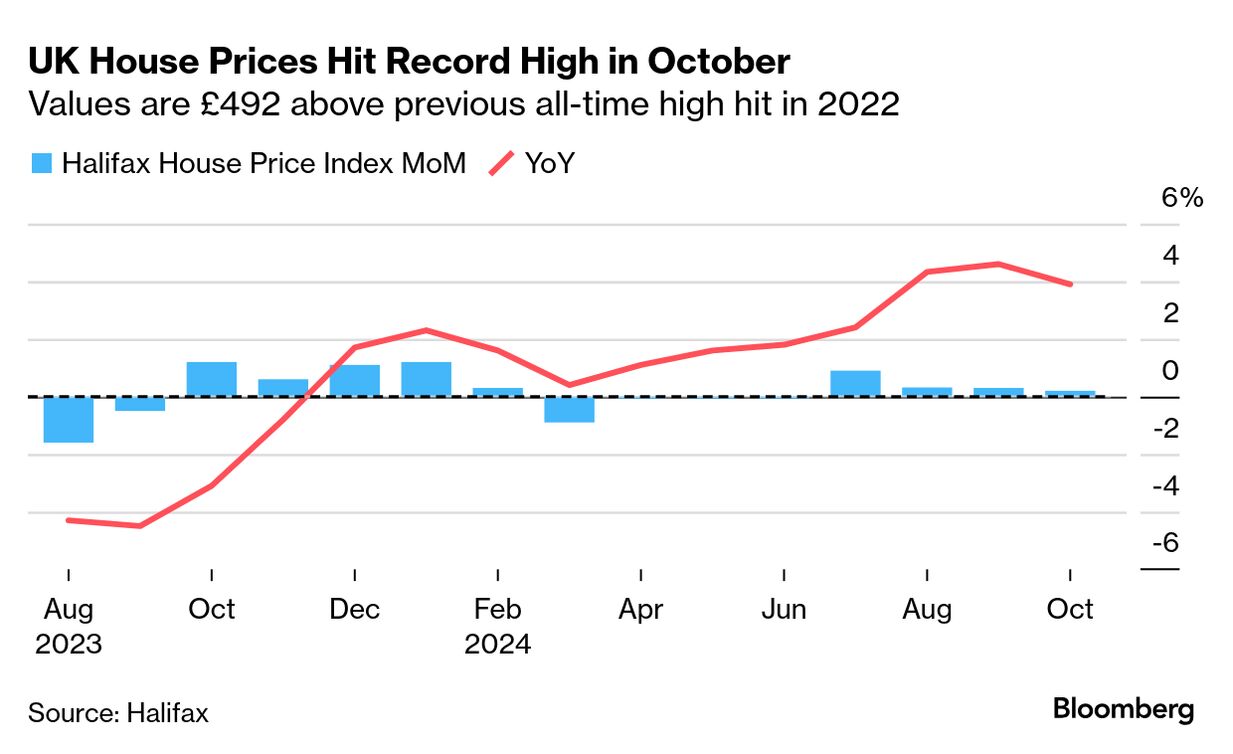

| Morning, I'm Louise Moon from Bloomberg UK's breaking news team, bringing you up to speed on today's top business stories. At first glance, indicators point to a pretty bullish housing market. Taylor Wimpey said today it expects to complete 10,000 homes this year, at the top end of guidance, with "strong underlying demand for the homes we sell." The housebuilder welcomed the government's moves to tackle a chronic lack of supply in the UK and reform the planning system. Shares inched higher. Meanwhile, on the pricing side, fresh Halifax data this morning shows house prices hitting a record high last month, boosted by cheaper mortgages. But, as ever, there's a catch. Price increases have slowed over the past year, and Halifax now predicts only modest growth. Why? Well, despite expectations that the Bank of England will cut rates again later today, hopes of another cut in December have largely faded due to worries that Rachel Reeves' borrowing spree will fan inflation. More on that from David Goodman below. And homebuilders are concerned. Taylor Wimpey noted "uncertainty" around the budget, while rival Persimmon yesterday flagged rising costs. The latter's shares tumbled, ending the day down around 8%. Tomorrow we get an update from Rightmove, where eyes will be on more than just floorplans. What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment