| Some truths are eternal, no matter who said them. Whether it was Niels Bohr, the Nobel Prize-winning physicist and atomic pioneer, or Yogi Berra of the New York Yankees who first uttered these words, they're true: "Prediction is very difficult, especially if it's about the future."

This week's US presidential election seems so important that it's natural that people will try to predict the result or find some kind of indicator to hold on to. For centuries, political prediction markets have sprung up to fulfill this need, and it's happened again. Several new ventures to allow trading of political futures have been launched in the last few weeks. Moves on the different markets has been odd at best, leading to claims of manipulation. And just as it's eternally difficult to predict the future, it also seems to be a fact that markets overshoot. That's what just happened.

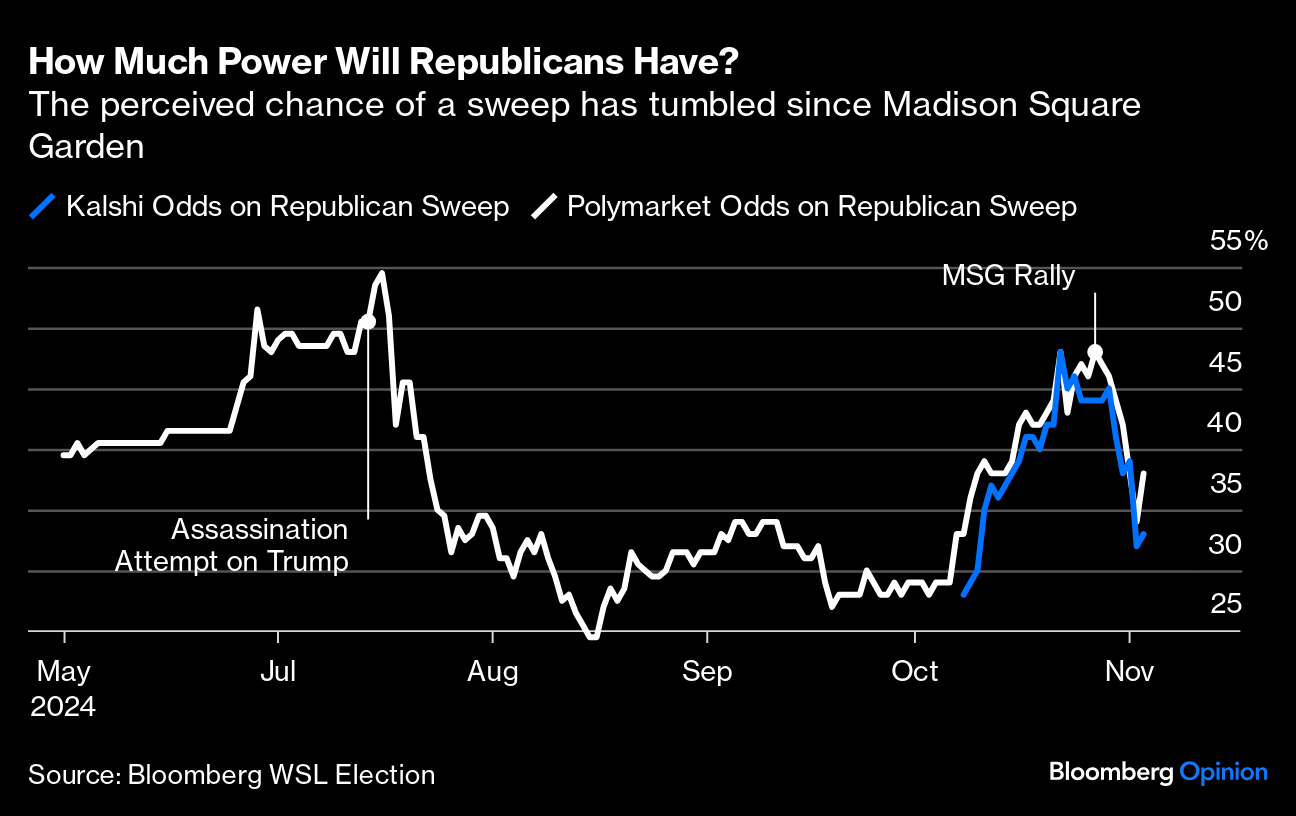

Starting early in October, the major markets all showed a steady growth in Donald Trump's chance of victory. This was led by the offshore Polymarket, with the aid of a series of large purchases by a Trump "whale" (and a brief blip caused by what appears to have been a Kamala Harris whale). Then came Trump's rally at Madison Square Garden a week ago. That changed the narrative. The PredictIt market, where political junkies take limited positions, began reeling in his odds. Polymarket, always more bullish about Trump, followed. Then on Saturday came the shocking poll in the Des Moines Register from one of the country's most reliable pollsters suggesting that Kamala Harris led in the heartland state of Iowa, which has increasingly voted Republican in recent elections, by three percentage points. If accurate, this implied Harris capturing other states where expectations have seemed tighter; supporters dared to speak of a landslide coming into view. As with any outlier, the poll has to be treated with caution, but the prediction market response was dramatic: At the time of writing, Trump's odds have improved a little again, but many plainly think that his chances have been overstated. The prospects of a Republican "clean sweep" of the presidency and both houses of Congress have also been reined in, although by less on Polymarket (always seemingly more enthusiastic about the Republicans) than on the Kalshi futures exchange: It's vital for bond markets that the chance of a Trump sweep is falling, as any form of congressional gridlock promises far more fiscal discipline. This should be good for bonds (if not, arguably, the economy) and should mean yields fall.

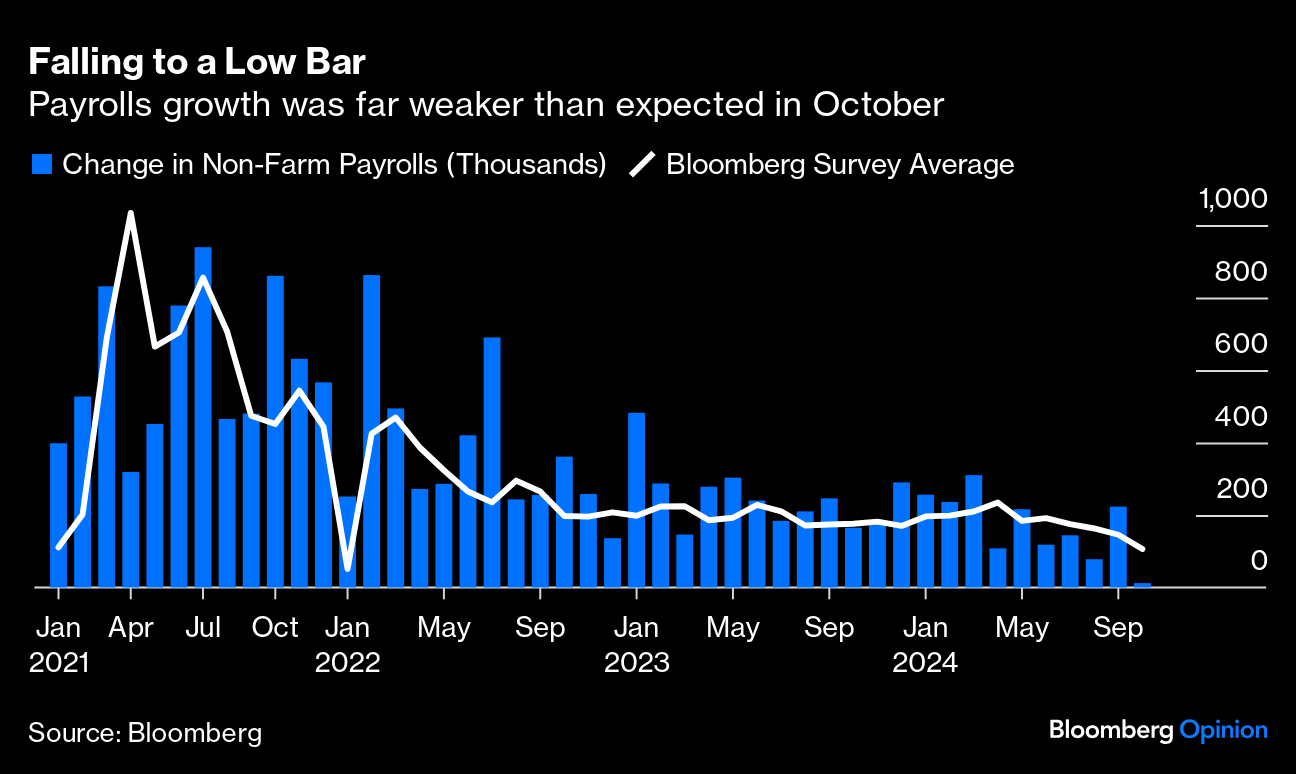

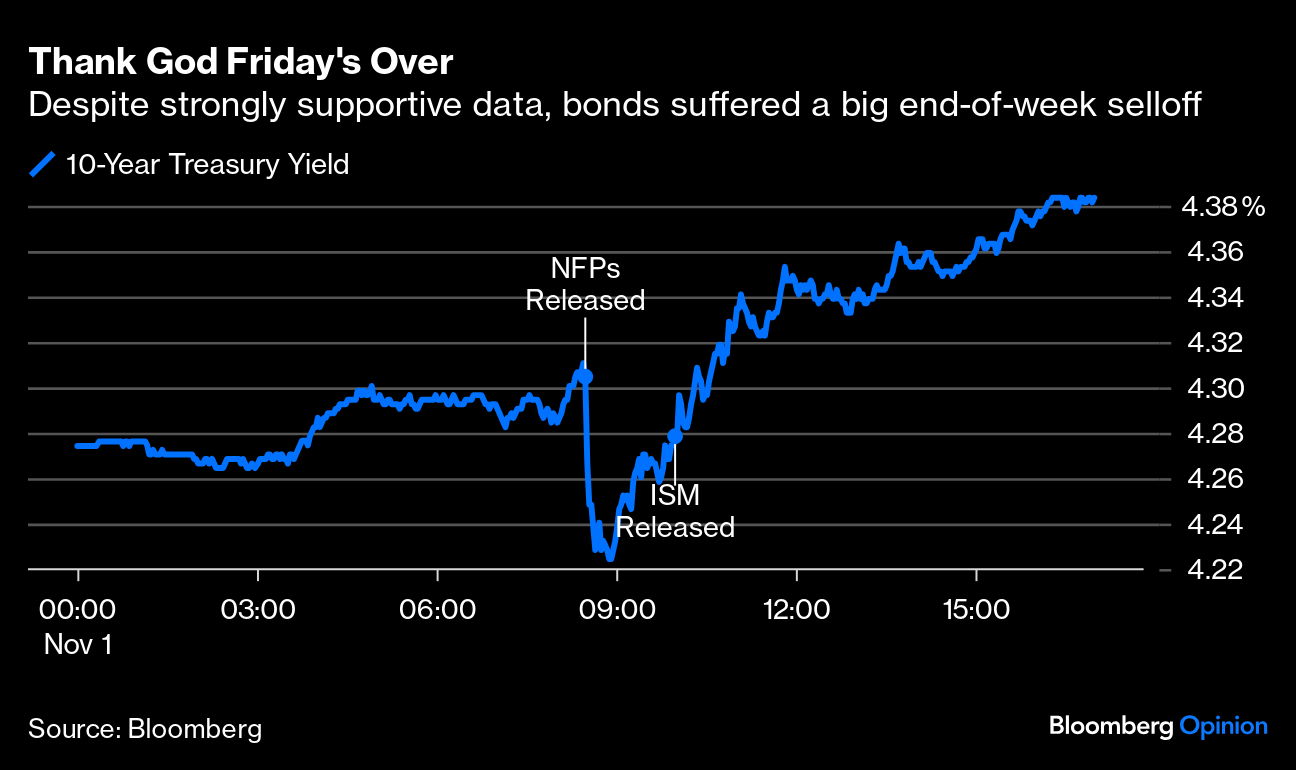

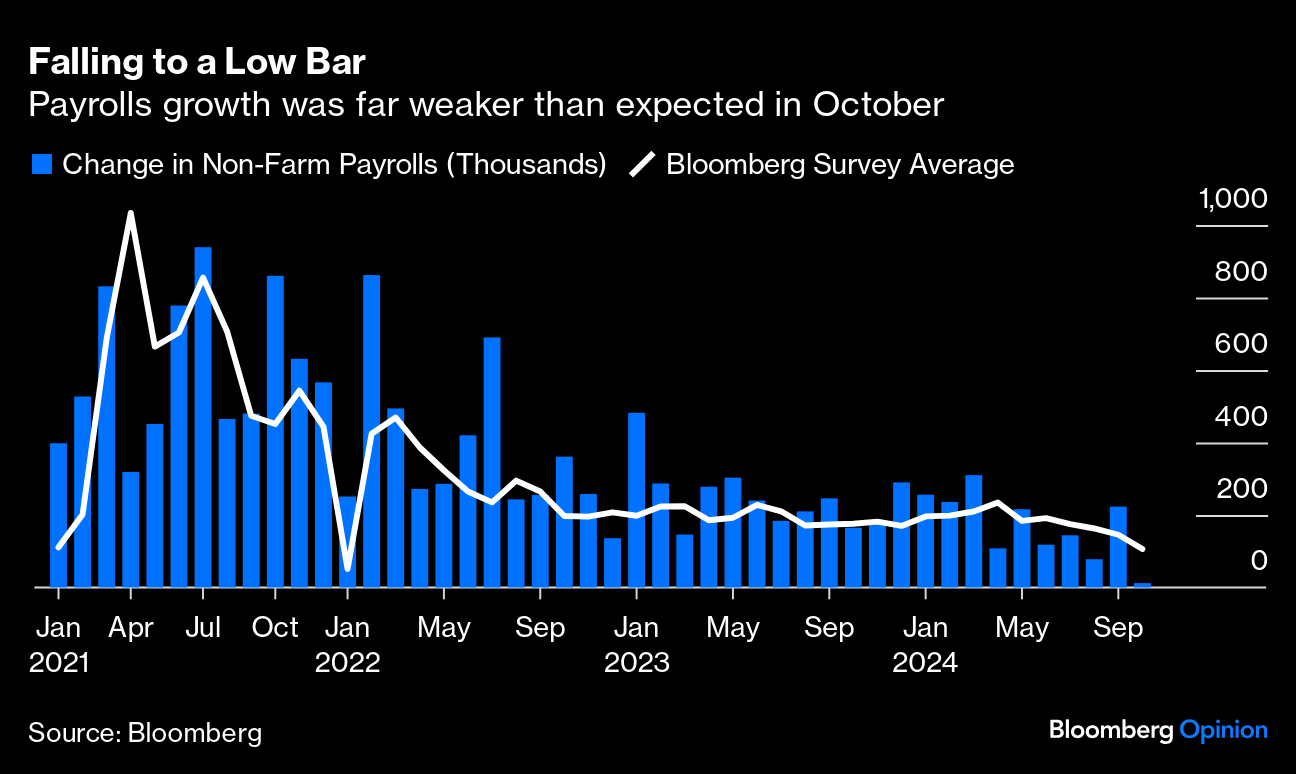

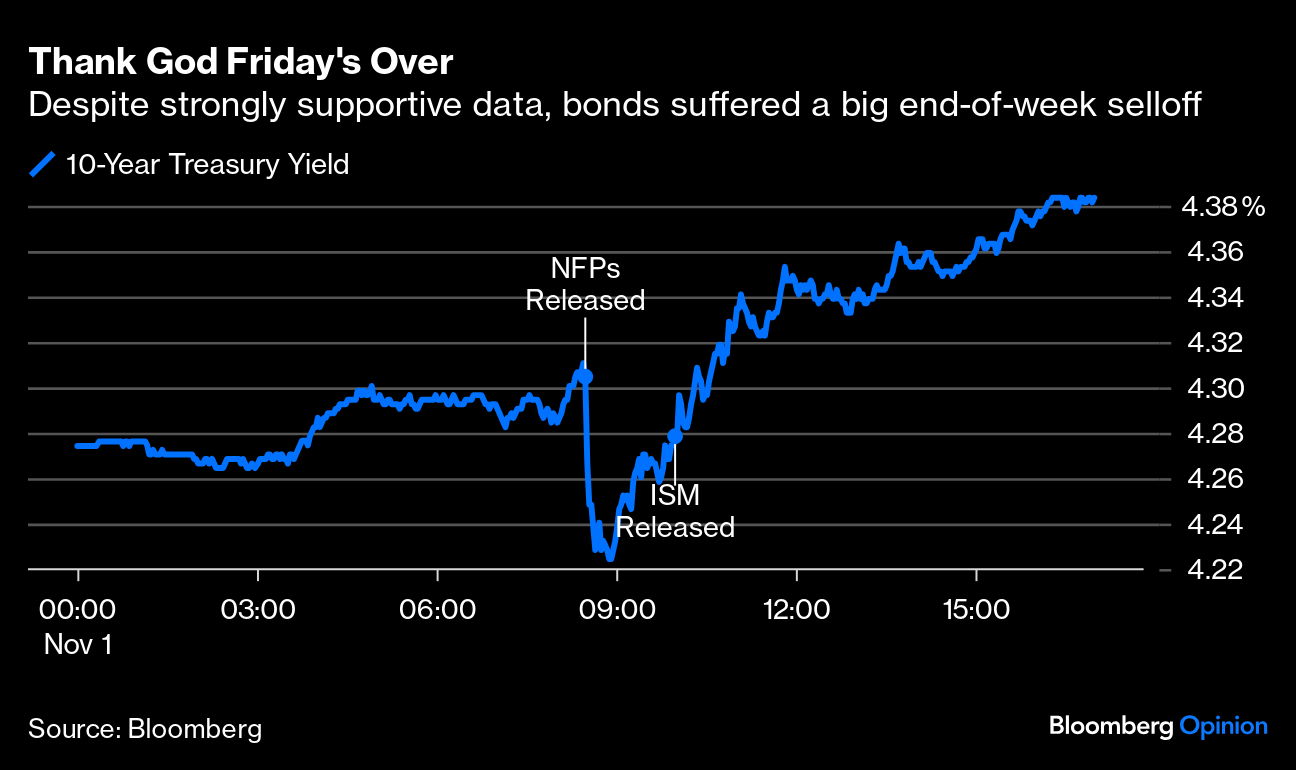

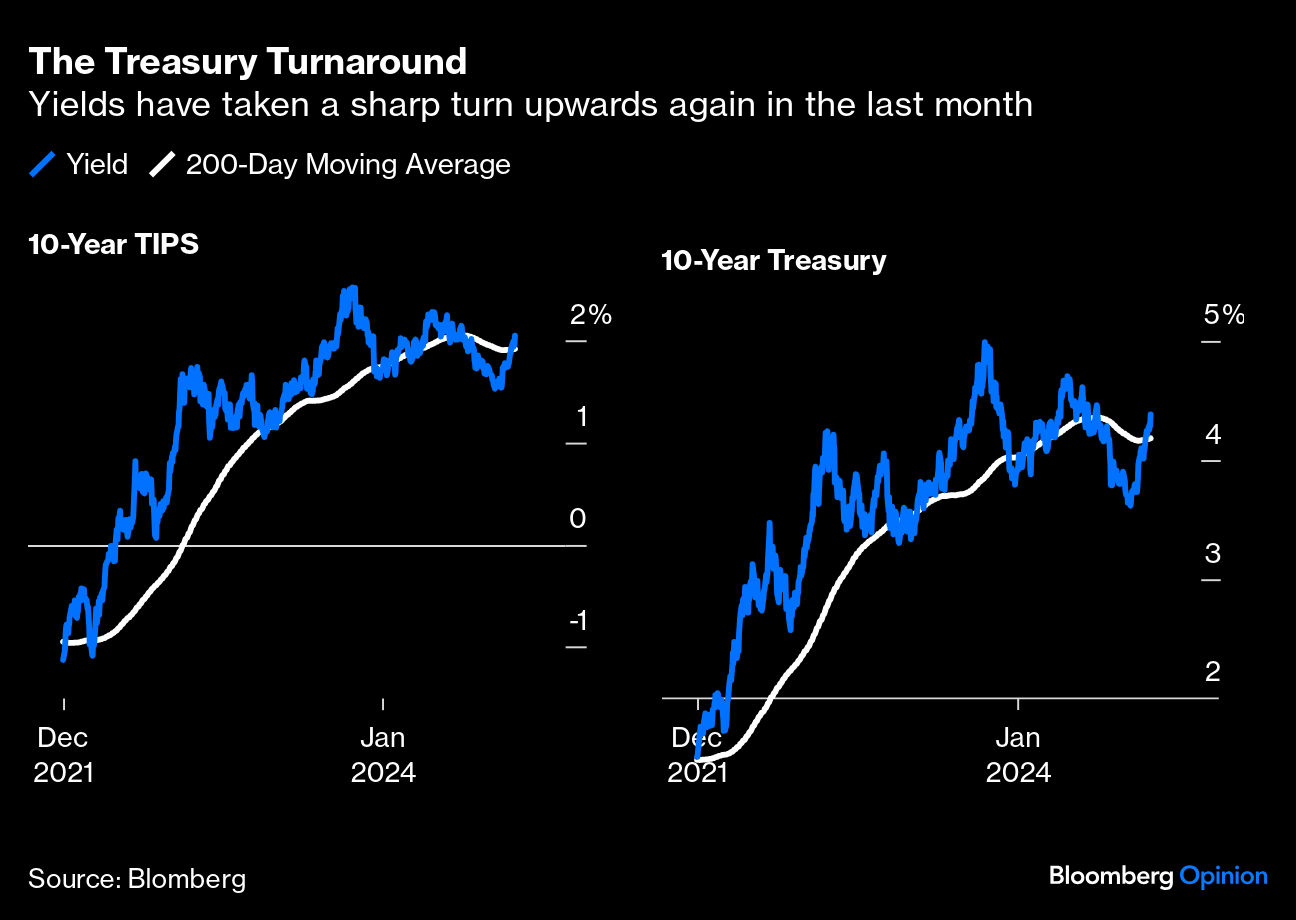

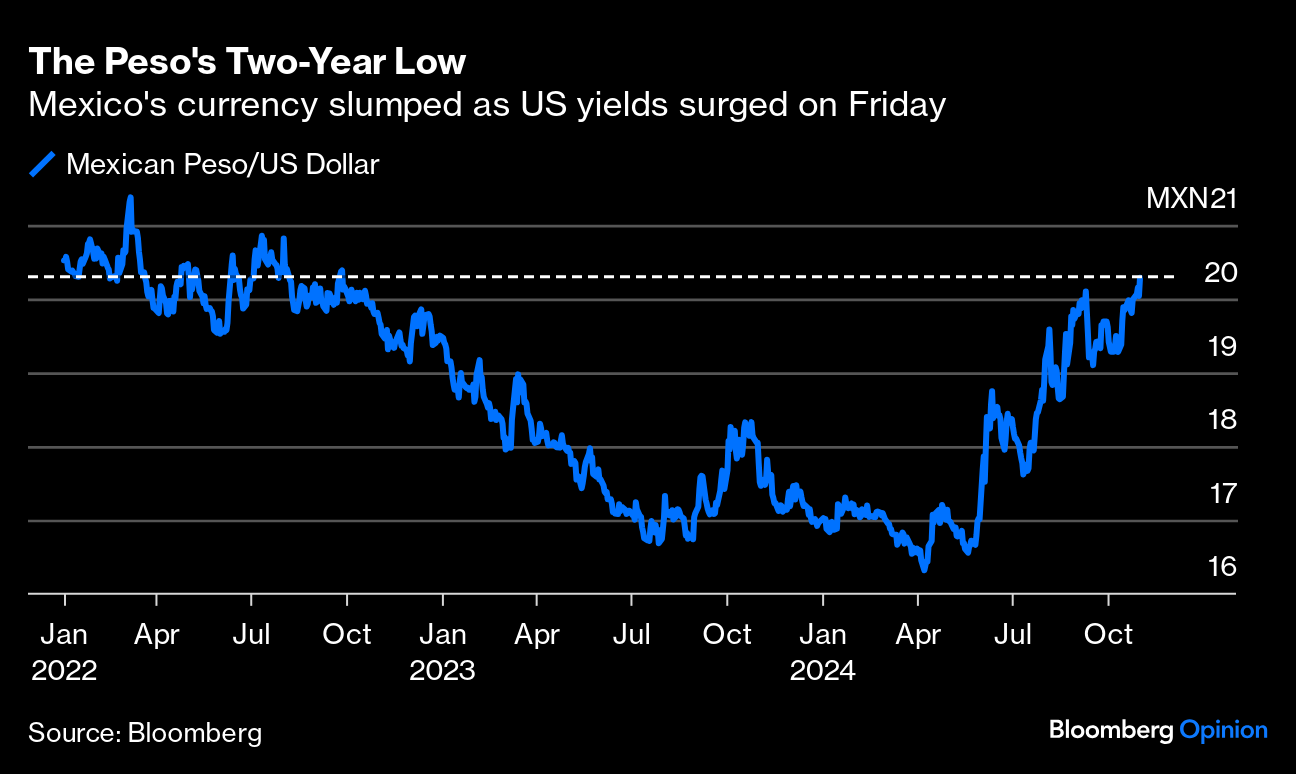

Many other markets that appear to have moved very much in line with Trump's perceived chances. The resemblance between Bloomberg's index of the Magnificent Seven stocks and Trump's performance on Polymarket is startling: Stocks haven't yet had a chance to react to the weekend Trump selloff, and the election is upon us. But on the face of it, if you think you're overexposed to a Trump victory, it makes sense to lighten your position a little before Tuesday's vote. What already looked likely to be turbulent could get very much more volatile, particularly if Harris emerges triumphant. And yet right up to the close on Friday, traders seemed oblivious to this risk. The election comes just after what appeared to be a bona fide economic surprise on Friday — but markets didn't take it that way. Last week, Points of Return warned that the Bloomberg consensus of economists expected only 100,000 jobs to have been added to US payrolls in October, for one of the weakest months since the pandemic. This set a low bar for expectations and the chance of a big beat. But in fact the numbers came in Friday far below their low expectations, just barely positive with 12,000 new jobs:  Adding salt, private sector employment dropped — the overall gain was solely due to the government. As everything is viewed through a political lens at present, it's worth looking in long-term focus at manufacturing payrolls, which dipped. The Biden administration presides over slightly more manufacturing jobs than at the pre-pandemic peak under Trump in 2019, but not by many. Overall, though, the rise in general employment over the last four years shouldn't be difficult for an incumbent party to defend. On more pressing financial matters, payrolls came as US Treasury yields had been rising for a month. A number of factors drove this, not least the surprisingly strong economic data of late. There had been even been some speculation that the Federal Reserve might decide not to cut the fed funds rate when it meets on Thursday. An awful employment number should put paid to that, and also reassure people to buy bonds. A decidedly lackluster Institute of Supply Management survey of manufacturing, coming out 90 minutes after the jobs number, should have ensured falling bond yields. But this is what in fact happened:  The initial response to the jobs data was an understandable to rush to buy bonds, taking the 10-year yield down almost 10 basis points. As soon as that had happened, however, traders seemed to spy an opportunity to get out of bonds, and did so. The ISM had no effect. Yields aren't back to last year's highs, but the trend is upward once more, despite the jumbo 50-basis-point cut in September: The higher yields attracted money to the dollar. Notably, the Mexican peso fell more than 1%, having strengthened when payrolls were published, to close at its weakest in two years. The rise in Treasuries is causing clear collateral damage elsewhere: How to explain this? First, the unemployment data isn't necessarily as alarming as it seems. Everyone knew that two hurricanes had hit the US southeast and that there had been major strikes while the numbers were being compiled. Some "noise" — a financial euphemism for the tragedies across the country — was inevitable. Following claims data suggesting that layoffs hadn't risen significantly after the storms, and surprisingly bullish estimates from other sources, it wasn't difficult to decide that this was a chance to exit bonds. But that leads to the second undeniable fact that many were plainly looking for such an opportunity. Worries about fiscal policy are intensifying, while there are also nerves about a possible second wave of inflation — previous historical episodes of big price rises have tended to see brief peaks followed by a trough and another surge.

And third, the possibility of Trump 2.0 with a supportive Congress, bringing tax cuts and major new tariffs in his wake, had fueled the rise in yields. His last administration started with a big run on Treasuries. So, traders took a fresh opportunity to sell bonds ahead of a Trump victory.

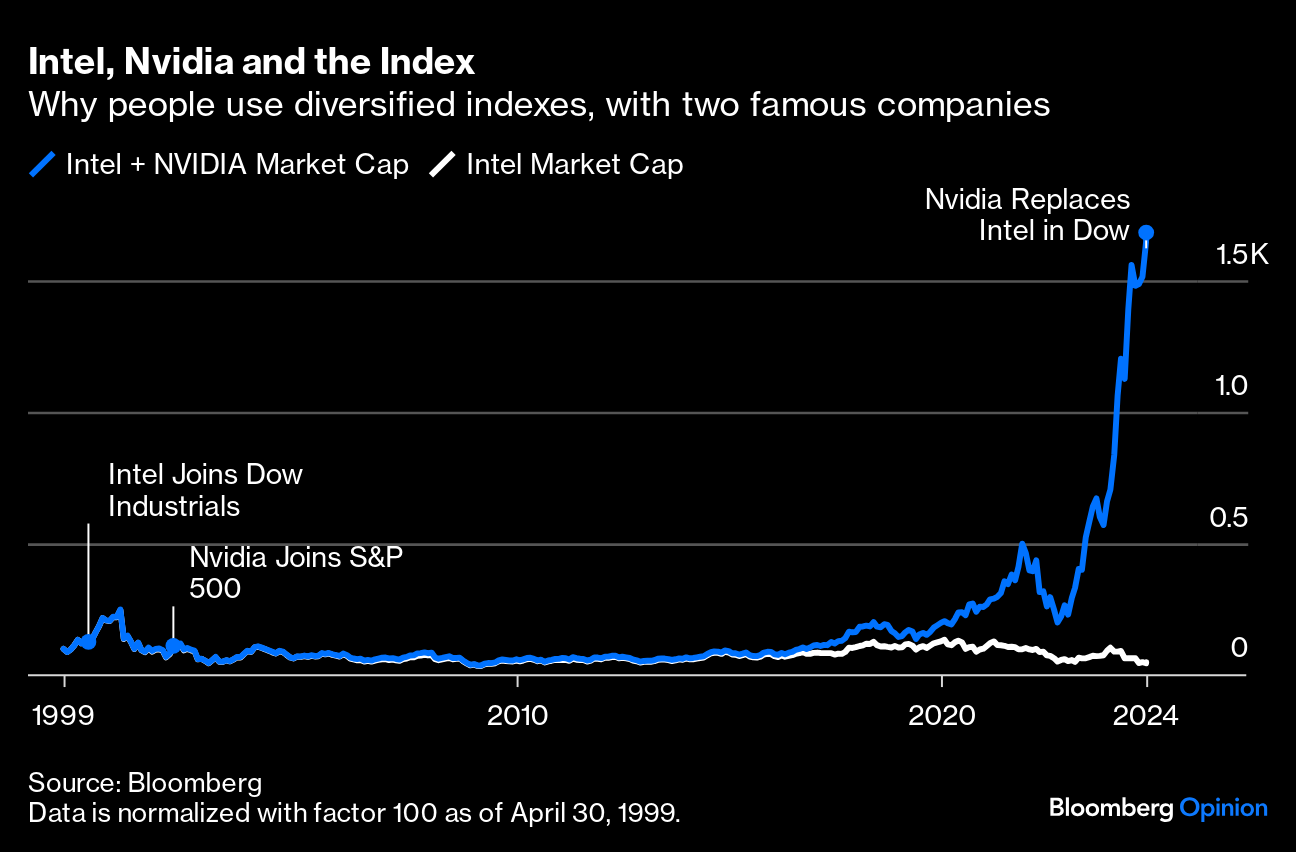

The contradiction here, of course, is that the Trump odds were already weakening by Friday, and have since tumbled. Judging by the way the dollar index has opened in Asian trading, giving up all its Friday gains and dropping below the level it briefly hit after the unemployment numbers, there could now be a belated attempt to address this:  The way a number of Trump trades have scarcely budged in the last week is hard to explain. They may well revive swiftly in the event of a Trump victory. But it looks as though markets' tendency to overshoot and the eternal difficulty of predicting the future have set up even more volatility for a week that was already bound to be difficult. After markets closed Friday came the announcement that Intel Corp. and Dow Inc. (formerly Dow Chemical) were to be dropped from the Dow Jones Industrial Average to be replaced by Nvidia Corp. and Sherwin-Williams Co. It has been treated as news, and painful corporate history is being made for Intel as the once-hegemonic chipmaker relinquishes its place to the company that brutally overtook it. However, this doesn't matter at all, beyond offering yet another opportunity to illustrate that the Dow is obsolete. Nvidia's conquest of Intel illustrates the futility of maintaining a small index and hoping that it will tell you anything. To capture the entire US corporate sector, which the Dow aims to do, you need a range of companies from each sector. That way, it makes no difference if one company supplants another — as has happened with Nvidia's successive decisions to go big on making chips for gaming, then Bitcoin mining, and now artificial intelligence — because both are in the index. Intel was overwhelmingly dominant in 1999 when it was added to the Dow. Including Nvidia would have made minimal difference at the time; Intel was to most intents and purposes the entire sector. Not including both, however, became egregious once Nvidia passed its long-term rival, and then suddenly became one of the three biggest companies in the world. Nvidia joined the S&P 500 in 2001 (replacing Enron after it collapsed), two years after Intel joined the Dow. But the Dow's limit to 30 stocks means that there's only room for one chipmaker at a time. Until the eve of the pandemic, this made little difference, but since then the gap has been huge. This is how the market cap of Intel has moved since 1999, compared with the combined market cap of Intel and Nvidia: If you have access to the terminal, try the "Open in GP" button to look at this and convert the axis to a log scale. Does this matter? When their DJIA tenure ended, Dow Chemical and Intel accounted for 0.76% and 0.36% of the index respectively. This won't make much difference in the short term. Nvidia's prospects are far better than Intel's, but it's also making money at a rate that seems unsustainable. The net effect of this move has been to sell low on Intel while buying high on Nvidia. (And the Dow also bought high on Intel way back in 1999, 23 years after it had joined the S&P.) It's better to do this the other way around. That said, it's stock pickers who are supposed to buy low and sell high, while indexes just track the overall market. Restricting to 30 stocks while attempting to give a broad picture of the market, however, forces an index provider to be a stock picker. And in this case, as often happens to active fund managers, their timing has been way, way off. To capture the market accurately, for research purposes, the S&P 500 was obviously preferable. If you're an ETF provider looking for an index to track that will make money for clients, the S&P is again obviously preferable. You wouldn't take the risk of missing the next Nvidia. That's why nobody uses the Dow to study the market, or as a basis to make money. It's still front-page news, but shouldn't be. Best consigned to history. Robert Frank was a great photographer. He produced one of the greatest ever volumes of street photography, The Americans, in the late 1950s, after spending years crisscrossing his adopted country. It's a great work of art and also a brilliant piece of documentary journalism. Jack Kerouac wrote the words. But Frank, a Jewish man born in Switzerland, lived on until 2019, and I had no idea he had found outlets in new media until I went to the big retrospective currently on display at New York's Museum of Modern Art. So, it turns out that he made the video of Run for New Order, the coolest British band of the 1980s, and for Summer Cannibals by Patti Smith. He also made Pull My Daisy, a movie written by Kerouac. It's really worth catching up with him. Have a good week everyone, and try to get some good sleep tonight.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Christina Sterbenz: You Need to See These Charts, Trust Us

- Liam Denning, Thomas Black, and Dave Lee: Musk's Election Bet Is Clear. How Might It Pay Off?

- Hal Brands: Biden's Biggest Foreign Policy Legacy Will Be in Economic Warfare

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment