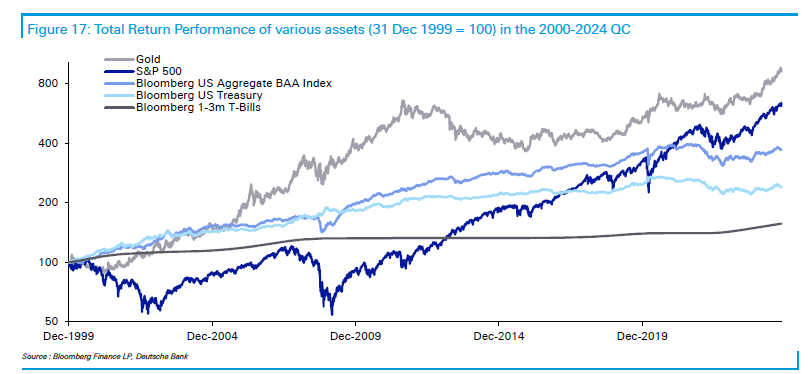

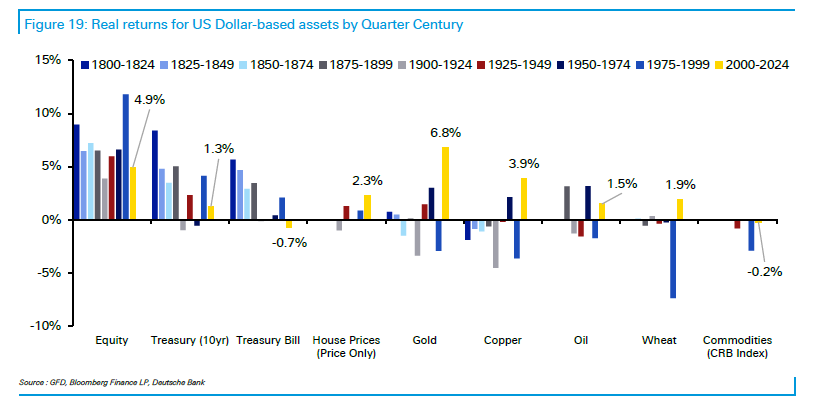

| It's hard to think of a better time for stock investing. The S&P 500 has smashed record after record, AI euphoria is everywhere and even veteran strategist Ed Yardeni — a big bull on Wall Street — worries he's not optimistic enough. And yet for all the exuberance, US equities are actually on track for their second-worst performance over the past 25 years when adjusting returns for inflation. That's according to Deutsche Bank's famous study on market gains over the nine quarter centuries since 1800. In fact, the nearly 5% yearly advance is so modest, it puts the asset class on track to underperform gold for the first time ever over this quarter-century timeframe, while precious metal, copper and wheat are among the top performers. It's quite the claim — one that will resonate with anyone who's seen their purchasing power eroded by inflation. While the rally in US stocks has been far stronger than developed peers, it's not "spectacular" in absolute terms or even relative to government bonds, writes Jim Reid, Deutsche Bank's global head of macro and thematic research. US equities, since the 1800s, have seen a real annualized total return of 6.9% — far outpacing 10-year Treasuries. All this may be hard to believe given the stunning developments the world has witnessed in the past 25 years from Apple's invention of the iPhone to voice assistants including Amazon's Alexa. Moreover, it was only in this century that three of the so-called Magnificent Seven stocks — Alphabet, Tesla and Meta Platforms — debuted in the US. A big part of why returns have been paltry is the starting point, says Deutsche Bank. This period began after all at the peak of the dot-com bubble, which saw the highest P/E ratio in the S&P 500's history. Case in point: Just a little adjustment to account for five extra years (i.e. from 1995) and the returns would be the third best in the sample. And what about the next 25? The bank thinks stocks will once again reliably beat government bonds, especially given ballooning deficits. "We're unlikely to leave the current policy era behind where the authorities have a bias to reflate when the inevitable crises associated with a levered low-growth system come along," the strategists wrote. "It's easy to imagine periodic bursts of inflation." —Isabelle Lee |

No comments:

Post a Comment