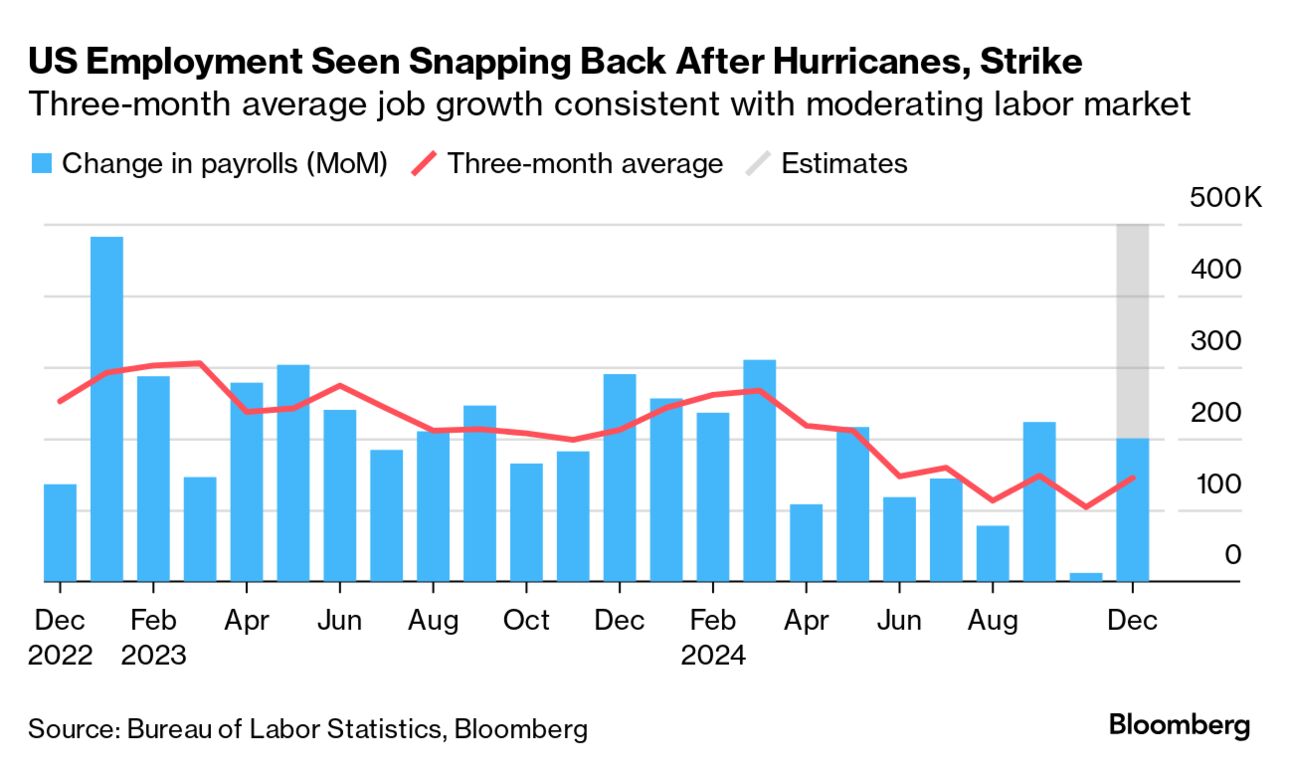

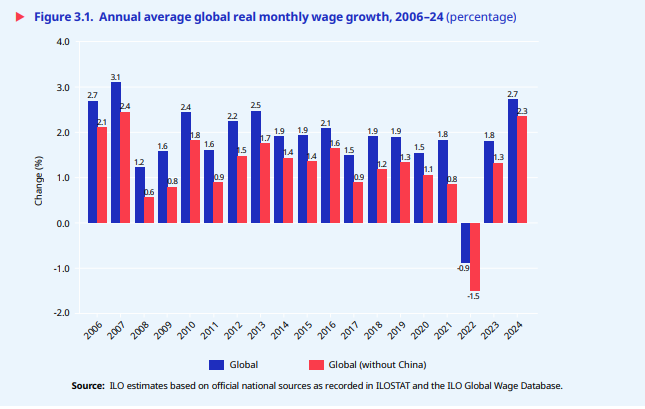

Early reports from Black Friday suggested that crowds were smaller than expected at some at some high-profile retail stores such as Macy's flagship in New York City. But online sales were strong, underscoring a fundamental lesson of US economics: Never underestimate the American consumer. US hiring probably jumped in November after hurricanes and a major strike undercut job growth a month earlier, consistent with a labor market that's healthy yet gradually cooling. Nonfarm payrolls probably advanced by 200,000 in November, according to a Bloomberg survey of economists. The data due Friday are also expected to show the unemployment rate held at 4.1%. On Wednesday, Fed Chair Jerome Powell participates in a moderated discussion, and investors will await any assessment of the job market and inflation as well as clues to whether the US central bank will lower interest rates this month. Elsewhere, the OECD will publish new economic forecasts on Wednesday, European Central Bank chief Christine Lagarde testifies to lawmakers the same day, and a plethora of inflation and growth numbers are due from Australia to Switzerland. See here for the rest of the week's economic events. With inflation largely easing around the world, global wages are once again rising faster than prices, according to research by the International Labor Organization. Real wages increased 1.8% on average worldwide in 2023, after falling nearly 1% the year before. Wage growth is seen picking up to a 2.7% pace this year — which would mark the fastest advance in more than 15 years. Real wage growth in China has been much faster than in other emerging G-20 economies, ILO said in its report. And 2024 figures are showing no sign of slowing down in the country. Excluding China, global wage growth would be 2.3% this year.

|

No comments:

Post a Comment