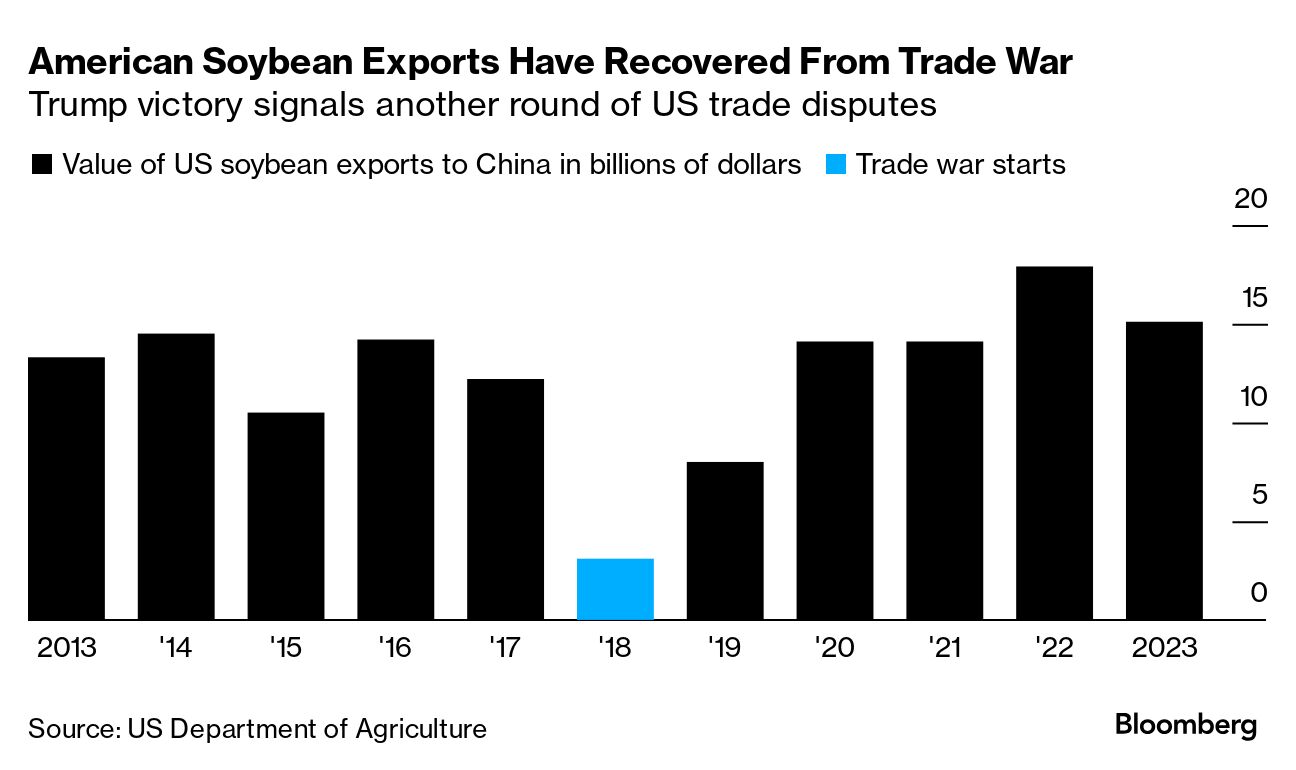

| Donald Trump's return to the White House has put the focus on potential trade disruptions in the agricultural world and what his presidency will mean for food prices. Here are some key things to watch out for: Trade Wars The president-elect has proposed a 10% to 20% tariff across the board on all imported goods into the US, and a 60% tariff on Chinese products. Such a move risks reprisals from the world's biggest soybean buyer. But how exactly might China respond? Bloomberg Economics says Beijing's retaliatory targets could be similar to the last time — particularly agricultural and energy exports from Republican-leaning states. If China wants to target US imports again, the options could be like in the first trade war, with soybeans and other commodities the most likely picks. China may also be better prepared this time. Since Trump's first term, Brazil has bolstered its position as the top soy supplier to China, and is now also the largest source of corn imports, replacing the big spike of US exports to China as part of a 2020 trade deal. In 2016, the US supplied more than 40% of Chinese soybean imports, but that fell to less than 18% in the first nine months of this year. For beef, South American suppliers stand to benefit if Trump's promises for tariffs against China end up resulting in a major trade dispute between the nations, according to executives at Brazil's Minerva. US Farmers US growers have been by and large behind Trump. At first, it seems contradictory they would back a president that radically altered global export markets after slapping tariffs on certain Chinese goods. After all, soybean sales to the Asian nation slid almost 79% in the first two years of his administration, leaving bins busting across the US Heartland. But Trump, who also rewrote trade with Mexico and Canada, threw $28 billion at farmers to soften the blow of his trade spats — something that helped him widen his lead in rural areas in 2020. Plus, many growers are looking for change amid a weakening farm economy. Read: Trump's Return Set to Upend Trade for American Farmers Yet Again Price Reaction A key question is what any shakeup in trade will mean for global prices. Expectations of a fresh round of trade disruptions with China initially sent US soy, corn and wheat futures plunging on Wednesday, before they recovered. The prospect of a trade war has fueled worries about slowing US exports and bigger stockpiles there if Beijing responds. But in the near term, China will need to secure soy supplies before Brazil's harvest begins early next year. Food Inflation Grocery prices featured heavily during the election campaign, including Kamala Harris' plan to ban price gouging. Trump talked about food prices in terms of putting tariffs on imports to lower costs. But as Deena Shanker writes for Bloomberg Businessweek, his real food policy proposal is embedded in his plan for mass deportation of undocumented immigrants. If Washington was to deport the 1.7 million undocumented workers who help power its food system, groceries will only get more expensive. More Food for Thought: COP29 The United Nations climate change conference kicks off in Baku, Azerbaijan next week, and conversations will include climate solutions for food. Against the backdrop of the summit, Bloomberg Green will convene the foremost leaders in business, finance, policy, academia and NGOs for candid talks on COP29's core goals. Learn more here. —Agnieszka de Sousa in London |

No comments:

Post a Comment