| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, we put the spotlight on how Wall Street is adapting to Saudi Arabia's domestic pivot. We'll also look to the US elections, along with a roundup of comments from key news-makers at the FII summit. "People used to come to us and ask for money," Yasir Al Rumayyan said at Saudi Arabia's eighth annual Future Investment Initiative. "We are now seeing a shift from people wanting to take our money to people wanting to co-invest." With that opening salvo, the governor of the Public Investment Fund confirmed what this newsletter highlighted last week: The titans of Wall Street are faced with a significant change in their relationships with the nearly $1 trillion PIF. Al Rumayyan said the fund aims to bring global investments down to 18% from 30% of its portfolio in 2020, in one of his most direct comments yet about the PIF's local focus. Still, he stressed that the absolute dollar amount for overseas deals was growing.  Yasir Al Rumayyan on Oct. 29. Source: FII The kingdom is in the midst of a trillion-dollar economic transformation plan and presents a massive opportunity for global firms. At the same time, the government is doubling down on efforts to get international firms to boost their local presence — or risk losing business.

Global giants are paying attention. Case in point: Brookfield last week lined up the PIF and Hassana — the investment arm of the kingdom's pension fund, as anchor investors on a new $2 billion private equity fund. At least half of this will be allocated to deals within the kingdom and to international firms looking to expand — a move aimed at attracting foreign direct investment. And as part of the deal, the Canadian firm will expand its office in Riyadh and make Brookfield Academy available locally. Hassana is also looking to commit up to $250 million to institutional investor EIG's $1 billion regional fund that will focus on infrastructure and energy transition projects. Also Read: BlackRock Deal Showcases Rise of Saudi Wealth Fund's New Star Others are piling in. Days before FII kicked off, General Atlantic said it's opening an office in Saudi Arabia, its first outpost in the Middle East, while Barclays is said it's considering re-entering the kingdom a decade after it pulled out. The lender plans to grow its team across the Middle East, including in Dubai and Abu Dhabi in addition to Riyadh. Meanwhile, payments firm Visa announced the opening of an innovation center in the Saudi capital — just its fourth globally. Over the past week, BlackRock got approval to set up its regional headquarters in the capital and Goldman Sachs unveiled plans for a new outpost in the city's financial district, deepening its presence in the largest Middle Eastern economy. "I've been coming to this event and watching the progress here, and the progress has been meaningful," Chief Executive Officer David Solomon told Joumanna Bercetche in an exclusive interview on the sidelines of the FII. The bank is also working on raising a Mideast-focused fund. Also Read: New York-Based Lender Pledges Up to $2 Billion Saudi Investments

That flurry also means that the Saudis have crossed a milestone in their race to lure foreign companies. Investment Minister Khalid al-Falih said the kingdom has granted 540 so-called regional headquarter licenses — ahead of a 2030 target of 500 — even as firms are still figuring out exactly what's required of them under that law. To be sure, financial centers in the United Arab Emirates are also making moves of their own, and firms face a delicate balancing act. Between his FII panel and the announcement of BlackRock's regional HQ, Larry Fink popped up in a post on X by Abu Dhabi's Sheikh Tahnoon bin Zayed Al Nahyan. The US giant is already partnering with Microsoft and an Emirati firm that's part of the royal's empire to bankroll data warehouses and energy infrastructure. Sheikh Tahnoon also met with Blackstone founder Steve Schwarzman, and the two discussed "the future of AI in investment management."

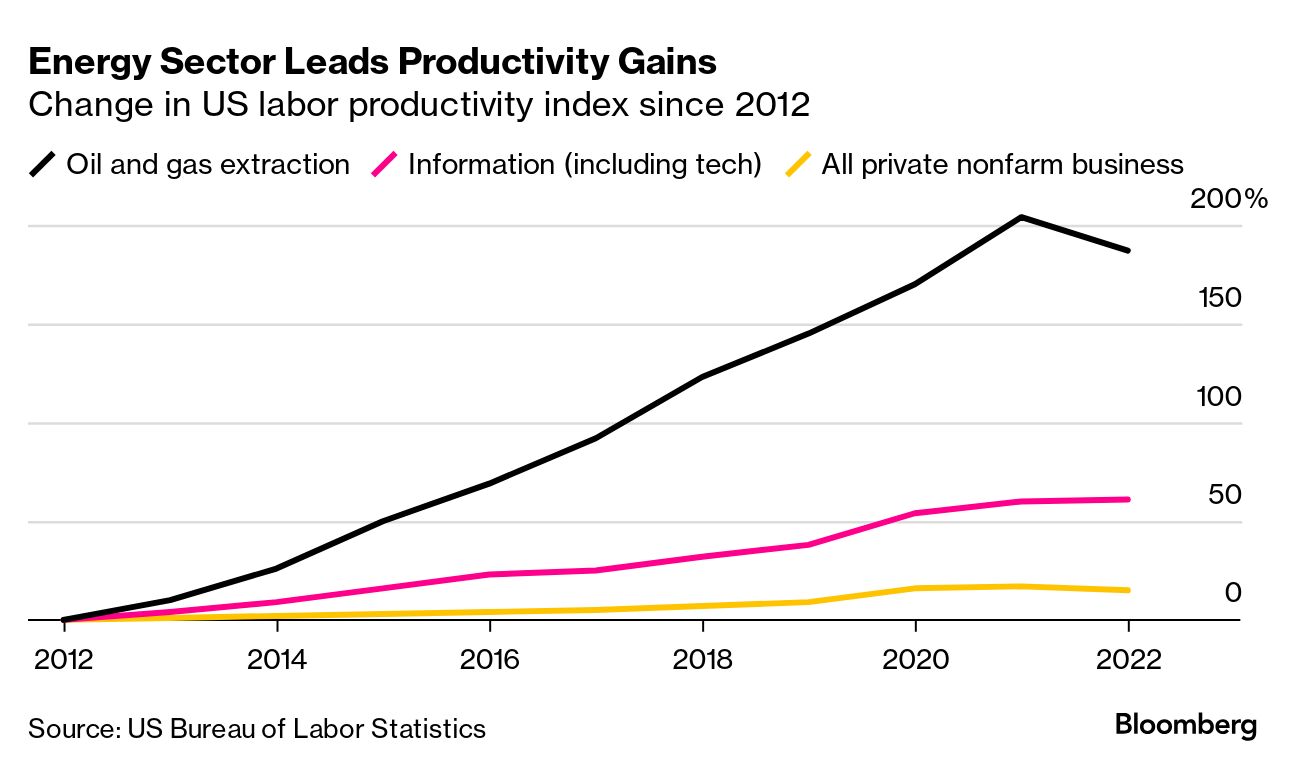

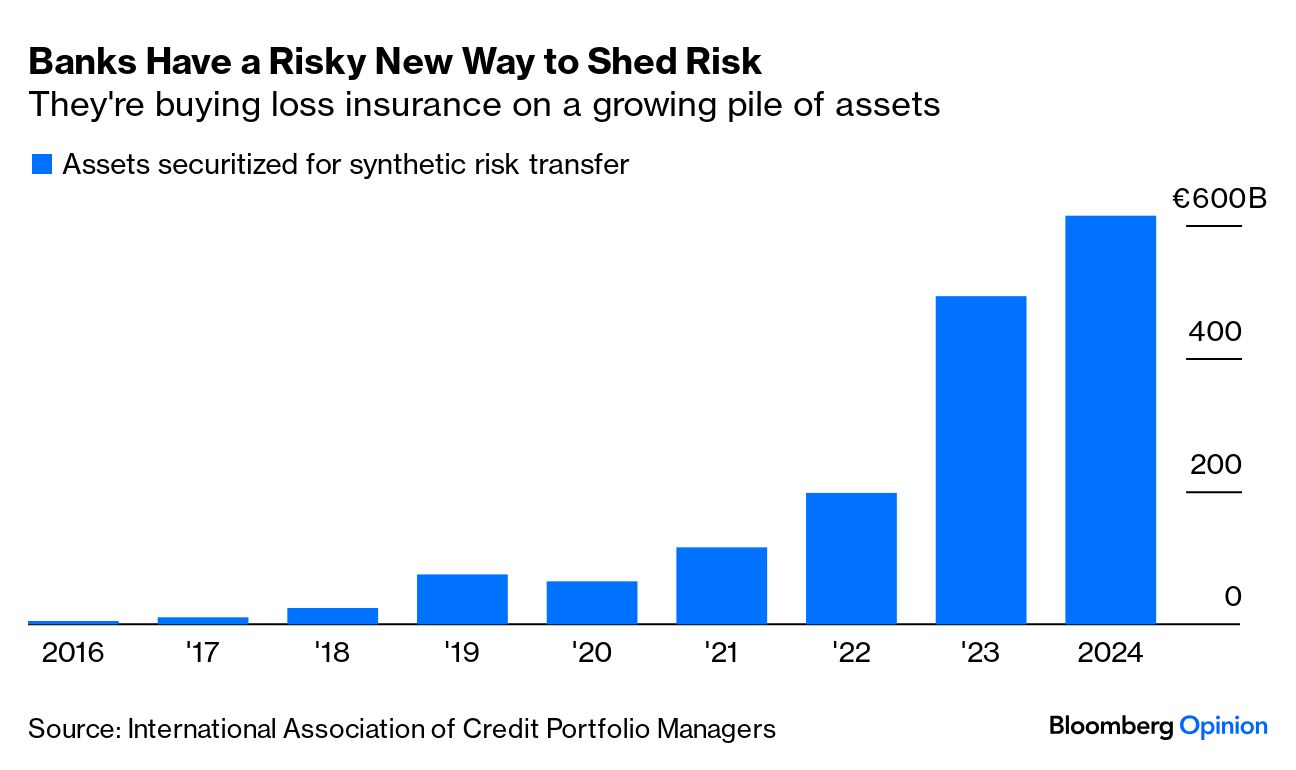

Also Read: Abu Dhabi Heavy Hitters Skip FII, Showing Riyadh Competition Blurred lines: "There's going to be a blur," Apollo's Marc Rowan said, referring to private credit and traditional bank debt. "We will not know — in the investment grade landscape — the difference between public and private 18 months from now." Dead heat: "We are at that moment of peak uncertainty. It is a race that Trump is favored to win but it is almost a coin toss." Citadel's Ken Griffin expects the race to the White House will be close, but the Republican candidate will ultimately win.  Ken Griffin, chief executive officer of Citadel Advisors. Photographer: Lionel Ng/Bloomberg Divergence: Wall Street chiefs were mostly upbeat on the prospects for the US economy, but raised concerns on Europe. Growth in European corporate profits is coming substantially from markets outside the continent, Standard Chartered CEO Bill Winters said, calling it "a structural problem." Overdone: Asked if they think there will be two more rate cuts this year, not a single executive in a panel that included the heads of Goldman, Morgan Stanley, Standard Chartered, Carlyle, Apollo and State Street, raised their hands. A majority agreed there might be one more reduction. Leadership: "I would say the most important thing when looking at different locations is first the financial — do you earn more money than you spend?," Ray Dalio said. "Second, do you have internal order in which, rather than conflict, you have good leadership and management?" — That was the billionaire Bridgewater Associates founder's explanation for his ties to the region. He also praised Crown Prince Mohammed bin Salman's leadership. Also Read: Where Saudi Arabia's MBS Beats China's Deng Xiaoping (Opinion) Existential threat. Elon Musk, who's had a fraught relationship with the kingdom, called AI a "significant existential threat," repeating an assessment he's shared in the past. SoftBank's Masayoshi Son, meanwhile, pushed back against the idea of an AI bubble and said Nvidia is undervalued. Lulu Retail increased the number of shares on offer in its initial public offering, targeting to raise up to $1.72 billion, in the UAE's biggest listing of the year. Meanwhile, Oman's state energy company plans to sell up to 49% in its methanol and LPG unit. Olam received a non-binding offer from a Saudi firm for its $4 billion agribusiness unit. Investcorp's former co-CEO is planning a $1 billion fund to buy stakes in financial services firms across the Global South.  Hazem Ben-Gacem Photographer: Bryan van der Beek/Bloomberg An investment firm backed by Abu Dhabi is set to take a stake in sports-car maker McLaren. AI-powered marketing company Insider raised $500 million in a funding round led by General Atlantic.  Insider CEO Hande Cilingir. Photographer: Christopher Pike/Bloomberg Inception — the research arm of Abu Dhabi's G42 — is the lesser-know OpenAI rival that's trying to win the Global South. Also Read: $5,300-a-Night Hotel Showcases Saudi Push to Become Tourism Hub Buyers of top-rated commercial mortgage-backed securities are suffering losses — revealing the depths of the US office-market crash. Wall Street largely wrote off the oil industry. It's now the most productive US sector, outpacing even tech.

Banks have a new way to game financial safeguards. It could mean more trouble for everyone. (Opinion)

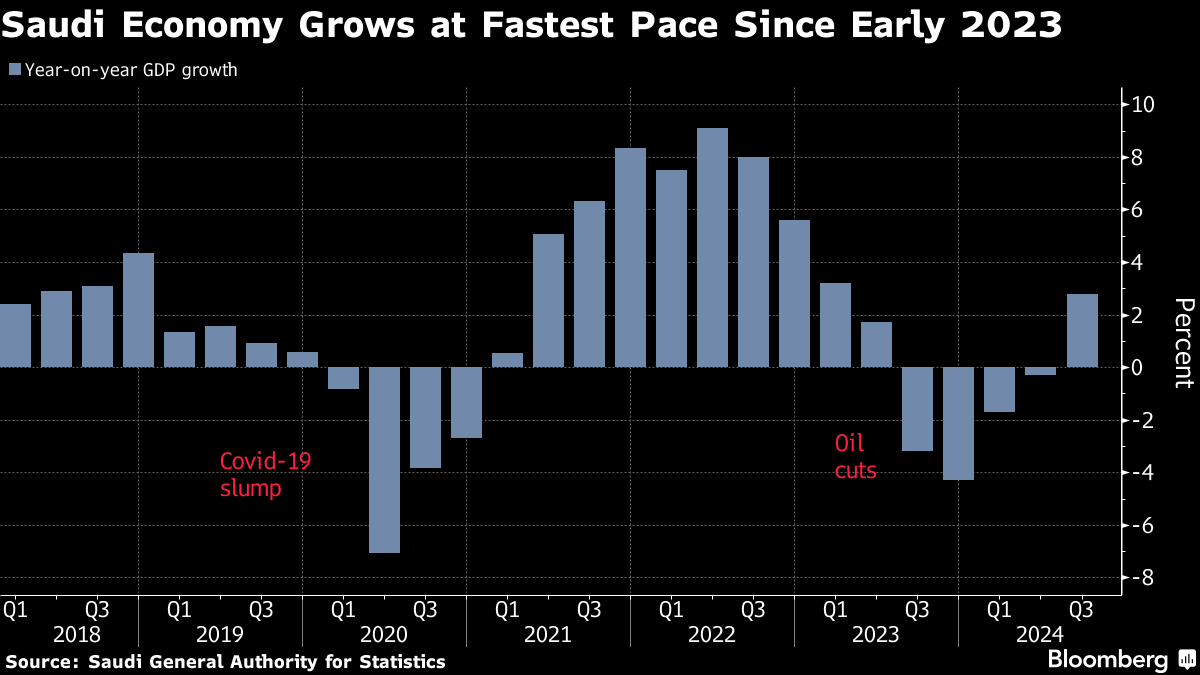

Amazon is keeping Alexa's AI-powered brain under wraps, at least until it's smart enough to compete against ChatGPT. Samsung's sudden $122 billion wipeout shows the cost of sleeping on AI. The US' efforts to contain China's tech supremacy drive are faltering. Russia is getting some of the most advanced AI chips from an Indian pharma company. Move over, Scotch. Single malts from India are poised to take the whiskey spotlight. Saudi Arabia's gross domestic product climbed 2.8% in the third quarter, as the non-oil sector rose quickly and the effects of petroleum-production cuts wore off. The oil industry, the main driver of the economy, was largely flat between July and September. The non-oil sector — that's benefiting from hundreds of billions of dollars of investment in everything from chip-making to resorts and sports — rose 4.2%. Related Coverage With polls showing Vice President Kamala Harris and former President Donald Trump poised for a photo finish in Tuesday's US election, let me hand it over to my colleague Abeer Abu Omar on how the outcome could impact the Middle East.  Former US President Donald Trump. Photographer: Christian Monterrosa/Bloomberg The Republican candidate has business interests across the region, including a golf course in the UAE. Just this year, the Trump Organization announced plans to launch a luxury tower in Dubai, a residential project in Jeddah and a $200 million luxury housing development in Oman — all in partnership with a Saudi builder. His son Eric Trump told the Financial Times in July that he is pursuing more deals in the region. Meanwhile, Trump's son-in-law Jared Kushner's private equity fund Affinity Partners has raised billions of dollars from the region, and has been making deals, including in Israel. "The presence of the Trump brand and varying degrees of commercial influence related to the former president across the Gulf are unlikely to diminish, regardless of the outcome of the November election," Robert Mogielnicki, senior resident scholar at The Arab Gulf States Institute in Washington wrote last month. Then there's the larger geopolitical impact. Should the Democratic nominee win tomorrow's elections, she will likely maintain US President Joe Biden's policies in the region especially when it comes to Israel's clashes with Iran and its proxies.  US Vice President Kamala Harris. Photographer: Sarah Rice/Bloomberg The vice president, who has been vocal about a two-state solution, had warned Israeli Prime Minister Benjamin Netanyahu about the civilian death toll in Gaza during a July meeting. She has also signaled her desire to jump-start a cease-fire process. On the other hand, a Trump win could be "terrible" for Israel, according to Bloomberg Opinion's Noah Feldman. If Democrats conclude that supporting the Jewish state cost them the White House, Israel could very well end up captive to the outcomes of US elections, he wrote. As for Gulf states, their official line on what they want out of the election is clear: Consistent US policy regardless of a Republican or Democratic win. Related Coverage If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment