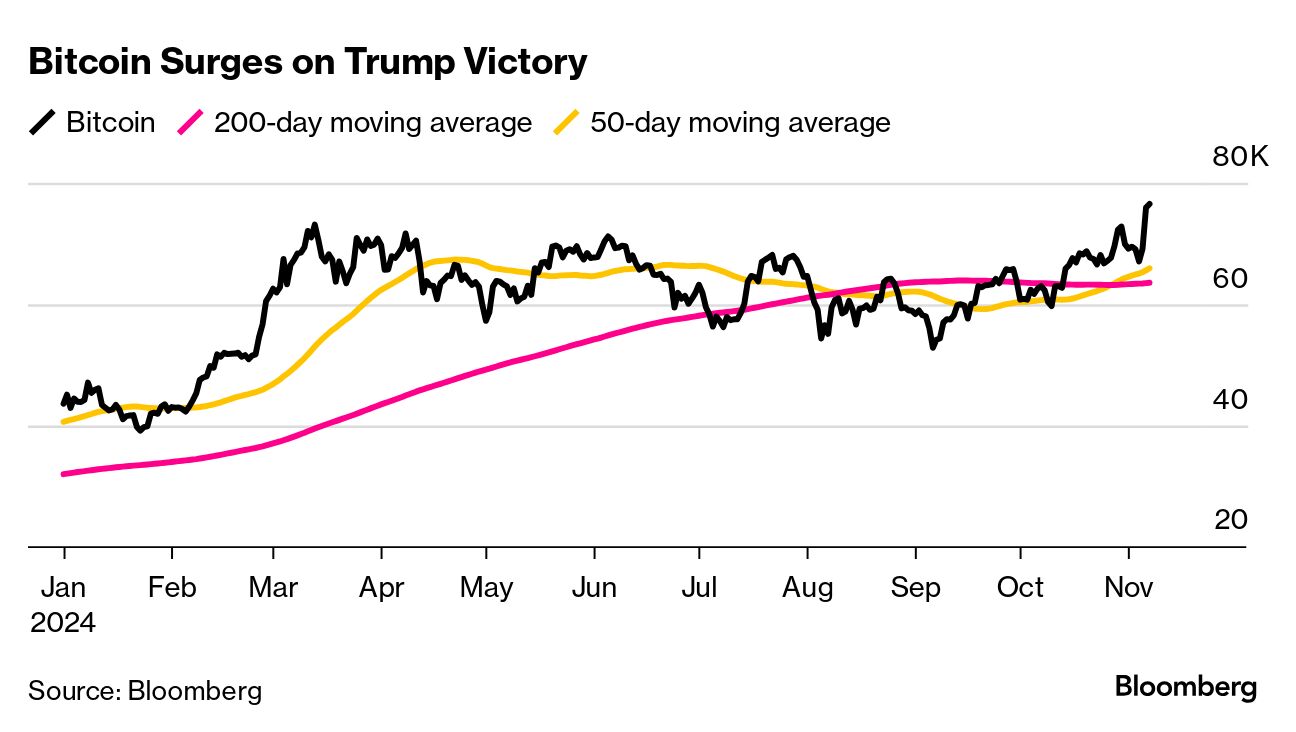

| There were two big votes this week with implications for your finances. Donald Trump won the presidential election. And on Thursday, the Federal Open Market Committee announced it was cutting its benchmark rate by a quarter percentage point. Both generated a lot of noise. Financial advisers say you can tune most of it out. But not all. There are important — in some cases counterintuitive — factors to mind as you reevaluate your investments and goals in an environment certain to change. Let's deal with Trump's win first. The markets responded in force. The S&P 500 reached record highs. The dollar posted its biggest gain against major currencies since 2020. Bitcoin surged. All this was driven by the idea that Trump's proposed economic policies — namely lower taxes and fewer regulations — will be a boon for business, with tariffs potentially boosting domestic manufacturing. But if you're going to make a trade or even slight portfolio tweak to adjust for a political shift, remember to check the data and not just your gut. That's the gist of some compelling work by John Rekenthaler, vice president of research for Morningstar. He shows, for example, that while people assume a Republican administration would be good for oil stocks and a Democratic one good for clean energy companies, the opposite actually happened if you look back at Trump's first term and then Biden's. Under Trump, oil and gas stocks sank, but then rose during Biden's term. Clean energy stocks perhaps paradoxically thrived under Trump, then suffered under Biden. Remember also to think beyond campaign talking points as you reassess your spending plans. On the stump, both candidates talked about lowering prices. But don't hold your breath — or hold off making purchases you need — waiting for them to come down dramatically. "Trump's policies could fire up inflation," noted Dan Coatsworth, an investment analyst at AJ Bell. He points out that big tariffs on imported goods could increase costs, as could a draconian approach to immigration that drives up companies' labor prices. Inflation brings us to the Federal Reserve, which has been in a years-long battle to dampen it. On Thursday, it announced its plans to lower the federal funds rate to a range of 4.5% to 4.75%. The adjustment follows a larger, half-point cut in September. That "jumbo" cut spurred hopes that inflation had finally faded and the housing market might exit a deep freeze. Neither has panned out quite as expected. So what could today's cut mean for you? Immediate housing-market relief is unlikely. Mortgage rates track Treasury yields, which have risen in recent weeks as traders positioned for a Trump victory. As a result, borrowing costs for housing have continued to climb, even after September's cut. "I would not want to be a first-time home buyer," Mark Struthers, financial planner at Sona Wealth, wrote to me today. Because mortgage rates are so tied to the 10-year Treasury, Struthers sees them continuing to rise as the bond market gets a sense of debt, deficit and growth going forward. "Home buyers may have to start living with higher mortgage rates even as other rates drop. They may not go up too much more, but they may not go down too much, either." Also frustrating for those looking to save for homes or other purchases: The cut is likely to eat into the interest you get from your high-yield savings account. On the fixed-income front, Lauren Goodwin, economist and chief market strategist at New York Life Investments, sees a potentially fruitful set of circumstances. "Policy interest rates are moving lower, but still-strong growth may mean the Fed moves more slowly than investors once thought," she said. "Lower rates boost borrower health, but still-moderate interest rates result in attractive investor yield." And to tie it all together, I asked Alvina Lo, chief wealth strategist at Wilmington Trust, what she sees as having a bigger effect on the everyday person's financial life: Trump's win or the Fed's cut? She said it comes down to timing and scope. "A new (returning) president will likely make a bigger policy impact that will take time to filter down to the everyday person's financial life," she said. "In contrast, a rate cut could have more immediate impacts in terms of lower costs of lending and interest payments." I take that as a strong case not to overreact and to make changes as a result of real policy shifts rather than slogans. — Charlie Wells P.S. Send questions about your own financial dilemmas to bbgwealth@bloomberg.net. We may get expert answers for you, and feature your question and the answer in an upcoming newsletter. Bitcoin jumped to a record high. Its surge was part of a wave of trades across global markets in response to Trump emerging victorious over Democratic rival Kamala Harris. Bitcoin's prior peak was in March, when investors were buoyed by inflows into US Bitcoin exchange-traded funds. Bitcoin is viewed by many as a so-called "Trump trade" because the former president embraced digital assets during his campaign after a major push by the industry. Yields on US government debt spiked to the highest level in months. The 10-year Treasury yield, the risk-free benchmark that anchors more than $50 trillion in global dollar-denominated fixed-income securities, soared by almost a quarter point Wednesday to reach 4.48% at one point, the highest since July. The higher yields come as policies proposed by Trump are viewed as likely to ignite inflation and swell the national debt. Higher borrowing costs could in turn filter into the next administration's economy, slowing growth and other markets. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Elon Musk was the biggest gainer in dollar terms. The world's richest man, Trump backer and chief executive of Tesla added $22.2 billion to his fortune, bringing it to a total of $290.3 billion. Tesla shares soared this week after Trump's win. Mark Zuckerberg was the biggest loser in dollar terms. Much of the Meta co-founder's wealth is tied up in the company's stock, which slumped after the company warned of worsening AI losses in an earnings report last week. Zuckerberg clocked a $6.8 billion loss, bringing his net worth to $209.3 billion. He is still the world's third richest person. Overall, Trump's win sparked a record $64 billion gain for the world's 10 richest people. Much of the gains for the ultra-rich come down to a surge in US stocks, underscoring bets that Trump, on his return to the White House, will implement an agenda favoring lower taxes and less regulation. US Mortgage Rates Rose (Yet) Again The climb is putting a damper on refinancing and homebuying activity. The average rate on a 30-year mortgage increased 7 basis points this week to 6.79%, the highest since July, according to Freddie Mac. It was the sixth straight weekly increase. Overall, rates have surged 70 basis points since Sept. 19, the day after the Fed's jumbo cut. Tom Ford Bought a Pricey New Pad in London American billionaire Tom Ford has bought a mansion in London's high-end Chelsea district for more than £80 million ($104 million), making it the UK's most expensive home deal this year.  Photographer: Dia Dipasupil/Getty Images North America The fashion designer purchased the property — nestled in a neighborhood famous for its stucco-fronted mansions — this summer, according to people familiar with the matter who weren't authorized to discuss the transaction. A representative for Ford declined to comment. This week, we're looking for people who have tried out financial therapy. If you have seen one of a growing number of financial therapists with the goal of helping you sort out your relationship with money, we'd love to hear from you. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. |

No comments:

Post a Comment