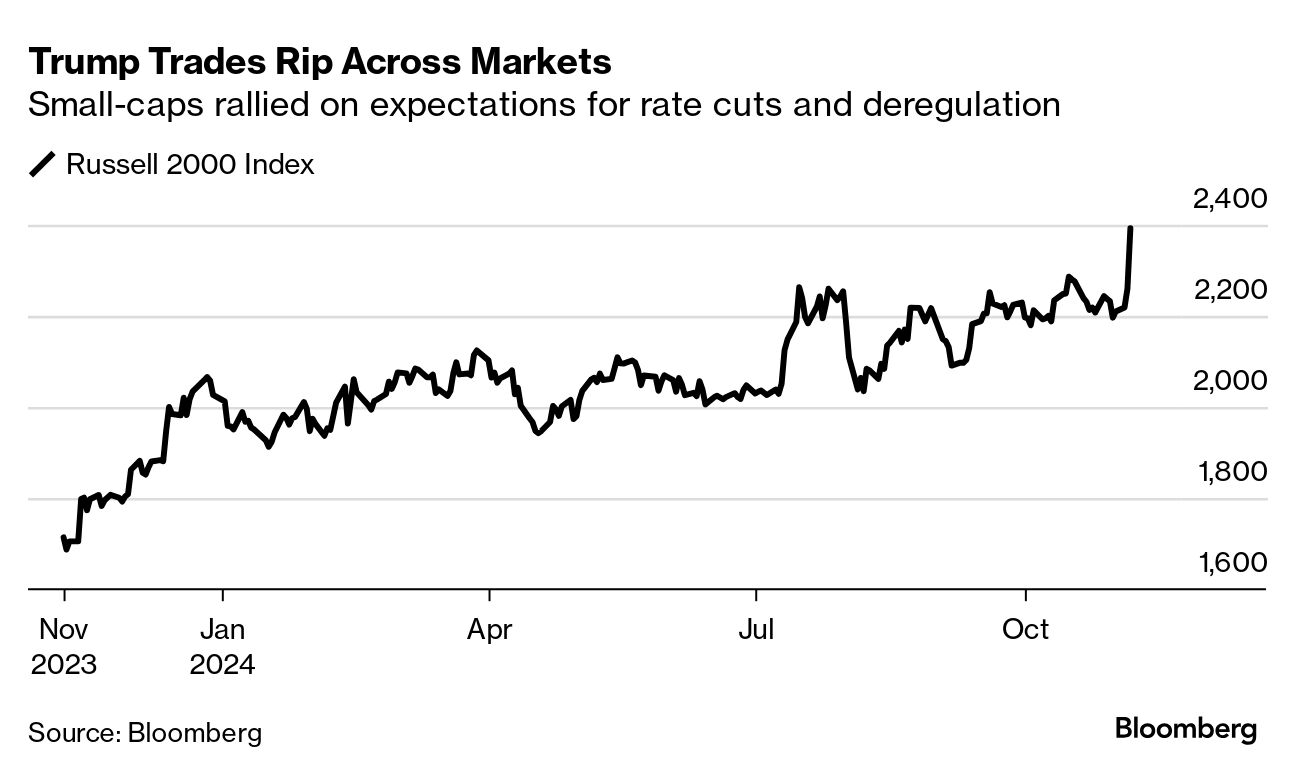

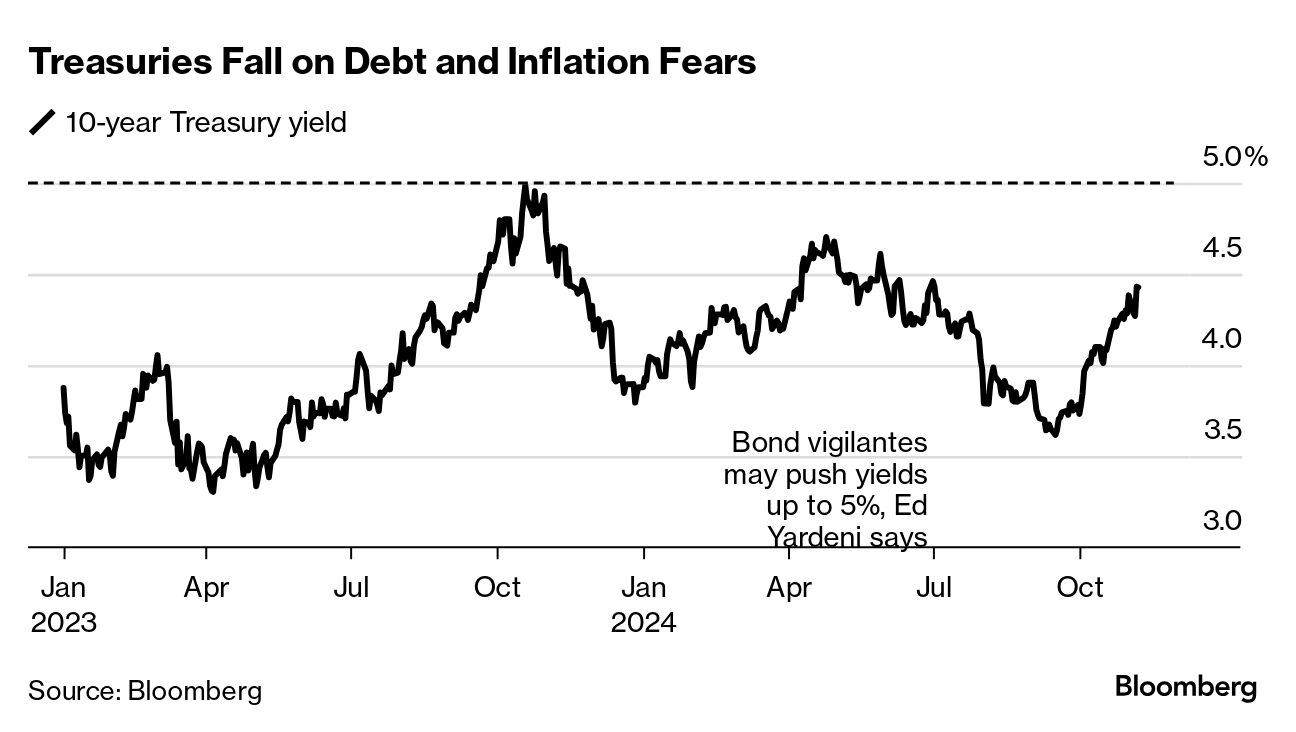

| One immediate effect from Donald Trump's election victory: Wall Street economists now see Fed policymakers keeping interest rates higher than they otherwise would have, given the likely inflationary effect of his policies. The question is: will the stock market take fright? For now, it's not a problem. An overwhelming majority of those surveyed by Bloomberg predict a 25-basis-point reduction today. But JPMorgan's economists now expect the Fed to lower rates every other meeting from March until it reaches 3.5%, compared with 3% earlier. Nomura's team anticipate only one reduction in 2025, with monetary policy on hold until the inflation shock from tariffs has passed. The bond market agrees that the inflation outlook has worsened: The 10-year Treasury yield surged 16 basis points on Wednesday to about 4.43%, building on increases since mid-September as Trump's chances improved. Higher borrowing costs should be especially dangerous to an expensive stock market and also to small-caps, which are more indebted. "There is one condition for US stocks to perform and it's that bond yields remain at a reasonable level," said Nicolas Forest, chief investment officer at Candriam. "If one stays below 4.5% for the 10-year, there's nothing dramatic there, but beyond that would become a very different environment." This is the biggest source of tension baked into the Trump equity trades. The unifying theme is reflation: Economic expectations and inflation up, fiscal sustainability down, and that means higher-for-longer interest rates. Of course, it's not unusual for stocks to rise with bond yields — in fact, that has been happening for most of 2024. The explanation is typically that economic growth is expected to accelerate enough to offset higher interest rates. But that depends on pro-corporate policies such as tax cuts and deregulation delivering an earnings boost that can overcome a drag from tariffs and mass deportation — or those latter proposals not getting implemented to any meaningful degree. That seems to the animating spirit behind yesterday's stock market euphoria. If that fundamental case doesn't satisfy, there might also be a mechanical aspect to all this, like with most big market moves these days. The drop in volatility combined with the equity rally is likely a green light for some systematic strategies to pile in — and probably some previously uncertain humans too in the short run. Looking beyond those short-term effects, equity investors may have to come to terms with a central bank that's more hawkish. "After four years of overshooting its inflation target, we doubt the Fed would be willing to look past a tariff-driven rise in inflation," wrote the Nomura team led by David Seif. —Justina Lee |

No comments:

Post a Comment