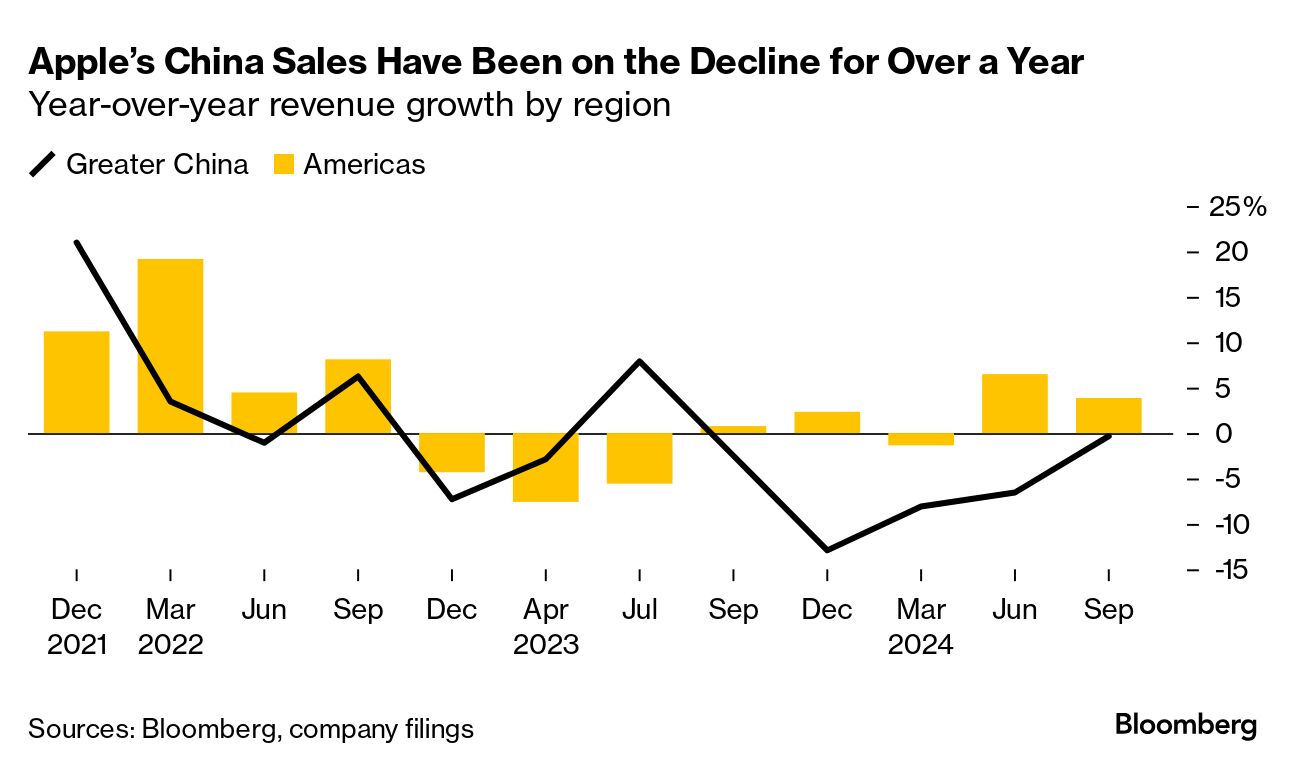

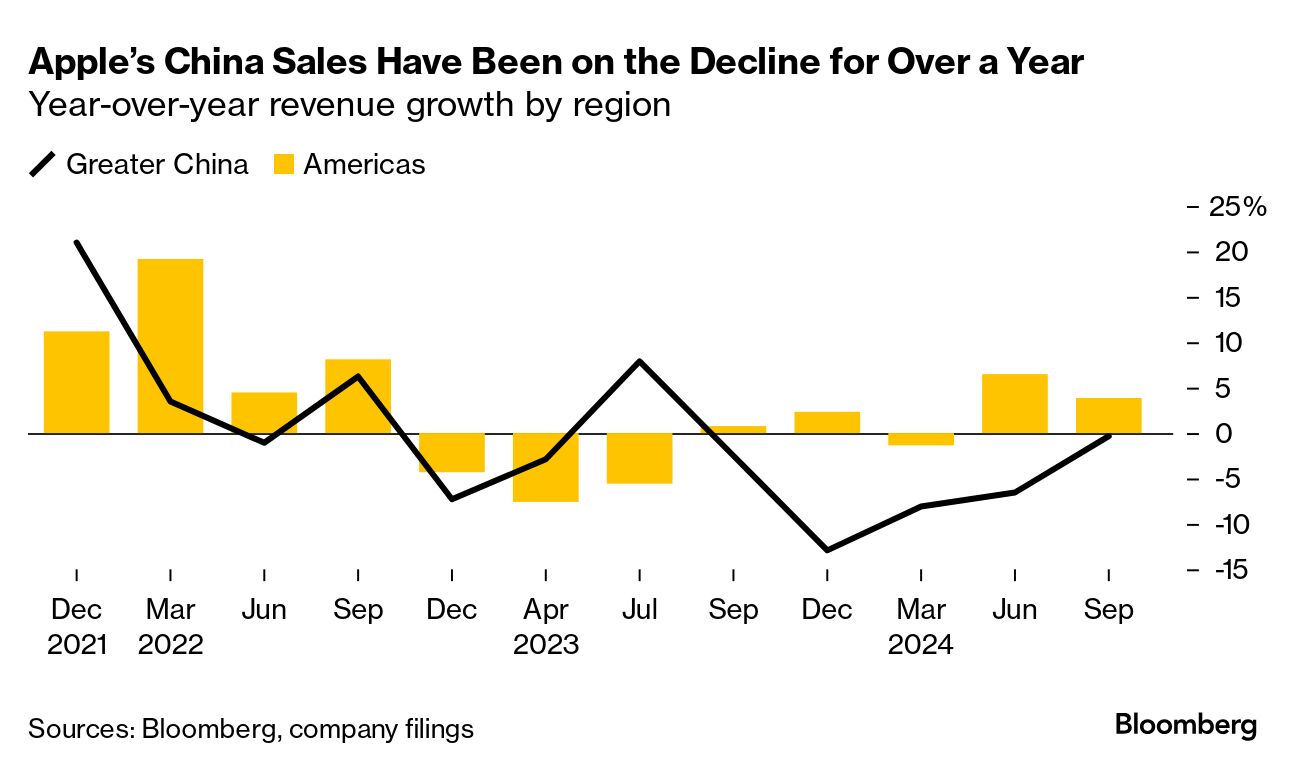

| Apple disappointed investors with a tepid sales forecast and lingering concerns about the intensely competitive China market as the company heads into its most critical sales period of the year. Traders have been betting that Apple Intelligence—its new suite of AI features—will help fuel demand for devices. The quarter was brighter for Amazon, which reported strong results as cost-cutting and investments in technology infrastructure put it on firmer footing. Intel sparked optimism that it's capable of reclaiming some lost market share after the chipmaker's earnings outperformed. Still, Intel and Samsung have shed a total of $227 billion in market value this year on their lack of leadership in AI.  Boeing and union leaders reached a tentative agreement to end a lengthy labor dispute that's throttled the company's aircraft production. The agreement would boost wages by 38% over four years and give workers a $12,000 signing bonus if approved. Bloomberg Opinion's Thomas Black says strikers should accept the latest offer. Across the Pacific, Japan's largest brokerage firm Nomura reported profit that beat estimates, despite recent scandals including a spoofing case and an attempted murder arrest. Markets will be focused on the US jobs report today, although the numbers may not significantly impact the Federal Reserve's decision on interest rates, with a quarter-point cut still expected at the November policy meeting. Forecasters expect the unemployment rate to remain steady at 4.1% despite temporary hiring disruptions from storms and strikes. Meanwhile, Canada's West Coast ports are bracing for strike action on Monday. The shutdown would include operations in Vancouver, the country's busiest port.

Residential buildings in Qingdao, China. Photographer: Raul Ariano/Bloomberg In China, home sales saw their first monthly rise this year in October as the government's latest stimulus blitz brought back buyers. There were more signs that the economy has stabilized somewhat as last month's factory activity exceeded analyst expectations. China is bracing for a potential Trump victory and higher tariffs on its goods, which Goldman Sachs economists say could dent growth and prompt Beijing to step up fiscal support. And don't miss this story on the growing deterioration in people-to-people ties between the US and China. Oil jumped following a report that Iran may be preparing to attack Israel from Iraqi territory in the coming days, jolting the market's attention back to a potential flare-up of Middle East hostilities. Closer to home, US oil production jumped to a fresh monthly record in August, in what is likely to make OPEC's decision on whether to return supplies to the market more complicated. |

No comments:

Post a Comment