| Hi, it's Dina Bass in Seattle. The AI boom is affecting Microsoft in a few unanticipated ways. But first... Three things you need to know today: • Apple's tepid forecast and struggling China business disappoint investors

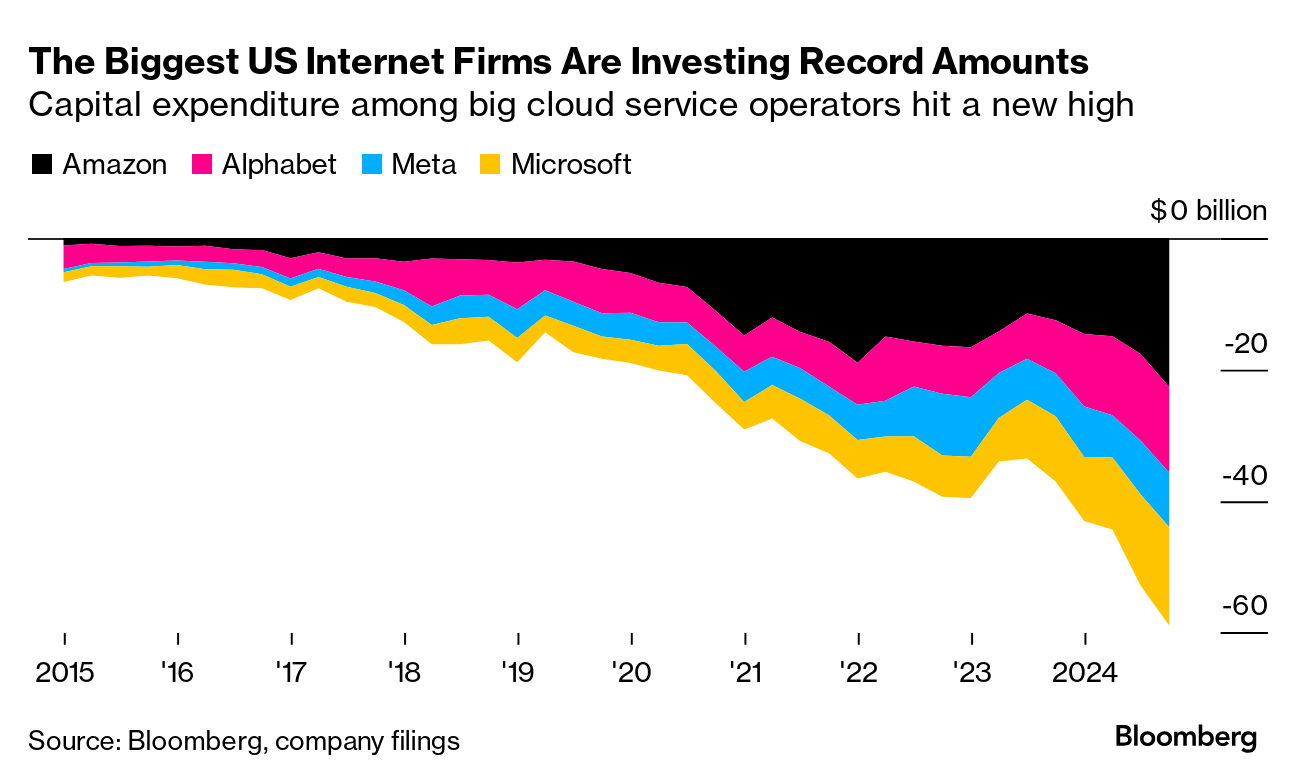

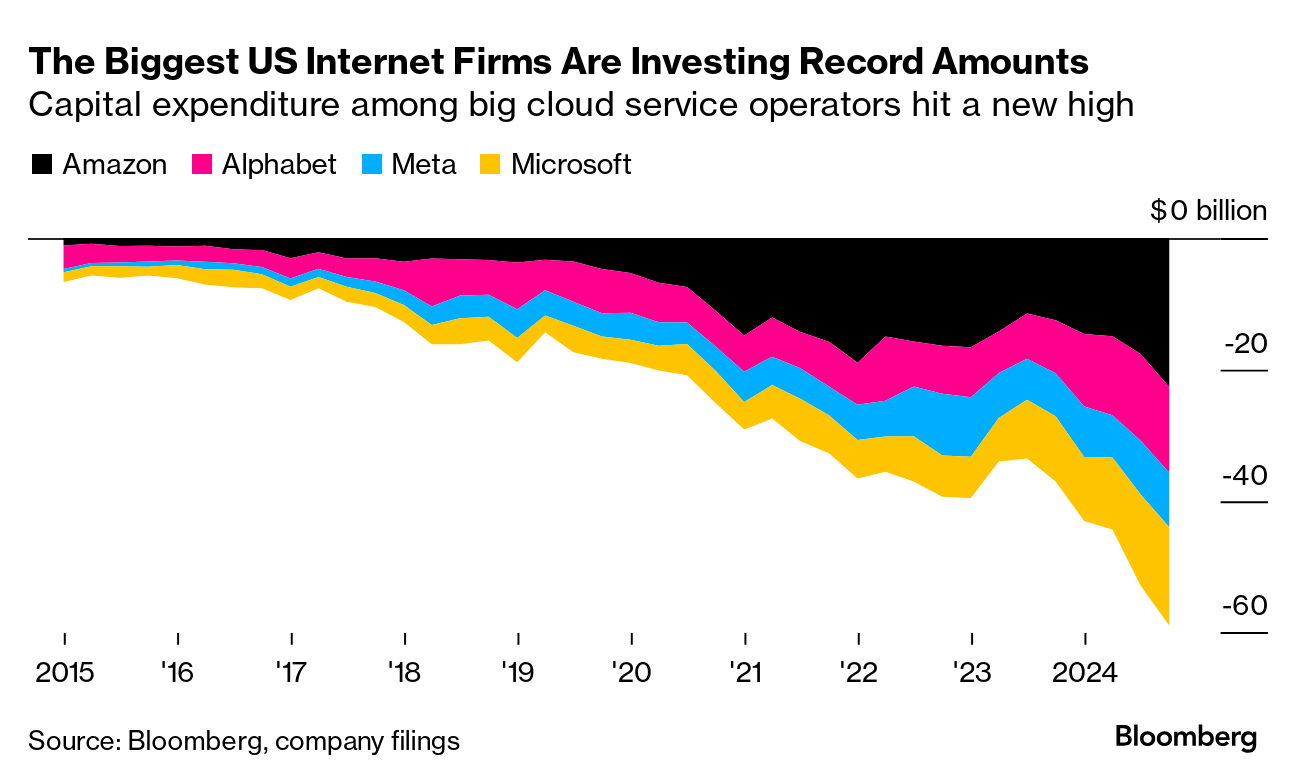

• Spanish fast-fashion chain Mango is using AI models in some ads

• OpenAI adds search features to ChatGPT in a challenge to Google Having too many people who want to give you money for your products is usually a high-class problem. But when it comes to Microsoft Corp., it's also an expensive one to fix. You see, Microsoft says it simply doesn't have enough data center capacity to meet customer demand for its artificial intelligence and cloud services. That's why Azure unit growth rates will continue to slow in the current quarter, a forecast that pushed its shares down Thursday in the biggest one-day drop in two years. To fix the issue, the software giant is pouring cash into building data centers at a quarterly rate — $14.9 billion for the three months ended Sept. 30 — that dwarfs what the company used to spend on capital expenditures in an entire year. Microsoft is not alone. During the same period, Alphabet Inc.'s Google plunked down $13.1 billion in capex, while Meta Platforms Inc. came in at $8.3 billion. Amazon.com Inc. was tops at $22.6 billion — and said it expects to spend $75 billion this year, with most of the money going to pay for cloud computing capacity at its Amazon Web Services unit. Gil Luria, an analyst at D.A. Davidson & Co., who cut his rating on Microsoft in September, on Wednesday referred to the AI capex situation as a "drunken bar fight." "There's some irrational escalation going on that at some point will come to a reckoning," Luria said. "But it may not be this week." Therein lies Microsoft's challenge. Some shareholders don't like all the spending and the potential impact on margins. But investors also don't like declining growth in Azure or the risk Microsoft could be overtaken by a rival in the generative AI market just as customers finally start to pay for these new tools. And Microsoft's most-valuable AI partner, OpenAI, which provides the models that underpin Microsoft's generative AI services, is certainly impatient with any shortfalls in the computing power it needs.  Generative AI, which creates text, video and images based on simple user prompts, is really inefficient in the way it uses computing power from a data center. Microsoft says it's focused on ways to fix that — better utilization of scarce graphics processing units and laying out servers and equipment to maximize performance and minimize how much energy and water is needed, for example. "We're really focused on being the most efficient provider of compute per megawatt," Chief Financial Officer Amy Hood said in an interview Wednesday. Hood and her team are typically masters at matching demand to data center expansion, but aspects of the AI race are foiling the usual strategies. Right now, only half of the company's spending on cloud and AI is based on customer demand, Hood told analysts on a conference call. The rest is going toward longer-duration assets like new data center buildings "that will support monetization over the next 15 years and beyond." The first part — chips and servers — can and will be adjusted if demand slows. Concrete and steel are harder to remove or repurpose. As Hood notes, Microsoft has done this sort of thing before, pointing to more than a decade ago when it had to switch from selling packaged copies of Office and Windows to renting out software stored in the cloud. It knows how to manage through the margin impact. Currently, the strategy is to spend big on capital expenditures, but rigorously scrutinize everything else, including personnel. If some people worry AI will take their jobs by doing their tasks, folks at Microsoft have faced a slightly different version where teams under pressure to constrain costs are laying off workers — so the company has funds to spend on capex for AI. Because there's one other thing Microsoft learned in the move from packaged software to the cloud: the cost of not being first. Fourteen years after Microsoft entered the infrastructure cloud market with Azure, Amazon still leads. Microsoft Chief Executive Officer Satya Nadella believes AI is a massive, generational tech shift, akin to the personal computer or the internet. That means the risk is investing too little, not too much.—Dina Bass A cyber prodigy defended companies against intrusion while continuing to amass data through a series of his own hacks. Then police burst into the Dutch coastal town of Zandvoor and arrested 20-year-old Pepijn Van der Stap. Peloton, struggling from a post-pandemic battering of its exercise business, tapped a former Ford and Apple executive as its new CEO. Samsung says it's making progress toward supplying advanced AI memory chips to Nvidia. Amazon's cloud unit and main e-commerce business produced strong results and led the company to give an optimistic forecast for the holiday season. |

No comments:

Post a Comment