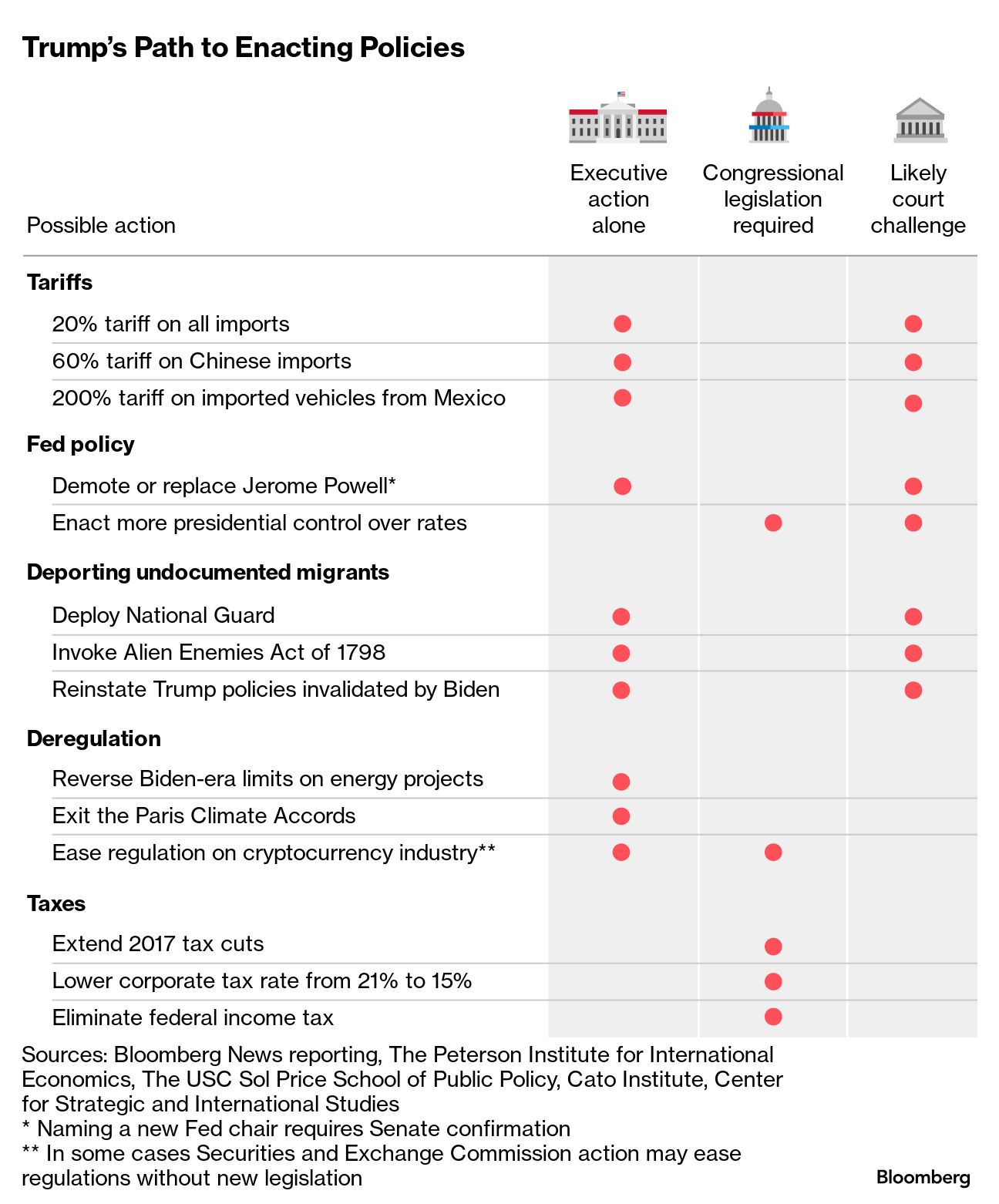

| For investors who plowed into stocks last week on speculation that Donald Trump's policies will bolster the economy, the challenge is to figure out which sectors will get a lasting boost. Tariffs, for example, could spark inflation and hurt large multinational firms, while potentially helping domestically oriented small-cap stocks. However, an immigration crackdown risks lifting labor costs, likely squeezing smaller businesses. The bond-market selloff unleashed by Trump's presidential victory last week ended almost as quickly as it began. Yet firms like BlackRock, JPMorgan and TCW Group have issued a steady drumbeat of warnings that the bumpy ride is likely far from over. Bitcoin rallied past $80,000 for the first time on Sunday, boosted by Trump's embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers. For many countries the prospect of Trump's return is less disconcerting than one might imagine, writes Mihir Sharma in Bloomberg Opinion. From India to Turkey to Indonesia, they are confident they will manage just fine — and perhaps even benefit more from their relationship with the US than they did under President Joe Biden. Foreign companies pulled more money from China last quarter, a sign that some investors are still pessimistic even as Beijing rolls out stimulus measures aimed at stabilizing growth. |

No comments:

Post a Comment