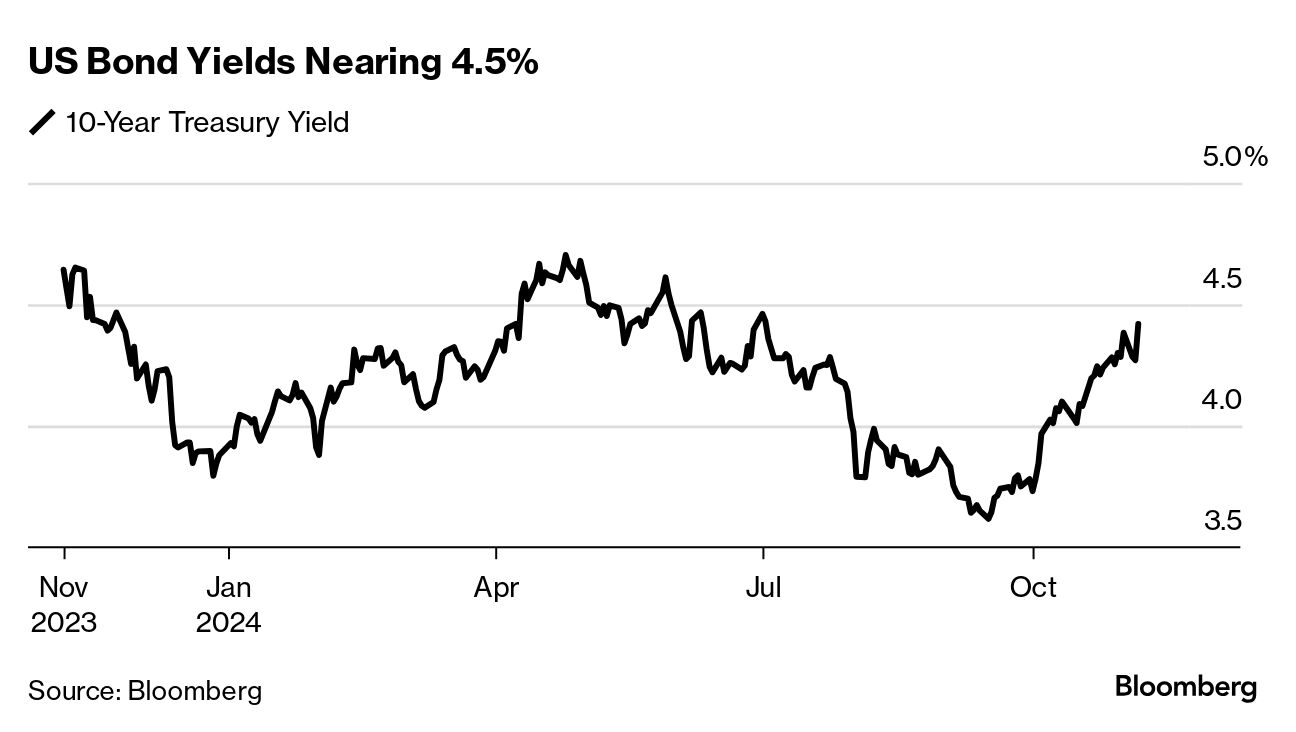

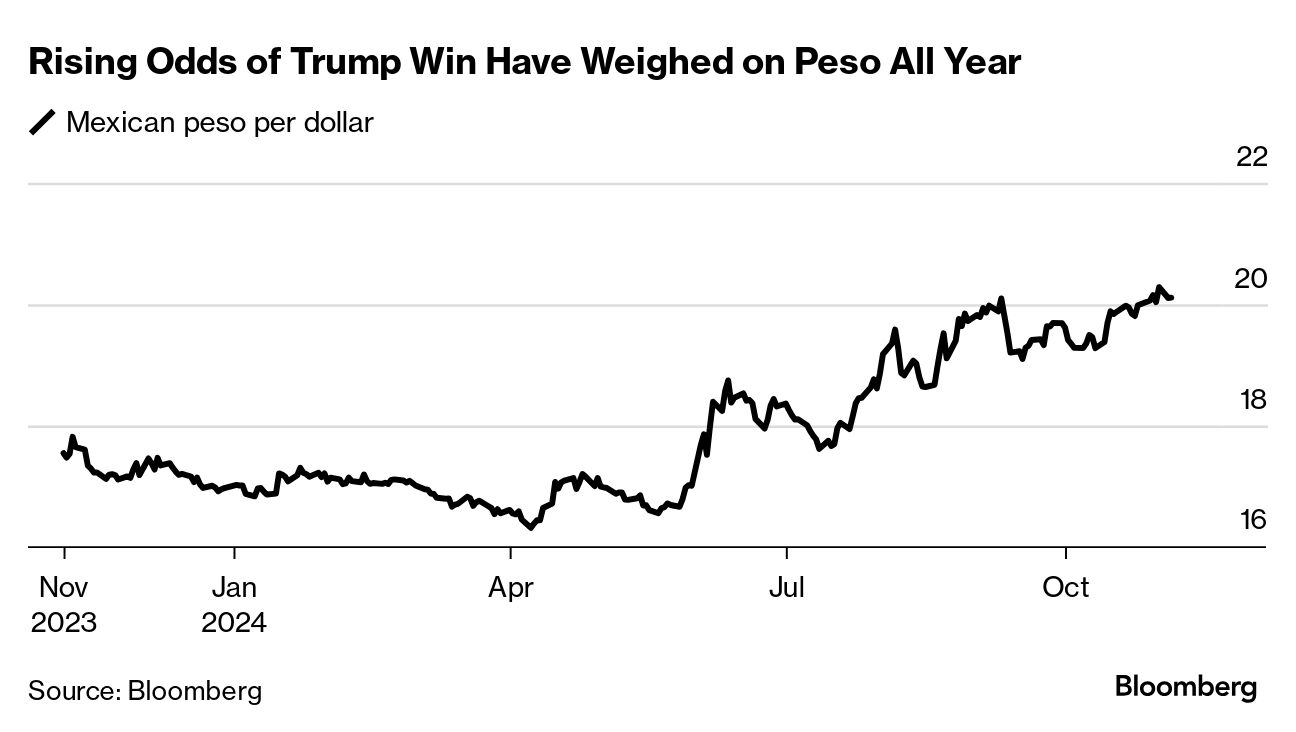

| Donald Trump scored a resounding win over Democrat Kamala Harris, vindicating traders who for the past couple of months have been pricing in a successful comeback for the Republican. Here's a look at the notable moves as the US wakes up to Trump the sequel: US stocks: Futures are rallying, putting the S&P 500 on pace for a fresh record high, on the prospect that Trump will juice the economy and corporate earnings with low taxes, deregulation and government spending. Contracts on the small-company Russell 2000 Index surged more than 6%. Sectors set to benefit include fossil-fuel energy companies, banks, pharmaceutical providers and prison managers. Treasury bonds: Yields are soaring on the view that Trump's agenda— more spending, low taxes, tariffs, restricted immigration — will fuel inflation. The 10-year US Treasury note edged towards 4.5%, a level not seen in about six months, before pulling back a bit. The dollar: The anticipation of faster inflation and thus higher interest rates lifted the greenback to its strongest in a year. While Trump has advocated for a weaker dollar, many investors say his policies will achieve the opposite. Oil, gold: A stronger greenback makes dollar-denominated commodities more expensive for international buyers, so crude and precious metals are falling. Gold has soared to records in 2024 because it's seen as a hedge against inflation and instability, but today at least the dollar strength is overriding those trends. Soybeans dropped given concerns about trade tensions with China, the biggest buyer. Crypto: Bitcoin jumped to a record high above $75,000. Trump embraced digital assets during his campaign after a major push by the industry, which deployed a giant war chest to further its agenda. Emerging markets: An index of developing-nation currencies fell the most since February 2023, with Mexico's peso leading the slump, on concern Trump's policies will curb emerging-market exports, hurt foreign economies and boost global inflation. Banks, brokers: Robust stock markets and an end to the Biden administration antitrust crackdown should mean fatter profits for banks and brokers. Bank of America, Citigroup, Morgan Stanley, JPMorgan Chase, Charles Schwab and Goldman Sachs are all up 6% or more in premarket trading. China stocks, currency: The yuan weakened the most in two years and Chinese stocks fell on the specter of Washington slapping tariffs of up to 60% on Chinese goods. The move could further weaken the world's second-largest economy and disrupt global supply chains. Investors still have plenty to chew over: - A Republican sweep of Congress would significantly ease the path for Trump to enact his policies, but it could be days before it's known which party has won the House.

- Trump's promised tariffs could ignite a global trade war that undermines stock markets.

- And perhaps most importantly, fears of a bloated budget deficit and a renewed inflation spiral may spur the bond vigilantes into action, pressuring leaders in Washington to keep spending in check. Higher yields could in turn hurt stocks.

For now, though, equity investors are celebrating. "This may well set the stage for further America First markets," said Arnab Das, global macro strategist at Invesco. "Trump is likely to pursue trade and immigration restrictions and — if Congress is onside in a clean sweep — deregulation, tax cuts and larger deficits." |

No comments:

Post a Comment