| To get John Authers' newsletter delivered directly to your inbox, sign up here. - Odds are above 95% for Donald Trump to win the presidency.

- Republicans have gained control of the US Senate.

- Significant uncertainty surrounds the House — Democrats might just take control.

- Global markets think this means growth, higher rates, higher inflation and a strong dollar.

- AND something to cheer up the half who need it.

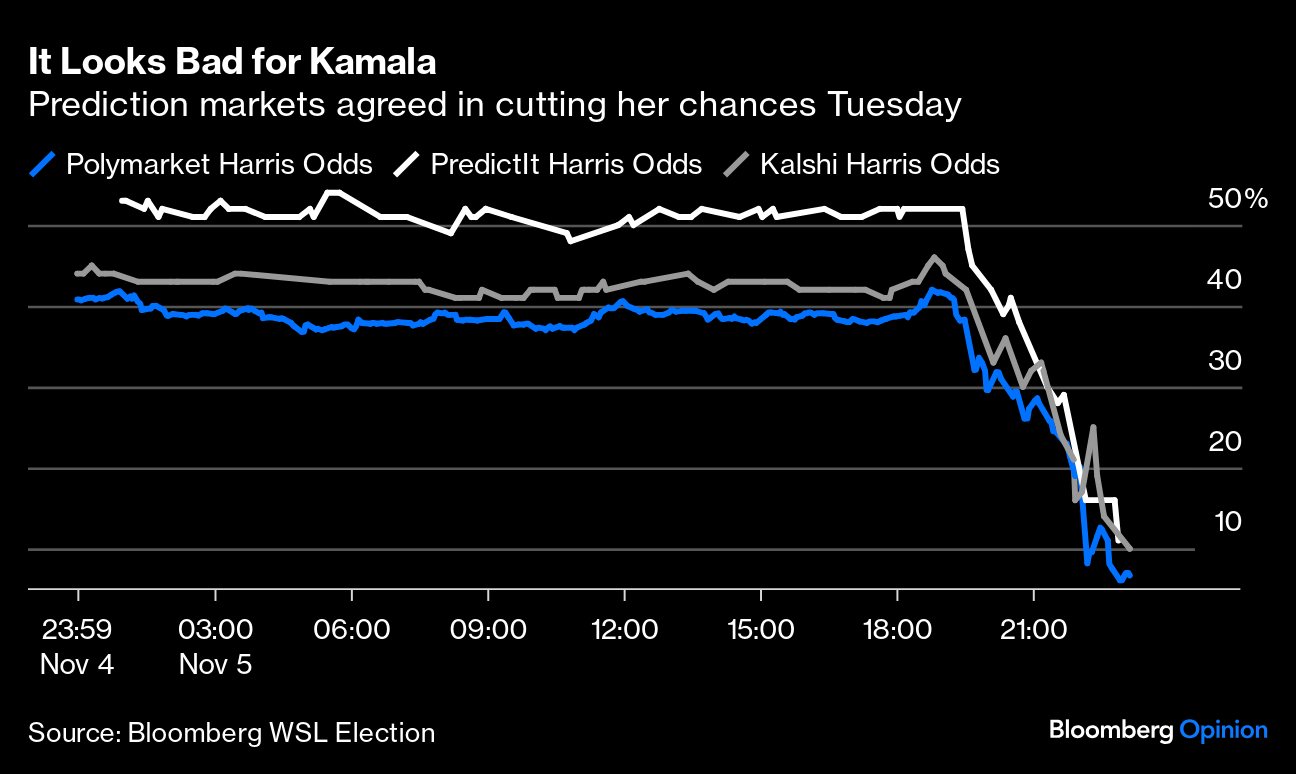

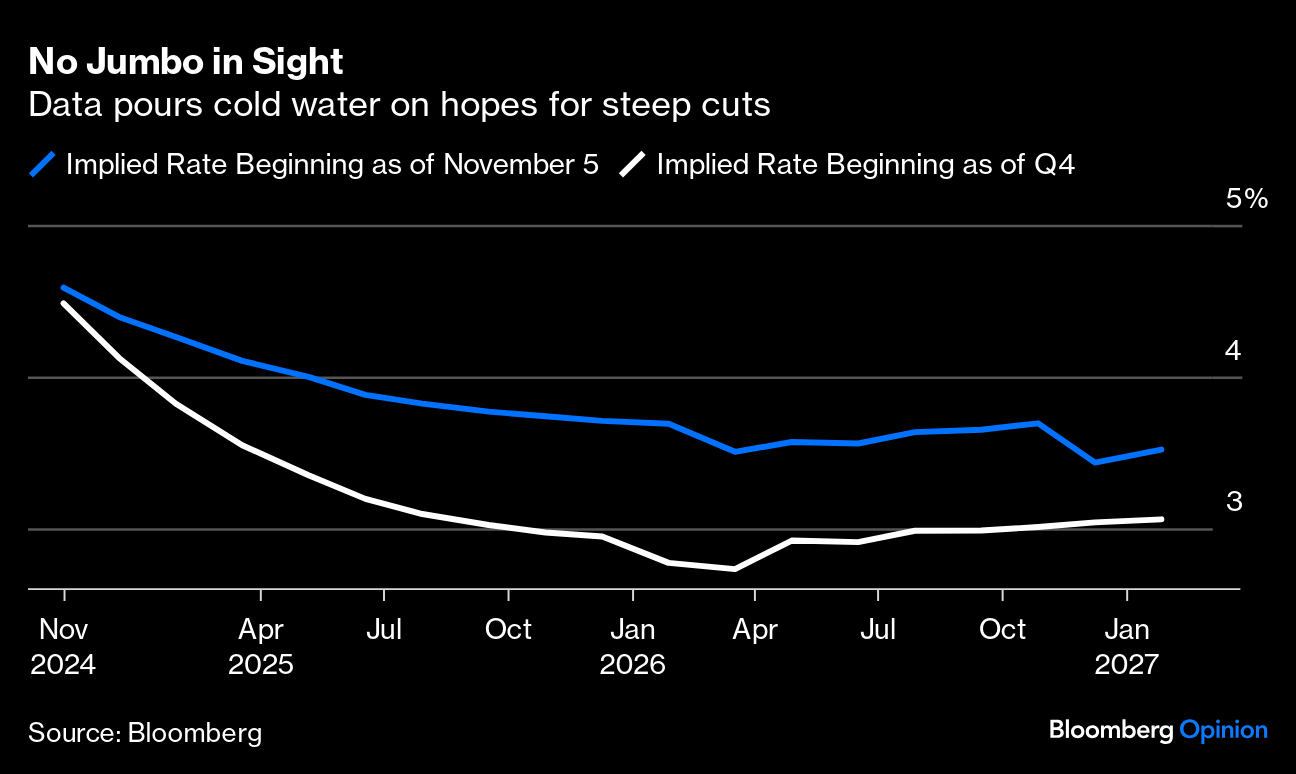

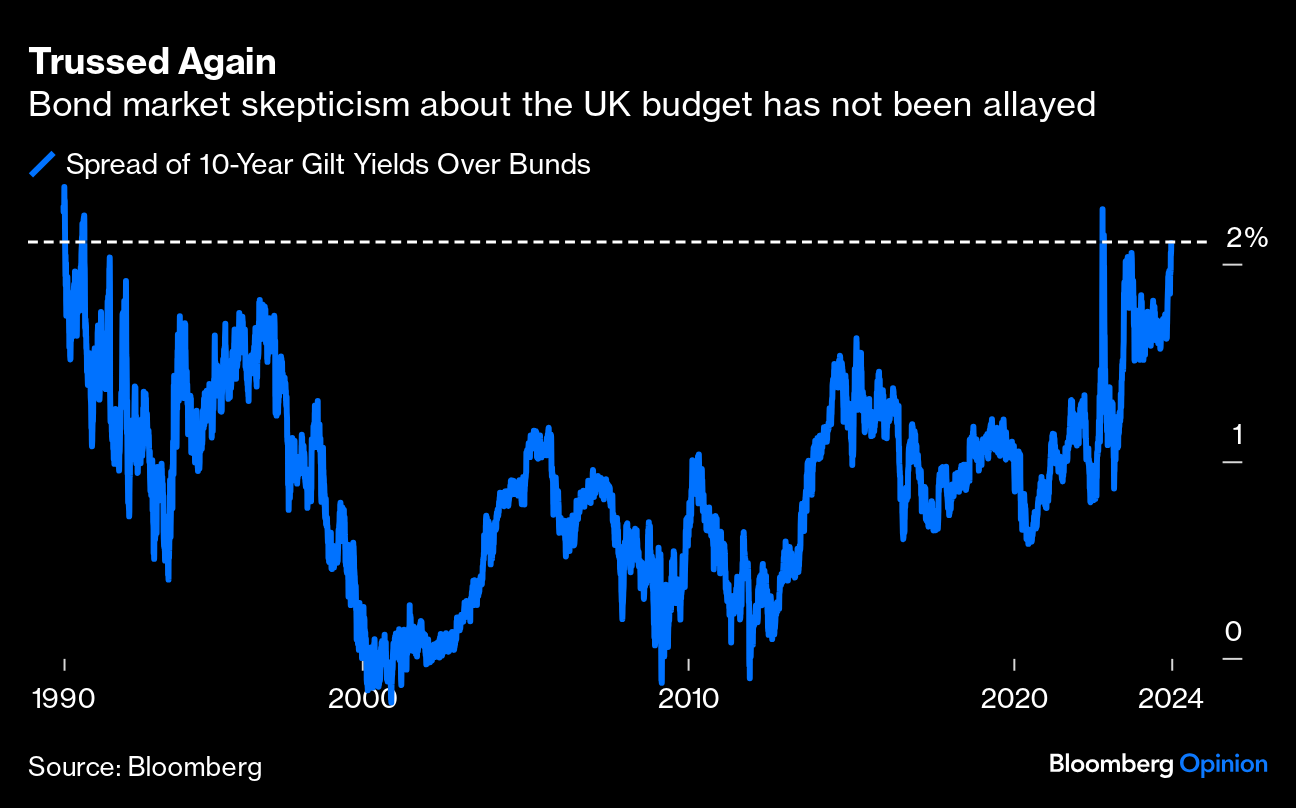

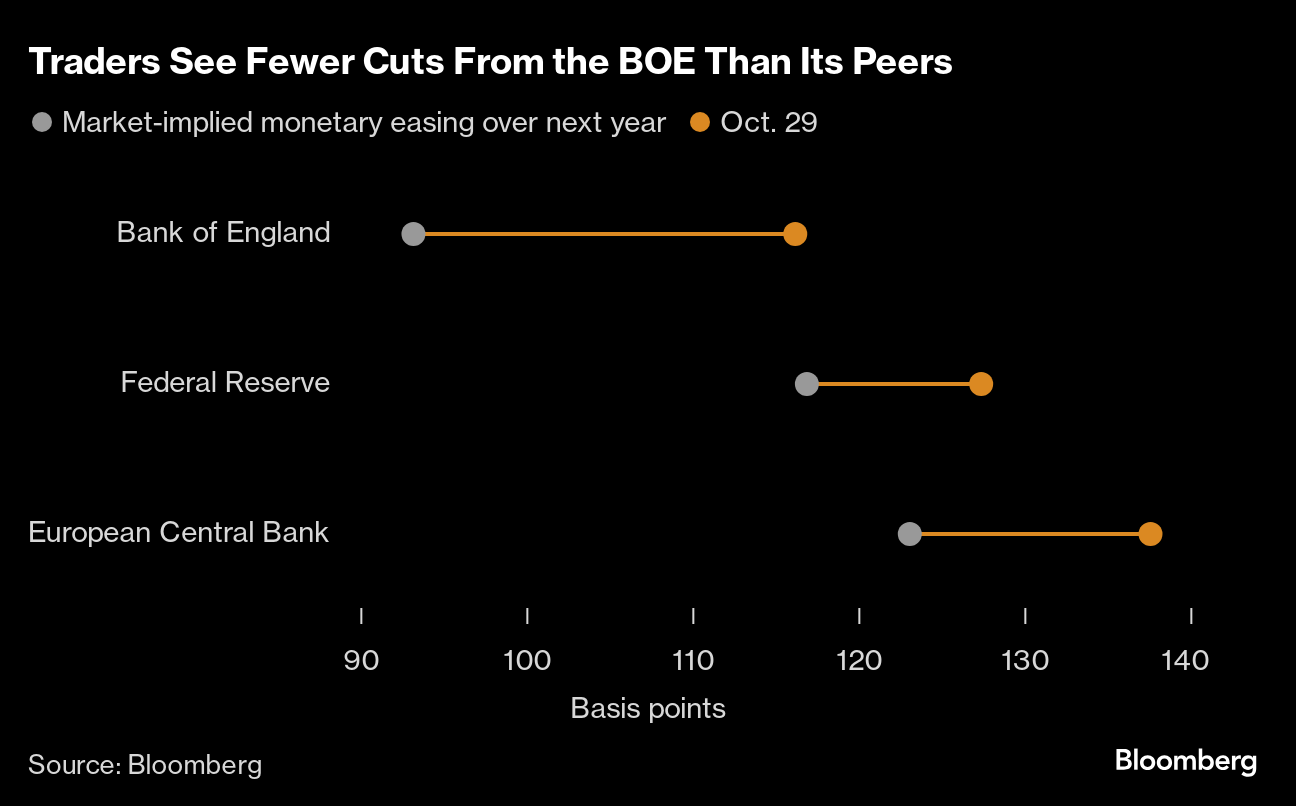

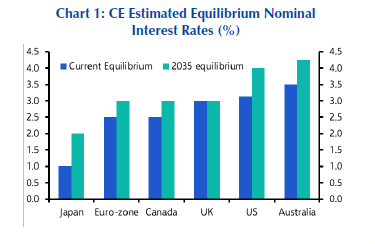

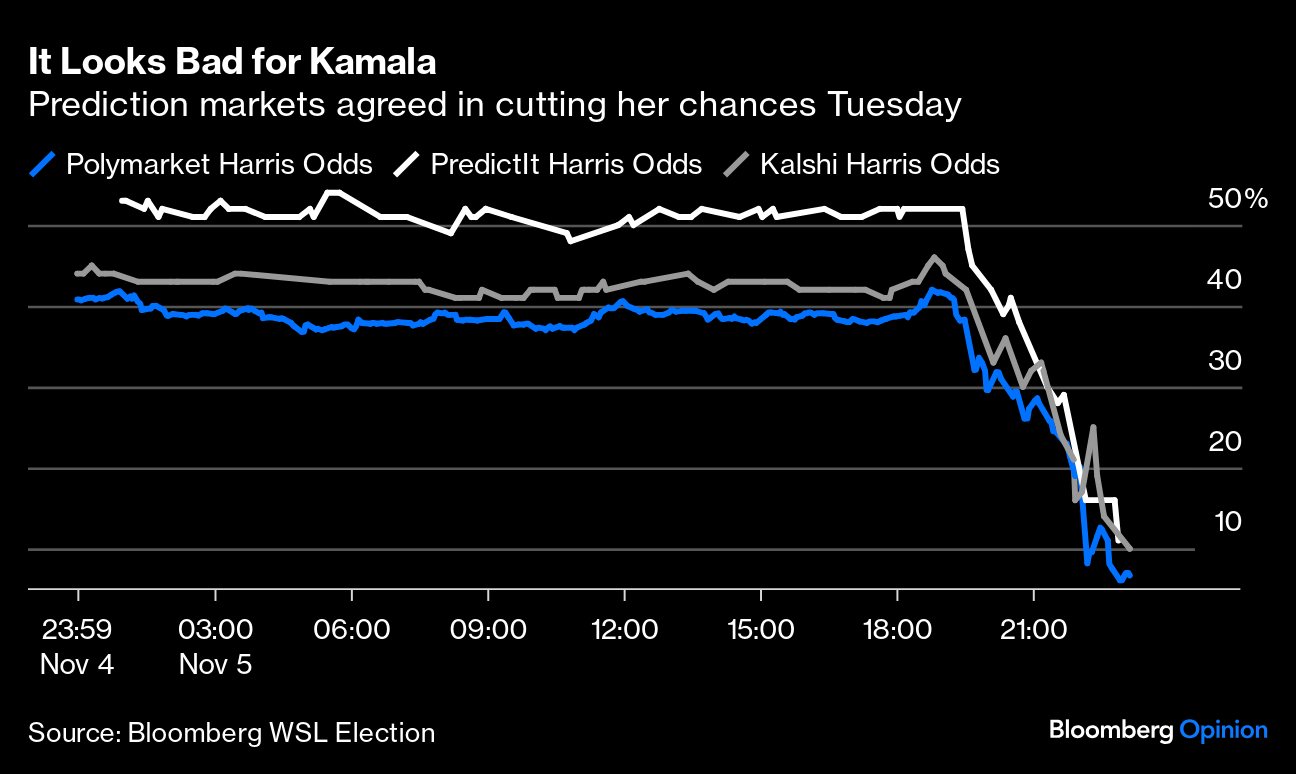

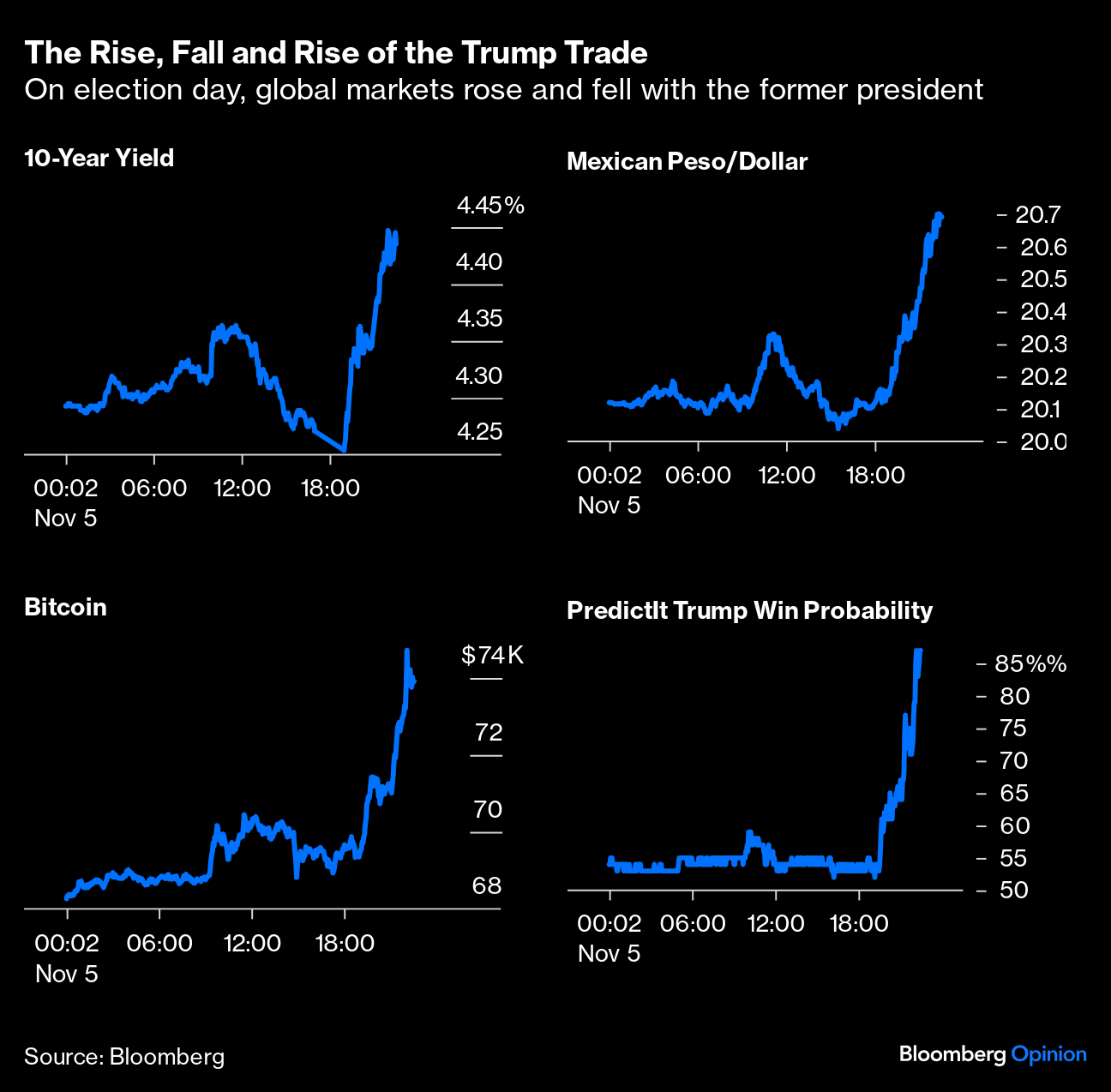

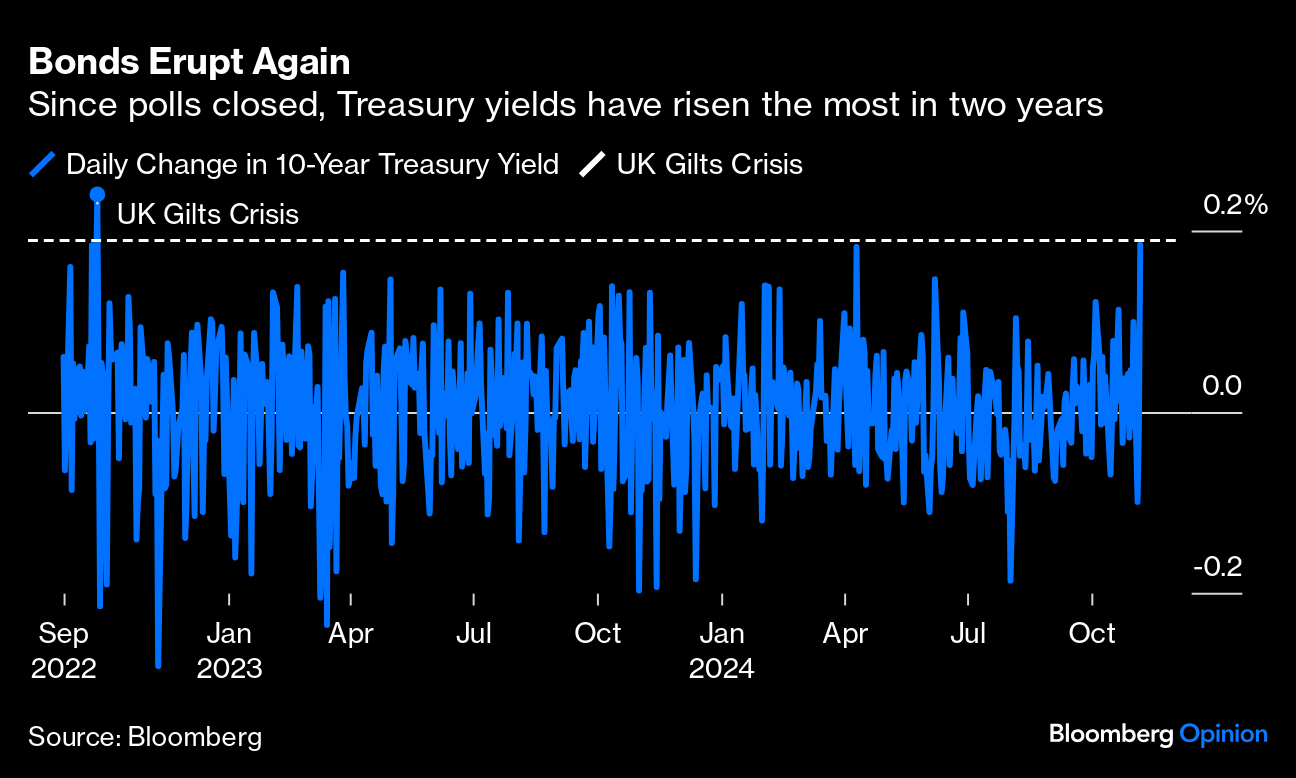

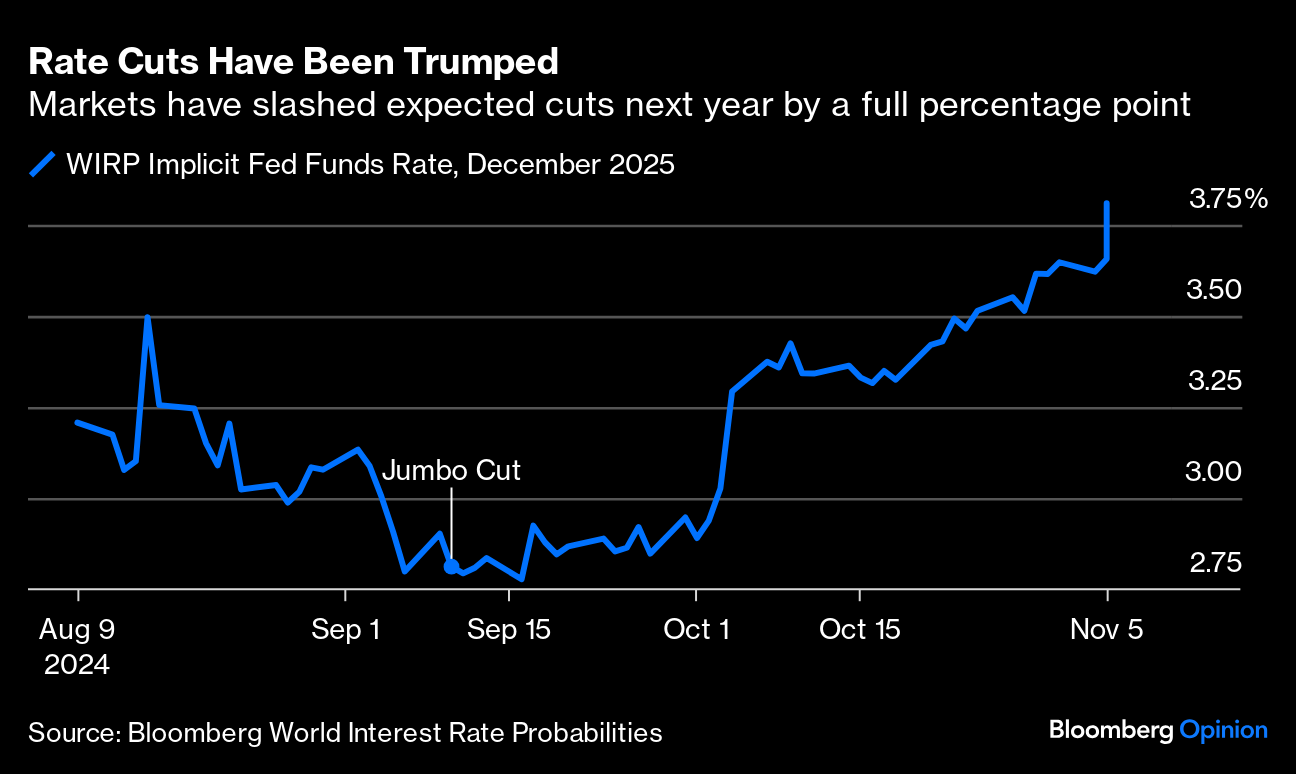

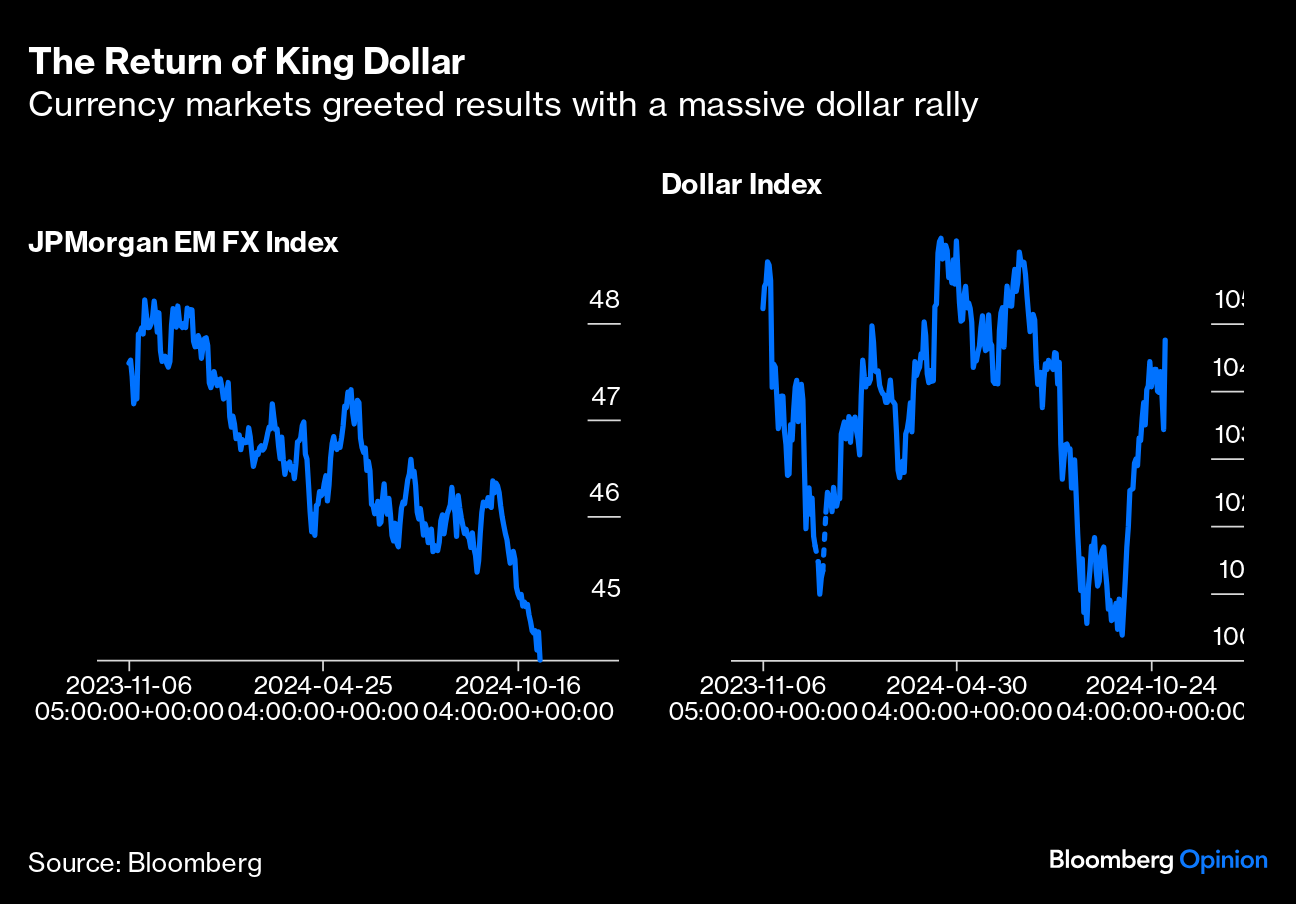

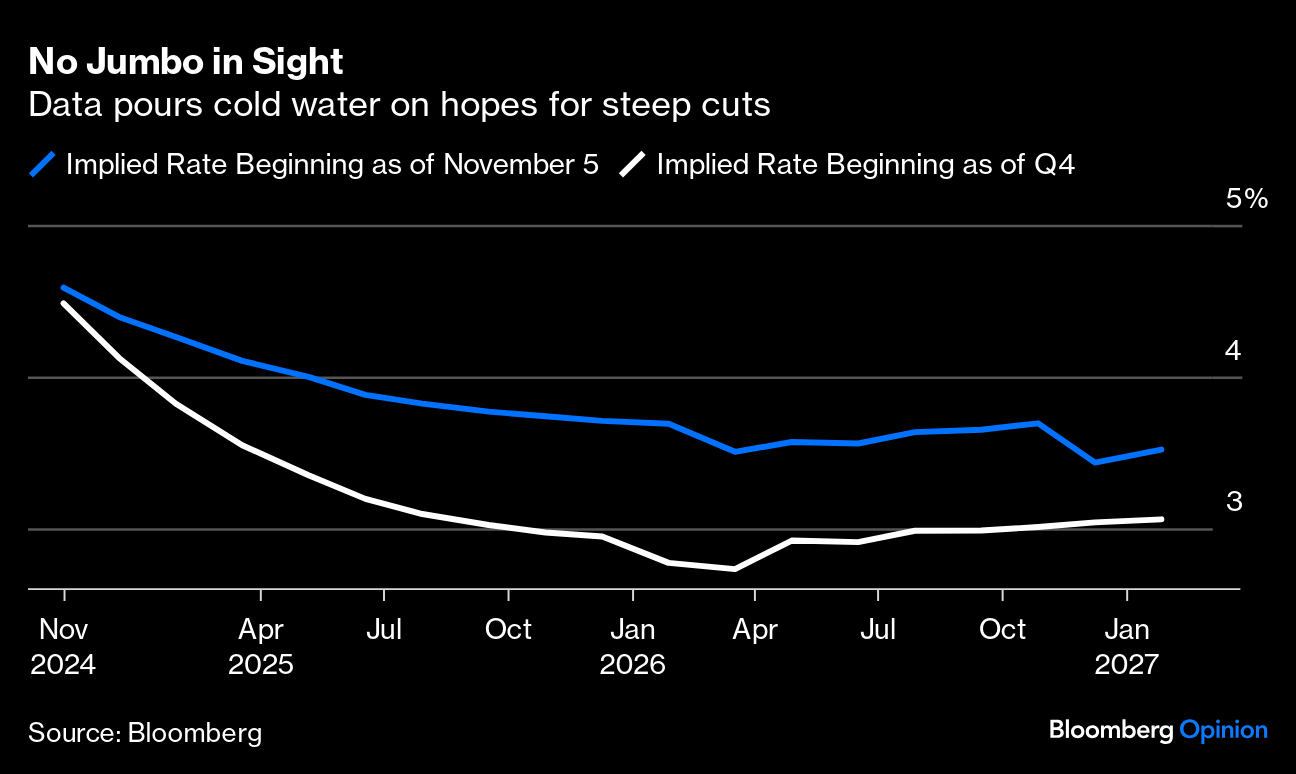

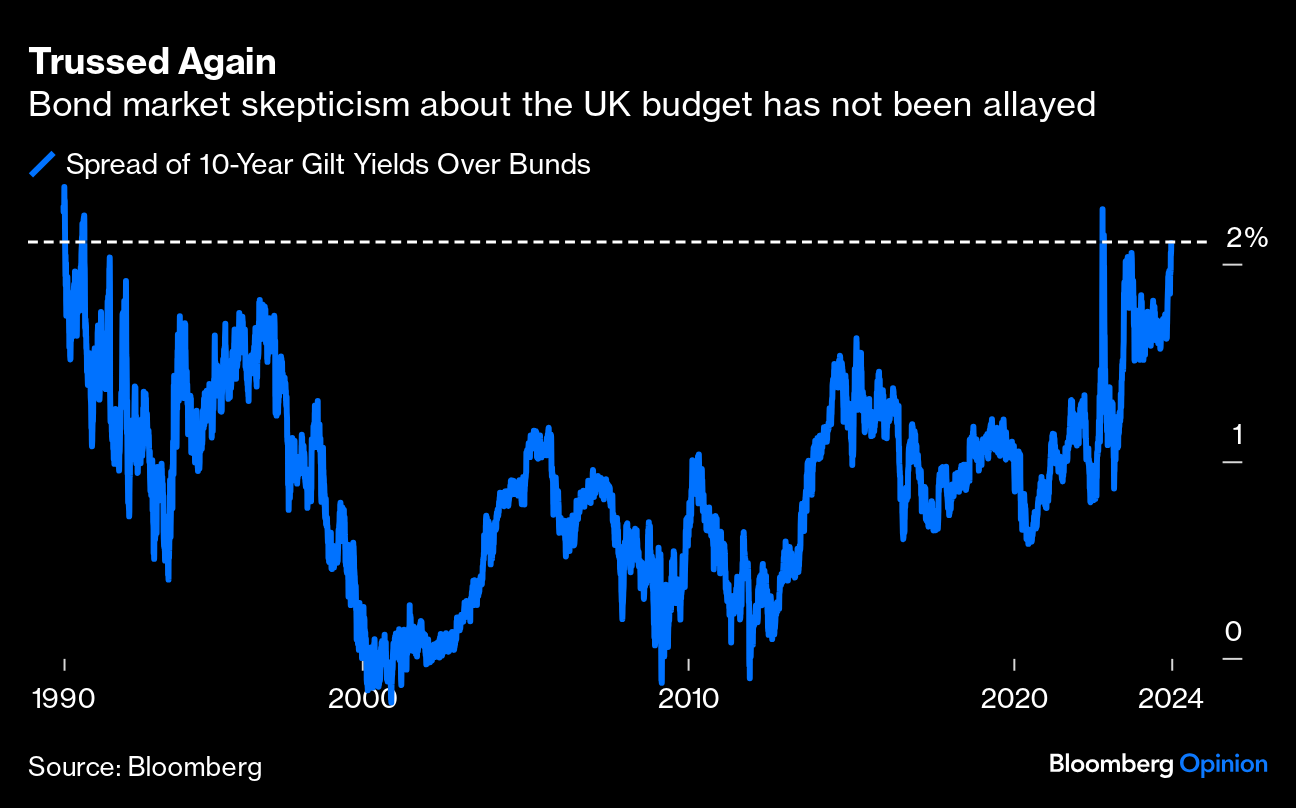

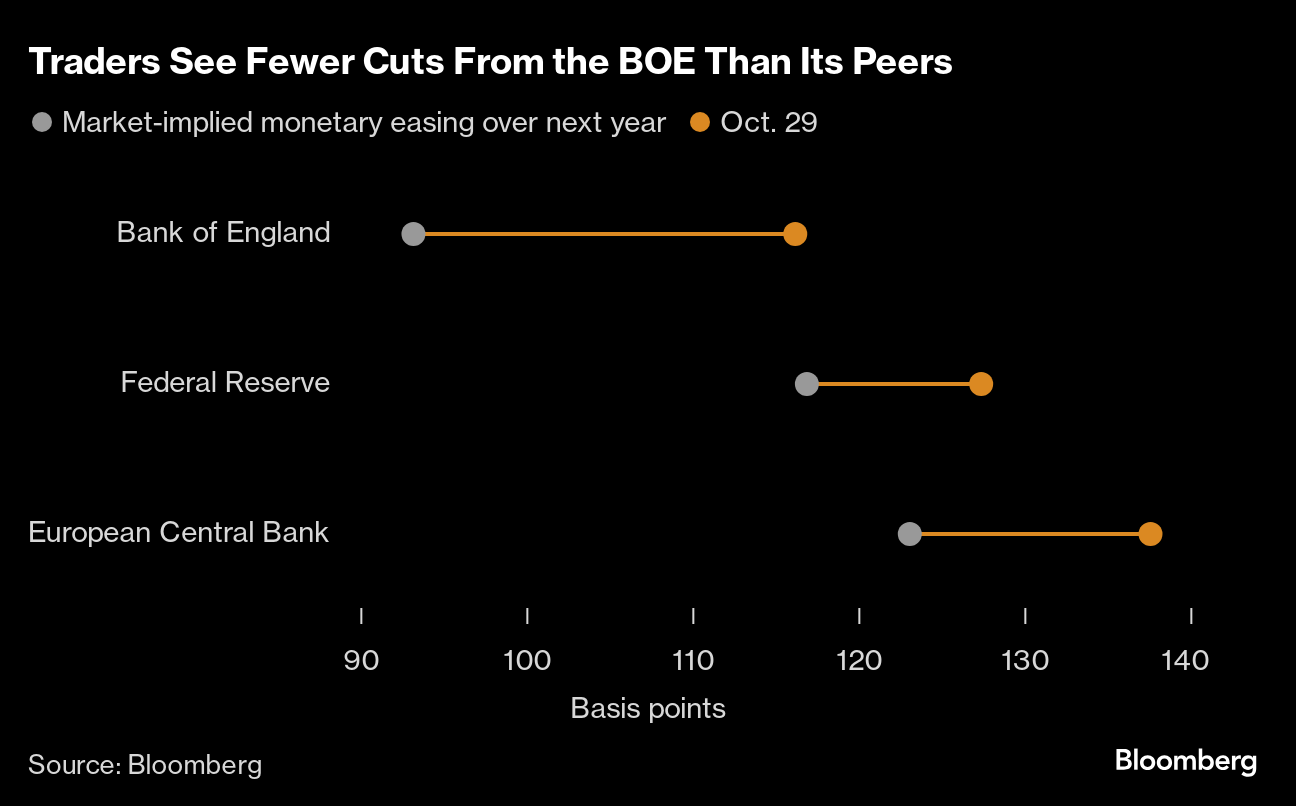

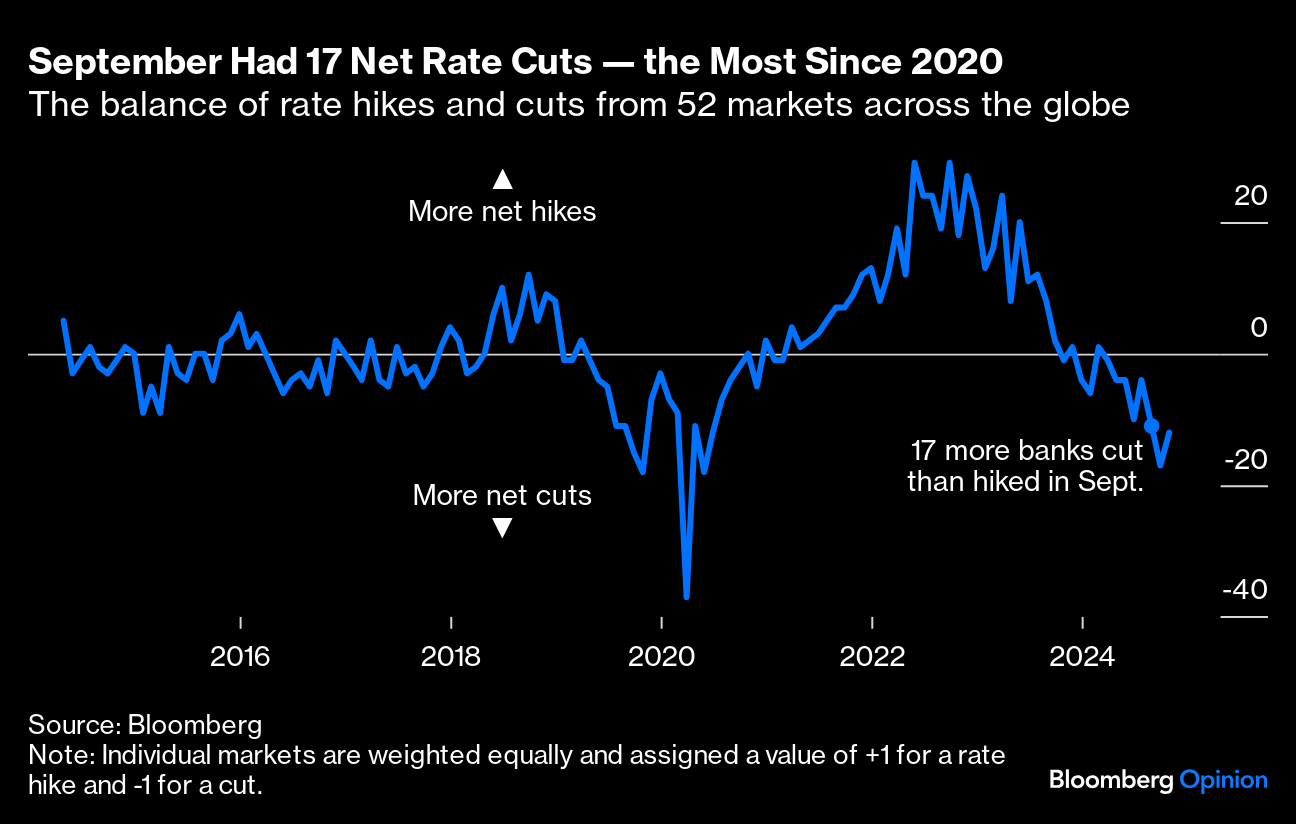

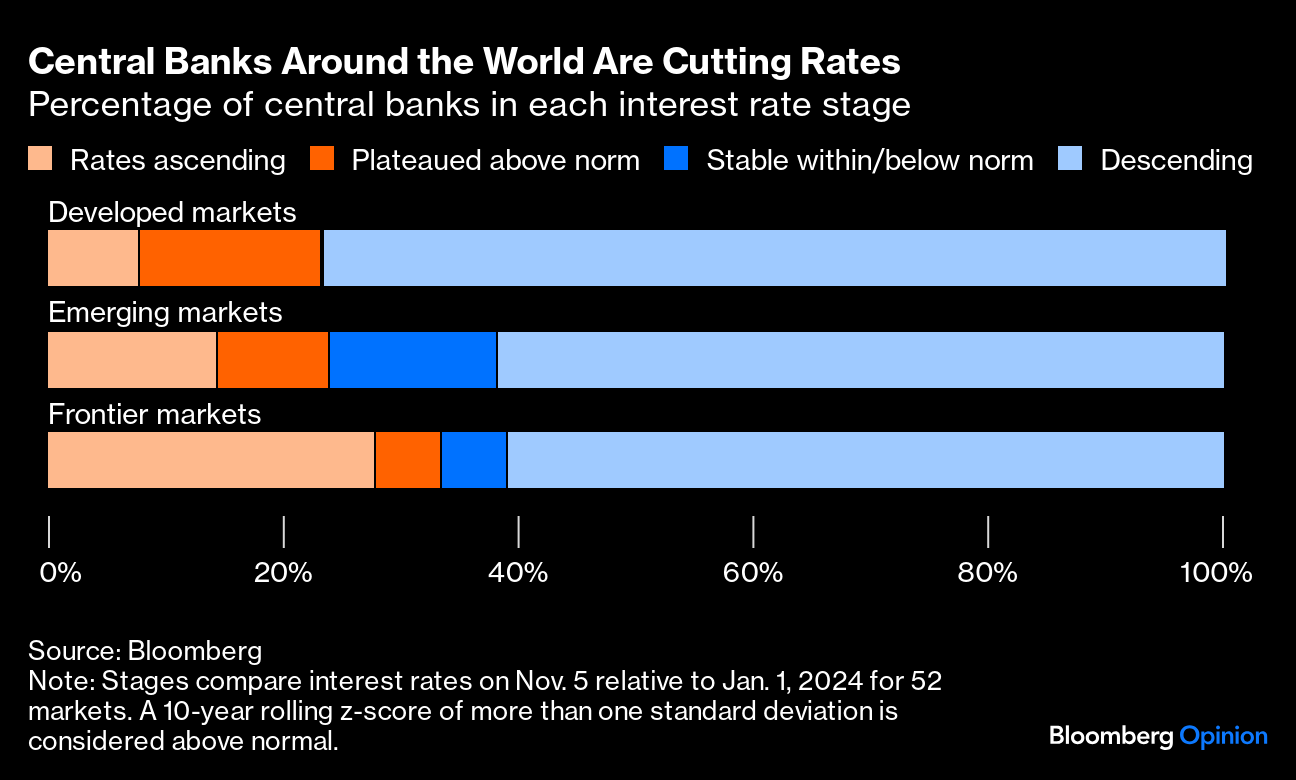

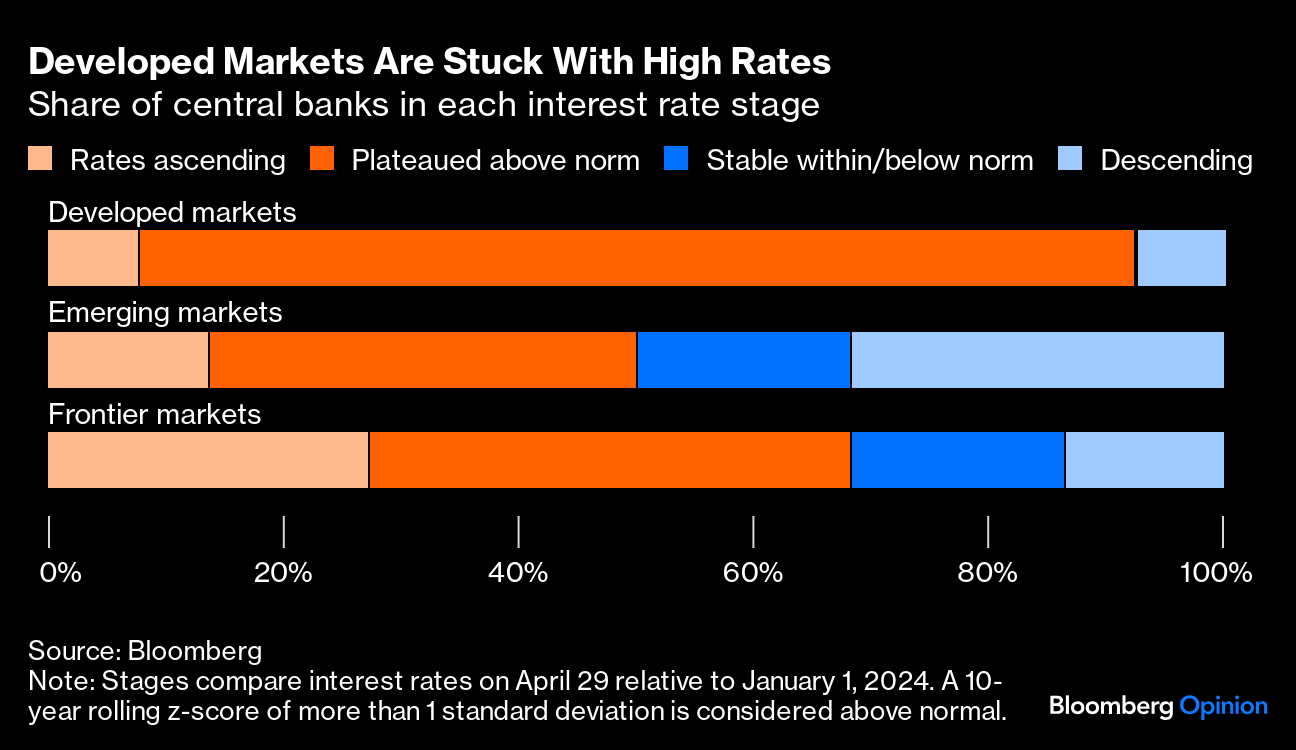

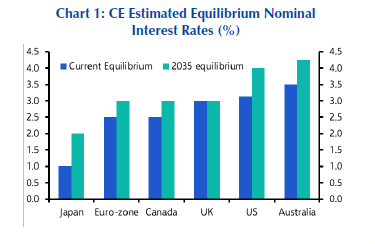

Any exercise on a deadline like this involves offering some hostages to fortune. At the time of writing (after midnight on the Eastern Seaboard), it's still mathematically possible for Vice President Kamala Harris to win the US presidency, but increasingly unlikely. These are how the odds on a Harris victory moved through the day on the three main prediction markets tracked by Bloomberg:  If she does manage to eke out a win, and the chances appear to be less than 5%, global markets will face yet more drama. There has already been plenty of that over the prospects of Donald Trump returning to the White House. Control of the House of Representatives, vital for tax policy, may depend on results in California, and are unlikely to be clear until well into Wednesday morning in the US at the earliest. Barring something dramatic for Harris, that is where the greatest uncertainty resides, but a Republican sweep at the moment looks more likely; the odds are put at 72% by both Kalshi and Polymarket. That would have a dramatic effect on the global bond market, but what's happened already is dramatic enough. This chart gives some indication of how bond yields, the Mexican peso and Bitcoin — now at an all time high — moved in lockstep with Trump's perceived chances throughout Tuesday. Traders put on the Trump trade in the morning, thought better of it in the afternoon, and then dove back once the results started to come in: The rise in Treasury yields is epic. It may soon be corrected, but particularly if Republicans hold the House; we should perhaps get ready for a confrontation between the bond market and the new government. Since the Wednesday session got underway in Asia, the 10-year Treasury yield has risen by almost 20 basis points. That's its biggest daily gain since the day in September 2022 when the gilts market revolted against the UK's Liz Truss. The comparison is telling, but not at all coincidental: That, to be clear, is because the bond market thinks Trump 2.0 would mean more inflation — a hugely ironic outcome given that his success appears to have been based in large part on the belief that he can fix the inflation problem. The 10-year inflation breakeven for the US — the bond market's forecast on price levels — is on course for its largest daily rise since January of last year. Higher yields and inflation imply higher policy rates from the Federal Reserve. Initial trading Tuesday evening suggested a total sea change since the Fed's "jumbo" cut 0f 50 basis points in September. Then the fed funds rate was expected to be 2.75% at the end of next year. Now it's above 3.75%: Trump also wants a weak dollar, which is an important part of his hopes to raise the US trade balance. It looks as though he would have difficulty getting it. The dollar is having an epic rally across the world. This is potentially a big problem for emerging markets: What happens next? The key players are central banks, and the bond and currency markets. Would central banks have to change course with a more expansionary US administration, and cut less than expected (of which more below)? And would the bond markets stand for it? The initial moves were extreme, and are already being rethought to some extent. This is how the Australian 10-year bond, trading in a country where the US results started to flow just as normal trading was getting underway, has moved in the last few hours. There may be such a rethink elsewhere:  The current situation in the UK, however, could get very difficult now that Treasury yields have risen so much. As you'll read below, the gilts market is already under pressure, which will intensify. Many commentators complained during the campaign — with reason — that neither candidate appeared to be taking the deficit seriously. Particularly if Republicans do take the House, we'll find out how much the bond market is prepared to fight the new administration on this. And with real risks of a rising dollar, the possibility of a confrontation with the Federal Reserve before next year is out also appears to have risen. When the Fed finally joined the rate-cuts party, it had ripple effects. The minutes of the last Federal Open Market Committee meeting reveal that the "Go Big or Go Home" decision was contentious, with Governor Michelle Bowman's public dissent the first in nearly two decades. But for the US central bank's peers, many of them anxious to start cutting, the decision was vitally important given the need for coordination in monetary policy. Just as in mountaineering, where climbers are roped to each other for safety, it's safer to descend when all are together. Ahead of Thursday's FOMC — and please note this was largely written before the polls closed in the US — here is the latest installment in our series on the Year of Descending Dangerously. The Fed will almost certainly cut again when it concludes its meeting. The consensus is for a cut of 25 basis points. Investors have abandoned bets on another jumbo cut of 50 basis points. Rate expectations as measured by Bloomberg's World Interest Rate Probabilities function showed that a month ago, the fed funds rate was seen falling below 3% by 2025 — that expectation no longer held, even before the election results:  Across the Atlantic, the Bank of England's policy meeting will precede the FOMC's. Governor Andrew Bailey is also expected to ease interest rates by 25 basis points to 4.75%, but that will possibly be for the final time for the year after last week's budget resurfaced inflation fears. Chancellor Rachel Reeves's budget triggered a bond selloff to evoke memories of the 2022 gilt crisis, and the US election will intensify the pressure. The nine-member Monetary Policy Committee may opt to keep rates where they are for the remainder of 2024 rather than stir the hornet's nest. The gap between UK and German 10-year government bond yields is now its widest in more than three decades, barring only a few days during the ill-fated Truss premiership, and the risk of an accident will focus minds:  Until last week's budget, the BOE had inflation where it wanted it, and was on course for a successive rate cut in each of its meetings for the rest of the year. All that has now been undone by the budget, and monetary policy has to be vigilant to prevent reversing gains made in bringing down prices. For now, investors see a slower pace of easing behind its peers, the Fed and the European Central Bank (again, note these numbers were taken before the election result):  Elsewhere, the descent from high interest rates is steadily progressing. Developed markets that lagged behind peers in emerging markets are now generally ahead of them in the process, with the Fed a crucial influence. Straying too far from the US has consequences that are not lost on other central banks. Thus, the Fed's outsized cut gave permission for others to ease. In the latest edition of our monthly diffusion index, in which rate cuts or hikes by each of the 57 central banks count equally, September saw the biggest balance toward lower rates since the pandemic began: Nowhere are rates coming down faster than in the developed markets, now outpacing emerging peers that generally got off to an earlier start. The great majority are now cutting: For context, this is the equivalent version of the chart produced in March when we started the series: Now that the descent has started, the next stage concerns the neutral real rate of interest (R*, or R-star), at which rates are not too restrictive on the economy and prices stable. Points of Return wrote about the R-star here; like many financial numbers, it exists but is unknowable in real time. Capital Economics' Jennifer McKeown attempts to predict the trough for interest rates in developed markets, and says that neutral rates for advanced economies have risen significantly since the post-Global Financial Crisis decade and will rise further. These are her estimates for 10 years hence:  McKeown says that three factors — the equilibrium nominal interest rate, the deviation of inflation from the target, and the size of the output gap — hold the key. The size of the output gap, in particular, is very hard to estimate. But as it stands, the Year of Descending Dangerously continues without major accident. Even before Tuesday, most accepted that the descent would be a little slower, and not go quite as far, as they were expecting at the turn of the year. But in economics, as in politics, opinions can always change. —Richard Abbey As was true in 2016 and 2020, roughly half the population of my adopted country will be deeply unhappy about this result. For them, I offer an interjection from my home country: Always Look on the Bright Side of Life. Even if you must admit that Heaven Knows I'm Miserable Now. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment