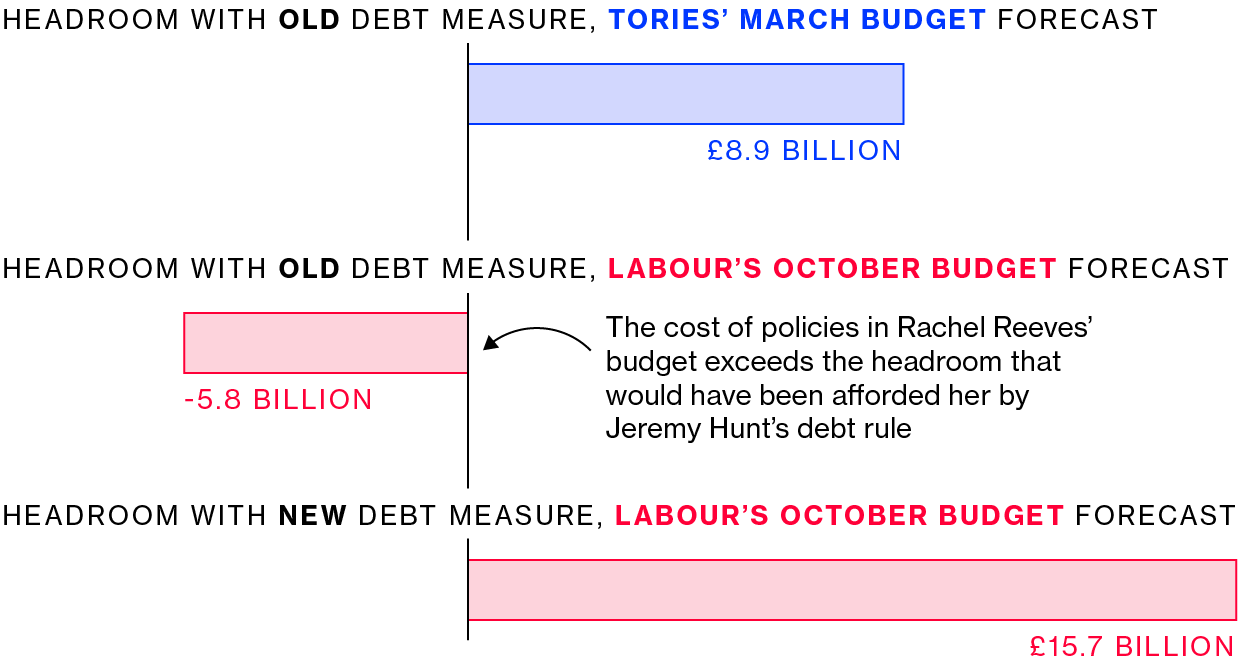

| Rachel Reeves can maybe begin to breathe a sigh of relief this weekend: the adverse market reaction to her budget has finally started to calm after rockiness yesterday that continued into the morning. Having built her reputation — and the Labour election campaign — on a promise of fiscal responsibility and economic stability, it has been quite extraordinary to watch the new chancellor try to calm a revolt in bond markets, as she did on Bloomberg TV last night. No, it has not been remotely near the scale of the reaction to the Liz Truss mini-budget she has so often criticized; but as my colleagues have emphasized, that's not saying a lot. Reaction from British business hasn't been particularly enthusiastic, either, with bosses giving "tepid" support to the budget, according to my collegaues. What was striking about the market reaction was that it happened despite the budget being extensively pre-trailed, including the decision to change borrowing rules to allow significantly more spending. But one of the surprises on Wednesday was how little headroom Reeves had left herself — only £15.7 billion. Now we know why, at least in part. In an extraordinary story from colleagues this afternoon, it turns out that Reeves was left £18 billion less headroom than expected due to an Office for Budget Responsibility error. It may have fueled the investor concerns we've been seeing in the markets since the budget. A footnote in the OBR outlook on Wednesday admitted that its March forecasts contained an error in the projections for public sector net financial liabilities. The number didn't matter so much when the OBR first did the calculation in March, but it became vitally important when it became Reeves' new measure of debt. (By the way, if you want to understand more about the budget and fiscal headroom, check out this graphics piece which breaks it down visually.) Crucially, reduced headroom means markets could have assumed Reeves started with more money for her budget this week, a misconception that may have helped fuel the selloff in gilts. As Dan Hanson of Bloomberg Economics explains: "The expectation in markets prior to the budget was that even if Reeves did borrow to invest, the changes to the debt metric would mean she would still be left with a healthy amount of headroom against her fiscal target. In the event, the headroom was wafer thin – that partly reflected Reeves borrowing more than expected but it was also a lot to do with the OBR overstating how much space there was in the first place." So that's something. It's been a difficult week for Reeves, but at least she can tell herself that the unfavorable market reaction she worked hard to avoid can't be entirely blamed on her. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment