- China unveiled a program to help resolve a local government hidden-debt crisis.

- The Bank of England governor said the market selloff following the UK budget last week was orderly.

- Here's who President-elect Donald Trump might tap to drive his economic agenda and here's an explainer about his tariff toolkit.

The biggest piece of news out of Federal Reserve Chair Jerome Powell's press conference Thursday had little to do with interest rates. Instead, it was his terse response to a question about whether he would resign if asked to by the incoming Trump administration. "No," he said. Asked in a follow up question whether the Fed had determined whether the president has the power to demote leaders of the central bank board, Powell — an attorney himself — said: "not permitted under the law." Trump hasn't suggested that he would try to remove Powell, or the vice chair for supervision, Michael Barr — who is pursuing a regulatory agenda that's opposed by Republicans. But he sure put a lot of pressure on Powell to cut rates in his first term, sometimes using aggressive language.  Jerome Powell Photographer: Ting Shen/Bloomberg And in speaking with Bloomberg Businessweek in June, Trump added a qualification to a comment that he planned to let Powell stay until his chairmanship runs out, in May 2026. "I would let him serve it out especially if I thought he was doing the right thing." But what if that wasn't the case? We may know as soon as early 2025. Because Powell let drop in the press briefing that, after 75 basis points of cumulative cuts to the benchmark rate, slowing the pace of easing is "something that we're just beginning to think about." Read More: Trump's Housing Policies Could Aggravate a National Shortage While emphasizing that "we don't think it's a good time to be doing a lot of forward guidance," he still offered some hints that supported the updated forecasts of a few Fed watchers. JPMorgan Chase is among those that sees policymakers shifting to once-a-quarter rate cuts, starting next quarter. - With regard to the potential for another cut in December, Powell said that "I'm not ruling it out or in."

- He characterized the latest inflation reading as not "terrible, but a little higher than expected."

- The economy's performance "has been very good, and "if anything, people feel next year — I've heard this from several people — that next year could even be stronger than this year."

Now, Powell also said that the current level of the benchmark rate remains "restrictive," and that the key challenge is to "steer between" moving too quickly and moving too slowly in easing the stance of monetary policy. Read More: Few of Workers' Biggest Gains From Biden Era Are Safe From Trump But if the Fed does indeed shift to once-a-quarter after December, that would suggest no moves in January or February. Will Trump keep quiet on that score? His first term suggests not. - Want to learn more about the post-election Fed outlook? Bloomberg's economics team is hosting a Live Q&A today at 12:30 p.m. New York time. Join Reade Pickert, Amara Omeokwe, Enda Curran and Michael Mackenzie for a discussion free and available to all. Join them here.

- Chancellor of the Exchequer Rachel Reeves' first UK budget got a difficult reception from the markets. The Bank of England is taking a more supportive approach.

- Economists trimmed their growth forecasts for South Korea again and brought forward their views on interest-rate cuts.

- Japan's households cut spending for a second month as inflation deters consumption, backing the central bank's case for caution in raising rates.

- Canada's economy grew at a faster pace than initially estimated over the last three years, according to annual revisions.

- France is hoping to persuade Poland into joining forces to block a trade deal between the EU and the Mercosur bloc that's been a quarter of a century in the making.

- Chile's consumer prices rose much than expected last month as a double-digit electricity rate hike kicked in.

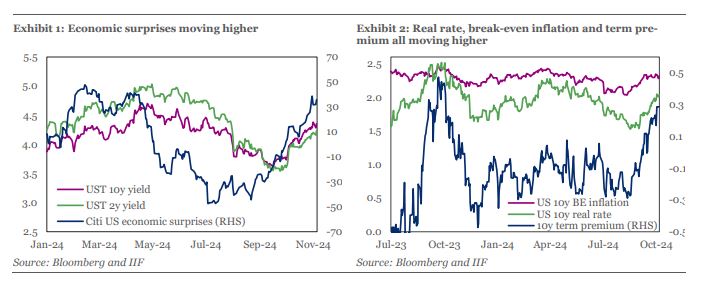

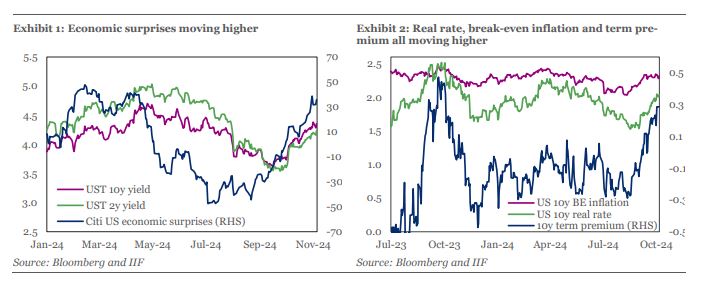

Ten-year bond yields have climbed by roughly the same amount as the Fed has cut its benchmark rate since Powell kicked off the easing cycle in mid-September. Marcello Estevao and Ashok Bhundia at the Institute of International Finance took a look why and found all three main components influencing long-term yields pointed higher. - Fed Policy Cycle: Recent data has pointed to a stronger-than-expected economic performance, prompting the market to scale back bets on easing.

- The Neutral Rate (r*): An improved productivity growth backdrop and expectations of a further expansion in fiscal policy are putting upward pressure on yields.

- The Term Premium: Trump's policy proposals are set to result in a significant increase in the federal debt, suggesting that interest rates will go up as financial markets absorb all the excess bond supply. Higher volatility is also a factor.

|

No comments:

Post a Comment