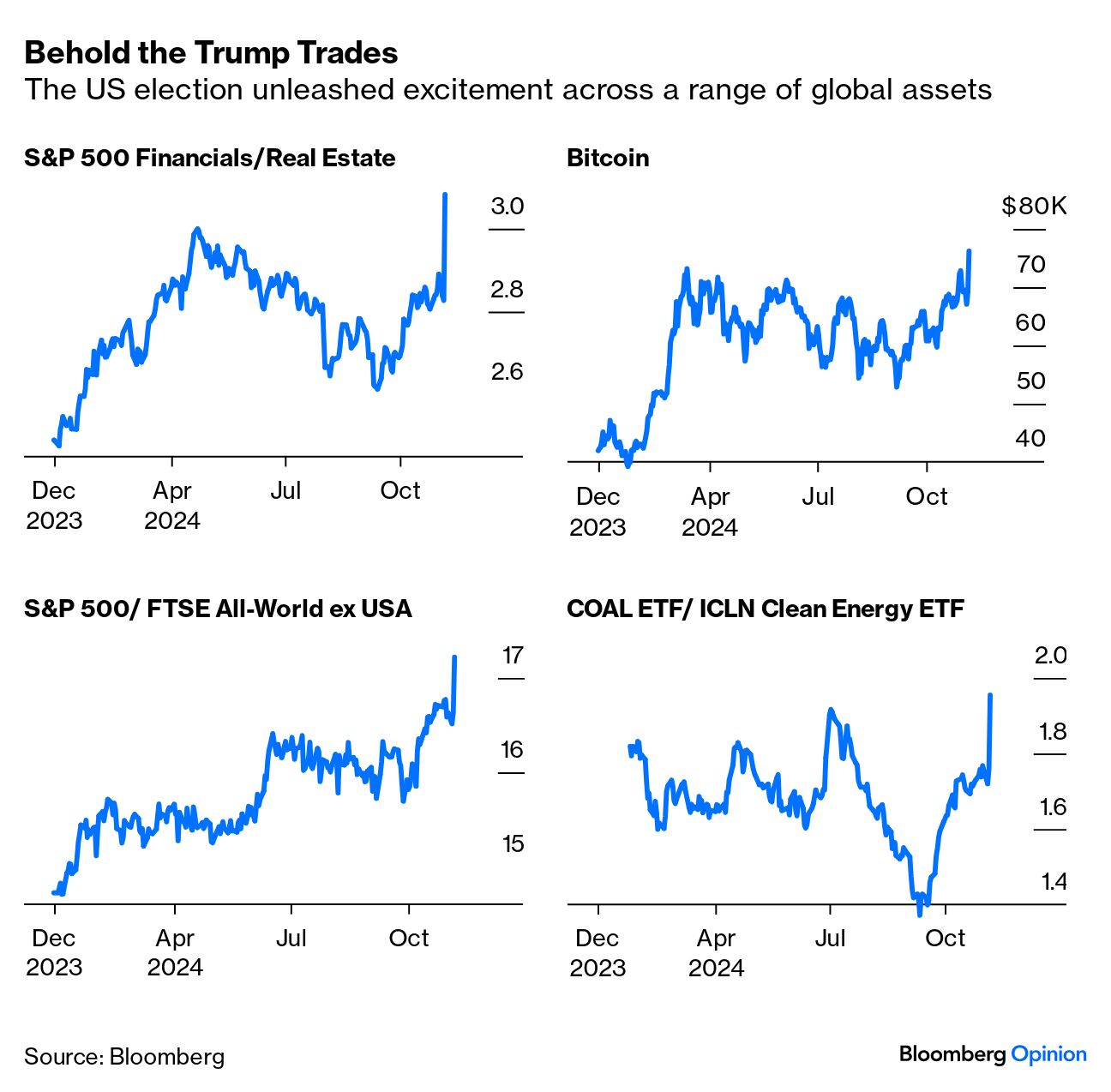

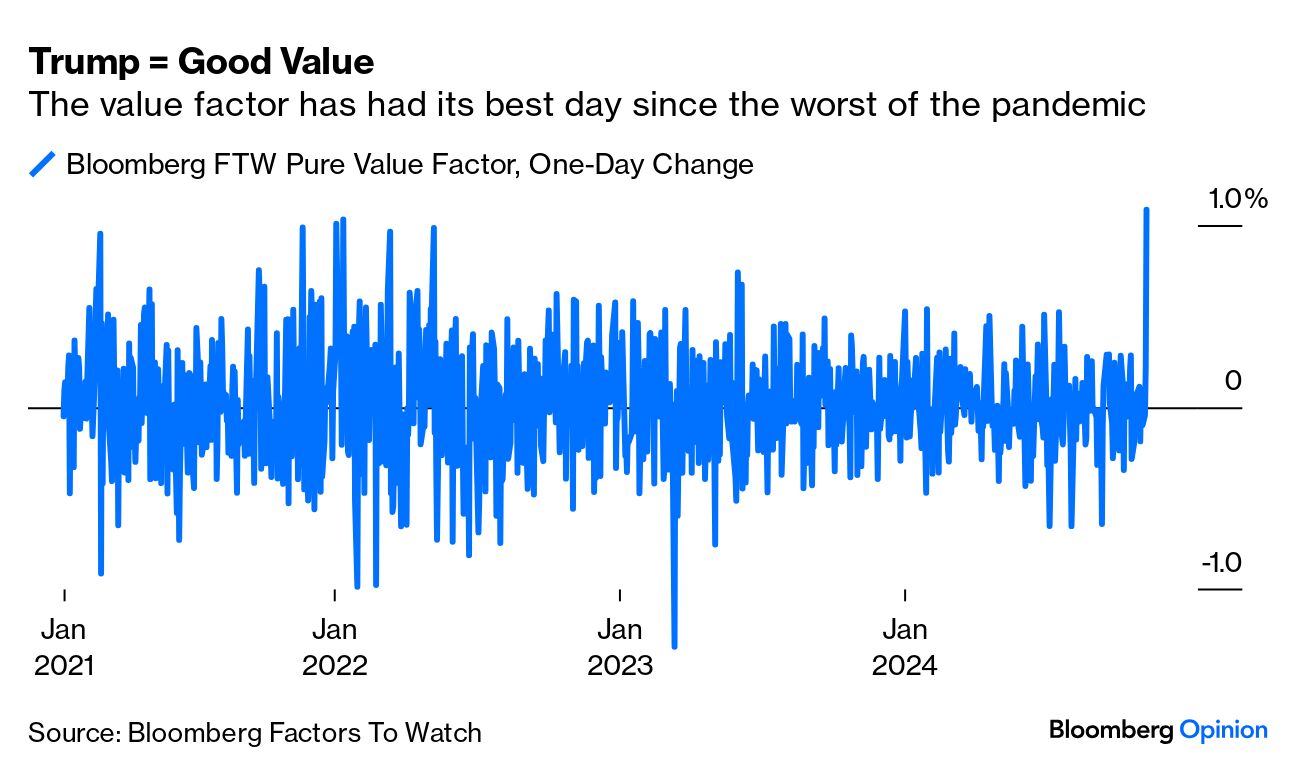

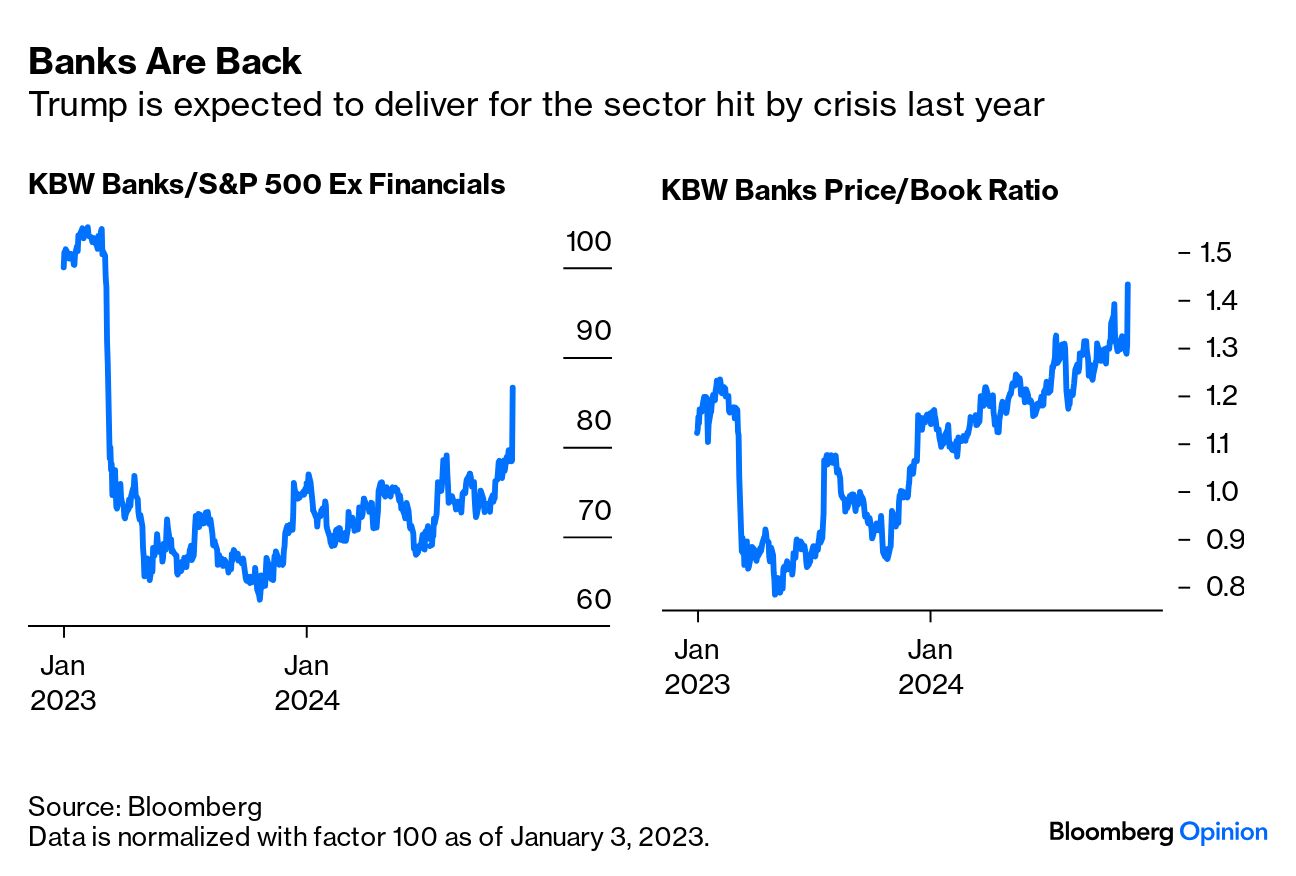

| It's all wrapped up. Donald Trump is going to be the US president again. He'll have a majority in the Senate, and probably the House. Now, we need to talk about the accompanying Trump Trade. Points of Return has warned that a Trump victory was already priced in, opening up risks of a nasty shock if he lost. Whether because those trades were dialed back in the last few days, or the surprisingly complete nature of his victory, Wednesday established that this was wrong. It was the best post-election day for the US stock market in history. The more spectacular trades most clearly linked to Trump and his agenda appear in this dashboard. Investors think he'll be fantastic for banks (largely because of deregulation), and terrible for his own industry of real estate (which could be harmed by higher rates); great for crypto, great for stocks in the US relative to everyone else (because America First), and great for coal at the expense of clean energy: Trump 2.0 is thought to be good for growth, thanks to tax cuts and deregulation. When growth is plentiful, investors look for stocks that are cheap. In these conditions, it's value that's in short supply, not growth. Hence, the value factor had its best day in the US since 2020: The rally for banks, hit by crisis early last year thanks to high bond yields, is remarkable. Shares in the sector are still a long way from making up all the ground lost when Silicon Valley Bank ran into trouble. But their valuation is markedly higher than before that crisis. There's confidence both that deregulation will allow them to let rip, and that their balance sheets are proof against another potential surge in bond yields: The Russell 2000 index of small caps gained almost 6%, its best day in two years. Elon Musk's Tesla Inc. gained 14.75% for its best performance outside of results days since the pandemic. And so on. This election felt like a big deal, and the markets fully confirm that. While much uncertainty has been removed, big questions remain. Here are some of the biggest:

Congress

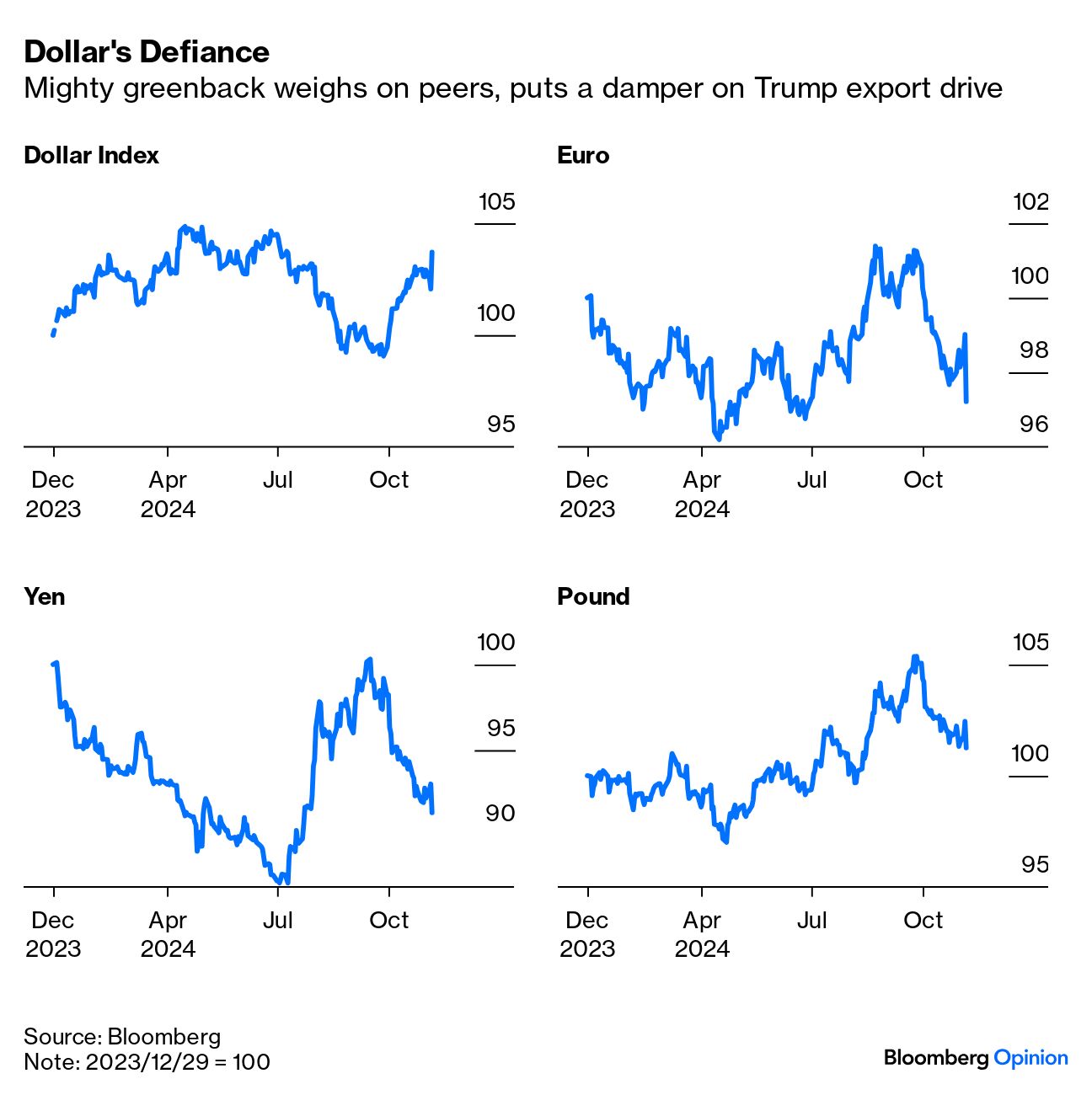

It's not settled who will control the House of Representatives yet, although it's fair to assume it will be the Republicans. Polymarket puts a 2.8% chance on a Democratic majority, which is about right. A surprise slipup for Republicans would trim the fiscal options (and move markets). The Trump Personnel Choices Who exactly takes the key posts? Much depends on exactly how much power the divisive figure of Musk is given. There is a range of possibilities to head the Treasury. Trump's picks for secretaries of State and Commerce and US Trade Representative matter hugely to his trade agenda. The Trump 1.0 economic cabinet was initially staffed largely by Goldman Sachs veterans. That's unlikely to happen again, but it's still unclear exactly how far he'll go in appointing ideologues. That will greatly determine critical choices in how the administration attempts to resolve the war in Ukraine (very early on); how far it goes in imposing tariffs (by summer); and how aggressively it cuts taxes (probably clear before Congress convenes in the fall). US-MCA Renegotiation The US-Mexico-Canada Agreement, the readustment of the old Nafta treaty that Trump signed in his first term, includes a clause that the nations must review progress and decide whether they want to continue with it on July 1, 2026. The USMCA might make it harder for the US to clamp down on "near-shoring" in which companies previously based in China move production to Mexico. As thwarting near-shoring appears to be a Trump priority, the chances are that the USMCA will soon be established as the next big set-piece for his agenda. Next year will see the first wave of tariffs and their response; then comes the opportunity to renegotiate the treaty with Mexico and Canada. The Next Fed Chair Jerome Powell's mandate at the Federal Reserve runs until May 2026. He has said that he won't resign before then, and Trump has said he won't be reappointed. This shapes up to be the truthiest moment of truth. Assuming Trump doesn't test the bounds of his power by firing Powell, or forcing him to resign, the new administration will have enough time to thrash out how it might want to change the Fed's independence in future by the time the chair steps down. The White House would be expected to name its candidate before the end of 2025 — at a point when it will have fired the opening volley of tariffs, and written tax changes into law. Thus there should be clarity over A) whether inflation really is brimming up again, and B) what the incumbent Fed intends to do about it. Arguably, Paul Volcker laid the foundation stone for the prosperity of the 1980s and 1990s by convincing the markets that a credible independent central bank could be an adequate replacement for the gold standard. This will be the moment when the Trump administration might just attempt to establish a new anchor for the financial system. The next president takes a zero-sum attitude to global relations. There's room for argument about whether this is in Americans' best interests. But in foreign exchange, a zero-sum mentality is necessary, and the currencies of US partners have shifted to make the US less competitive: This is a big problem. The centrality of industrialization to Trump's reelection bid means he cannot afford a strong dollar. Is there an easy fix? Not quite. Societe Generale's Kit Juckes notes that accommodative fiscal policy — when gross domestic product growth has averaged almost 3% in the last five years — further dims the chance of a weak dollar. Trump cannot have his cake and eat it: Throw in trade tariffs at a time when the unemployment rate is only at 4.1%, and he won't get a weaker dollar any more than Ronald Reagan was able to in the first half of the 1980s. But maybe the slightly depressing news is that while a weaker dollar is unlikely in the near term, we are likely to see it remain in the relatively narrow range of the last couple of years. It is strong, and it's staying strong until US policy (easier fiscal policy and tighter monetary policy than its neighbors) changes.

Juckes suggests that a Plaza Accord-style devaluation (in which central banks coordinated to weaken the dollar in 1985) is inconceivable. Gavekal Research's Will Denyer lists a host of other options, including capital controls. However, this is harder than it seems, given the dependence of the US government and corporate sector on foreign capital. (As Steve Blitz of TS Lombard describes it, the rest of the world lends the US money with which to buy their exports; it will be difficult to get rid of one without the other.) Denyer says: Trump could use the threat of tariffs as a negotiating tool in an attempt to get other countries to revalue their currencies. However, in the absence of broader economic policy shifts, it is doubtful whether currency intervention — even multilateral intervention — will materially weaken the US dollar... There is a sizable probability that loose fiscal policy and sticky inflation will keep monetary policy relatively tight, supporting the US dollar and confounding Trump's aim of weakening the currency.

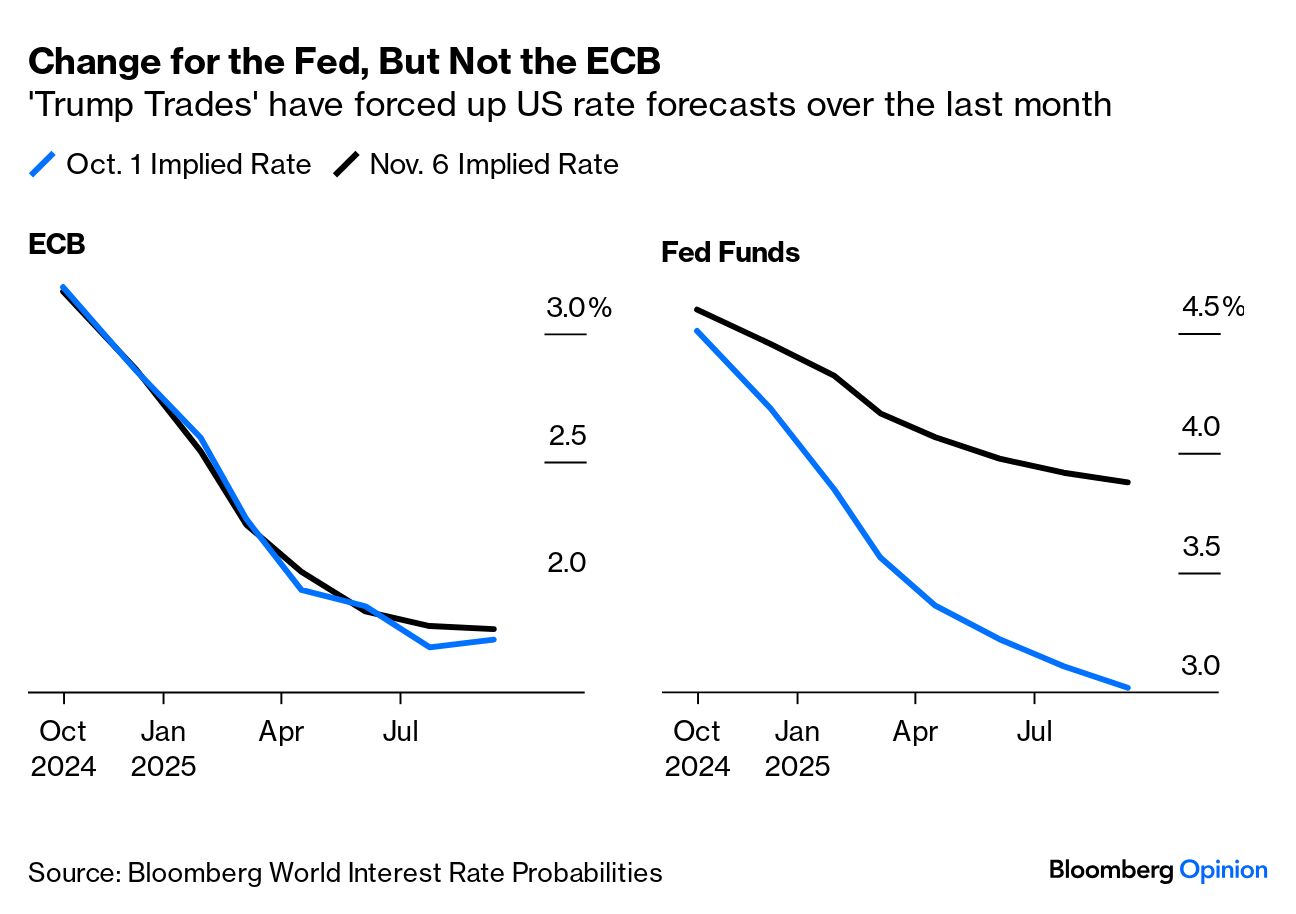

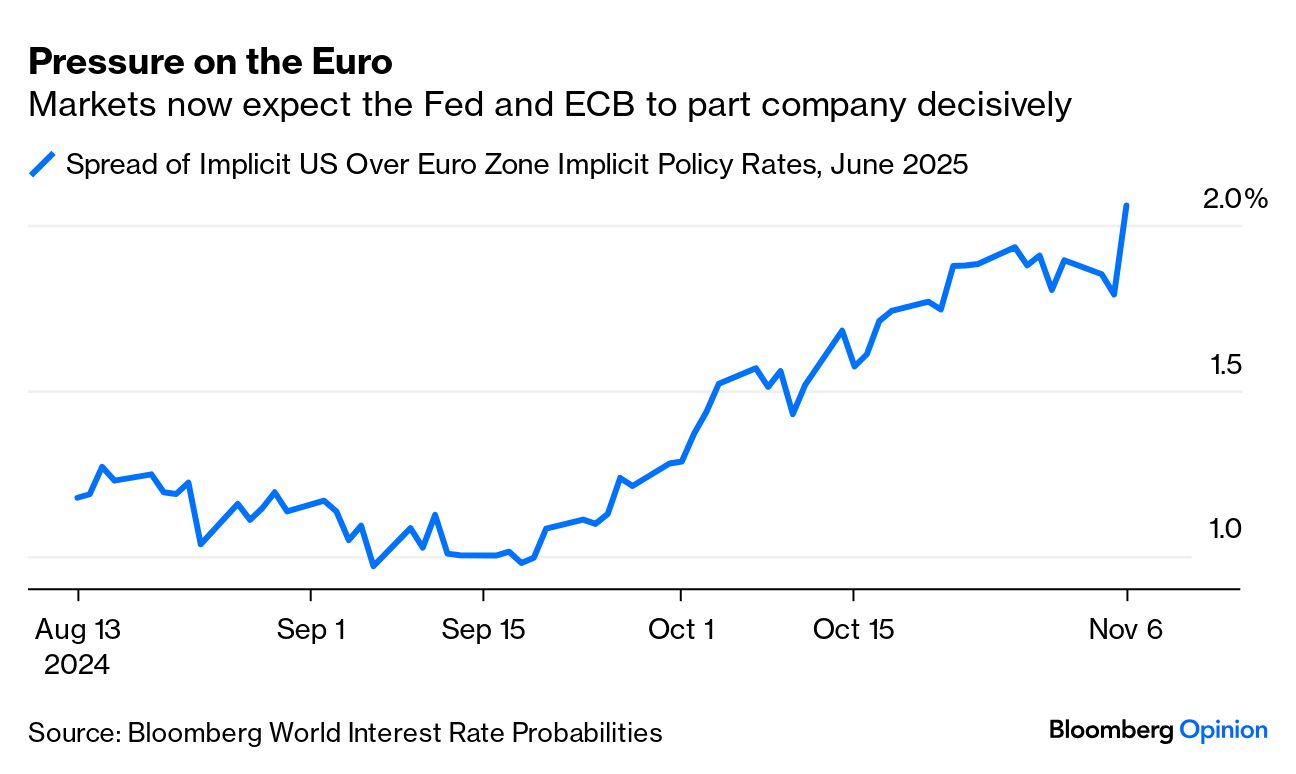

China, as ever, is the critical player. It let the yuan fall 1% against the dollar Wedensday, its biggest decline in almost two years. The MSCI index of emerging markets, both within and without China, slumped after the polls. The impact of the stimulus announced on the eve of the recent Golden Week holiday continues to dissipate. The standing committee of the National People's Congress started a meeting on the economy Monday. The timing to coincide with the US election was deliberate, and the proposals to emerge could be a crucial sign of China's strategy: The implications for changing US monetary policy are also roiling the world. Compare how expectations (embedded in the overnight index swaps market) for policy rates at the Fed and the European Central Bank have changed since the start of last month — the ECB's projected course is unchanged, while expected cuts to fed funds have been reined in drastically: Viewed another way, this is how the gap between expected rates for the two central banks as of June 2025 has moved over the last few months. There's another problem, which economists call "crowding out." If the US is spending and borrowing more, that will crowd out borrowing by other governments. With rising US yields, other jurisdictions must offer creditors more, which can hurt. The ructions in the UK gilt market, ahead of Thursday's Bank of England meeting, are a foretaste. The market doubts that the UK can borrow as much as it wants to, and by pushing up gilt yields — the effective interest rate the government must pay — they can make this a self-fulfilling prophecy. Then there's Germany, whose coalition government fell apart Wednesday after Chancellor Olaf Scholz fired his finance minister, Christian Lindner, who comes from the rival Free Democrats, and called a snap election. The problem was a breakdown in trust over how to deal with Germany's intractable fiscal difficulties, exacerbated by surging global bond yields. The recent history of European governments calling early elections is not encouraging. It's been tried this year in both the UK and France, and it didn't work out well for the incumbents (now-former Prime Minister Rishi Sunak and the weakened President Emmanuel Macron). The greater Germany's difficulties dealing with a strong dollar, the greater the risk of political backlash.

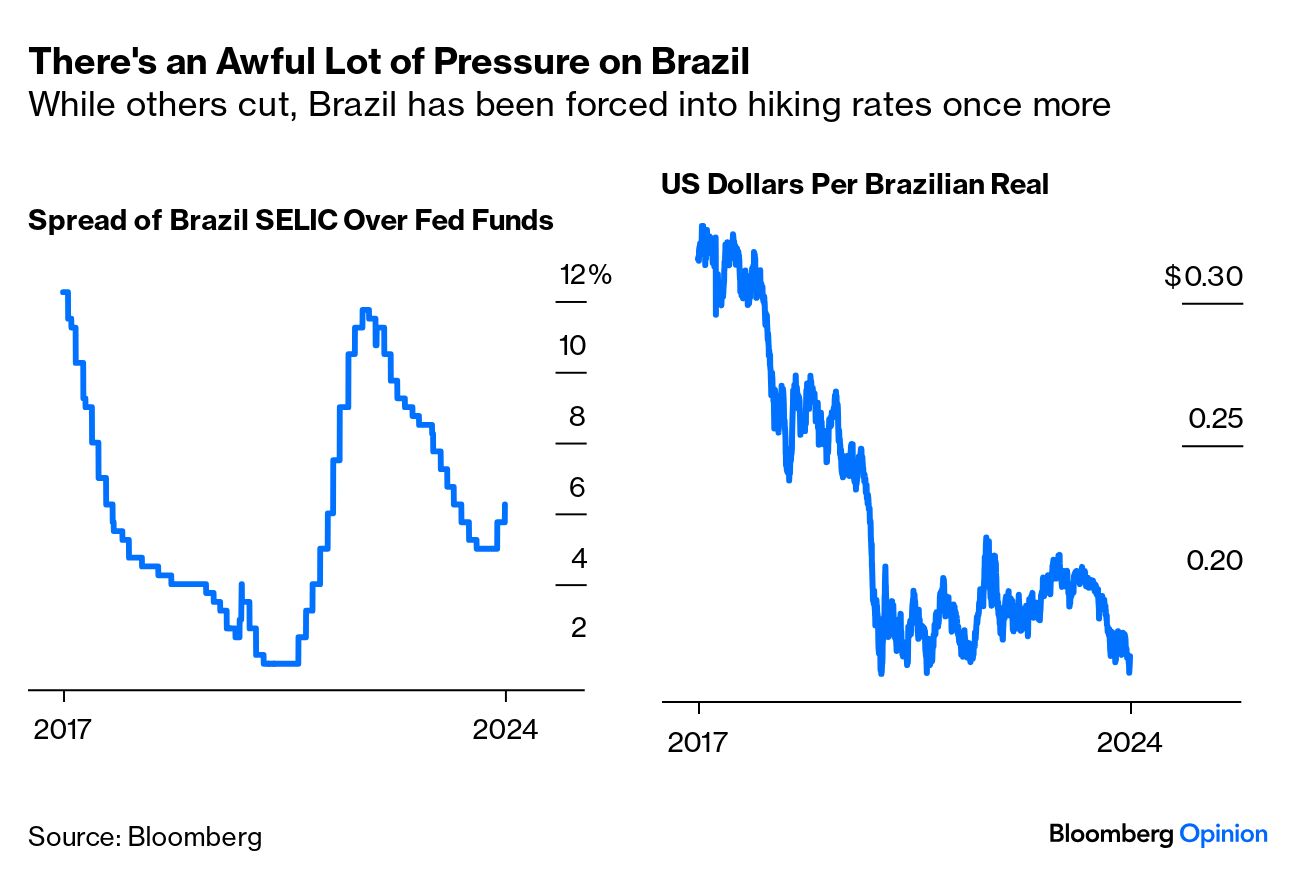

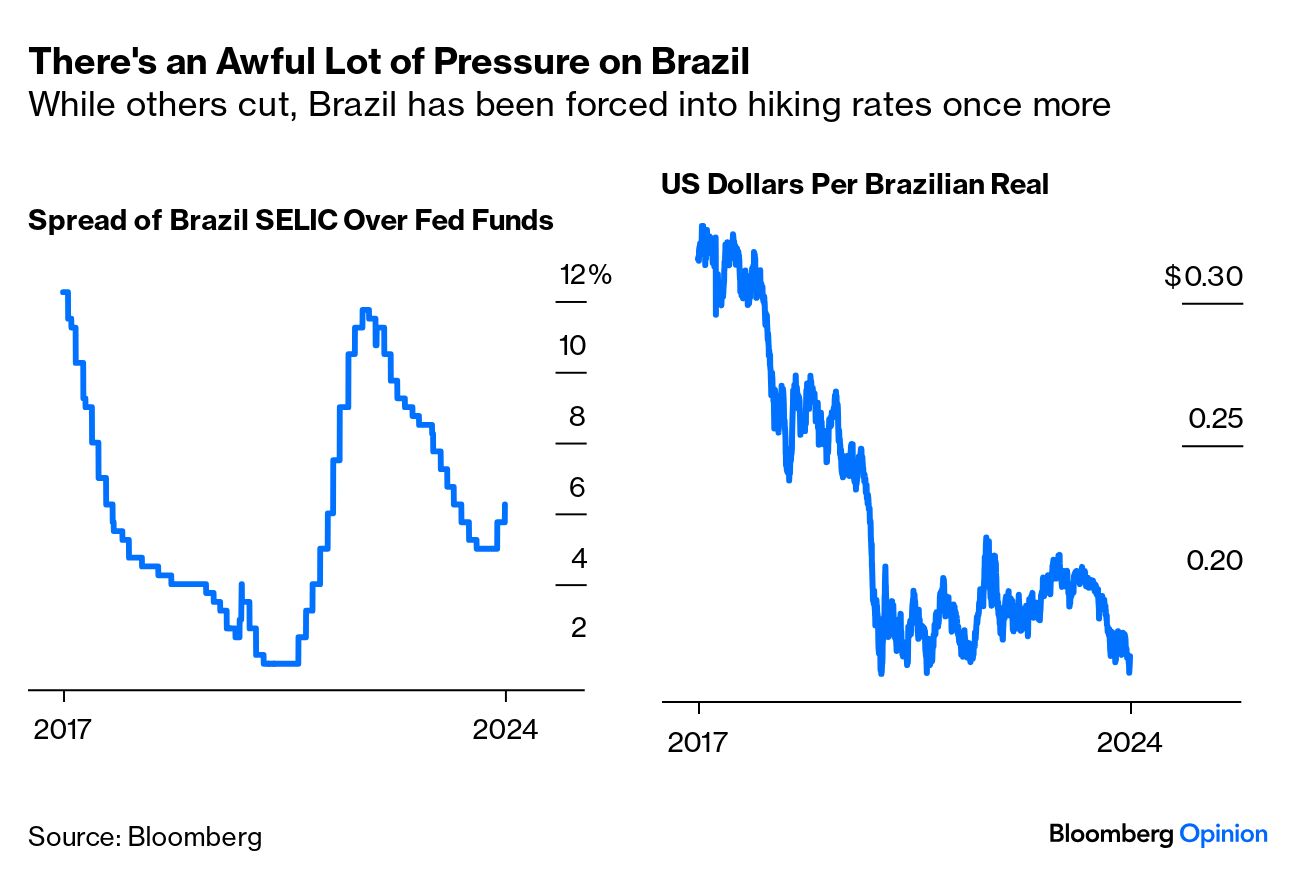

And finally, Brazil. Investors are dubious as to whether the government can really get away with the borrowing it plans to do. That's created pressure on the currency, bringing it back to pandemic-era lows, which on Wednesday night prompted the central bank to raise its policy rate by 50 basis points:

Brazil had pulled off a great balancing act, hiking early to control inflation and embarking on an easing. Moving into reverse isn't good. Be prepared for Trump 2.0 to cause problems like this elsewhere. —Richard Abbey During the campaign, Survival Tips offered a list of the songs that the Trump team wanted to play at rallies, but faced opposition from the artists. It was a darn good list, and we can only hope there's a job for Trump's DJ at the White House. This seems a good time to air them again. The specific song the DJ wanted to play is linked in each case: Adele, Abba, Bruce Springsteen, Beyonce, the Beatles, Creedence Clearwater Revival, the Rolling Stones, Rihanna, Phil Collins, Pharrell Williams, Neil Young, Eddy Grant, Panic! at the Disco, R.E.M., Guns N' Roses, Celine Dion, Isaac Hayes, Foo Fighters, Tom Petty and the Heartbreakers, Prince, Leonard Cohen, the Smiths, Queen and White Stripes. Listen to that lot and it will get you pumped to buy some crypto. Or at least it might cheer you up.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment