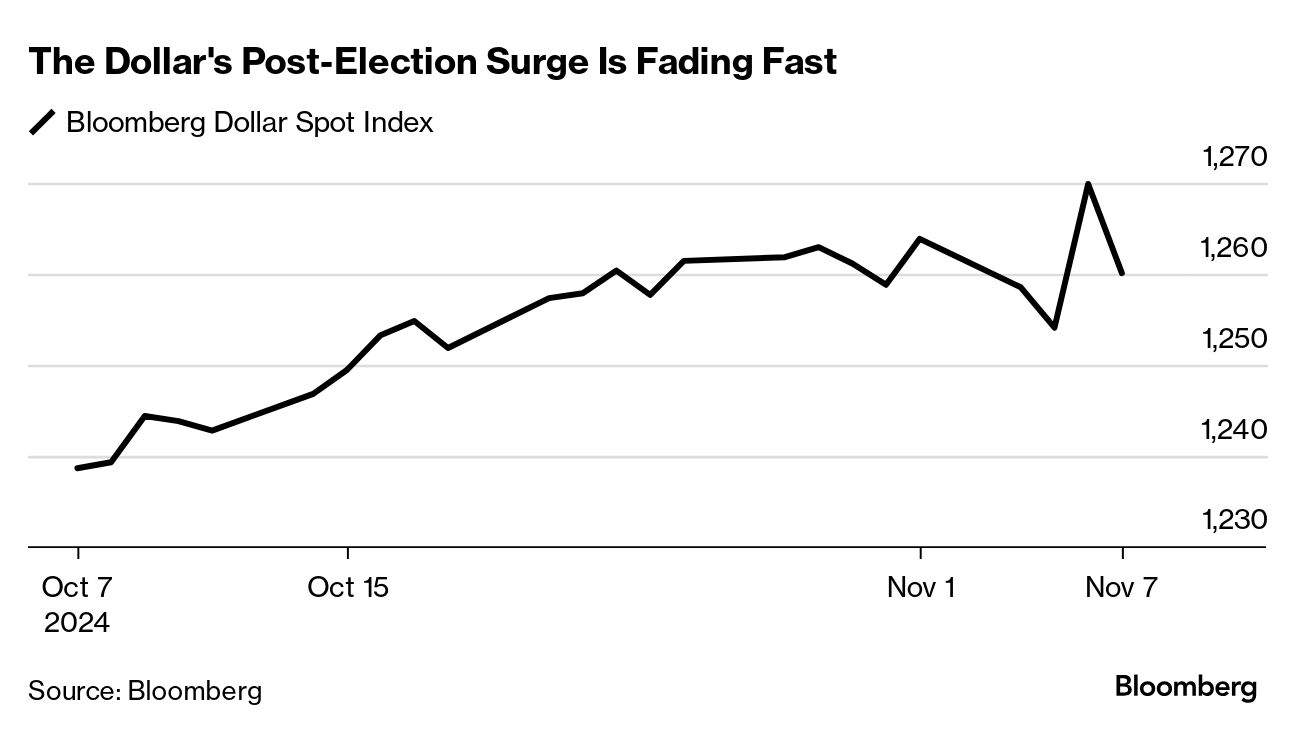

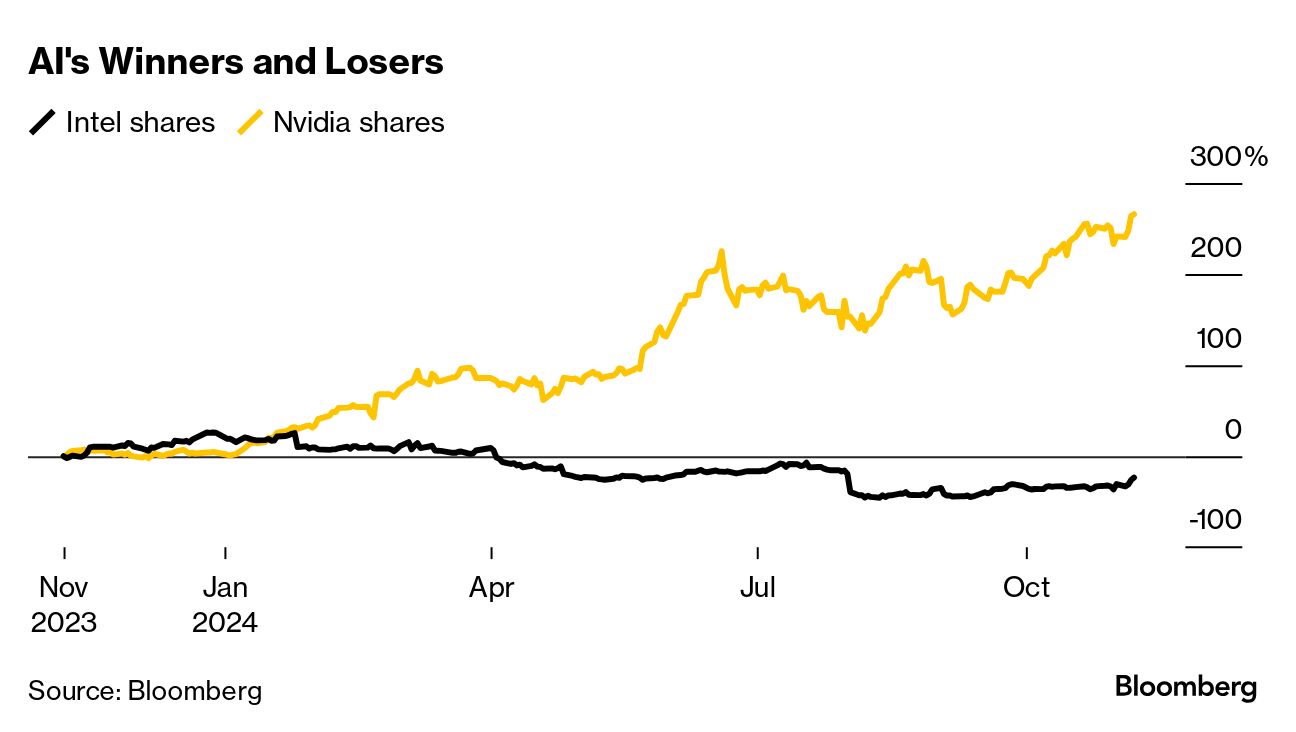

| Markets have singularly revolved around Donald Trump's election triumph this week and he will reshape the economic and political landscape. Stocks and crypto reacted euphorically, with investors betting that the Republican victor will supercharge US economic growth, support American industry and loosen the regulation of digital assets. The S&P 500 is on the verge of closing out its best week in a year and Bitcoin cracked new all-time highs. The message is more muddled in other markets. The dollar has reversed most of its post-election surge, and is tracking to end the week lower. Ten-year Treasury yields are roughly the same as where they started the week, after a two-day whipsaw. That sideways action is evidence of the next big debate on Wall Street: Will Trump make his campaign promises come true? Yes, Trump is expected to push through higher tariffs, lower taxes and looser regulation — all of which could fan inflation by pouring fuel on an already strong economy. But there are also forces in the opposite direction — like whether the Federal Reserve then keeps interest rates higher for longer. Powell in his press conference yesterday hinted at a willingness to defy any political pressure — responding with a sharp "no" when asked if he would step aside if Trump asked for his resignation. The other complicating factor is whether rising bond US yields will hurt equity prices, and if an ensuing selloff would lead Trump to moderate his tactics. No president in modern history has so publicly made the rallying stock market such a crucial barometer of his success. Amundi SA's Vincent Mortier says he's watching the 5% level on the 10-year bond as a alert level for stocks. While some of his firm's funds had positioned themselves to gain from a Trump victory rally, he thinks caution is now more appropriate. "We will probably take some profit in the coming days," said Mortier, the firm's chief investment officer. For more, check out this explainer by Bloomberg Opinion's John Authers: --Lynn Thomasson |

No comments:

Post a Comment