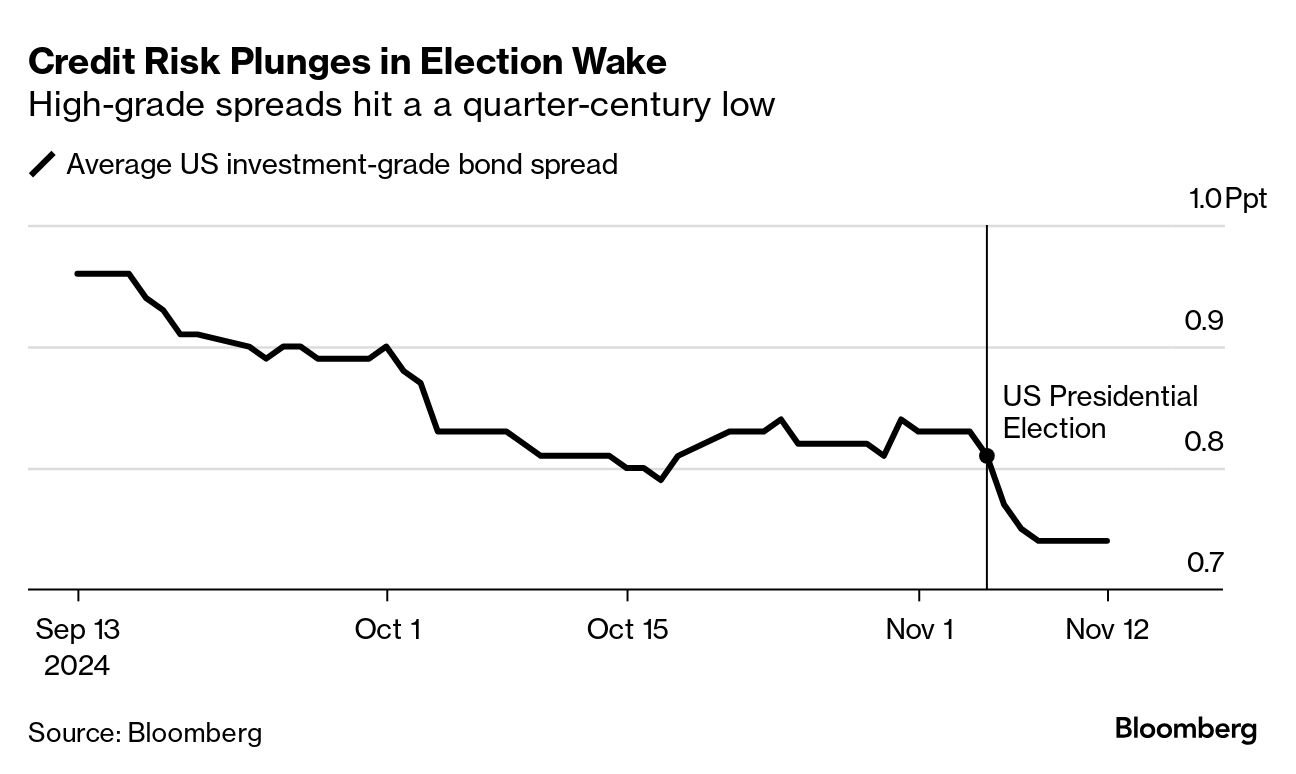

| It's not just stock markets that are euphoric over Donald Trump's victory. Since the election, a key measure of risk for US investment-grade corporate bonds has fallen to its lowest level since 1998. In junk-bond land, the same metric is the lowest since 2007. And money is being poured into fixed-income assets. The moves are puzzling. Trump's promises of tax cuts, tariffs and mass deportations could raise labor costs, stoke inflation and slash profits for companies that rely on imports. Yet investors seem to be looking past all of that. "The fact that the market is not pricing in any risk of volatility seems too good to be true," said Travis King, head of US investment-grade corporates at Voya Investment Management. "There are still many questions about what parts of the agenda and policy get put in place." Corporate treasurers aren't missing out on chance for attractive financing. They've been flooding the market with bond offerings this week, both in the US and Europe. Risk in credit markets is measured by the yield spread — the premium that issuers need to pay over comparable government debt. The narrower the spread, the lower the perceived risk. But that doesn't mean companies are borrowing more cheaply. In the US, yields on Treasuries have surged since mid-September on concern that inflation will pick back up. But with spreads this tight, companies may be figuring it's better to tap markets now, before yields go even higher. Credit investors' appetite for risk is a global phenomenon: China just borrowed dollars in global markets at essentially the same cost as the US, and traders immediately drove the yields on the bonds down even further. Yield spreads on emerging market bonds are the lowest they've been since February 2020, according to a JPMorgan index. —Olivia Raimonde |

No comments:

Post a Comment